Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

As filed with the Securities and Exchange Commission on December 4, 2019

Registration No. 333-

United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

EVERI HOLDINGS INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation or organization)

20-0723270

(I.R.S. Employer Identification Number)

7250 S. Tenaya Way, Suite 100

Las Vegas, Nevada 89113

(800) 833-7110

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

Michael D. Rumbolz

President and Chief Executive Officer

Everi Holdings Inc.

7250 S. Tenaya Way, Suite 100

Las Vegas, Nevada 89113

(800) 833-7110

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

James J. Moloney

Gibson, Dunn & Crutcher LLP

3161 Michelson Drive

Irvine, California 92612

(949) 451-4343

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this Registration Statement.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, check the following

box: o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other

than securities offered only in connection with dividend or interest reinvestment plans, please check the following box: ý

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. o

If this form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the

Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ý

If this form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional

classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth

reporting company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth reporting company" in Rule 12b-2 of the Exchange Act

(check one):

|

|

|

|

|

|

|

|

|

Large accelerated filer o

|

|

Accelerated filer ý

|

|

Non-accelerated filer o

|

|

Smaller reporting company o

Emerging Growth Company o

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. o

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Securities

to Be Registered

|

|

Amount to Be

Registered(1)

|

|

Proposed Maximum

Offering Price Per

Unit(2)

|

|

Proposed Maximum

Aggregate Offering

Price(2)

|

|

Amount of

Registration Fee(2)

|

|

|

|

Common Stock, $0.001 par value per share

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock, $0.001 par value per share

|

|

|

|

|

|

|

|

|

|

|

|

Debt Securities

|

|

|

|

|

|

|

|

|

|

|

|

Warrants

|

|

|

|

|

|

|

|

|

|

|

|

Units

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL

|

|

|

|

|

|

|

|

|

|

|

-

(1)

-

There

is being registered hereunder an indeterminate number of securities as may be issued and sold, from time to time, by the registrant at

indeterminate prices.

-

(2)

-

Pursuant

to Rules 456(b) and 457(r) under the Securities Act of 1933, as amended (the "Securities Act"), the Registrant is deferring payment of

all registration fees in respect of securities which are being registered in an indeterminate amount.

Table of Contents

PROSPECTUS

EVERI HOLDINGS INC.

Common Stock

Preferred Stock

Debt Securities

Warrants

Units

We may, from time to time, offer to sell common stock, preferred stock, debt securities, warrants or units, either individually or in combination.

This

prospectus provides you with a general description of the securities that may be offered. Each time we offer and sell securities hereunder, we will provide a supplement to this prospectus that

contains specific information about such offering and the terms of the securities being offered. The prospectus supplement may also add, update or change information contained or incorporated in this

prospectus. You should carefully read this prospectus, the applicable prospectus supplement and any related free writing prospectus, as well as any documents incorporated by reference, before buying

any of the securities being offered. This prospectus may not be used to offer or sell securities without a prospectus supplement describing the method and terms of the offering.

The

securities may be offered directly by us, through agents designated from time to time by us or to or through underwriters or dealers. If any agents, dealers or underwriters are involved in the

sale of any securities, their names, any over-allotment and any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable from

the information set forth, in the applicable prospectus supplement. See the section entitled "Plan of Distribution" for more information.

Our

common stock trades on the New York Stock Exchange, or NYSE, under the symbol "EVRI".

INVESTING IN OUR SECURITIES INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD REVIEW CAREFULLY THE RISKS AND UNCERTAINTIES DESCRIBED UNDER THE HEADING "RISK FACTORS" CONTAINED HEREIN

ON PAGE 3 AND IN ANY APPLICABLE PROSPECTUS SUPPLEMENT AND IN ANY OTHER DOCUMENT INCORPORATED BY REFERENCE HEREIN OR THEREIN.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of

this prospectus. Any representation to the contrary is a criminal offense. No gaming or regulatory agency has approved or disapproved of these securities, or passed upon the adequacy or accuracy of

this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is December 4, 2019

Table of Contents

TABLE OF CONTENTS

We have not authorized any person to provide you with any information or represent anything about us other than what is contained in this prospectus, any prospectus supplement

and any pricing supplement. We do not take any responsibility for, and can provide no assurance as to the reliability of, any information that others may provide to you. You should not assume that the

information in this prospectus or any document incorporated by reference is accurate as of any date other than the date on its front cover. Our business, financial condition, results of operations and

prospects may have changed since the date indicated on the front cover of such documents. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any securities

other than the securities offered hereunder, nor does this prospectus constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is

unlawful to make such offer or solicitation in such jurisdiction.

