Current Report Filing (8-k)

May 07 2020 - 4:26PM

Edgar (US Regulatory)

CT0001345126false 0001345126 2020-05-04 2020-05-04 0001345126 codi:SeriesBPreferredSharesRepresentingSeriesBTrustPreferredInterestInCompassDiversifiedHoldingsMember 2020-05-04 2020-05-04 0001345126 codi:SeriesAPreferredSharesRepresentingSeriesATrustPreferredInterestInCompassDiversifiedHoldingsMember 2020-05-04 2020-05-04 0001345126 codi:SharesRepresentingBeneficialInterestsInCompassDiversifiedHoldingsMember 2020-05-04 2020-05-04 0001345126 codi:SeriesCPreferredSharesRepresentingSeriesCTrustPreferredInterestInCompassDiversifiedHoldingsMember 2020-05-04 2020-05-04

SECURITIES AND EXCHANGE COMMISSION

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 4, 2020

COMPASS DIVERSIFIED HOLDINGS

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

(State or other jurisdiction

|

|

|

|

|

COMPASS GROUP DIVERSIFIED

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

(State or other jurisdiction

|

|

|

|

|

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (203) 221-1703

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

Shares representing beneficial interests in Compass Diversified Holdings

|

|

|

|

|

Series A Preferred Shares representing Series A Trust Preferred Interest in Compass Diversified Holdings

|

|

|

|

|

Series B Preferred Shares representing Series B Trust Preferred Interest in Compass Diversified Holdings

|

|

|

|

|

Series C Preferred Shares representing Series C Trust Preferred Interest in Compass Diversified Holdings

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

|

|

Registrant’s Business and Operations

|

|

|

Entry into a Definitive Material Agreement

|

On May 4, 2020, Compass Diversified Holdings (the “Trust”) and Compass Group Diversified Holdings LLC (the “Company” and together with the Trust, “CODI”) announced that CODI priced an underwritten public offering of 5,000,000 common shares of the Trust at a price to the public of $17.60 per share (the “Common Offering”), for gross proceeds to CODI of $88 million. In connection with the Common Offering, the Trust, the Company and Compass Group Management LLC entered into an Underwriting Agreement (the “Underwriting Agreement”) with Morgan Stanley & Co. LLC, as manager of the several underwriters listed therein (collectively, the “Underwriters”), pursuant to which CODI agreed to sell and the Underwriters agreed severally to purchase, subject to and upon terms and conditions set forth therein, 5,000,000 common shares of the Trust. As part of the Common Offering, CODI granted the Underwriters a

30-day

option to purchase up to an additional 750,000 common shares of the Trust.

Pursuant to the Underwriting Agreement, the executive officers and directors of the Company entered into agreements in substantially the form included in the Underwriting Agreement providing for a

45-day

“lock-up”

period with respect to sales of specified securities, subject to certain exceptions.

The common shares offered by CODI were registered under the Securities Act of 1933, as amended (the “Securities Act”), pursuant to a Registration Statement on Form

S-3

(Registration No.

333-

234665) (the “Registration Statement”). The offer and sale of the common shares are described in CODI’s prospectus dated November 13, 2019, constituting a part of the Registration Statement, as supplemented by a prospectus supplement dated May 4, 2020.

The foregoing description of the Underwriting Agreement does not purport to be complete and is qualified in its entirety by reference to the Underwriting Agreement, which is filed as Exhibit 1.1 to this Current Report on Form

8-K,

and is incorporated into this report by reference.

|

|

Creation of a Direct Financial Obligation or an Obligation under an Off Balance Sheet Arrangement of a Registrant.

|

On May 7, 2020, the Company consummated the issuance and sale of an additional $200 million aggregate principal amount of its 8.000% Senior Notes due 2026 (the “Additional Notes”) offered pursuant to a private offering to qualified institutional buyers in accordance with Rule 144A under the Securities Act and to

non-U.S.

persons under Regulation S under the Securities Act. The Company will use the net proceeds from the sale of the Additional Notes and the Common Offering to repay the outstanding balance on its existing revolving credit facility, with the remainder of the net proceeds from the sale of the Additional Notes to be used to provide the Company with liquidity to allow it to opportunistically pursue future acquisitions and for general corporate purposes.

