Equitrans Midstream Corporation (NYSE: ETRN) today announced

2021 financial and capital expenditure guidance. Included in the

“Non-GAAP Disclosures” section of this news release are important

disclosures regarding the use of non-GAAP supplemental financial

measures, including information regarding their most comparable

GAAP financial measure.

Financial Forecast:(1)

$ millions

2021 Forecast

Net income attributable to ETRN

$540 - $610

Adjusted EBITDA

$1,035 - $1,105

Deferred revenue

$295

Free cash flow

$(150) - $(80)

Retained free cash flow

$(410) - $(340)

Capital Expenditures and Capital

Contributions:

$ millions

2021 Forecast

Mountain Valley Pipeline (MVP)

$670 - $720

Gathering(2)

$305 - $335

Transmission(3)

$45 - $65

Water

$20

Total

$1,040 - $1,140

(1)

Does not reflect impact of

capital markets transactions, if any.

(2)

Includes approximately $30

million from ETRN’s 60% interest in Eureka Midstream Holdings, LLC

(Eureka).

(3)

Includes capital contributions of

approximately $20 million to Mountain Valley Pipeline, LLC (MVP JV)

for the MVP Southgate project.

Additional Information:

- Approximately 70% of the 2021 forecast for total operating

revenue is expected to be generated from firm reservation

fees.

- The mid-point of the 2021 financial forecast range assumes an

average of 8.0 MMdth per day total gathered volume.

- The MVP JV is continuing to target a full in-service date for

the MVP in late 2021 at a total project cost estimate of $5.8 -

$6.0 billion. The 2021 financial forecast assumes an MVP in-service

date of December 31, 2021.

- The 2021 water EBITDA forecast is approximately $25 million.

The year-over-year decrease is driven by a lower forecast for

delivered water volumes.

Investor Presentation

ETRN management speaks to investors from time-to-time and the

presentation for these discussions, which is updated periodically,

is available via www.equitransmidstream.com.

Non-GAAP Disclosures

Adjusted EBITDA

As used in this news release, adjusted EBITDA means, as

applicable, net income, plus income tax expense, net interest

expense, loss on early extinguishment of debt, depreciation,

amortization of intangible assets, impairments of long-lived

assets, payments on the preferred interest in EQT Energy Supply,

LLC (Preferred Interest), non-cash long-term compensation expense

(income), and transaction costs, less equity income, AFUDC-equity,

unrealized gain (loss) on derivative instruments and adjusted

EBITDA attributable to noncontrolling interest.

Free Cash Flow

As used in this news release, free cash flow means net cash

provided by operating activities plus principal payments received

on the Preferred Interest, and less net cash provided by operating

activities attributable to noncontrolling interest, capital

expenditures (excluding the noncontrolling interest share (40%) of

Eureka capital expenditures), capital contributions to MVP JV, and

dividends paid to Series A Preferred shareholders.

Retained Free Cash Flow

As used in this news release, retained free cash flow means free

cash flow less dividends paid to common shareholders.

Adjusted EBITDA, free cash flow and retained free cash flow are

non-GAAP supplemental financial measures that management and

external users of ETRN's consolidated financial statements, such as

industry analysts, investors, lenders, and rating agencies, may use

to assess:

- ETRN’s operating performance as compared to other publicly

traded companies in the midstream energy industry without regard to

historical cost basis or, in the case of adjusted EBITDA, financing

methods

- The ability of ETRN’s assets to generate sufficient cash flow

to pay dividends to ETRN’s shareholders

- ETRN’s ability to incur and service debt and fund capital

expenditures and capital contributions

- The viability of acquisitions and other capital expenditure

projects and the returns on investment of various investment

opportunities

ETRN believes that adjusted EBITDA, free cash flow, and retained

free cash flow provide useful information to investors in assessing

ETRN's financial condition and results of operations. Adjusted

EBITDA, free cash flow, and retained free cash flow should not be

considered as alternatives to net income, operating income, net

cash provided by operating activities, as applicable, or any other

measure of financial performance or liquidity presented in

accordance with GAAP. Adjusted EBITDA, free cash flow, and retained

free cash flow have important limitations as analytical tools

because they exclude some, but not all, items that affect net

income, operating income and net cash provided by operating

activities. Additionally, because these non-GAAP metrics may be

defined differently by other companies in ETRN's industry, ETRN's

definitions of adjusted EBITDA, free cash flow, and retained free

cash flow may not be comparable to similarly titled measures of

other companies, thereby diminishing the utility of the measures.