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we have filed with the Securities and Exchange Commission (the "SEC") using a

"shelf" registration process. Under this shelf registration process, we may, from time to time, offer and sell securities described in this prospectus in one or more offerings. This prospectus

provides you with a general description of us and the securities offered under this prospectus.

Each

time we offer and sell securities with this prospectus, we will provide a prospectus supplement and, if applicable, a related free writing prospectus that will describe the specific terms of the

offering. Such prospectus supplement and free writing prospectus may include or incorporate by reference a discussion of any risk factors or other special considerations applicable to those securities

or to us. The prospectus supplement and related free writing prospectus may also add to, update or change the information contained in this prospectus, and accordingly, to the extent inconsistent, the

information in this prospectus will be superseded by the information in

the prospectus supplement or the related free writing prospectus. Please carefully read this prospectus, the prospectus supplement and any related free writing prospectus issued by us, in addition to

the information contained in the documents we refer to under the headings "Where You Can Find More Information" and "Incorporation of Certain Information by Reference."

Unless

otherwise indicated or the context otherwise requires, the terms "we," "us," "our," the "Company," "Everi," "Everi Holdings" and similar terms refer to Everi Holdings Inc., a Delaware

corporation, and its consolidated subsidiaries.

ABOUT EVERI HOLDINGS INC.

Everi is a leading supplier of entertainment and technology solutions for the casino, interactive, and gaming industries, with a focus on both casino operators

and their players. We provide casino operators with a diverse portfolio of products including innovative gaming content and gaming machines that power the casino floor, and casino operational and

management systems that include comprehensive end-to-end payments solutions, critical intelligence offerings, gaming operations efficiency technologies, and self-service loyalty tools and

applications. Everi reports its results of operations based on two operating segments: Everi Games and Everi FinTech.

Everi

Games provides gaming operators products and services, including: (a) gaming machines primarily comprised of Class II and Class III slot machines placed under participation

or fixed fee lease arrangements or sold to casino customers, including TournEvent® that allows operators to switch from in-revenue gaming to out-of-revenue tournaments; (b) system

software, licenses, ancillary equipment, and maintenance; and (c) business-to-consumer and business-to-business interactive activities. In addition, Everi Games develops and manages the central

determinant system for the video lottery terminals ("VLTs") installed in the State of New York and it also provides similar technology in certain tribal jurisdictions.

Everi

FinTech provides gaming operators cash access and related products and services, including: (a) access to cash at gaming facilities via Automated Teller Machine ("ATM") cash withdrawals,

credit card cash access transactions, point of sale ("POS") debit card cash access transactions, and check verification and warranty services; (b) equipment that provides cash access and

efficiency-related services; (c) self-service enrollment, loyalty, and marketing equipment and services; (d) products and services that improve credit decision making, automate cashier

operations, and enhance patron marketing activities for gaming establishments; (e) compliance, audit, and data solutions; and (f) online payment processing solutions for gaming operators

in states that offer intrastate, Internet-based gaming, and lottery activities.

Everi

Holdings was formed as a Delaware limited liability company on February 4, 2004 and was converted to a Delaware corporation on May 14, 2004. Our principal executive offices are

located at 7250 South Tenaya Way, Suite 100, Las Vegas, Nevada 89113. Our telephone number is (800) 833-7110. Our website address is www.everi.com. The information on our website is not

part of this prospectus.

1

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein contain forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and the Private Securities Litigation Reform

Act of 1995. Forward-looking statements provide our current expectations and forecasts about future events.

