Delta Reports First Loss in Five Years -- 3rd Update

April 22 2020 - 7:57PM

Dow Jones News

By Alison Sider

Delta Air Lines Inc. reported its first quarterly loss in over

five years, as the coronavirus pandemic ravaged the travel

industry.

With much of the world subject to travel restrictions and

government orders to stay home, air travel has largely ceased.

Passenger volumes have plummeted 95% in the U.S., and airlines

expect fears of illness to weigh heavily on travel demand for the

foreseeable future.

For Delta and other airlines, the virus interrupted a historic

boom in business. Delta had posted 10 consecutive years of annual

profits and was anticipating another year of buoyant demand in

2020. The airline's last quarterly loss was in the fourth quarter

of 2014.

The outlook changed abruptly as the virus spread beyond China.

The 18% revenue decline Delta reported on Wednesday for the latest

quarter is likely only the beginning, because the pandemic's full

chilling effect on travel didn't take hold until March. Delta said

it expects a 90% drop in revenue during the second quarter.

Delta Chief Executive Ed Bastian told employees the recovery

could take two to three years. "We do know that Delta will be a

smaller airline for some time, and we should be prepared for a

choppy, sluggish recovery even after the virus is contained," he

said in a memo. "I hope it's sooner, but we need to be realistic in

our planning."

Delta's shares fell 2.7% in Wednesday trading.

Delta reported a net loss of $534 million for the first three

months of the year, down from a profit of $730 million during the

first quarter of 2019. Adjusted earnings swung to a loss of $326

million, or 51 cents a share, down from a profit of 96 cents a

share a year ago.

The losses have made preserving cash a priority. Delta is aiming

to slow the rate at which it is burning through cash from $100

million a day at the end of March to $50 million a day by the end

of June. The airline expects to end the second quarter with $10

billion in liquidity, up from $6 billion now. Paul Jacobson,

Delta's finance chief, agreed to call off his planned retirement to

help steer the airline through the crisis.

Mr. Bastian said Delta issued over a million refunds worth more

than $500 million in March. For much of the month, he said, Delta

paid out more in refunds than it made in ticket sales. That gap is

starting to narrow, though Mr. Jacobson said he expects sales to

remain slightly negative as Delta works through a backlog of

refunds.

Delta said it has raised $5.4 billion since March, including

loans and a $1.2 billion deal to sell aircraft and lease them back.

The airline also sought government aid to pay workers in the coming

months and said it has already received the first $2.7 billion in

funds from the Treasury Department, half of what it will receive

under that program. The airline is eligible for an additional $4.6

billion secured loan from the government.

The airline said it plans to apply for that funding by the end

of the month, but has through September to decide whether to draw

the money. Mr. Bastian said he believed the government funding

would provide enough liquidity to get through the crisis without

asking for additional government relief.

To cut costs, Delta has extended payment terms with airports,

vendors and lessors; worked with manufacturers to push back

aircraft deliveries; cut executive pay and parked planes. The

airline can't reduce its workforce in the coming months as a

condition of receiving federal aid, but about 35,000 employees have

volunteered for unpaid leave.

Delta took a $112 million charge on some of its investments in

foreign carriers, though it said others were only temporarily

impaired. Mr. Bastian said Delta doesn't have plans to sell its

stakes in foreign airlines, but also can't afford to provide any

financing to help them weather the difficulties.

United Airlines Holdings Inc. reported a pretax loss of $2.1

billion during the first quarter, including certain one-time items

like an allowance for a loss on a loan to a South American airline.

United said Tuesday that it is tapping equity markets in an effort

to shore up its balance sheet -- selling shares to raise more than

$1 billion.

Delta executives said Wednesday that they don't have immediate

plans to issue equity, preferring to raise more funding by

borrowing against assets.

Delta executives said they don't have immediate plans to issue

equity, preferring to raise more funding by borrowing against

assets. Delta said late Wednesday that it would issue $1.5 billion

in senior secured notes through a private offering and enter into a

new $1.5 billion term loan facility.

The airline said it would use domestic slots at major airports

in the U.S. and London and some international routes as

collateral.

Write to Alison Sider at alison.sider@wsj.com

(END) Dow Jones Newswires

April 22, 2020 19:42 ET (23:42 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

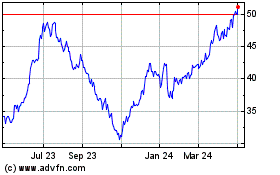

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

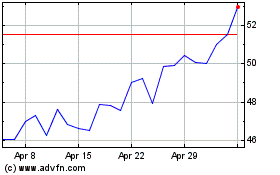

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Apr 2023 to Apr 2024