CVS, Under Pressure After Aetna Deal, Sets Long-Term Profit Goals

June 04 2019 - 8:19AM

Dow Jones News

By Sharon Terlep

CVS Health Corp., under pressure to reassure skeptical

investors, provided longer-term financial forecasts for the first

time since acquiring insurer Aetna Inc.

CVS reaffirmed its 2019 financial targets, but its projections

beyond this year came in slightly below Wall Street expectations.

The company said Tuesday it expects adjusted earnings per share

above $7 in 2020, growing by a mid-single digit percentage in 2021

and smaller increases the years following.

Wall Street analysts had predicted adjusted earnings per share

of $7.22 for next year and growth of 8% to $7.80 for 2021,

according to a poll by Refinitiv. The adjusted earnings exclude

factors unrelated to CVS operations, including costs and income

related to asset sales and acquisitions.

CEO Larry Merlo and his executive team will host a meeting with

investors and financial analysts Tuesday morning to review their

forecasts and strategy. Also Tuesday, the company's lawyers will be

in a federal court in an unusual proceeding to defend their $70

billion merger, which closed in November.

CVS is under pressure to find new ways to counter slowing

revenue from prescription drugs, which drive the bulk of the

pharmacy chain's sales. The company and its rivals also face

government scrutiny of the traditional pharmacy-benefits business

model, particularly rebates paid by drugmakers. Health insurers'

shares have also been dragged down by some Democrats' support for

universal government health coverage.

In February, CVS gave a downbeat earnings projection for 2019,

pushing its shares down sharply and leading investors to press for

more detail about the company's growth plans. The shares have

stagnated despite stronger-than-expected first-quarter results, and

CVS has promised a fuller picture of its future in the Tuesday

session.

On Tuesday, CVS said by the end of 2021 it plans to have 1,500

new health-hub stores designed to offer a broader range of

services, many aimed at those with chronic illnesses. The company,

with about 9,800 stores, previously said it aimed to convert

roughly 1,000 locations into hubs and hadn't given a timeline.

A trio of heath hubs in Houston has proved successful, Kevin

Hourican, president of CVS Pharmacy, said in an interview. He

declined to say whether the new model improved store profitability

but said the stores posted increased traffic and higher demand for

prescriptions and medical services, and on average sold

higher-margin items.

Rival Walgreens Boots Alliance Inc. is also adding similar

services to hundreds of U.S. drugstores. Ultimately CVS hopes its

health-hub model will lower costs for chronic-disease sufferers,

which will save the company money through Aetna while creating a

service other insurers will pay for.

CVS plans to fund the health-hub expansion by cutting back on

traditional store refurbishments, Mr. Hourican said. It plans this

year to open additional hubs in Houston, the Philadelphia area,

Atlanta and Tampa, Fla.

The company said it still expects the merger with Aetna to

create about $300 million to $350 million of cost savings and other

benefits in 2019 and about $800 million of so-called synergies in

2020.

For 2019, the company kept the targets it set in February, when

it predicted adjusted earnings of $6.75 to $6.90 per share and

consolidated revenue of $251.2 billion to $254.4 billion.

CVS shares, which have tumbled this year, were little changed

before U.S. markets officially opened Tuesday. The shares rose 36

cents to $53.75 in premarket action.

--Anna Wilde Mathews contributed to this article.

Write to Sharon Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

June 04, 2019 08:04 ET (12:04 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

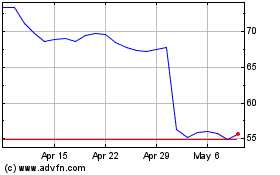

CVS Health (NYSE:CVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

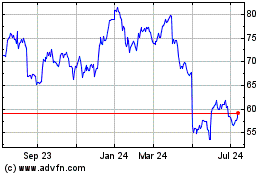

CVS Health (NYSE:CVS)

Historical Stock Chart

From Apr 2023 to Apr 2024