These

forward-looking statements include, among other things, statements regarding the following matters: trends in gaming establishment and patron usage of our products; benefits realized by using

our products and services; product development, including the release of new game features and additional game and system releases in the future; regulatory approvals; gaming regulatory, card

association, and statutory compliance; the implementation of new or amended card association and payment network rules; consumer collection activities; future competition; future tax liabilities;

future goodwill impairment charges; international expansion; resolution of litigation; dividend policy; new customer contracts and contract renewals; future results of operations (including revenue,

expenses, margins, earnings, cash flow and capital expenditures); expected key improvements in free cash flow; expectations regarding our improved credit profile; future interest rates and interest

expense; future borrowings; and future equity incentive activity and compensation expense. In some cases these statements are identifiable through the use of words such as "anticipate," "believe,"

"estimate," "expect," "intend," "plan," "project," "target," "can," "could," "may," "will," "should," "would," "likely," and similar expressions. In addition, any statements that refer to projections

of our future financial performance, our anticipated growth, and trends in our business and other characterizations of future events or circumstances are forward-looking statements. We caution you not

to place undue reliance on these forward-looking statements. These forward-looking statements are not a guarantee of future performances and are subject to assumptions and involve known and unknown

risks, uncertainties and other important factors that could cause the actual results, performance or achievements of the Company, or industry results, to differ materially from any future results,

performance, or achievement implied by such forward-looking statements. These risks, uncertainties and important factors include, but are not limited to, market and economic forces; our substantial

leverage; our ability to compete in the gaming industry, manage competitive pressures, navigate gaming market contractions, and continue operating in Native American gaming markets; expectations

regarding our existing and future installed base and win per day, our product portfolio, and development and placement fee arrangements; expectations regarding customers', gaming establishments', and

patrons' preferences and demands for future gaming offerings; our ability to comply with the Europay, MasterCard, and Visa global standard for cards equipped with security chip technology; changes in

gaming regulatory, card association, and statutory requirements, as well as regulatory and licensing difficulties; and our ability to maintain our current customers; uncertainty of the timing and

closing of acquisitions, if any; and our ability to successfully access the capital markets to raise funds.

No

assurance can be given that the actual future results will not differ materially from the forward-looking statements that we make for a number of reasons including those described above and in the

"Risk Factors" section of our Annual Report on Form 10-K for the year ended

December 31, 2018, as well as in any future filings we may make that may be incorporated by reference herein. For information on the documents we are incorporating by reference

and how to obtain a copy, please see the "Where You Can Find More Information" section in this prospectus. Unless required by law, we undertake no obligation to publicly update or revise any

forward-looking statements to reflect new information or future events or otherwise.

You

should read this prospectus with the understanding that our actual future results may be materially different from what we expect.

2

Table of Contents

RISK FACTORS

Investing in our securities involves a high degree of risk. Before making an investment decision, you should consider carefully the risks, uncertainties and

other factors described in our most recent Annual Report on Form 10-K, as supplemented and updated by subsequent quarterly reports on Form 10-Q and current reports on Form 8-K

that we have filed or will file with the SEC, which are incorporated herein by reference, as well as the risk factors and other information contained in or incorporated by reference into the

applicable prospectus supplement and any related free writing prospectus.

If

any of these risks were to occur, our business, affairs, prospects, assets, financial condition, results of operations and cash flows could be materially and adversely affected. If this occurs, the

trading price and/or value of our securities could decline, and you could lose all or part of your investment. For more information about our SEC filings, please see "Where You Can Find More

Information."

3

Table of Contents

USE OF PROCEEDS

We intend to use the net proceeds we receive from the sale of securities by us for general corporate purposes unless otherwise set forth in the applicable

prospectus supplement.

4

Table of Contents

DESCRIPTION OF CAPITAL STOCK

The following is a summary of the material terms of our capital stock, including our restated certificate of incorporation and amended and restated bylaws. You

are strongly encouraged, however, to read our restated certificate of incorporation, amended and restated bylaws and any other relevant agreements, each of which is filed or will be filed as an

exhibit to the registration statement of which this prospectus is a part. Additionally, copies of these documents are available from us upon request. Please also refer to "Where You Can Find More

Information" to find out where copies of these documents may be obtained.

General

Our authorized capital stock consists of 50,000,000 shares of preferred stock, of which there are no shares outstanding, and 500,000,000 shares of common

stock, of which 72,730,634 shares were outstanding on November 22, 2019, held by eight (8) holders of record.

Common Stock

The holders of common stock are entitled to one vote per share on all matters, including the election of directors. Our Certificate of Incorporation and Bylaws

provide that the directors shall be divided into three classes constituting the entire board of directors (the "Board"). The members of each class of directors serve staggered three-year terms. Given

that only a portion of the total number of directors is elected each year, a greater number of shares is required to ensure the ability to elect a specific number of directors than would be required

if the entire Board were elected each year.

