Current Report Filing (8-k)

December 05 2019 - 4:33PM

Edgar (US Regulatory)

false 0001276187 0001276187 2019-12-05 2019-12-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 5, 2019

ENERGY TRANSFER LP

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

1-32740

|

|

30-0108820

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification Number)

|

8111 Westchester Drive, Suite 600

Dallas, Texas 75225

(Address of principal executive offices)

(214) 981-0700

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

|

|

|

|

|

Title of each class

|

|

Trading

symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Units

|

|

ET

|

|

New York Stock Exchange

|

|

Item 2.01.

|

Completion of Acquisition or Disposition of Assets.

|

On December 5, 2019, Energy Transfer LP, a Delaware limited partnership (“ET”), completed the acquisition of SemGroup Corporation, a Delaware corporation (“SemGroup”), pursuant to the terms of the Agreement and Plan of Merger, dated as of September 15, 2019 (the “Merger Agreement”), by and among ET, Nautilus Merger Sub LLC, a Delaware limited liability company and a wholly owned subsidiary of ET (“Merger Sub”), and SemGroup. Under the terms of the Merger Agreement, Merger Sub merged with and into SemGroup (the “Merger”), with SemGroup surviving the Merger.

At the effective time of the Merger on December 5, 2019 (the “Effective Time”), each share of Class A Common Stock, par value $0.01 per share, of SemGroup (such shares, collectively, the “SemGroup Common Stock” and each, a “Share”) issued and outstanding immediately prior to the Effective Time (other than shares held by SemGroup in treasury and shares held by ET or Merger Sub or by any wholly owned subsidiaries of SemGroup, ET or Merger Sub immediately prior to the Effective Time) was converted into the right to receive (i) $6.80 in cash, without interest, and (ii) 0.7275 common units representing limited partner interests in ET (“ET common units”). In accordance with that certain Certificate of Designations of Series A Cumulative Perpetual Convertible Preferred Stock of SemGroup Corporation, filed with the Secretary of State of the State of Delaware on January 19, 2018, as amended by that certain Amendment No. 1 to Certificate of Designations of Series A Cumulative Perpetual Convertible Preferred Stock of SemGroup Corporation, filed with the Secretary of State of the State of Delaware on September 16, 2019 (as amended, the “Certificate of Designations”), each share of Series A Cumulative Perpetual Convertible Preferred Stock, par value $0.01 per share, of SemGroup that was issued and outstanding as of immediately prior to the Effective Time was redeemed by SemGroup for cash at a price per share equal to 101% of the Liquidation Preference (as defined in the Certificate of Designations).

No fractional ET common units were issued in the Merger, and SemGroup’s stockholders received cash in lieu of fractional ET common units.

|

Item 7.01.

|

Regulation FD Disclosure.

|

On December 5, 2019, ET and SemGroup issued a joint press release announcing the completion of the Merger. The full text of the press release is attached hereto as Exhibit 99.1.

Forward Looking Statements

This Current Report on Form 8-K may include certain statements concerning expectations for the future, including statements regarding the anticipated benefits and other aspects of the transactions described above, that are forward-looking statements as defined by federal law. Such forward-looking statements are subject to a variety of known and unknown risks, uncertainties, and other factors that are difficult to predict and many of which are beyond management’s control, including the risk that the anticipated benefits from the Merger cannot be fully realized. An extensive list of factors that can affect future results are discussed in ET’s Annual Report on Form 10-K for the year ended December 31, 2018 and other documents filed by ET from time to time with the Securities and Exchange Commission. ET undertakes no obligation to update or revise any forward-looking statement to reflect new information or events.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

ENERGY TRANSFER LP

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

LE GP, LLC,

its general partner.

|

|

|

|

|

|

|

|

|

|

Date: December 5, 2019

|

|

|

|

By:

|

|

/s/ Thomas E. Long

|

|

|

|

|

|

Name:

|

|

Thomas E. Long

|

|

|

|

|

|

Title:

|

|

Chief Financial Officer

|

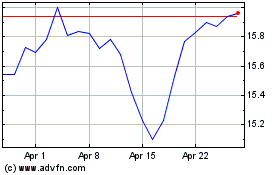

Energy Transfer (NYSE:ET)

Historical Stock Chart

From Mar 2024 to Apr 2024

Energy Transfer (NYSE:ET)

Historical Stock Chart

From Apr 2023 to Apr 2024