Current Report Filing (8-k)

December 11 2019 - 6:01AM

Edgar (US Regulatory)

0001318568

false

0001318568

2019-12-04

2019-12-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 10, 2019 (December 5, 2019)

Everi Holdings Inc.

(Exact name of registrant as specified

in its charter)

|

Delaware

|

|

001-32622

|

|

20-0723270

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

7250 S. Tenaya Way, Suite 100

Las Vegas, Nevada

|

|

89113

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number,

including area code: (800) 833-7110

N/A

(Former name or former address if changed

since last report.)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value

|

EVRI

|

The New York Stock Exchange

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the

Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

Item

1.01

|

Entry

into a Material Definitive Agreement.

|

On December 5, 2019, Everi

Holdings Inc. (the “Company”) entered into an underwriting agreement (the “Underwriting Agreement”)

with Jefferies LLC and Stifel, Nicolaus & Company, Incorporated, as representatives of the several underwriters

(the “Underwriters”), in connection with a public offering (the “Offering”), pursuant to which the

Company agreed to issue and sell 10,000,000 shares of common stock (the “Base Shares”), par value $0.001

per share (the “Common Stock”), plus an additional 1,500,000 shares (the “Optional Shares” and,

together with the Base Shares, the “Shares”) that may be sold pursuant to an option granted to the Underwriters.

On December 6, 2019, the Underwriters exercised their option to purchase all the Optional Shares. The Shares were offered and

sold at a public offering price of $11.25 per Share and were purchased by the Underwriters from the Company at a price of

$10.6875 per Share. The Offering closed on December 10, 2019.

The estimated net proceeds from the Offering

were approximately $122.5 million, after deducting the Underwriters’ discounts and commissions and estimated expenses payable

by the Company.

The Offering was made pursuant to the Company’s

automatically effective shelf registration statement on Form S-3 (Registration No. 333-235347), which was previously filed on December

4, 2019 with the Securities and Exchange Commission.

The Underwriting Agreement contains customary

representations, warranties and agreements by the Company and customary conditions to closing, obligations of the parties and termination

provisions. Additionally, the Company has agreed to indemnify the Underwriters against certain liabilities, including liabilities

under the Securities Act of 1933, as amended, or to contribute to payments the Underwriters may be required to make because of

any of those liabilities. Furthermore, the Company and its officers and directors have agreed with the Underwriters not to offer

or sell any shares of its common stock (or securities convertible into or exchangeable for common stock), subject to limited exceptions,

for a period of 90 days after the date of the Underwriting Agreement without the prior written consent of the Underwriters.

The Underwriters and certain of their

affiliates have, from time to time, performed, and may in the future perform, various commercial and investment banking and

financial advisory services for us and our affiliates, for which they received or will receive customary fees and expenses.

A copy of the Underwriting Agreement is attached as Exhibit

1.1 hereto and is incorporated herein by reference. The foregoing description of the Underwriting Agreement does not purport to

be complete and is qualified in its entirety by reference to such exhibit.

A copy of the opinion of Gibson, Dunn &

Crutcher LLP relating to the validity of the Shares is filed herewith as Exhibit 5.1.

On December 5, 2019, Everi Payments Inc.,

a direct wholly owned subsidiary of the Company (“Everi Payments”) issued a consent solicitation statement seeking

consent (the “Consent Solicitation”) from holders of Everi Payments’ 7.50% Senior Unsecured Notes due 2025 (the

“Notes”) to modify the definition of “Public Equity Offering” in the indenture governing the Notes. The

proposed modification would include public equity offerings by parent companies of Everi Payments, including the Company, as Public

Equity Offerings for purposes of the indenture.

On December 5, 2019, Everi Payments issued

a conditional notice of redemption in respect of $84.5 million in aggregate principal amount of the Notes. The redemption is conditioned

upon (x) the issuance by the Company of the Base Shares in the offering and (y) the execution of a supplemental indenture reflecting

the proposed terms contained in the Consent Solicitation.

The Company can provide no assurance that

the Consent Solicitation will be approved by holders of the Notes or that the redemption will occur.

The Company is currently in

discussions to amend (the “Proposed Amendment”) its credit agreement, dated as of May 9, 2017 (as amended), among

Everi Payments, as borrower, Everi Holdings Inc., as a guarantor, the lenders party thereto and Jefferies Finance LLC,

as administrative agent, collateral agent, swing line lender, letter of credit issuer, sole lead arranger and sole

bookrunner (as amended, the Credit Agreement).

The Proposed Amendment would provide, among

other things: (i) a reduction in the applicable margins for the interest rates payable in respect of the Company’s term loan

facility; and (ii) the addition of a prepayment premium applicable to the repriced term loan facility of 1.00% of the principal

amount thereof that is repaid in respect of (a) any voluntary prepayment or mandatory prepayment with proceeds of debt that has

a lower effective yield than the repriced term loan facility or (b) any amendment to the repriced term loan facility that reduces

the interest rate thereon, in each case, to the extent occurring within six months after the closing date of the Proposed Amendment.

No other changes are expected to be made to the pricing, debt repayment terms, maturity dates and/or financial covenants, in each

case, applicable to the Company’s credit facilities pursuant to the Proposed Amendment. The consummation of the Proposed

Amendment is subject to certain conditions precedent. The Company can provide no assurance that the Proposed Amendment will be

consummated on the terms described above or at all.

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

Exhibit No.

|

|

|

|

|

|

1.1

|

Underwriting Agreement, dated December 5, 2019, among Everi Holdings Inc., Jefferies LLC, and Stifel, Nicolaus & Company, Incorporated.

|

|

|

|

|

5.1

|

Opinion of Gibson, Dunn & Crutcher LLP

|

|

|

|

|

23.1

|

Consent of Gibson, Dunn & Crutcher LLP (contained in Exhibit 5.1)

|

|

|

|

|

104

|

The cover page of this Current Report on Form 8-K, formatted in Inline XBRL.

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

EVERI HOLDINGS INC.

|

|

|

|

|

|

|

Date:

|

December 10, 2019

|

|

By:

|

/s/ Todd A. Valli

|

|

|

|

|

Todd A. Valli,

Senior Vice President, Corporate Finance and

Chief Accounting Officer

|

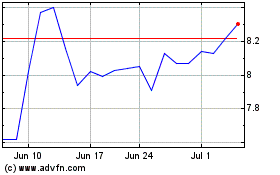

Everi (NYSE:EVRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

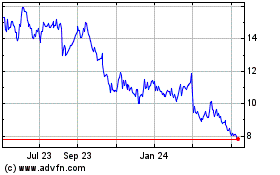

Everi (NYSE:EVRI)

Historical Stock Chart

From Apr 2023 to Apr 2024