Holders

of common stock are entitled to receive ratably such dividends as may be declared by the Board from funds legally available therefore. In the event of liquidation, dissolution or winding up of

the Company holders of common stock are entitled to share ratably in all assets remaining after payment of liabilities and satisfaction of any preferential rights of the holders of the preferred

stock. Holders of common stock have no preemptive, subscription or conversion rights. There are no redemption or sinking fund provisions, and there is no liability for further calls or assessments by

the Company.

Preferred Stock

The Board has the authority, without any further action by stockholders, to issue 50,000,000 shares of preferred stock in one or more series with dividend

rights, conversion rights, voting rights, redemption terms, liquidation preferences and other rights or preferences that could be senior to those of holders of common stock. There are no shares of

preferred stock outstanding.

Anti-Takeover Provisions

We are subject to Section 203 of the Delaware General Corporation Law, or DGCL. Subject to certain exceptions, Section 203 prevents a publicly

held Delaware corporation from engaging in a "business combination" with any "interested stockholder" for three years following the date that the person became an interested stockholder, unless the

interested stockholder attained such status with the approval of the Board or unless the business combination is approved in a prescribed manner. A "business combination" includes, among other things,

a merger or consolidation involving us, and the interested stockholder and the sale of more than 10% of our assets. In general, an "interested stockholder" is any entity or person beneficially owning

15% or more of our outstanding voting stock and any entity or person affiliated with or controlling or controlled by such entity or person. The restrictions contained in Section 203 are not

applicable to any of our existing stockholders.

In

addition, our restated certificate of incorporation and amended and restated bylaws include a number of provisions that may have the effect of discouraging persons from pursuing non-negotiated

takeover attempts. These provisions include:

-

§

-

a classified Board;

-

§

-

a requirement that directors may only be removed for cause and only by an affirmative

vote of the holders of a majority of the Company's voting stock; and

5

Table of Contents

-

§

-

the inability of stockholders to call special meetings and to act without a meeting.

Subject

to the exceptions set forth below, certain business combinations involving a "Related Person" require the approval of the holders of at least 80% of the outstanding shares entitled to vote

generally in the election of directors (which we refer to as "voting shares") and the approval of the holders of a majority of the voting shares not owned beneficially by the Related Person. The 80%

voting requirement does not apply if:

-

§

-

the terms of the business combination meet certain fairness standards set forth in our

restated certificate of incorporation;

-

§

-

the business combination is approved by the holders of a majority of the voting shares

not owned beneficially by the Related Person; and

-

§

-

all other affirmative voting requirements imposed by applicable law or our restated

certificate of incorporation are met.

Alternatively,

the business combination can be approved by a majority of the "Continuing Directors" and such other vote as may be required by law or by our restated certificate of incorporation.

"Related

Person" means any person, entity or group that beneficially owns five percent or more of the outstanding voting stock (subject to certain exceptions) and affiliates and associates of any such

person, entity or group.

"Continuing

Director" means, as to any Related Person:

-

§

-

a member of the Board who was a director of our company's predecessor prior to

June 9, 1987 or thereafter became a director of our company prior to the time the Related Person became a Related Person; and

-

§

-

any successor of such a director who is recommended by a majority of such directors then

on the Board.

However,

to be a Continuing Director as to any Related Person, the director must not be the Related Person or an affiliate of the Related Person.

Options

As of September 30, 2019, options representing the right to purchase 12,681,502 shares of common stock were issued and outstanding at a weighted average

exercise price of $5.15. The outstanding options were granted to certain of our employees, officers, directors and consultants pursuant to our 2014 Equity Incentive Plan (as amended and restated) and

our 2012 Equity Incentive Plan (as amended).

Restricted Stock and Restricted Stock Units

As of September 30, 2019, there were no shares of restricted (unvested) stock awards outstanding and 3,405,682 restricted stock units outstanding, which

includes 2,378,682 time-based restricted stock units and 1,027,000 performance-based restricted stock units.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Broadridge Financial Solutions, Inc. ("Broadridge") and its telephone number is

(800) 353-0103.

New York Stock Exchange

Our common stock is listed on the NYSE under the symbol "EVRI."

