FedEx Hit by Trade Tensions and Split With Amazon -- 3rd Update

September 17 2019 - 7:28PM

Dow Jones News

By Paul Ziobro

FedEx Corp. sharply cut its profit forecast for the year as it

faces higher costs to expand services, lower revenue from cutting

ties with Amazon.com Inc. and a worsening economic backdrop,

sending shares of the delivery company plummeting 10% in

after-hours trading.

The Memphis, Tenn., company expects per-share earnings to fall

between 16% and 29% in the current fiscal year, compared with an

expectation of a mid-single-digit percentage decline issued in

June. FedEx also lowered its revenue outlook.

The profit warning comes after the company posted an 11% drop in

fiscal first-quarter profit driven by weakness in its Express unit,

which delivers packages by jets and is being hampered by global

trade disruption.

Meanwhile, FedEx's Ground unit, where revenue is growing largely

due to carrying more e-commerce packages, is spending heavily on

additional transportation costs and equipment rentals to keep up

with that demand.

The company said it is taking more cost-cutting steps to try to

offset the weaker environment, including retiring planes and

grounding others after the holiday shopping season.

"The global macro economy continues to soften, and we are taking

steps to reduce capacity," FedEx Chief Executive Frederick Smith

said on Tuesday's earnings call.

One of the challenges to FedEx's business is the lack of a trade

deal with China, which has reduced the movement of goods

internationally. Mr. Smith said the company initially expected a

trade resolution as it entered its current fiscal year. "We were

hopeful of a trade deal and some sort of return to normalcy and

that has not taken place," he said.

For the first quarter ended Aug. 31, FedEx reported a profit of

$745 million, or $2.84 a share, compared with $835 million, or

$3.10 a share, a year earlier. Excluding expenses related to its

integration of TNT Express, per-share earnings were $3.05.

Revenue declined slightly to $17.05 billion.

Analysts polled by FactSet expected earnings of $3.15 a share

and $17.06 billion in revenue.

Earnings for the fiscal year ending in May are expected to be

between $11 and $13 a share before mark-to-market accounting

adjustments and integration expenses.

Last year, FedEx posted adjusted earnings of $15.52 a share.

The weaker outlook comes as shippers and carriers gear up for

the holiday shopping season, when planning and upgrades will be put

to the test as the number of packages surges.

It also comes as FedEx is in the midst of major reshuffling in

the delivery marketplace as demand rises for e-commerce

shipments.

It will soon start delivering packages seven days a week

throughout the entire year instead of just during the holidays and

will bring into its own network nearly all of the two million

packages it once handed off to the U.S. Postal Service for delivery

to doorsteps. Those added costs are weighing on FedEx's bottom

line.

FedEx will also be trying to expand its e-commerce business

without delivering packages for the largest online player in the

U.S., Amazon.com. FedEx in recent months ended its two major

shipping contracts with Amazon, forgoing about $900 million in

annual revenue. Instead, FedEx is aligning itself with retailers

like Walmart Inc. and Target Corp., as well as other online

businesses that compete with Amazon. FedEx recently signed on

Dick's Sporting Goods Inc. as a customer, for instance, to deliver

the retailer's online orders.

FedEx is continuing to raise prices to offset the higher costs

associated with all of the online orders to homes. Next year, it

plans to raise rates an average of 4.9% on packages sent through

its Express and Ground networks, while imposing a 5.9% rate

increase on Freight shipments.

Despite the weakness in the Express division, FedEx continues

spending heavily to modernize its air fleet and some processing

facilities.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

September 17, 2019 19:13 ET (23:13 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

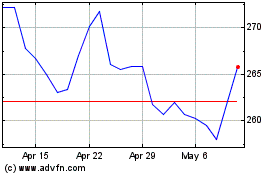

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

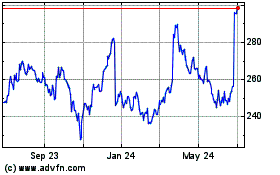

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024