FedEx Shares Fall After Lower Outlook From Trade Tensions

September 18 2019 - 10:59AM

Dow Jones News

By Patrick Thomas

Shares of FedEx Corp. (FDX) plunged about 12% to $151.23

Wednesday after the logistics company cut its forecast for the

year.

The Memphis, Tenn., company lowered its revenue outlook and said

it expects earnings to fall in its current fiscal year.

The profit warning comes after the company posted an 11% drop in

its first-quarter net income, driven by weakness in its Express

unit.

Shares of FedEx are down about 6% this year and off roughly 37%

over the past 12 months.

Analysts across the board downgraded their price estimates for

the company's stock. Stifel cut its rating on the company from

"buy" to "hold" and lowered its price target to $171 from $185 a

share. Morgan Stanley analysts cut their price target to $120 from

$131 and JPMorgan & Chase Co. lowered its target to $146 from

$168 a share.

"FedEx is tied heavily to the global macro and U.S. economy, so

to work, we believe the tailwinds need to be favorable, and

currently they're not," the Stifel analysts said in a research

note. "The 'self-help' related to continued margin expansion at

FedEx Express that management had been touting the past couple of

years has practically disappeared."

Shares of logistics rival United Parcel Service Inc. (UPS) were

down 1.3% and shares of the parent company of DHL, Deutsche Post

AG, were off 1.6%.

Write to Patrick Thomas at patrick.thomas@wsj.com

(END) Dow Jones Newswires

September 18, 2019 10:44 ET (14:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

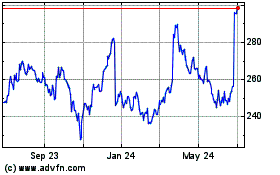

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

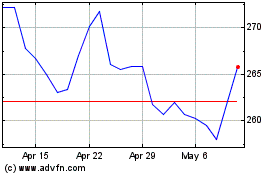

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024