6

Table of Contents

DESCRIPTION OF DEBT SECURITIES

The debt securities we may offer pursuant to this prospectus will be general unsecured obligations of Everi Holdings Inc. Our unsecured senior debt

securities will be issued under an indenture to be entered into by us and a trustee (the "Trustee") chosen by us, qualified to act as such under the Trust Indenture Act of 1939, as amended, or the

Trust Indenture Act, and appointed under such indenture. The form of unsecured senior debt indenture is filed as an exhibit to the registration statement of which this prospectus is a part. You should

refer to the applicable indenture for more specific information.

The

senior debt securities will rank equally with each other and with all of our other unsecured and unsubordinated indebtedness. Our senior debt securities will effectively be subordinated to any of

our secured indebtedness, including amounts we have borrowed under any secured revolving or term credit facility, and the liabilities of our subsidiaries.

We

will include the specific terms of each series of the debt securities being offered in a prospectus supplement.

DESCRIPTION OF WARRANTS

We may issue warrants to purchase any combination of debt securities, common stock, preferred stock or other securities of our company or any other entity. We

may issue warrants independently or

together with other securities. Warrants sold with other securities may be attached to or separate from the other securities. We will issue warrants under one or more warrant agreements between us and

a warrant agent that we will name in the prospectus supplement.

The

prospectus supplement relating to any warrants we are offering will include specific terms relating to the offering. We will file the form of any warrant agreement with the SEC, and you should

read the warrant agreement for provisions that may be important to you. The prospectus supplement will include some or all of the following

terms:

-

§

-

the title of the warrants;

-

§

-

the aggregate number of warrants offered;

-

§

-

the designation, number and terms of the debt securities, common stock, preferred stock

or other securities purchasable upon exercise of the warrants, and procedures by which those numbers may be adjusted;

-

§

-

the exercise price of the warrants;

-

§

-

the dates or periods during which the warrants are exercisable;

-

§

-

the designation and terms of any securities with which the warrants are issued;

-

§

-

if the warrants are issued as a unit with another security, the date, if any, on and

after which the warrants and the other security will be separately transferable;

-

§

-

if the exercise price is not payable in U.S. dollars, the foreign currency, currency unit

or composite currency in which the exercise price is denominated;

-

§

-

any minimum or maximum amount of warrants that may be exercised at any one time; and

-

§

-

any terms, procedures and limitations relating to the transferability, exchange or

exercise of the warrants.

7

Table of Contents

DESCRIPTION OF UNITS

We may issue units of securities consisting of one or more of the following securities: common stock, preferred stock, debt securities, warrants or any

combination thereof. We may evidence each series of units issued by unit certificates that we will issue under a separate agreement. We may enter into unit agreements with a unit agent. Each unit

agent will be a bank or trust company that we select. You should read the particular terms of these documents, which will be described in more detail in the applicable prospectus supplement.

If

we offer any units, certain terms of that series of units will be described in the applicable prospectus supplement, including, without limitation, the following, as

applicable:

-

§

-

the title of the series of units;

-

§

-

identification and description of the separate constituent securities comprising the

units;

-

§

-

the price or prices at which the units will be issued;

-

§

-

the date, if any, on and after which the constituent securities comprising the units will

be separately transferable;

-

§

-

if appropriate, a discussion of material United States federal income tax considerations;

and

-

§

-

any other terms of the units and their constituent securities.

8

Table of Contents

PLAN OF DISTRIBUTION

We will set forth in the applicable prospectus supplement a description of the plan of distribution of the securities that may be offered pursuant to this

prospectus.

9

Table of Contents

LEGAL MATTERS

Certain legal matters in connection with the securities will be passed upon by Gibson, Dunn & Crutcher LLP, our counsel. Legal counsel to any

underwriters may pass upon legal matters for such underwriters and will be named in the applicable prospectus supplement.

EXPERTS

The consolidated financial statements as of December 31, 2018 and 2017 and for each of the three years in the period ended December 31, 2018 and

management's assessment of the effectiveness of internal control over financial reporting as of December 31, 2018 incorporated by reference in this prospectus have been so incorporated in

reliance on the reports of BDO USA, LLP, an independent registered public accounting firm, incorporated herein by reference, given on the authority of such firm as experts in accounting and

auditing.

