CVS Reaps Benefits of Aetna Deal -- WSJ

February 13 2020 - 3:02AM

Dow Jones News

By Anna Wilde Mathews and Dave Sebastian

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 13, 2020).

CVS Health Corp. turned a profit that beat Wall Street

expectations and projected results for 2020 that matched estimates,

as it capped its first year of integrating health insurer Aetna

Inc.'s operations.

The earnings continued a string of quarters that mark a recovery

from a year ago, when CVS's shares dropped sharply after it offered

lackluster 2019 guidance. Shares of CVS rose slightly in trading

Wednesday morning on the New York Stock Exchange.

The company also said that the head of its pharmacy-benefits

unit, Derica Rice, will leave. His exit comes after the departure

earlier this year of Kevin Hourican, the leader of the pharmacy

operations, who left to take a CEO job elsewhere.

CVS said Alan Lotvin, currently an executive vice president,

will take over the PBM. The company previously said that chief

operating officer Jonathan Roberts would temporarily lead the

pharmacy unit.

CVS said during a conference call with analysts and investors

that it is seeing benefits from its nearly $70 billion takeover of

Aetna, which closed in late 2018.

"We have set a clear and bold path for CVS Health to be the most

consumer-centric health company, transforming the way care is

delivered in the U.S.," CVS Chief Executive Larry Merlo said. "With

over a year of successful integration, we have laid a strong

foundation for growth."

Former Aetna Chief Executive Mark Bertolini, who recently

resigned from CVS's board after publicly saying he was being pushed

out, told The Wall Street Journal the integration of the two

companies was far from complete.

In an interview, Mr. Merlo said, "The integration planning has

been complete for a while now; the execution of that has gone

extremely well." He said the company is delivering more financial

synergies from the deal than expected.

For 2020, CVS expects per-share earnings from continuing

operations of $5.47 to $5.60, or $7.04 to $7.17 on an adjusted

basis. It sees operating income of $12.8 billion to $13 billion, or

$15.5 billion to $15.8 billion on an adjusted basis.

Analysts polled by FactSet have projected 2020 earnings per

share of $5.52, or $7.15 on an adjusted basis.

CVS reported fourth-quarter net income of $1.75 billion, or

$1.33 a share, compared with a loss of $419 million, or 37 cents a

share, in the comparable quarter a year before. Adjusted earnings

were $1.73 a share.

Analysts were looking for earnings of $1.22 a share, or $1.68 a

share on an adjusted basis.

CVS said its revenue rose 22.9% to $66.89 billion from the same

period the year before as revenue from premiums shot up. Analysts

were targeting $63.93 billion.

Revenue in its retail segment, which fulfills prescription

medications and sells a range of merchandise, was $22.58 billion,

up from $22.03 billion in the year-earlier period. Like competitor

Walgreens Boots Alliance Inc., CVS faces pressure on margins in its

retail-pharmacy business.

Mr. Merlo said the company's health-hub stores, which offer a

broader array of health services than its traditional pharmacies,

are showing higher prescription volume and front-store sales in

line with expectations. Yet he didn't offer financial details on

their performance. He said the company would share more information

later this year.

CVS is in the process of rolling out around 1,500 of the new

stores, which target people with chronic conditions such as

diabetes with testing, monitoring and treatment plans.

The company's health-care benefits business, which includes

Aetna, posted revenue of $17.15 billion, up nearly threefold from

the prior year. The segment's medical-loss ratio, which represents

the share of premiums paid out in claims, was 85.7% for the

quarter.

Write to Anna Wilde Mathews at anna.mathews@wsj.com and Dave

Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

February 13, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

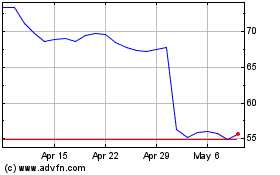

CVS Health (NYSE:CVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

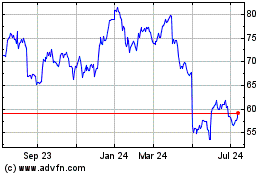

CVS Health (NYSE:CVS)

Historical Stock Chart

From Apr 2023 to Apr 2024