By Anna Wilde Mathews

CVS Health Corp.'s announcement Monday that former Aetna Inc.

Chief Executive Mark Bertolini will leave the CVS board exposed

tensions underlying one of the biggest U.S. health-care

mergers.

Mr. Bertolini joined the board after the pharmacy operator paid

nearly $70 billion to buy the health insurer in 2018.

The two companies promised an ambitious health-care

transformation, melding their varied businesses of filling

prescriptions, managing drug benefits and providing health

insurance to reduce costs and improve customer experience.

Before the deal closed, Mr. Bertolini was a key voice in selling

the idea that the combined company could bring major changes to

health care. But afterward, Mr. Bertolini didn't retain an

executive role, instead joining a board dominated by CVS directors,

with the company led by CVS Chief Executive Larry Merlo.

Now, Mr. Bertolini says he is being pushed out, with the

integration of the two companies still not complete. CVS said he

would be leaving "following the successful integration of the Aetna

business."

"I was willing to continue to serve on the board of directors in

support of the most transformative effort in health care for our

nation. However, the board thought otherwise," Mr. Bertolini said

in an interview.

He said he would be departing when CVS was still digesting

Aetna's insurance business. "Integration is far from over," he

said.

Asked about his relationship with Mr. Merlo, he said, "There's

always going to be a natural tension between the current CEO and

the former CEO in any discussions regarding how you move the

strategy forward. He's the guy in the seat, I'm not."

Mr. Bertolini made the comments shortly after CVS announced that

he and two other directors won't stand for reelection. The company

said it was reducing the size of its board following

corporate-governance best practices.

CVS Chairman David Dorman said in a statement issued by the

company that the remaining board members strongly back management

and its direction.

"The integration has been a success and the board has the utmost

confidence in the current management team and the progress the

combined company has shown to date," a CVS spokesman said.

In 2017, the leadership of the two companies forged an unlikely

alliance. Mr. Merlo, a former pharmacist who has led CVS since

2011, had overseen the company's pharmacy-benefit manager,

Caremark, but didn't have a strong background in the

health-insurance business.

Mr. Bertolini, a longtime managed-care executive who had been

CEO of Aetna since 2010, was a high-profile corporate leader who

had long spoken about his own experiences with the health-care

system. And even after relinquishing his chief executive title, he

kept up his public activity, including publishing and promoting a

book on leadership.

The CVS-Aetna deal was always seen as a huge operational

challenge, as the companies would have to pull together vastly

different businesses, ranging from corner drugstores to Aetna's

Medicare and Medicaid coverage.

In his book published last year, Mr. Bertolini said the merger

would entail monitoring many details, requiring a "maniac with the

focus, the tenacity, and the urgency to resolve them all."

But, he wrote, "There was only room for one CEO, and Larry Merlo

was it. He had the bigger balance sheet, and his is the acquiring

company; so he deserves to lead the new organization."

Mr. Bertolini also wrote that if Aetna had completed a planned

acquisition of Humana Inc., which was blocked on antitrust grounds

before the CVS deal, he would have relished leading that combined

company.

Investors had mixed reactions to the CVS-Aetna deal, partly due

to concerns about the obstacles to integrating the various

businesses.

CVS shares fell sharply a year ago after the company issued a

downbeat earnings projection. Investors pressed for more detail

about the company's growth plans, and CVS promised it would return

to profit growth this year, accelerating in the future. Shares have

since risen as the company delivered stronger-than-expected results

in subsequent quarters.

CVS is in the process of opening around 1,500 health hub stores,

which are designed to offer a broader range of services than its

traditional drugstores, many aimed at people with chronic illnesses

such as diabetes.

George Hill, an analyst with Deutsche Bank, said investors now

have enough comfort with CVS's direction that Mr. Bertolini's

departure and comments won't disturb them, though he wrote that the

development might raise some eyebrows.

Matthew Borsch, an analyst with BMO Capital Markets, said

investors' view of CVS has brightened.

Yet, he said, Mr. Bertolini's unusual public statement, combined

with the recent departure of the company's president of pharmacy,

might "raise questions about whether everything is going as well as

management insists."

Strong headwinds remain. CVS, like competitor Walgreens Boots

Alliance Inc., faces pressure on margins in its retail pharmacy

business. Also, investors have pushed down shares of insurers over

political concerns, as Democratic presidential candidates advocate

for a major revamp of the U.S. health-care system.

And CVS faces the threat of an activist investor as a

shareholder. Starboard Value LP has taken a stake in CVS and held

talks with the company, The Wall Street Journal reported in

November, citing people familiar with the matter. Those talks had

been amicable, but Starboard is one of the top activist firms.

--Connie Driebusch contributed to this article.

Write to Anna Wilde Mathews at anna.mathews@wsj.com

(END) Dow Jones Newswires

February 03, 2020 19:14 ET (00:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

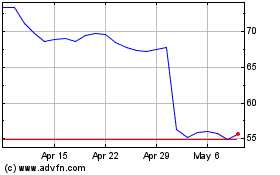

CVS Health (NYSE:CVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

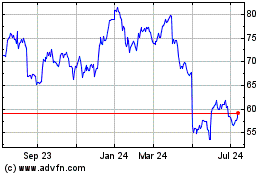

CVS Health (NYSE:CVS)

Historical Stock Chart

From Apr 2023 to Apr 2024