Statement of Changes in Beneficial Ownership (4)

February 23 2021 - 4:02PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Bullock William L. Jr. |

2. Issuer Name and Ticker or Trading Symbol

CONOCOPHILLIPS

[

COP

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

Executive Vice President & CFO |

|

(Last)

(First)

(Middle)

16930 PARK ROW DR. |

3. Date of Earliest Transaction

(MM/DD/YYYY)

2/20/2021 |

|

(Street)

HOUSTON, TX 77084

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 2/20/2021 | | M | | 39618 | A | (1) | 56976 | D | |

| Common Stock | 2/20/2021 | | D | | 24028 | D | $48.0375 | 32948 | D | |

| Common Stock | 2/20/2021 | | F | | 15590 | D | $48.0375 | 17358 | D | |

| Common Stock | | | | | | | | 4716.083 (2) | I | By ConocoPhillips Savings Plan |

| Common Stock | | | | | | | | 133 (3) | I | By William L. Bullock Family Trust |

| Common Stock | | | | | | | | 133 (4) | I | By Mother |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Stock Units | (5) | 2/20/2021 | | M | | | 39618 | (6) | (7) | Common Stock | 39618 | $0.00 | 0 | D | |

| Explanation of Responses: |

| (1) | Each stock unit was the economic equivalent of one share of common stock and settled in cash. |

| (2) | Includes units acquired through routine dividend transactions that are exempt under rule 16a-11 and through a qualified plan that are exempt under rule 16b-3. |

| (3) | The reporting person holds a Power of Attorney for the trustee of the William L. Bullock Family Trust. The reporting person is among the beneficiaries of the trust. The reporting person disclaims beneficial ownership of the ConocoPhillips common stock held by the trust except to the extent of his pecuniary interest therein. |

| (4) | The reporting person is the guardian of his mother's estate and is among the beneficiaries of the estate. The reporting person disclaims beneficial ownership of his mother's shares to the extent he does not have a pecuniary interest in such shares. |

| (5) | The stock units represent ConocoPhillips common stock on a 1-for-1 basis. |

| (6) | The stock units will be forfeited if the reporting person separates from service prior to the end of an escrow period ending on the earliest to occur of the following: (a) termination of employment as a result of layoff; (b) termination of employment after attainment of age 55 with five years of service; (c) termination of employment due to death or total disability; (d) termination of employment following a change in control; or (e) February 20, 2021. During the escrow period, the reporting person may not dispose of the stock units. The stock units will be settled in cash on the later of (a) the end of the escrow period or (b) the earlier of (i) death (ii) February 20, 2021 or (iii) six months after separation from service in which case the stock units will be settled in cash based on the fair market value of the units on that date. The reporting person may also elect to defer settlement of stock units until a later date. |

| (7) | The stock units do not have an expiration date. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Bullock William L. Jr.

16930 PARK ROW DR.

HOUSTON, TX 77084 |

|

| Executive Vice President & CFO |

|

Signatures

|

| Shannon B. Kinney (by Power of Attorney filed with the Commission on February 20, 2019) | | 2/23/2021 |

| **Signature of Reporting Person | Date |

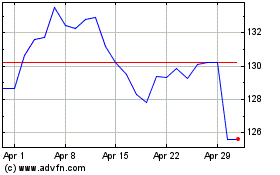

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Mar 2024 to Apr 2024

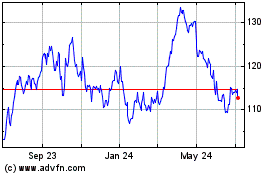

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Apr 2023 to Apr 2024