ConocoPhillips Cuts 2020 Capital Expenditures By 10%

March 18 2020 - 9:27AM

Dow Jones News

By Michael Dabaie

ConocoPhillips said it will reduce its 2020 operating plan

capital expenditures by $700 million, or about 10% from its

previous guidance, in response to the recent oil market

downturn.

Shares fell 7.7% premarket to $24.24.

The company said it will slow operated development activity in

the Lower 48 states, expects decreases in non-operated activity in

the Lower 48, and will defer drilling in Alaska.

ConocoPhillips said it expects the reductions to impact 2020

full-year production guidance by about 20,000 barrels of oil

equivalent per day.

The company said it will also reduce its 2020 share repurchase

program to a quarterly run rate of $250 million beginning in the

second quarter from the previous run rate of $750 million.

Combined, the capital and share repurchase actions represent a

reduction in 2020 cash uses of $2.2 billion, with limited impact to

the company's productive capacity, ConocoPhillips said.

The company continues to review its capital and operating plans

and will provide a full 2020 guidance update with first-quarter

earnings April 30.

"Our industry is clearly experiencing an unprecedented event

brought about by simultaneous supply and demand shocks," Chief

Executive Ryan Lance said. "The actions we are now taking reflect

an acknowledgement of current events as well as uncertainty around

the timing and path of a recovery."

Write to Michael Dabaie at michael.dabaie@wsj.com

(END) Dow Jones Newswires

March 18, 2020 09:12 ET (13:12 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

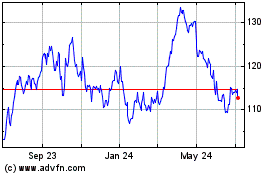

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Mar 2024 to Apr 2024

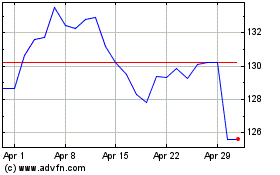

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Apr 2023 to Apr 2024