Amended Statement of Beneficial Ownership (sc 13d/a)

March 23 2020 - 4:20PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange of 1934

(Amendment No. 3)*

Diamond

Offshore Drilling, Inc.

(Name of Issuer)

Common Stock

(Title of

Class of Securities)

252271C102

(CUSIP Number)

Marc A.

Alpert

Senior Vice President, General Counsel and Secretary

Loews Corporation

667

Madison Avenue

New York, NY 10065

(212) 521-2000

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

March 20, 2020

(Date of

Event which Requires Filing of this Statement)

If the filing

person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a

signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

|

*

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

|

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of section 18 of

the Securities Exchange Act of 1934 (the “Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

CUSIP No. 25271C102

|

|

Page 2 of 4 Pages

|

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF

REPORTING PERSONS

Loews Corporation

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (See Instructions)

(a) ☐ (b) ☐

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

SOURCE OF FUNDS (See Instructions)

OO

|

|

5

|

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) ☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware

|

|

|

|

|

|

|

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE VOTING POWER

73,119,047

|

|

|

8

|

|

SHARED VOTING POWER

None

|

|

|

9

|

|

SOLE DISPOSITIVE POWER

73,119,047

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

None

|

|

|

|

|

|

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

73,119,047

|

|

12

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) ☐

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11)

53.1%

|

|

14

|

|

TYPE OF REPORTING PERSON (See

Instructions)

CO HC

|

Item 4. Purpose of Transaction

Item 4 is hereby amended by deleting the text thereof in its entirety and replacing it with the following:

As described in Item 5 of this Schedule 13D, the Reporting Person beneficially owns 73,119,047 shares, or 53.1%, of the Common Stock of the

Issuer. By virtue of its ownership of a majority of the outstanding Common Stock, the Reporting Person has the power to elect the entire Board of Directors of the Issuer. As of the date of this Amendment No. 3 to Schedule 13D, three of the

Issuer’s ten directors are executive officers of the Reporting Person. The Issuer has indicated to the Reporting Person that: (i) it has nominated seven directors for election at its 2020 annual meeting of shareholders, only two of whom

are executive officers of the Reporting Person; and (ii) effective as of its 2020 annual meeting of shareholders, it has appointed its Chief Executive Officer as Chairman of the Board, replacing the executive officer of the Reporting Person who

currently serves as Chairman of the Board.

The Reporting Person regularly reviews the Issuer’s business, performance, financial

condition, results of operations, and anticipated future developments and prospects, as well as general economic conditions and existing and anticipated market and industry conditions and trends affecting the Issuer. The Reporting Person regularly

discusses such matters with the Issuer’s management and Board of Directors either directly or through Board participation. As a result of these or other factors and any such discussions, the Reporting Person may from time to time, and reserves

the right to, consider, study, formulate and actively participate in any plans or proposals regarding the Issuer, including any of the actions or transactions enumerated in clauses (a) through (j) of Item 4 of Schedule 13D. Such actions or

transactions may also include, among others, dispositions of the Issuer’s Common Stock or the acquisition of additional shares of the Issuer’s Common Stock, including an acquisition or series of acquisitions or transaction that could

result in a going private transaction governed by Rule 13e-3 under the Act. The Reporting Person further reserves the right to change its intentions with respect to any of the foregoing.

Page 3 of 4 Pages

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOEWS CORPORATION

|

|

|

|

|

|

|

Dated: March 23, 2020

|

|

|

|

By:

|

|

/s/ Marc A. Alpert

|

|

|

|

|

|

|

|

Marc A. Alpert

|

|

|

|

|

|

|

|

Senior Vice President, General Counsel and Secretary

|

Page 4 of 4 Pages

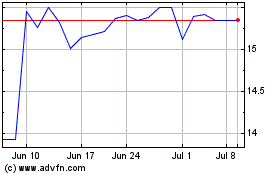

Diamond Offshore Drilling (NYSE:DO)

Historical Stock Chart

From Mar 2024 to Apr 2024

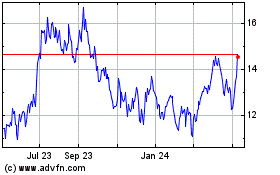

Diamond Offshore Drilling (NYSE:DO)

Historical Stock Chart

From Apr 2023 to Apr 2024