Free cash flow and retained free cash flow should not be viewed as

indicative of the actual amount of cash that ETRN has available for

dividends or that ETRN plans to distribute and are not intended to

be liquidity measures.

ETRN is unable to provide a reconciliation of projected adjusted

EBITDA from projected net income, the most comparable financial

measure calculated in accordance with GAAP, or a reconciliation of

projected free cash flow or retained cash flow to net cash provided

by operating activities, the most comparable financial measure

calculated in accordance with GAAP. ETRN has not provided a

reconciliation of projected adjusted EBITDA to projected net

income, the most comparable financial measure calculated in

accordance with GAAP, due to the inherent difficulty and

impracticability of predicting certain amounts required by GAAP

with a reasonable degree of accuracy. Net income includes the

impact of depreciation expense, income tax expense, the revenue

impact of changes in the projected fair value of derivative

instruments prior to settlement, potential changes in estimates for

certain contract liabilities and unbilled revenues and certain

other items that impact comparability between periods and the tax

effect of such items, which may be significant and difficult to

project with a reasonable degree of accuracy. Therefore, a

reconciliation of projected adjusted EBITDA to projected net income

is not available without unreasonable effort.

ETRN is unable to project net cash provided by operating

activities because this metric includes the impact of changes in

operating assets and liabilities related to the timing of cash

receipts and disbursements that may not relate to the period in

which the operating activities occurred. ETRN is unable to project

these timing differences with any reasonable degree of accuracy to

a specific day, three or more months in advance. Therefore, ETRN is

unable to provide projected net cash provided by operating

activities, or the related reconciliation of each of projected free

cash flow and projected retained free cash flow to projected net

cash provided by operating activities without unreasonable effort.

ETRN provides a range for the forecasts of net income attributable

to ETRN, adjusted EBITDA, free cash flow and retained free cash

flow to allow for the inherent difficulty of predicting certain

amounts and the variability in the timing of cash spending and

receipts and the impact on the related reconciling items, many of

which interplay with each other.

Water EBITDA

As used in this news release, water EBITDA means the earnings

before interest, taxes, depreciation and amortization of ETRN’s

water services business. Water EBITDA is a non-GAAP supplemental

financial measure that management and external users of ETRN’s

consolidated financial statements, such as industry analysts,

investors, lenders and rating agencies, use to assess the impact of

ETRN’s water services business on ETRN’s operating performance and

ETRN’s ability to incur and service debt and fund capital

expenditures. Water EBITDA should not be considered as an

alternative to ETRN’s net income, operating income or any other

measure of financial performance presented in accordance with GAAP.

Water EBITDA has important limitations as an analytical tool

because the measure excludes some, but not all, items that affect

net income and operating income. Additionally, because water EBITDA

may be defined differently by other companies in ETRN’s industry,

the definition of water EBITDA may not be comparable to similarly

titled measures of other companies, thereby diminishing the utility

of the measure.

ETRN has not provided a reconciliation of projected water EBITDA

from projected water operating income, the most comparable measure

calculated in accordance with GAAP. ETRN does not allocate certain

costs, such as interest expenses, to individual assets within its

business segments. Therefore, the reconciliation of projected water

EBITDA from projected water operating income is not available

without unreasonable effort.

About Equitrans Midstream Corporation:

Equitrans Midstream Corporation (ETRN) has a premier asset

footprint in the Appalachian Basin and, as the parent company of

EQM Midstream Partners, is one of the largest natural gas gatherers

in the United States. Through its strategically located assets in

the Marcellus and Utica regions, ETRN has an operational focus on

gas transmission and storage systems, gas gathering systems, and

water services that support natural gas development and production

across the Basin. With a rich 135-year history in the energy

industry, ETRN was launched as a standalone company in 2018 with

the vision to be the premier midstream services provider in North

America. ETRN is helping to meet America’s growing need for

clean-burning energy, while also providing a rewarding workplace

and enriching the communities where its employees live and work.

