By Christopher M. Matthews, Rebecca Elliott and Sarah McFarlane

The global oil-and-gas industry remains under extreme financial

pressure as demand for fossil fuels rebounds slowly after being

crushed by the coronavirus pandemic.

Some of the largest western oil companies including Exxon Mobil

Corp. and Royal Dutch Shell PLC signaled this week that key parts

of their business continued to struggle through the summer and

early fall, which will weigh down the third-quarter results they

are set to report in coming weeks.

Exxon warned Thursday that parts of its business continue to be

unprofitable, even as the company performed better than in the

second quarter. The Texas oil giant said it expected earnings from

its oil production unit to improve by as much as $1.8 billion from

the second quarter, but that its natural gas sales and its refining

business may lose more money. Analysts forecast a quarterly loss of

more than $500 million when the company reports on Oct. 30, which

would mark its third consecutive quarter in the red.

Shell said Wednesday it would cut up to 9,000 jobs in a broad

restructuring, and warned it was also poised to report poor third

quarter earnings, including a second consecutive quarterly loss in

its oil-and-gas production business. The planned job cuts follow

similar moves at peers including BP PLC and Chevron Corp. to rein

in costs amid the pandemic. Exxon has said it is conducting a

workforce review, which may lead to layoffs.

This year's lousy oil-and-gas earnings have turned off many

investors, who remain unenthusiastic about the companies despite a

modest rebound in crude prices from the historic lows of this

spring. A stock index of U.S. oil-and-gas companies is down about

55% in 2020 even as the overall stock market is up slightly.

Exxon's shares are down around 50% so far this year, while Shell's

are down about 58%.

U.S. benchmark oil prices remain around $40 a barrel, levels too

low for most exploration and production companies to turn a profit,

and smaller, independent players continue to face a struggle for

survival. On Wednesday, Houston-based shale driller Oasis Petroleum

Inc. filed for chapter 11, joining at least three dozen other North

American oil-and-gas producers in seeking bankruptcy protection

this year, according to law firm Haynes and Boone LLP.

"Due to historically low global energy demand and commodity

prices, we determined that it is best for Oasis Petroleum to take

decisive action to strengthen our liquidity and overcome the

headwinds now challenging both our company and industry," Oasis

Chief Executive Thomas Nusz said in a statement.

As the number of global Covid-19 infections continue to rise,

the return of restrictions that could reduce the number of cars on

the road and overall economic activity is leading to market

pessimism that oil demand will take a long time to recover.

Russia's energy ministry has said it doesn't expect a fast

recovery, while Vitol Group, the world's biggest independent oil

trader, said earlier this week it doesn't expect oil prices to rise

until 2021.

"The demand side of the equation will continue to be under

threat during the fourth quarter of the year, with Covid-19 cases

rising at an alarming rate, notably in Europe, which has already

imposed new restrictions to curve down the number of cases," said

Paola Rodriguez-Masiu, an analyst at Rystad Energy.

Rystad expects around 150 additional North American oil and gas

producers to file for bankruptcy by the end of 2022 if crude prices

remain around $40 a barrel.

The U.S. is now generating less than 11 million barrels of oil

daily, down from around 13 million barrels a day early this year,

Energy Information Administration data show. Two-thirds of

oil-and-gas executives who responded to a recent survey by the

Federal Reserve Bank of Dallas said they think U.S. oil production

will never fully recover.

Meanwhile, domestic consumption of gasoline and distillates

including diesel remains depressed, down roughly 9% from a year

ago, according to the EIA. That is weighing on refiners such as

Marathon Petroleum Corp., which said Wednesday that it was laying

off some 2,000 employees. Many of those cuts are tied to the

company's recent decision to keep two of its refineries idled

indefinitely. In all, Marathon Petroleum is cutting around 12% of

its jobs, excluding roles at its Speedway gas station chain, which

7-Eleven Inc. has agreed to buy.

For major oil companies with large liquefied natural gas

businesses, analysts expect weaker margins. LNG is sold via

long-term contracts where prices are often linked to oil with a

time lag of 3 to 6 months. That means the fall in oil prices

earlier this year only reached LNG during the third quarter.

"The macro environment certainly was very difficult and

profitability will have deteriorated in refining and LNG," said

Irene Himona, an analyst at Société Générale, who expects another

tough quarter for major oil companies.

Longer-term doubts are also clouding the industry's outlook as

it contends with competition from renewable energy sources, the

prospect of tightening government regulations and the increased use

of electric vehicles. BP said in September that global oil demand

could have already peaked and that it would potentially never

recover to pre-pandemic levels.

BP, Shell and other major European fossil fuel companies have

said they plan to invest heavily in renewable energy over the next

decade. Exxon, Chevron and most U.S. shale companies remain

committed to oil and gas.

Dan Pickering, chief investment officer of Pickering Energy

Partners LP, said that the industry has lost some investors over

concerns about the energy transition, even though the world will

need large amounts of oil and gas for decades to come.

"It has been a slow-growth business for a long time. It may turn

into a no growth to a declining business for a long time," Mr.

Pickering said.

Still, some executives are hopeful that the reduced investment

in oil and gas production this year will result in higher oil

prices in future. Total SA has drawn up a 10-year investment plan

based on a $50 a barrel price for the Brent crude oil benchmark. On

Thursday, Brent oil traded for around $41 a barrel.

"We are at $40 in the middle of a huge crisis where we have seen

a big oversupply and a huge lack of demand," Total Chief Executive

Patrick Pouyanne told investors this week. "I am sure that in two

to three years we will see higher prices and forget like we have

done in the last five years," he added.

Write to Christopher M. Matthews at

christopher.matthews@wsj.com, Rebecca Elliott at

rebecca.elliott@wsj.com and Sarah McFarlane at

sarah.mcfarlane@wsj.com

(END) Dow Jones Newswires

October 01, 2020 12:47 ET (16:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

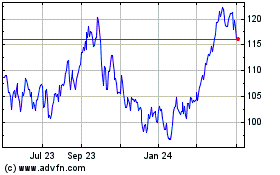

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

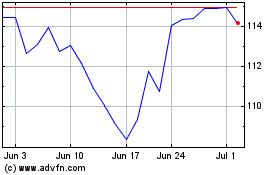

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024