2nd UPDATE: DineEquity 1Q Profit Doubles On Margin Growth

May 03 2011 - 2:01PM

Dow Jones News

DineEquity Inc.'s (DIN) first-quarter earnings more than

doubled, as the casual-dining company improved its margins and

continued to pay down its debt.

The owner of the Applebee's and IHOP has made refranchising and

revitalizing Applebee's restaurants its priority since acquiring

the chain in 2007.

The turnaround of Applebee's is evident, as domestic

same-restaurant sales increased 3.9% in the first quarter compared

to the same period a year earlier. Low-priced items, such as its

all-you-can-eat soup, salad and breadsticks promotion starting at

$5.99, hit on customer value without cutting in to margins.

IHOP, on the other hand, is coming off a rough first quarter.

Same-store sales decreased 2.7% as the breakfast chain's

all-you-can-eat pancakes, launched in January, proved to be a miss,

likely dampened by popular New Year's resolutions to eat healthier,

the company said.

Stewart said the current chicken-and-waffles promotion is

resonating much better with customers.

IHOP entered into a licensing agreement allowing the sale of

eight IHOP-branded frozen items in Wal-Mart Stores Inc. (WMT)

through a partnership with a consumer packaged goods company, which

DineEquity declined to name.

"Our goal is to extend the reach of the brand to areas it

doesn't normally go," Chief Executive Julia Stewart told Dow Jones

Newswires, adding that the company will have more details of the

impact later in the year.

The products will be in 3,000 Wal-Mart stores in the next 30

days, but the deal isn't exclusive to Wal-Mart, Stewart said. The

products will face competition from Kellogg Co.'s (K) Eggo Waffles

and other popular frozen breakfast treats.

IHOP's second quarter is also expected to see a boost form

Easter brunch business. DineEquity said the shift in the holiday

from the first to second quarter this year caused a decline of 0.4

percentage points in first quarter same-store sales for the

chain.

DineEquity continues to make progress on plans to sell

company-owned Applebee's restaurants to franchisee's, trading

future sales for more consistent royalty revenue. Largely because

of the refranchising of 65 additional Applebee's restaurants in the

first quarter, DineEquity was able to reduce its total debt by

8.8%, or $178.6 million, from the previous quarter.

The company reported a first-quarter profit of $28.1 million, or

$1.53 a share, up from $12.8 million, or 75 cents a share, a year

earlier.

Shares of DineEquity were recently up 3.3% to $51.42. The stock

is up about 21% over the past 12 months.

DineEquity's gross margin grew to 36.9% from 32.2% in the

year-earlier period, as Applebee's restaurant operating margin rose

to 15.3% from 14.8%.

While most casual-dining chains are struggling to offset

commodity inflation and are concerned about the effect of rising

gas prices on consumers, DineEquity said it doesn't see the

industry headwinds as an issue for its chains.

"I'm cautious in terms of saying they won't have an impact on

our brands, but it hasn't to date," Stewart said. "And I think we

can price to cover their impact at both brands, if we need to."

She said in lieu of using discounting to drive traffic, the

company relies on a pipeline of new items that are already

value-oriented with good margins. Restaurants who don't have

interesting new food to advertise are sometimes forced to discount

their current offers, sacrificing margins, "in order to have

something to talk about on TV," she said.

-By Annie Gasparro, Dow Jones Newswires; 212-416-2244;

annie.gasparro@dowjones.com

--Melodie Warner contributed to this article.

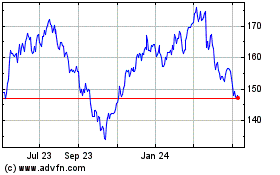

Darden Restaurants (NYSE:DRI)

Historical Stock Chart

From Aug 2024 to Sep 2024

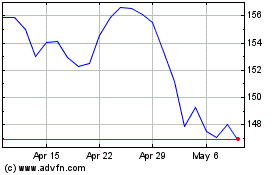

Darden Restaurants (NYSE:DRI)

Historical Stock Chart

From Sep 2023 to Sep 2024