By Sharon Terlep

Clorox Co., Amazon.com Inc. and Domino's Pizza Inc. can't ramp

up fast enough to meet demand for cleaning products, home

deliveries and snack food. More people are streaming videos from

Netflix and music from Spotify. Shares of Peloton Interactive Inc.

have soared as fitness buffs scrap their gym memberships.

Meanwhile companies that rely on people traveling, being

together or venturing out in public are crashing. Restaurant chain

Cheesecake Factory Inc. furloughed most of its workers. Air carrier

Delta Air Lines Inc. and retailer J.Crew Group Inc. are slashing

costs, scrambling for loans and restructuring as they sustain

massive losses.

The big question is how many of these new consumer habits will

endure more permanently as the country inches back to something

resembling normal life. The answer will have far-reaching

implications for industries from food and fashion to travel and

technology, forcing companies to rework supply chains, product

lineups and relationships with retailers.

"The three month period we are going through is going to equate

to three years of consumer changes wrapped up in one quarter,"

David Gibbs, chief executive officer of Taco Bell parent Yum Brands

Inc., said this week.

Not everyone agrees. Several retailers said spending slowed in

April after consumers stockpiled in March. "We largely expect

consumers to eventually return to previous habits, as they slowly

exit confinement and cautiously settle into a new normal," PepsiCo

Inc. CEO Ramon Laguarta said.

Take the Longos, a couple that lives in Valhalla, N.Y., a small

town 30 miles north of Manhattan. Pamela Longo, an assistant

principal and mother of two, wasn't a fan of home workouts. Her

husband, Michael, who owns a financial planning firm, long wanted

to work once a week from home but always ended up in the

office.

Seven weeks after they were forced into their suburban New York

home by coronavirus, Pamela has started riding a Peloton bike in

the basement that allows users to join in virtual spin classes. She

also added online workout classes, finding the fitness combination

far more efficient and motivational than she anticipated, she

said.

"I never would have predicted this," she said.

Michael has discovered he has more family time without a

twice-daily, 30-minute commute, he is hashing out plans to spend as

little as three days a week at the office. "This is a horrible

thing that has happened, but there is some good coming out of

this," Mr. Longo said.

Some of their changes may be more temporary. For instance,

Pamela says she has enjoyed learning new, time-consuming recipes,

including an Italian pasta dish on a recent night, but will revert

to simpler dishes once she returns to work.

To get inside the minds of consumers like the Longos,

corporations are marshaling their expertise and resources in hopes

of getting ahead of changing needs and preferences.

Consumer-products giant Procter & Gamble Co., for example,

knows that people aren't only buying more Tide laundry detergent

but also doing more loads of laundry because it follows digital

monitors installed inside some consumers' washing machines to show

how often they run loads. Legions of analysts and consultants are

taking surveys, combing sales data and building models to try to

gauge where demand is going.

More subtle, micro trends are emerging as well. Retailers report

selling a higher ratio of shirts to pants, as people dress for

video calls. Jigsaw puzzles are selling out. Post-It notes are

falling out of favor amid empty offices. Pricey coffee is getting a

boost, as cafe-lovers are forced to brew at home.

"A lot of people are focused on what the 80% of consumers will

feel like in the new normal. Are they going to go out and eat, or

go to the movie?, " said David Garfield, managing director of

consulting firm AlixPartners and the head of the consumer-products

practice. "It's really about the remaining 20%. Because most

businesses can't operate on 80% of demand. They will need a major

overhaul."

More evidence of how consumers are behaving emerged last week in

a series of earnings reports. The pandemic is driving up demand for

packaged foods from companies like Kraft Heinz Co. and Kellogg Co.,

giving them a chance to win back customers who stopped eating their

cheese and cereal products long ago. Kraft Heinz sales rose 6.2%

from a year earlier on a comparable basis. Kellogg said its

comparable sales for the first quarter climbed 8%, including

improvements in its cereal business, which has struggled for

years.

For years, consumers have gravitated toward fresh foods and

niche brands they viewed as healthier, hurting sales at big food

companies. Kraft Heinz Chief Executive Miguel Patrico says the

pandemic has thrown that trend into reverse.

"Consumers are coming back to big brands. In times of

uncertainty, they want to experiment less with new brands," he

said. The leaders of Coca-Cola Co. and Molson Coors Beverage Co.

said much the same.

Homebound shoppers were also a boon for big tech companies.

Amazon said Thursday its revenue rose 26% from a year earlier to

$75.5 billion in the three months through March -- by far the

highest on record for what is usually Amazon's slowest period of

the year. Profits, however, fell due to extraordinary expenses

related to the pandemic. Shelter in place orders in many countries

helped increase Facebook Inc.'s user growth in the first quarter

and boosted eBay Inc. to better-than-expected sales.

The extent of how consumers change their behavior hinges a lot

on how families lived before the crisis.

Erin Russell and Travis Haag, 38-year-old parents of

four-year-old twins in Holt, Mich., have changed much about their

daily routines but little about how they spend their money. The

family rarely dined out, vacationed or went to the movies before

the pandemic, they said, so aren't missing those outings.

Erin is an architectural designer for a national insurer, and

Travis is a grounds mechanic for the state of Michigan in nearby

Lansing. Their children attend preschool and Travis's mother cared

for them the two days a week they weren't in school. The preschool

is closed and Travis' mom is at high risk of contracting

coronavirus. Erin now works full time from home, while Travis is

furloughed, leaving him caring for the kids most of the time.

Travis is still adjusting to being the main caregiver, but the

couple says the setup is working overall.

Erin's main gripe: she has to drink coffee at home. A daily

drinker of either Starbucks or Dunkin' coffee, she has taken up

making whipped coffee and getting nicer Keurig options to

supplement what she calls "old man," or drip coffee, at home.

"It's a tolerable substitute, but it's not Starbucks," she

said.

The pandemic has altered another consumer paradigm. One of the

most difficult parts of selling a product is getting consumers to

actually try it, said Kristina Rogers, who leads Ernst &

Young's global consumer sector. Companies go to lengths to get

their brands in the hands of shoppers, giving away free products

and services in hopes exposure will convince them to make a

switch.

"We've been forced to try a lot of new things," Ms. Rogers said.

"The longer that we are forced to change our habits, the longer we

might adopt them. It's not just, 'Yeah, it's a habit.' I might have

to accept a change because I can't afford to go back. I might also

just like something else more."

One change Pamela Longo made was to spring for a $100-a-year

subscription to Beachbody online fitness classes, which she'd never

before considered, and plans to stick with the program.

The Longos expect their priorities will remain changed, if not

for good, for some time beyond the current crisis.

The family had planned a week-long trip to Disney World in

Florida in April. Even if the theme park opens and stay-at-home

orders lift, Michael Longo said, the family won't be in big public

spaces or on an airplane until at least next year. Instead, they

hope to get in a visit to Cape Cod or the Hamptons this summer,

where they can drive and avoid big crowds.

Write to Sharon Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

May 02, 2020 00:14 ET (04:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

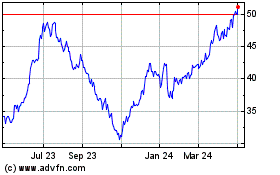

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

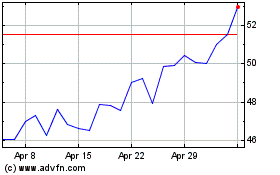

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Apr 2023 to Apr 2024