As Ex-Enron CEO Exits Prison, Some of Company's Old Businesses Thrive

February 24 2019 - 10:05AM

Dow Jones News

By Rebecca Elliott

Former Enron Corp. Chief Executive Jeffrey Skilling has been

released from federal custody after serving more than 12 years in

prison for his role in one of the biggest business scandals in

American history. He re-enters a world in which some of the

businesses built from his old company's less appreciated assets

have become formidable in their own right.

Enron is a symbol of corporate fraud and excess since the

Houston-based energy conglomerate collapsed nearly two decades ago

amid questions about its accounting practices. Mr. Skilling, who

was released Thursday according to the Federal Bureau of Prisons,

was among several executives who faced criminal charges after the

company filed for bankruptcy in 2001.

A lawyer who represented Mr. Skilling didn't immediately return

requests for comment, nor did the Federal Bureau of Prisons. He was

convicted in 2006 on counts of fraud, conspiracy and insider

trading, and after the verdict, continued to maintain his

innocence.

A former McKinsey & Co. consultant, Mr. Skilling, 65, joined

Enron in 1990 and helped transform the natural gas pipeline company

into a trading behemoth before assuming the top job in early 2001.

While Enron proved to be worth far less than it claimed after its

finances came under scrutiny later that same year, many of the

assets Enron cast aside over the years became valuable building

blocks for some of today's top energy firms, from leading shale

driller EOG Resources Inc. to pipeline giant Kinder Morgan Inc. to

the wind arm of General Electric Co.

EOG Resources Inc.

EOG has emerged as a leading oil and gas exploration and

production company since being spun off from Enron in 1999. The

Houston-based driller once known as Enron Oil & Gas Co. was

among the pioneers of horizontal drilling and hydraulic fracturing,

the techniques that have allowed shale drillers to extract a bounty

of oil and gas from dense rock formations.

While shale companies primarily used these methods to unlock

natural gas early on, EOG recognized that the same approach could

be used to economically extract crude as well, a pivot that has

helped drive domestic oil production to an all-time high of 12

million barrels a day this month, according to the Energy

Information Administration. EOG now drills in basins from West

Texas to Wyoming.

Kinder Morgan Inc.

After being passed over for the top job at Enron, Richard Kinder

left the company in 1996, going on to start a pipeline business

that would grow into Kinder Morgan. The former Enron chief

operating officer, along with energy lawyer William Morgan, bought

Enron Liquids Pipeline L.P. for about $40 million, and subsequently

expanded the pipeline system, ultimately developing a vast network

of conduits that crisscrosses the U.S.

The Houston-based company now has an interest in roughly 84,000

miles of pipelines that transport oil, natural gas and other

products, regulatory filings show, making it one of the largest

pipeline firms in the U.S.

GE Renewable Energy

A subsidiary of General Electric Co. bought Enron's wind power

assets out of bankruptcy in 2002, marking the company's foray into

what would become a leading form of renewable energy generation. GE

has since become one of the largest wind turbine manufacturers,

joining companies such as Vestas Wind Systems AS and Siemens Gamesa

Renewable Energy SA. The company sold 2,825 wind turbines in 2017,

when its renewable energy business generated $10.3 billion in

revenue, regulatory filings show.

Mr. Skilling's plans now that he has become a free man are

unclear. But he told The Wall Street Journal in an interview

shortly after his 2006 conviction that he might eventually want to

share more of Enron's story.

"At some point, people will ask what really happened [at

Enron]," he said at the time. "It would be good if they had someone

there who could tell them."

--Russell Gold and

Katherine Blunt

contributed to this article.

Write to Rebecca Elliott at rebecca.elliott@wsj.com

(END) Dow Jones Newswires

February 24, 2019 09:50 ET (14:50 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

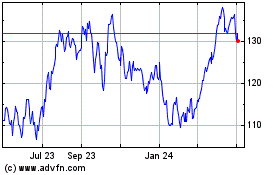

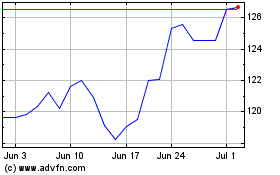

EOG Resources (NYSE:EOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

EOG Resources (NYSE:EOG)

Historical Stock Chart

From Apr 2023 to Apr 2024