Dow Posts Lower Profit, Sales

October 24 2019 - 7:17AM

Dow Jones News

By Dave Sebastian

Dow Inc. reported lower quarterly profit and sales, citing a

decline in global energy prices.

For the third quarter, Dow posted a profit of 45 cents a share,

compared with $1.36 cents a share a year earlier. Analysts polled

by FactSet were expecting 72 cents a share. Adjusted earnings were

91 cents a share, down from $1.34 a share a year earlier but ahead

of the 70 cents a share analysts had expected.

Dow, which makes plastics and silicones, is the former

materials-science business of DowDuPont, which spun it out in

April.

Lower local prices weighed on sales, which declined 14.8% to

$10.76 billion. Analysts expected $10.74 billion. Sales in

packaging and specialty plastics decreased 17.8%.

The company also recorded equity losses of $44 million, in place

of a $135 million gain on a pro forma basis a year earlier. Dow

said that was largely because of margin compression in joint

ventures in Kuwait.

Dow in August agreed to sell by the end of the year its acetone

derivatives business to Altivia Ketones & Additives, an

affiliate of privately held chemical producer Altivia. The planned

divestiture includes its production assets located in Institute,

West Va. Dow said it will remain a tenant at the Institute site,

retaining ownership of certain manufacturing assets. Acetone

derivatives are used in the manufacture of pharmaceuticals,

plastics, fibers and films.

The company reported a drop in certain expense items, including

selling, general and administrative costs, and recorded $147

million in restructuring- and asset-related charges.

(END) Dow Jones Newswires

October 24, 2019 07:02 ET (11:02 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

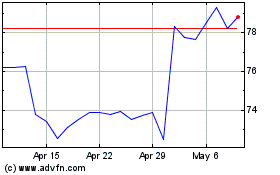

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Mar 2024 to Apr 2024

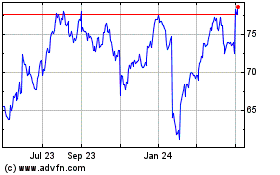

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Apr 2023 to Apr 2024