Delta Reports First Loss in Five Years

April 22 2020 - 7:30AM

Dow Jones News

By Alison Sider

Delta Air Lines Inc. reported its first quarterly loss in over

five years, as the coronavirus pandemic ravaged the travel

industry.

With much of the world subject to travel restrictions and

government orders to stay home, air travel has largely ceased.

Passenger volumes have plummeted 95% in the U.S., and airlines

expect fears of illness to weigh heavily on travel demand for the

foreseeable future.

For Delta and other airlines, the virus interrupted a historic

boom in business. Delta had posted 10 consecutive years of annual

profits and was anticipating another year of buoyant demand in

2020. The airline's last quarterly loss was in the fourth quarter

of 2014.

The outlook changed abruptly as the virus spread beyond China.

The 18% revenue decline Delta reported for the latest quarter on

Wednesday is likely only the beginning, because the pandemic's full

chilling effect on travel didn't take hold until March. Delta said

it expects a 90% drop in revenue during the second quarter.

"These are truly unprecedented times for all of us, including

the airline industry," Delta CEO Ed Bastian said. "Delta is taking

decisive action to prioritize the safety of our employees and

customers while protecting our business and bolstering

liquidity."

Delta reported a net loss of $534 million for the first three

months of the year, down from a profit of $730 million during the

first quarter of 2019. Adjusted earnings swung to a loss of $326

million, or 51 cents a share, down from a profit of 96 cents a

share a year ago.

The losses have made preserving cash a priority. Delta is aiming

to slow the rate at which it is burning through cash from $100

million a day at the end of March to $50 million a day by the end

of June. The airline expects to end the second quarter with $10

billion in liquidity, up from $6 billion now. Paul Jacobson,

Delta's finance chief, agreed to call off his planned retirement to

help steer the airline through the crisis.

Delta said it has raised $5.4 billion since March, including

loans and a $1.2 billion deal to sell aircraft and lease them back.

The airline also sought government aid to pay workers in the coming

months and said it has already received the first $2.7 billion in

funds from the Treasury Department, half of what it will receive

under that program. The airline is also eligible for an additional

$4.6 billion secured loan from the government.

To cut costs, Delta has extended payment terms with airports,

vendors and lessors; worked with manufacturers to push back

aircraft deliveries; cut executive pay and parked planes. The

airline can't reduce its workforce in the coming months as a

condition of receiving federal aid, but some 35,000 employees have

volunteered for unpaid leave.

United Airlines Holdings Inc. reported a pretax loss of $2.1

billion during the first quarter, including certain one-time items

like an allowance for a loss on a loan to a South American airline.

United said Tuesday that it is tapping equity markets in an effort

to shore up its balance sheet -- selling shares to raise over $1

billion.

Write to Alison Sider at alison.sider@wsj.com

(END) Dow Jones Newswires

April 22, 2020 07:15 ET (11:15 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

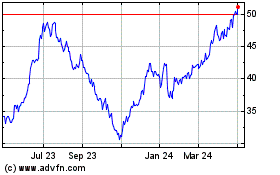

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

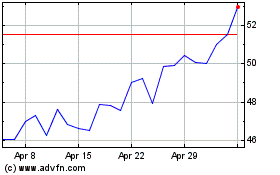

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Apr 2023 to Apr 2024