Amended Current Report Filing (8-k/a)

March 01 2023 - 12:40PM

Edgar (US Regulatory)

0001739104

true

0001739104

2023-02-21

2023-02-21

0001739104

us-gaap:CommonStockMember

2023-02-21

2023-02-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event

Reported): February 21, 2023

Elanco

Animal Health Incorporated

(Exact name of registrant as specified

in its charter)

| Indiana | |

001-38661 | |

82-5497352 |

(State

or other jurisdiction

of incorporation) | |

(Commission

File Number) | |

(I.R.S. Employer Identification No.) |

2500 Innovation Way

Greenfield, Indiana (Address of principal executive offices)

| |

46140 (Zip

Code) |

Registrant’s telephone number, including area code: (877)

352-6261

Not Applicable

(Former Name or Address, if Changed Since Last

Report)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ | Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each

class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which

registered |

| Common stock, no par value |

|

ELAN |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

¨ Emerging

growth company

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Explanatory Note.

On February 21, 2023, Elanco Animal Health Incorporated (the “Company”)

issued a press release announcing its financial results of operations for the fiscal quarter and full year ended December 31, 2022, which

was furnished on a Form 8-K filed on that date (the “Original 8-K”). This Form 8-K/A is filed to provide certain updates to

the information reported in the Original 8-K.

| Item 2.02 |

Results of Operation and Financial Condition. |

The Company issued a press release announcing its financial results

of operations for the fiscal quarter and full year ended December 31, 2022. Subsequent to that date, in connection with finalization of

the audited financial statements for the year ended December 31, 2022, the Company determined that an immaterial amount of estimated sales

rebates and discounts was not recorded correctly in a Western Europe affiliate. The Company also reduced expense related to a

management incentive plan. In connection with other immaterial revisions being made to the Company’s financial statements related

to the previously disclosed valuation allowance for taxes for a Southeast Asia affiliate, the Company has further revised its financial

statements to accurately reflect results in all periods. The revisions related to the sales rebates and discounts estimates had the following

impacts on the Company’s results compared to those reported in the Company’s earnings release issued on February 21, 2023:

| o | Revenue

decreased from $988 million to $985 million |

| o | Reported

net loss increased from $54 million to $55 million, adjusted net income decreased from $95

million to $94 million |

| o | Adjusted

EBITDA decreased from $174 million to $172 million |

| o | Reported

and adjusted EPS was unchanged |

| o | Revenue

decreased from $4,418 million to $4,411 million |

| o | Reported

net loss increased from $74 million to $78 million, adjusted net income decreased from $548

million to $544 million |

| o | Adjusted

EBITDA decreased from $1,023 million to $1,017 million |

| o | Reported

EPS decreased from $(0.15) to $(0.16), Adjusted EPS was unchanged |

| • | As of December 31, 2022: |

| o | Net

leverage increased from 5.4x to 5.5x |

| • | These revisions have no impact on the Company’s 2023 guidance

as issued on February 21, 2023. |

Revised consolidated statements of operations, and tables reconciling

GAAP financial measures and non-GAAP financial measures and tables reflecting revisions to previously reported financial statements are

attached as Exhibit 99.1 and incorporated by reference into this Item 2.02.

The revisions described above are reflected in the consolidated financial

statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022. The Form 10-K

also reports a material weakness in internal control over financial reporting related to income tax provisions.

The Company is posting an updated version of the Q4 Earnings Presentation

reflecting the revisions described above in the “Events and Presentations” section of its investor website.

Use of Non-GAAP Financial Measures:

We use non-GAAP financial measures, such as revenue growth excluding

the impact of foreign exchange rate effects, EBITDA, adjusted EBITDA, adjusted EBITDA margin, adjusted net (income) loss, adjusted EPS,

adjusted gross profit and adjusted gross margin and net debt leverage to assess and analyze our operational results and trends as explained

in more detail in the reconciliation tables later in this Form 8-K/A.

We believe these non-GAAP financial measures are useful to

investors because they provide greater transparency regarding our operating performance. Reconciliation of non-GAAP financial

measures and reported GAAP financial measures are included in the tables accompanying this Form 8-K/A and are posted on our website

at www.elanco.com. The primary material limitations associated with the use of such non-GAAP measures as compared to U.S. GAAP

results include the following: (i) they may not be comparable to similarly titled measures used by other companies, including

those in our industry, (ii) they exclude financial information and events, such as the effects of an acquisition or

amortization of intangible assets, that some may consider important in evaluating our performance, value or prospects for the

future, (iii) they exclude items or types of items that may continue to occur from period to period in the future and

(iv) they may not exclude all unusual or non-recurring items, which could increase or decrease these measures, which investors

may consider to be unrelated to our long-term operations. These non-GAAP measures are not, and should not be viewed as, substitutes

for U.S. GAAP reported measures. We encourage investors to review our unaudited consolidated financial statements in their entirety

and caution investors to use U.S. GAAP measures as the primary means of evaluating our performance, value and prospects for the

future, and non-GAAP measures as supplemental measures.

The information in this Item 2.02, including Exhibit 99.1 attached

hereto, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (“Exchange Act”), or otherwise subject to the liabilities of that Section and shall not be incorporated

by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, or the Exchange Act,

except as otherwise expressly stated in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Elanco Animal Health Incorporated |

| |

|

| Date: March 1, 2023 |

By: |

/s/ Todd Young |

| |

|

Name: Todd Young |

| |

|

Title: Executive Vice President and Chief Financial Officer |

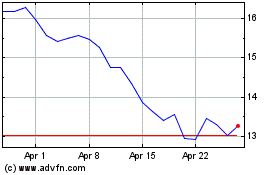

Elanco Animal Health (NYSE:ELAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Elanco Animal Health (NYSE:ELAN)

Historical Stock Chart

From Apr 2023 to Apr 2024