10

Table of Contents

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to "incorporate by reference" information that we file with it, which means that we can disclose important information to you by referring

you to documents previously filed with the SEC. The information incorporated by reference is an important part of this prospectus, and the information that we later file with the SEC will

automatically update and supersede this information. The following documents that we filed with the SEC pursuant to the Securities Exchange Act of 1934, as amended (the "Exchange Act"), are

incorporated herein by reference:

-

§

-

our

Annual Report on Form 10-K for the fiscal year ended December 31,

2018;

-

§

-

our Quarterly Reports on Form 10-Q for the quarterly periods ended

March 31, 2019,

June 30, 2019 and

September 30, 2019;

-

§

-

our Current Reports on Form 8-K filed with the SEC on

January 24, 2019,

May 21, 2019, and

November 5, 2019;

-

§

-

the description of our common stock contained in our registration statement

on Form 8-A filed with the SEC on September 16, 2005, including any amendment or report filed for the purpose of updating that description; and

-

§

-

our Definitive Proxy Statement on Schedule 14A filed on

April 22, 2019, in connection with our 2019 Annual Meeting of Stockholders, only to the extent incorporated by reference in our

Annual Report on Form 10-K for the year ended December 31,

2018.

We

also incorporate by reference into this prospectus additional documents that we may file with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Exchange Act from the date of this

prospectus to the completion of the offering of the securities. These documents may include Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on

Form 8-K, as well as proxy statements. We are not incorporating by reference any information furnished under items 2.02 or 7.01 (or corresponding information furnished under

item 9.01 or included as an exhibit) in any past or future Current Report on Form 8-K that we may file with the SEC, unless otherwise specified in such Current Report.

Any

information in any of the foregoing documents will automatically be deemed to be modified or superseded to the extent that information in this prospectus or in a later filed document that is

incorporated or deemed to be incorporated herein by reference modifies or replaces such information.

You

may request and we will provide to each person, including any beneficial owner, to whom this prospectus is delivered, a copy of any document incorporated by reference in this prospectus, including

the exhibits thereto, at no cost, by writing or telephoning us at the following address or telephone number:

Everi

Holdings Inc.

7250 S. Tenaya Way, Suite 100

Las Vegas, Nevada 89113

Attention: Harper H. Ko, EVP, Chief Legal Officer — General Counsel, and Corporate Secretary

WHERE YOU CAN FIND MORE INFORMATION

We are required to file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an Internet site that

contains reports, proxy statements and other information about registrants, like us, that have been filed electronically with the SEC. You can access the SEC's Internet site at http://www.sec.gov. You

can also obtain information about us on our website at http://www.everi.com. Information on our website or any other website is not incorporated by reference into this prospectus.

11

Table of Contents

We

have filed a registration statement on Form S-3 with the SEC relating to the securities covered by this prospectus. This prospectus is a part of the registration statement and does not

contain all of the information in the registration statement. Whenever a reference is made in this prospectus to a contract or other document of ours, please be aware that the reference is only a

summary and that you should refer to the exhibits that are part of the registration statement for a copy of the contract or other document. The registration statement, exhibits and schedules are

available through the SEC's website at http://www.sec.gov.

12

Table of Contents

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following is a statement of the estimated expenses to be incurred in connection with the issuance and distribution of the securities being registered,

other than underwriting discounts, commissions and transfer taxes, to be paid by the Registrant.

|

|

|

|

|

|

|

|

Amount

|

|

|

SEC registration fee

|

|

$

|

|

(1)

|

|

Printing expenses

|

|

$

|

|

(2)

|

|

Accounting fees and expenses

|

|

$

|

|

(2)

|

|

Legal fees and expenses

|

|

$

|

|

(2)

|

|

Trustee and Transfer Agent fees

|

|

$

|

|

(2)

|

|

Blue Sky Fees

|

|

$

|

|

(2)

|

|

Miscellaneous (including listing and rating agency fees)

|

|

$

|

|

(2)

|

|

Total

|

|

$

|

|

(2)

|

-

(1)

In

accordance with Rules 456(b) and 457(r), we are deferring the payment of registration fees for securities offered under this registration

statement.

(2)

These

fees and expenses are calculated based on the securities offered and the number of issuances and accordingly cannot be estimated at this time.

The applicable prospectus supplement will set forth the estimated amount of fees and expenses associated with any offering of securities.

