ConocoPhillips Lifts Planned 2021 Share Repurchases by $1 Billion

June 30 2021 - 9:18AM

Dow Jones News

By Robb M. Stewart

ConocoPhillips boosted its planned share buybacks in 2021 by $1

billion in the expectation of greater savings and benefits from its

recently-completed takeover of shale rival Concho Resources

Inc.

Ahead of a market update Wednesday in which the energy company

said it would affirm its commitment to a disciplined,

returns-focused strategy, it said the increase in planned share

repurchases would bring total planned distributions for the year to

about $6 billion, or 7% of ConocoPhillips's current market

capitalization.

The company in March resumed share buybacks at an annualized

level of $1.5 billion, a 50% increase on repurchases underway in

the final quarter of 2020 when the program was suspended due to the

Concho acquisition. ConocoPhillips closed the $9.7 billion

acquisition of Concho in mid-January, greatly expanding its

footprint in the Permian Basin of Texas and New Mexico, the hottest

oil field in the U.S.

ConocoPhillips said it was raising anticipated Concho

transaction-related synergies and savings to $1 billion annually.

At the same time, it said it would reduce capital spending in 2021

and adjusted operating cost guidance by $200 million and $100

million, due to "stronger-than-expected business execution."

Capital expenditure is expected to average about $7 billion

annually, resulting in roughly 3% compounded annual production

growth at an average reinvestment rate of about 50%, it said.

ConocoPhillips said its return on capital employed is projected

to grow 1 to 2 percentage points annually, with balance sheet

strength further improving throughout 2022-2031 plan period.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

June 30, 2021 09:04 ET (13:04 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

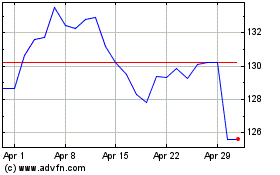

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Mar 2024 to Apr 2024

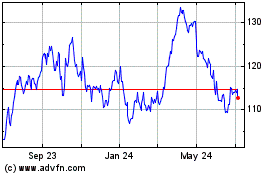

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Apr 2023 to Apr 2024