Current Report Filing (8-k)

May 08 2023 - 6:02AM

Edgar (US Regulatory)

0000028823False00000288232023-05-052023-05-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): May 5, 2023

Diebold Nixdorf, Incorporated

(Exact name of registrant as specified in its charter)

__________________________________________________________

| | | | | | | | | | | | | | | | | |

| Ohio | | 1-4879 | | 34-0183970 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | |

| 50 Executive Parkway, P.O. Box 2520 | | | | |

| Hudson, | Ohio | | | | 44236 |

| (Address of principal executive offices) | | | | (Zip Code) |

Registrant's telephone number, including area code: (330) 490-4000

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common shares, $1.25 per value per share | | DBD | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing

On May 5, 2023, Diebold Nixdorf, Incorporated (the “Company”) received notice (the “Listing Standard Notice”) from the New York Stock Exchange (the “NYSE”) that as of May 4, 2023 it was not in compliance with the continued listing standard set forth in Section 802.01C of the NYSE’s Listed Company Manual (“Section 802.01C”) because the average closing price of the Company’s common shares (the “Common Shares”) was less than $1.00 per share over a consecutive 30 trading-day period. The Listing Standard Notice has no immediate impact on the listing of the Common Shares on the NYSE, subject to the Company’s compliance with the NYSE’s other continued listing requirements.

Section 802.01C requires the Company to notify the NYSE, within 10 business days of receipt of the Listing Standard Notice, of its intent to cure this deficiency. The Company intends to respond to the NYSE within ten business days of receipt of the Listing Standard Notice affirming its intent to cure the deficiency, subject to the Company’s compliance with the NYSE’s other continued listing requirements. Pursuant to the NYSE’s rules, the Company has a six-month period following receipt of the Listing Standard Notice to regain compliance with the NYSE’s minimum share price requirement. The Company can regain compliance with the minimum share price requirement at any time during the six-month cure period if, on the last trading day of any calendar month during the cure period or on the last day of the cure period, the Company has (i) a closing share price of at least $1.00, and (ii) an average closing share price of at least $1.00 over the 30 trading-day periods ending on the last trading day of that month.

The Listing Standard Notice does not affect the Company’s business operations or its reporting obligations with the Securities and Exchange Commission (the “SEC”).

Item 8.01. Other Events

On May 5, 2023, the Company announced an extension of the previously announced public exchange offer (the “Exchange Offer”) with respect to its outstanding 8.50% Senior Notes due 2024 (144A CUSIP: 253651AA1; REG S CUSIP: U25316AA5; Registered CUSIP: 253651AC7) (the “2024 Senior Notes”). The Exchange Offer, which was previously scheduled to expire at 5:00 p.m., New York City time, on May 5, 2023, has been extended until 5:00 p.m., New York City time, on May 19, 2023, unless earlier terminated or extended by the Company (such time and date, as it may be extended, the “Expiration Time”). Any 2024 Senior Notes tendered may be withdrawn at any time prior to the Expiration Time, but not thereafter (the “Withdrawal Deadline”). Except for the extension of the Expiration Time and Withdrawal Deadline, all other terms of the Exchange Offer remain unchanged.

The Company issued a press release relating to the extension of the Exchange Offer and the events described in Item 3.01 of this Current Report on Form 8-K, attached hereto as Exhibit 99.1, which is incorporated by reference in its entirety.

FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K contains statements that are not historical information and are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements give current expectations or forecasts of future events and are not guarantees of future performance. Statements can generally be identified as forward looking because they include words such as “believes,” “anticipates,” “expects,” “intends,” “plans,” “will,” “estimates,” “potential,” “target,” “predict,” “project,” “seek,” and variations thereof or “could,” “should” or words of similar meaning. Statements that describe the Company's future plans, objectives or goals are also forward-looking statements, which reflect the current views of the Company with respect to future events and are subject to assumptions, risks and uncertainties that could cause actual results to differ materially. Although the Company believes that these forward-looking statements are based upon reasonable assumptions regarding, among other things, the economy, its knowledge of its business, and key performance indicators that impact the Company, these forward-looking statements involve risks, uncertainties and other factors that may cause actual results to differ materially from those expressed in or implied by the forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The factors that may affect the Company's results include, among others, the Company’s ability to cure the deficiency set forth in the Listing Standard Notice and for its Common Shares to remain listed on the NYSE, and other factors included in the Company’s filings with the SEC, including its Annual Report on Form 10-K for the year ended December 31, 2022 and in other documents the Company files with the SEC.

Except to the extent required by applicable law or regulation, the Company undertakes no obligation to update these forward-looking statements to reflect future events or circumstances or to reflect the occurrence of unanticipated events. You should consider these factors carefully in evaluating forward-looking statements and are cautioned not to place undue reliance on such statements.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| |

Exhibit Number | Description |

| |

| |

| |

104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | Diebold Nixdorf, Incorporated |

| May 5, 2023 | By: | /s/ Jonathan B. Leiken |

| | Name: | Jonathan B. Leiken |

| | Title: | Executive Vice President, Chief Legal Officer and Secretary |

| | | |

| | | |

| | | |

| | | |

| | | |

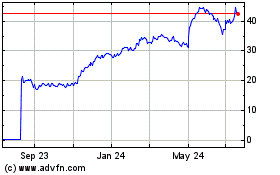

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

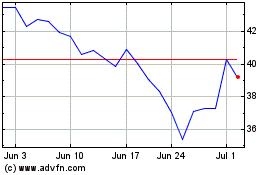

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Apr 2023 to Apr 2024