Item 15. Indemnification of Directors and Officers.

Section 145 of the General Corporation Law of Delaware empowers a corporation to indemnify any person who was or is a party or is threatened to be made

a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, by reason of the fact that he or she is a director, officer,

employee or agent of the corporation or is or was serving at the request of the corporation as director, officer, employee or agent of another corporation or enterprise. Depending on the character of

the proceeding, a corporation may indemnify against expenses (including attorneys' fees), judgments, fines and amounts paid in settlement actually and reasonably incurred in connection with such

action, suit or proceeding if the person identified acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of the corporation and, with respect

to any criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful. In the case of an action by or in the right of the corporation, no indemnification may be made

in respect to any claim, issue or matter as to which such person shall have been adjudged to be liable for negligence or misconduct in the performance of his or her duty to the corporation unless and

only to the extent that a Court of Chancery or the court in which such action or suit was brought shall determine that despite the adjudication of liability such person is fairly and reasonably

entitled to indemnity for such expenses which the court shall deem proper. Section 145 further provides that to the extent that a director or officer of a corporation has been successful in the

defense of any action, suit or proceeding referred to above or in the defense of any claim, issue or matter herein, he or she shall be indemnified against expenses (including attorneys' fees) actually

and reasonably incurred by him or her in connection therewith.

The

certificate of incorporation of the Company provides, in effect, that, to the fullest extent permitted by Delaware General Corporation Law, the Company shall indemnify any person who was or is a

party or is threatened to be made a party to any action, suit or proceeding of the type described above by reason of the fact that he or she is a director, officer, employee or agent of the Company.

II-1

Table of Contents

The

Company's certificate of incorporation relieves its directors from monetary damages to the Company or its stockholders for breach of such director's fiduciary duty as a director to the full extent

permitted by the Delaware General Corporation Law. Under Section 102(b)(7) of the Delaware General Corporation Law a corporation may relieve its directors from personal liability to such

corporation or its stockholders for monetary damages for any breach of their fiduciary duty as directors except (i) for a breach of the duty of loyalty, (ii) for failure to act in good

faith, (iii) for intentional misconduct or knowing violation of law, (iv) for willful or negligent violations of certain provisions in the Delaware General Corporation Law imposing

certain requirements with respect to stock purchases, redemptions and dividends or (v) for any transaction from which the director derived an improper personal benefit.

Item 16. Exhibits.†

EXHIBIT INDEX

-

*

Previously

filed.

**

Filed

herewith.

†

Everi

Holdings Inc. will file as an exhibit to a Current Report on Form 8-K (i) any underwriting,

remarketing or agency agreement relating to the securities offered hereby, (ii) the instruments setting forth the terms of any debt securities, preferred stock, warrants or units,

(iii) any additional required opinions of counsel with respect to legality of the securities offered hereby and (iv) any required opinion of counsel as to certain tax matters relative to

the securities offered hereby. The Form T-1 Statement of Eligibility of the Trustee under the Indenture for Senior Debt will be filed on Form 305B2 in accordance with the requirements of

Section 305(b)(2) of the Trust Indenture Act of 1939, as amended.

II-2

Table of Contents

Item 17. Undertakings.

A. The

undersigned Registrant hereby undertakes:

(1) To

file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To

include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To

reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof)

which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of

securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may

be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the

maximum aggregate offering price set forth in the "Calculation of Registration Fee" table in the effective registration statement; and

(iii) To

include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the

registration statement.

Provided, however, that paragraphs (A)(1)(i), (A)(1)(ii) and (A)(1)(iii) do not apply if the

registration statement is on Form S-3 and the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the

Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is

contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That,

for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the

securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To

remove from registration by means of a post-effective amendment any of the securities being registered that remain unsold at the termination of the offering.

(4) That,

for the purpose of determining liability under the Securities Act to any purchaser:

(i) Each

prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus

was deemed part of and included in the registration statement; and

(ii) Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating to

an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by section 10(a) of the Securities Act shall be deemed to

be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in

the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a

new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such

II-3

Table of Contents

securities

at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the

registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a

purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration

statement or made in any such document immediately prior to such effective date.

