United to Cut More Flights In Quarter -- WSJ

July 22 2020 - 3:02AM

Dow Jones News

By Doug Cameron

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 22, 2020).

United Airlines Holdings Inc. said it will trim more flying this

quarter in response to stalling demand while cost-cutting efforts

will reduce how much cash it burns moving into the fall.

Chicago-based United on Tuesday reported a quarterly loss of

about $1.6 billion and said it plans to fly 35% of its normal

schedule in the three months through September. That is in line

with guidance it gave for August after the airline reduced planned

flying because of a recent surge in Covid-19 cases in many parts of

the country.

In the spring, United cut more flights than rivals such as Delta

Air Lines Inc. and American Airlines Group Inc. as the pandemic

sapped travel demand, and it said Tuesday that it is doing better

than others in matching its capacity with those still prepared to

fly.

United's revenue for the second quarter fell 87% from a year

earlier.

The airline said it expects to burn through an average of $25

million a day in cash in what is traditionally the industry's

strongest and most-profitable quarter, down from $40 million in the

three months to June 30.

United Chief Executive Scott Kirby has been among the most

cautious about an industry recovery, and the airline recently

warned it might have to shed almost half its domestic workforce --

some 36,000 staff -- unless demand recovers. Its aim is to persuade

employees to take voluntary packages, and the airline said about

6,000 have so far accepted.

The airline's downbeat outlook led it to secure government

grants and loans and raise debt and equity from the private sector.

It expects to end the September quarter with $18 billion in

available liquidity, though this includes the potential proceeds of

a government loan that it has yet to decide whether to accept,

United reported a net loss of $1.63 billion in what it termed

"the most difficult financial quarter in its 94-year history." In

last year's second quarter, it posted a $1.05 billion profit.

Revenue in the latest period fell to $1.48 billion.

The company's shares broke a three-session decline on Tuesday to

close up 2.3%, and were up slightly in after-hours trading.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

July 22, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

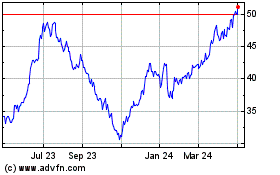

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

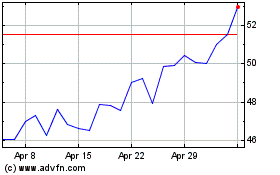

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Apr 2023 to Apr 2024