Darden Restaurants

Inc. (DRI) is slated to release its first quarter 2012

earnings on September 19, after market closes. The current Zacks

Consensus Estimate for the first quarter is pegged at 78 cents per

share (reflecting a year-over-year negative growth of 2.24%).

Darden has outperformed the Zacks

Consensus Estimate in two of the last four quarters and was in line

in the remaining two quarters. The average earnings surprise was

positive 3.38%.

Fourth Quarter

Recap

Darden’s fourth quarter 2011

earnings of $1.00 per share were in line with the Zacks Consensus

Estimate and grew 23.0% year over year.

Total revenue spiked 6.8% year over

year to $1,990.4 million and also edged out the Zacks Consensus

Estimate of $1,990.0 million.

Combined same-store sales for the

company’s three core brands, namely Olive Garden, Red Lobster and

LongHorn Steakhouse, rose 2.2%.

During the quarter, Darden hiked

its quarterly dividend by 34% to 43 cents per share, indicating an

annual dividend of $1.72.

Guidance

For the first quarter of 2012,

Darden expects earnings per share from continuing operations of 78

cents. The company estimates combined same-restaurant sales for its

three core brands, Olive Garden, Red Lobster and LongHorn

Steakhouse to increase 2.8% during the period.

The U.S same restaurant sales at

Red Lobster, Longhorn Steakhouse and Specialty Restaurant Groups

are estimated to escalate 10.7%, 4.8% and 5.1%, respectively, in

the first quarter of 2012. However, comparable restaurant sales at

Olive Garden are expected to plunge 2.9%.

For fiscal 2012, Darden expects

earnings per share growth to remain at the lower end of its

previously announced range of 12% to 15%. However, the company

raised its overall sales growth by 0.5% to 6.5%-7.5%, due to an

increase in blended same-store sales growth estimate for its three

core brands to 3% from its earlier forecast of 2.5%. The company

reiterated its 80 to 90 net new restaurants' goal for fiscal

2012.

Estimates Revisions

Trend

Estimates fell significantly in the

last 30 days implying that the analysts depict a negative outlook

for the upcoming quarter. The current Zacks Consensus Estimate is

$3.79 for 2012, reflecting a year-over-year growth of 11.22%. For

2013, the Zacks Consensus Estimate is $4.29, reflecting a

year-over-year growth of 13.17%.

Agreement of

Analysts

Revision trends in the last 30 days

have drifted toward the negative side with just one positive

change. For the first quarter, 22 out of the 24 analysts covering

the stock lowered their estimates while none moved in the opposite

direction. For fiscal 2012 and 2013, estimates were slashed by 23

and 17 analysts, respectively, while one raised the same for fiscal

2012.

The analysts remain skeptical about

the coming quarter as Hurricane Irene will likely impact the

company’s first quarter 2012 earnings by 2 cents and same-store

results at Red Lobster, Olive Garden and LongHorn Steakhouse

restaurants by 20 to 30 basis points.

The analysts believe that first

quarter results will also be impacted by food cost pressure. As a

result of the storm, Darden has trimmed its 2012 earnings

estimate.

Magnitude of Estimate

Revisions

Over the past 30 days, Darden's

estimates have dropped by 10 cents for the first quarter and by 6

cents for both fiscal 2012 and 2013 respectively. In the past 7

days, estimates have not changed.

Our Take

We expect Darden to report first

quarter earnings in line with the Zacks Consensus Estimate, since

all the persisting challenges have been taken into account and no

further downside exists in the near term.

We prefer Darden Restaurants’

strong value proposition, menu improvements, remodeling programs

(especially at LongHorn Steakhouse and Red Lobster), excellent

unit-level execution with differentiated brands and expansion plan.

LongHorn Steakhouse will also likely deliver strong results in the

upcoming quarter.

Management anticipates that the

trend of increased productivity and lower employee turnover will

benefit fiscal 2012 results. Labor and restaurant expenses are

expected to be down annually aided by sales leverage and

transformational cost reduction initiatives.

Darden also expects improving labor

costs to continue through 2013 given a new labor matrix/scheduling

system. For 2012, Darden expects to generate $65–$75 million in

costing savings.

However, the company is not

completely immune to challenges. While Red Lobster is wooing

customers with a number of promotional activities, rising sea food

costs may restrain the concept’s margins. Additionally,

underperformance of Olive Garden (another core brand of Darden)

poses a serious threat to Darden.

Moreover, stiff competition

resulting in higher discounting rates and promotional offers,

increasing food costs for the upcoming year and cautious consumer

spending also remain causes for concern.

We have a Zacks #3 Rank (short-term

Hold recommendation) on the company’s shares. We also reiterate our

long-term Neutral rating.

One of Darden’s primary

competitors, Red Robin Gourmet Burgers Inc. (RRGB)

reported second quarter 2011 adjusted earnings of 48 cents per

share, handily beating the Zacks Consensus Estimate of 36 cents and

the year-ago quarter earnings of 29 cents.

DARDEN RESTRNT (DRI): Free Stock Analysis Report

RED ROBIN GOURM (RRGB): Free Stock Analysis Report

Zacks Investment Research

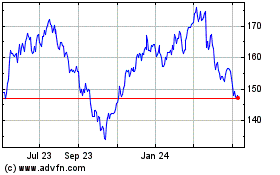

Darden Restaurants (NYSE:DRI)

Historical Stock Chart

From Aug 2024 to Sep 2024

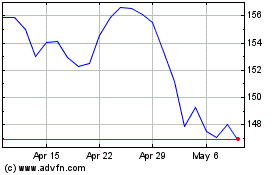

Darden Restaurants (NYSE:DRI)

Historical Stock Chart

From Sep 2023 to Sep 2024