(5) That,

for the purpose of determining liability of the Registrant under the Securities Act to any purchaser in the initial distribution of the securities: The undersigned Registrant

undertakes that in a primary offering of securities of the undersigned Registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the

purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned Registrant will be a seller to the purchaser and will be considered

to offer or sell such securities to such purchaser:

(i) Any

preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any

free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to by the undersigned Registrant;

(iii) The

portion of any other free writing prospectus relating to the offering containing material information about the undersigned Registrant or its securities provided by or on behalf

of the undersigned Registrant; and

(iv) Any

other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.

B. The

undersigned registrant hereby undertakes that, for the purposes of determining any liability under the Securities Act, each filing of the registrant's annual report pursuant to

Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan's annual report pursuant to Section 15(d) of the Securities

Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of

such securities at that time shall be deemed to be the initial bona fide offering thereof.

C. Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing

provisions, or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore,

unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling

person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered,

the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification

by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

D. The

undersigned registrant hereby undertakes, if applicable, to file an application for the purpose of determining the eligibility of the trustee to act under subsection (a) of

section 310 of the Trust Indenture Act ("Act") in accordance with the rules and regulations prescribed by the Commission under section 305(b)(2) of the Act.

II-4

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of

the requirements for filing on Form S-3 and has duly caused this Registration Statement on Form S-3 to be signed on its behalf by the undersigned, thereunto duly authorized in the City

of Las Vegas, State of Nevada on December 4, 2019.

|

|

|

|

|

|

|

|

|

EVERI HOLDINGS INC.

|

|

|

By:

|

|

/s/ MICHAEL D. RUMBOLZ

Michael D. Rumbolz

President and Chief Executive Officer and Director (Principal Executive Officer)

|

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS:

Pursuant

to the requirements of the Securities Act of 1933, this Registration Statement on Form S-3 has been signed by the following persons in the capacities and on the date indicated. Each of

the directors and/or officers of the Registrant whose signature appears below hereby appoints Michael D. Rumbolz, Randy L. Taylor and Todd A. Valli each of them severally as his attorney-in-fact to

sign his name and on his behalf, in any and all capacities stated below, and to file with the Securities and Exchange Commission any and all amendments, including post-effective amendments to this

Registration Statement as appropriate, and generally to do all such things in their behalf in their capacities as officers and directors to enable the Registrant to comply with the provisions of the

Securities Act of 1933, and all requirements of the Securities and Exchange Commission.

|

|

|

|

|

|

|

Name and Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

/s/ MICHAEL D. RUMBOLZ

Michael D. Rumbolz

|

|

President and Chief Executive Officer and Director (Principal Executive Officer)

|

|

December 4, 2019

|

/s/ RANDY L. TAYLOR

Randy L. Taylor

|

|

Executive Vice President and Chief Financial Officer (Principal Financial Officer)

|

|

December 4, 2019

|

/s/ TODD A. VALLI

Todd A. Valli

|

|

Senior Vice President and Chief Accounting Officer (Principal Accounting Officer)

|

|

December 4, 2019

|

/s/ E. MILES KILBURN

E. Miles Kilburn

|

|

Director

|

|

December 4, 2019

|

II-5

Table of Contents

|

|

|

|

|

|

|

Name and Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

/s/ GEOFFREY P. JUDGE

Geoffrey P. Judge

|

|

Director

|

|

December 4, 2019

|

/s/ RONALD V. CONGEMI

Ronald V. Congemi

|

|

Director

|

|

December 4, 2019

|

/s/ EILEEN F. RANEY

Eileen F. Raney

|

|

Director

|

|

December 4, 2019

|

/s/ LINSTER W. FOX

Linster W. Fox

|

|

Director

|

|

December 4, 2019

|

/s/ MAUREEN T. MULLARKEY

Maureen T. Mullarkey

|

|

Director

|

|

December 4, 2019

|

/s/ ATUL BALI

Atul Bali

|

|

Director

|

|

December 4, 2019

|

II-6

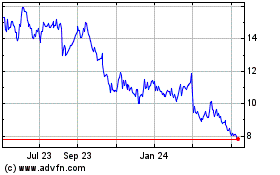

Everi (NYSE:EVRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

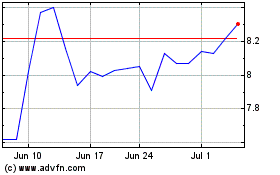

Everi (NYSE:EVRI)

Historical Stock Chart

From Apr 2023 to Apr 2024