Current Report Filing (8-k)

February 06 2023 - 8:57AM

Edgar (US Regulatory)

0000028823False12/3100000288232023-02-062023-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): February 2, 2023

Diebold Nixdorf, Incorporated

(Exact name of registrant as specified in its charter)

__________________________________________________________

| | | | | | | | | | | | | | | | | |

| Ohio | | 1-4879 | | 34-0183970 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | |

| 50 Executive Parkway, P.O. Box 2520 | | | | |

| Hudson, | Ohio | | | | 44236 |

| (Address of principal executive offices) | | | | (Zip Code) |

Registrant's telephone number, including area code: (330) 490-4000

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common shares, $1.25 per value per share | | DBD | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On February 2, 2023, the Board of Directors (the “Board”) of Diebold Nixdorf, Incorporated (the “Company”) increased the size of the Board from 12 to 14 members and appointed Marjorie L. Bowen, age 57, and Emanuel R. Pearlman, age 62, to the Board, effective immediately, to fill the vacancies created by the increase. Ms. Bowen’s and Mr. Pearlman’s terms will expire at the Company’s 2023 Annual Meeting of Shareholders. As of the date of this filing, the Board has not determined the Committees on which Ms. Bowen or Mr. Pearlman will serve and will file an amendment to this Form 8-K within four business days after such determination has been made.

Ms. Bowen and Mr. Pearlman’s compensation for service as directors will be consistent with that of the Company’s non-employee directors, as described the Company’s definitive proxy statement filed with the Securities and Exchange Commission on March 24, 2022.

There are no related party transactions between the Company and either of Ms. Bowen or Mr. Pearlman that would require disclosure under Item 404(a) of Regulation S-K.

Ms. Bowen and Mr. Pearlman were each identified by the Company as potential Board members in accordance with the requirements of the Transaction Support Agreement dated October 20, 2022, as amended, described in more detail in the Company’s Current Reports on Form 8-K dated October 20, 2022, November 29, 2022, and December 21, 2022 (as amended, the “TSA”). Pursuant to TSA, the Company intends to nominate Ms. Bowen and Mr. Pearlman for election to the Board at the Company’s 2023 Annual Meeting of Shareholders, to succeed two persons who were members of the Board at the time of the execution of the TSA. Accordingly, the Company intends to reduce the size of the Board effective at 2023 Annual Meeting of Shareholders.

Chief Executive Officer Octavio Marquez was elected Chair of the Board of Directors, effective February 2, 2023. Mr. Gary Greenfield will not stand for re-election as director at the Company’s 2023 Annual Meeting of Shareholders. Mr. Greenfield’s decision not to stand for re-election is not the result of any disagreement between Mr. Greenfield and the Company on any matter relating to the operations, policies or practices of the Company.

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On February 2, 2023, the Board resolved to amend the Amended and Restated Code of Regulations of the Company (the “Regulations”), effective immediately, to increase the size of the Board from not more than thirteen (13) persons to not more than fourteen (14) persons. Specifically, the first paragraph of Section 1 of Article III of the Regulations is stricken in its entirety and replaced as follows:

Section 1 - Number, Election and Term of Office

Except as otherwise expressly provided in the Articles of Incorporation, the Board of Directors shall be composed of not more than fourteen (14) persons nor less than five (5) persons unless this number is changed by: (1) the shareholders in accordance with the law of Ohio, or (2) the vote of the majority of the Directors in office. Within the foregoing range, the Directors may, by vote of a majority of the Directors in office, set the size of the Board. Any Director’s office created by the Directors by reason of an increase in their number may be filled by action of a majority of the Directors in office.

Except as stated above, the Regulations are unchanged.

The foregoing is a summary of the material change introduced by the new Regulations. A copy of the Regulations of the Company, effective as of February 2, 2023, is included as Exhibit 3.1 of this Current Report on Form 8-K and is incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

On February 6, 2023, the Company issued a press release related to the events described in Item 5.02. A copy of the press release is attached hereto as Exhibit 99.1 and furnished herewith.

Cautionary Note on Forward-Looking Statements

Statements included in this Form 8-K that are not historical facts, including statements regarding the Company’s future performance and operations, its strategic plans, and other related items, are forward-looking statements. Forward-looking statements involve risks and uncertainties including, but not limited to, those detailed in risk factors and elsewhere in the Company's Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q, and other filings with the U.S. Securities and Exchange Commission (the “SEC”). Should one or more of the risks or uncertainties detailed in the company’s filing with the SEC materialize, or should underlying assumptions prove incorrect, actual outcomes may vary materially from those forecasted or expected. The Company disclaims any intention or obligation to update publicly or revise such statements, whether because of new information, future events or otherwise.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | Diebold Nixdorf, Incorporated |

| February 6, 2023 | By: | /s/ Jonathan B. Leiken |

| | Name: | Jonathan B. Leiken |

| | Title: | Executive Vice President, Chief Legal Officer and Secretary |

| | | |

| | | |

| | | |

| | | |

| | | |

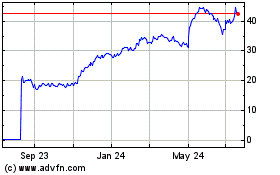

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

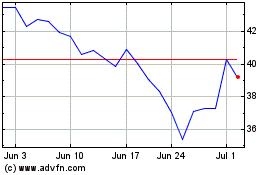

From Mar 2024 to Apr 2024

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Apr 2023 to Apr 2024