Exxon to Slash Up to 15% of Global Workforce, Including 1,900 Jobs in U.S. -- Update

October 29 2020 - 2:48PM

Dow Jones News

By Christopher M. Matthews

Exxon Mobil Corp. said Thursday that it expects to shed as much

as 15% of its global workforce over the next year, including 1,900

jobs in the U.S., as the coronavirus pandemic continues to batter

the oil industry.

The struggling oil giant announced the U.S. job cuts Thursday,

and in response to questions added that it anticipates it will

eliminate around 14,000 positions, including employees and

contractors, through 2021. It said most of the cuts to U.S.

employees would come from its management offices in Houston, and

that it expects the reductions will be both voluntary and

involuntary.

Exxon has said it is conducting a global review of its 74,000

employees and more than 13,000 contractors, and previously

announced 1,600 layoffs in Europe and voluntary layoffs in

Australia.

Exxon made the latest announcement a day before it is set to

report quarterly earnings. Analysts expect the company to post its

third consecutive quarterly loss for the first time on record.

Despite a modest economic recovery, oil-and-gas companies are

being hammered by a sustained drop in consumption of gasoline and

jet fuel as millions of people work from home and avoid driving and

flying during the pandemic.

New lockdowns in Europe in response to climbing Covid-19 cases

are damping hopes that the global economy will regain its footing

this year. That is combining with longer-term concerns about future

competition from renewable energy and electric vehicles to drag

down the value of many oil-and-gas companies to decade lows.

The oil-and-gas industry has shed tens of thousands of jobs, and

many of Exxon's peers have already announced significant

layoffs.

Royal Dutch Shell PLC said in September it would cut up to 9,000

jobs in a broad restructuring, and BP PLC plans to cut nearly

10,000 jobs, or 14% of its workforce, and freeze pay increases for

senior level managers. U.S. rival Chevron Corp. has said it would

reduce its 44,679 workforce by as much as 15%.

Exxon's shares have fallen more than 50% this year, and the

company has had to borrow billions of dollars to pay its costly

dividend. Its shares were up more than 3% Thursday following the

layoff announcement.

Shell and BP cut their dividends earlier this year to shore up

their finances. Exxon and Chevron said this week they would

maintain their current dividend payments. Exxon's dividend, which

currently yields around 10%, costs the company about $15 billion

per year.

Exxon said earlier this year it would cut its capital

expenditures by $10 billion to around $23 billion and has slowed

projects from West Texas to Africa. It suspended matching

contributions to U.S. employees' retirement plans in October.

Exxon struggled prior to the pandemic after U.S. shale producers

unleashed vast amounts of oil and gas, helping push down global

prices. It has been six years since Brent oil, the global

benchmark, topped $100 a barrel.

Between 2009 and 2019, Exxon spent $261 billion on capital

expenditures, while its oil and gas production remained flat, and

it added $45 billion in debt, according to investment bank Evercore

ISI. Its return on capital employed in 2009 was 16%; last year, it

was 4%.

Chief Executive Darren Woods, who took over in 2017, hoped to

reverse the company's fortunes by dramatically increasing Exxon's

oil production by 2025, a plan that has been put in jeopardy by the

pandemic.

Analysts predict that Exxon will have to continue borrowing

money to cover its dividend next year, let alone grow

production.

In a message to employees last week, Mr. Woods said the company

faces significant headwinds and would succeed by becoming more

efficient and cutting costs, including jobs. But Mr. Woods said oil

demand will ultimately continue to grow, justifying Exxon's

long-term plans.

"Even accounting for the short-term demand impact of Covid-19,

the investment case is still clear," Mr. Woods wrote.

Write to Christopher M. Matthews at

christopher.matthews@wsj.com

(END) Dow Jones Newswires

October 29, 2020 14:33 ET (18:33 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

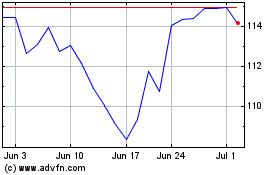

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

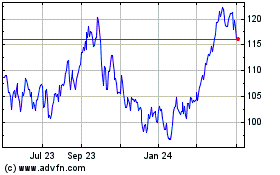

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024