For more information on Equitrans Midstream Corporation, visit

www.equitransmidstream.com; and to learn more about our

environmental, social, and governance practices, visit

https://csr.equitransmidstream.com.

Cautionary Statements

This news release contains certain forward-looking statements

within the meaning of Section 21E of the United States Securities

Exchange Act of 1934, as amended (the Exchange Act), and Section

27A of the United States Securities Act of 1933, as amended (the

Securities Act), concerning ETRN and other matters. These

statements may discuss goals, intentions and expectations as to

future plans, trends, events, results of operations or financial

condition, or otherwise, based on current beliefs of the management

of ETRN, as well as assumptions made by, and information currently

available to, such management. Words such as “could,” “will,”

“may,” “assume,” “forecast,” “position,” “predict,” “strategy,”

“expect,” “intend,” “plan,” “estimate,” “anticipate,” “believe,”

“project,” “budget,” “potential,” “target,” "expect," "intend" or

“continue,” and similar expressions are used to identify

forward-looking statements. These statements are subject to various

risks and uncertainties, many of which are outside ETRN's control.

Without limiting the generality of the foregoing, forward-looking

statements contained in this communication specifically include

expectations of plans, strategies, objectives and growth and

anticipated financial and operational performance of ETRN and its

affiliates, including guidance regarding net income attributable to

ETRN, adjusted EBITDA, deferred revenue, free cash flow, retained

free cash flow and water EBITDA; projected revenue (including from

firm reservation fees) and volume; the cost, timing of regulatory

approvals, and targeted in-service dates of current or in-service

projects or assets, in each case as applicable; the impact of a

dispute with EQT (or resolution thereof) regarding the Hammerhead

gathering agreement and/or ownership of the Hammerhead pipeline on

ETRN’s business and results of operations; expected cash flows and

minimum volume commitments; projected capital contributions and

capital and operating expenditures, including the amount and timing

of reimbursable capital expenditures, capital budget and sources of

funds for capital expenditures; dividend amounts, timing and rates;

liquidity and financing requirements, including sources and

availability; and expectations regarding production, gathered and

water volumes in ETRN’s areas of operations. These forward-looking

statements involve risks and uncertainties that could cause actual

results to differ materially from projected results.

Accordingly, investors should not place undue reliance on

forward-looking statements as a prediction of actual results. ETRN

has based these forward-looking statements on current expectations

and assumptions about future events. While ETRN considers these

expectations and assumptions to be reasonable, they are inherently

subject to significant business, economic, competitive, regulatory

and other risks and uncertainties, many of which are difficult to

predict and beyond ETRN’s control. The risks and uncertainties that

may affect the operations, performance and results of ETRN’s

business and forward-looking statements include, but are not

limited to, those set forth under Item 1A, "Risk Factors" in ETRN's

Annual Report on Form 10-K for the year ended December 31, 2019

filed with the Securities and Exchange Commission (the SEC), as

updated by the risk factors disclosed under Part II, Item 1A, "Risk

Factors," of ETRN’s Quarterly Report on Form 10-Q for the three

months ended September 30, 2020 filed with the SEC. Any

forward-looking statement speaks only as of the date on which such

statement is made, and ETRN does not intend to correct or update

any forward-looking statement, unless required by securities laws,

whether as a result of new information, future events or otherwise.

As forward-looking statements involve significant risks and

uncertainties, caution should be exercised against placing undue

reliance on such statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201217005113/en/

Analyst inquiries: Nate Tetlow – Vice President,

Corporate Development and Investor Relations 412-553-5834

ntetlow@equitransmidstream.com

Media inquiries: Natalie Cox – Communications and

Corporate Affairs 412-395-3941 ncox@equitransmidstream.com

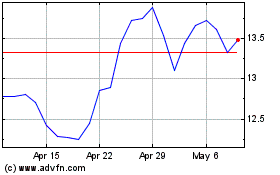

Equitrans Midstream (NYSE:ETRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

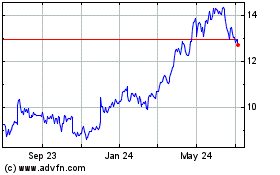

Equitrans Midstream (NYSE:ETRN)

Historical Stock Chart

From Apr 2023 to Apr 2024