The Additional Notes were issued pursuant to an indenture, dated as of April 18, 2018 (the “Indenture”), between the Company and U.S. Bank National Association, as trustee (the “Trustee”). A copy of the Indenture (including the form of 8.000% Senior Notes due 2026) was previously filed as Exhibit 4.1 to CODI’s Current Report on Form

8-K

filed with the Securities and Exchange Commission on April 18, 2018. The description of the Indenture and the Additional Notes in this report is a summary and is qualified in its entirety by the terms of the Indenture.

The Additional Notes constitute a single class under the Indenture, together with $400 million of the Company’s 8.000% Senior Notes due 2026 issued on April 18, 2018 (the “Existing Notes” and, together with the Additional Notes, the “Notes”), and have identical terms as the Existing Notes, except that the Additional Notes were issued (i) at a price of 101.000% of the principal amount plus accrued and unpaid interest from May 1, 2020 up to, but excluding, May 7, 2020, and (ii) on a different issue date.

The Notes bear interest at the rate of 8.000% per annum and will mature on May 1, 2026. Interest on the Notes is payable in cash on May 1 and November 1 of each year, with an initial interest payment on the Additional Notes on November 1, 2020.

At any time prior to May 1, 2021, the Company may on any one or more occasions redeem up to 40% of the aggregate principal amount of the Notes outstanding under the Indenture (provided that at least 60% of the Notes issued under the Indenture remain outstanding), at a redemption price equal to 108% of the principal amount of the Notes to be redeemed, plus accrued and unpaid interest to, but not including, the redemption date, with the net cash proceeds of one or more “equity offerings” (as defined in the Indenture), subject to certain conditions. At any time prior to May 1, 2021, the Company may also redeem the Notes at its option, in whole or in part, at a redemption price equal to 100% of the principal amount of the Notes to be redeemed plus the “applicable premium” (as defined in the Indenture) as of, and accrued and unpaid interest to, but not including, the applicable redemption date. On or after May 1, 2021, the Company may redeem all or a part of the Notes, on any one or more occasions, at the redemption prices set forth in the Indenture, beginning at 104% of the principal amount of the Notes to be redeemed if redeemed during the twelve-month period beginning on May 1, 2021 and decreasing over the succeeding two years to 100.0% of the principal amount to be redeemed beginning on or after May 1, 2023, plus, in each case, accrued and unpaid interest thereon, if any, to, but not including, the applicable redemption date.

Upon a change of control, as defined in the Indenture, the Company will be required to make an offer to purchase the Notes at a purchase price equal to 101% of the principal amount of the Notes on the date of purchase, plus accrued interest, if any, to but excluding the redemption date.

The Notes are general senior unsecured obligations of the Company and are not guaranteed by the subsidiaries through which the Company currently conducts substantially all of its operations. The Notes rank equal in right of payment with all of the Company’s existing and future senior unsecured indebtedness, and rank senior in right of payment to all of the Company’s future subordinated indebtedness, if any. The Notes are effectively subordinated to the Company’s existing and future secured indebtedness, to the extent of the value of the assets securing such indebtedness, including the indebtedness under the Company’s existing revolving credit facility.

The Indenture contains several restrictive covenants including, but not limited to, limitations on the following: (i) the incurrence of additional indebtedness, (ii) restricted payments, (iii) dividend and other payments affecting restricted subsidiaries, (iv) the issuance of preferred stock of restricted subsidiaries, (v) transactions with affiliates, (vi) asset sales and mergers and consolidations, (vii) future subsidiary guarantees and (viii) liens, subject in each case to certain exceptions.

The Indenture contains customary terms that upon certain events of default occurring and continuing, either the trustee or the holders of not less than 25% in aggregate principal amount of the Notes then outstanding may declare the principal of the Notes and any accrued and unpaid

interest through the date of such declaration immediately due and payable. In the case of certain events of bankruptcy or insolvency relating to the Company, the principal amount of the Notes, together with any accrued and unpaid interest thereon through the occurrence of such event, will automatically become and be immediately due and payable.

On May 7, 2020, CODI closed the sale of the 5,000,000 common shares of the Trust. The following documents are being filed with this Current Report on Form

8-K

and shall be incorporated by reference into the Registration Statement: (i) the Underwriting Agreement; (ii) validity opinion with respect to the common shares of the Trust and their underlying trust common interests of the Company; and (iii) tax opinion with respect to the common shares.

Section 9 Financial Statements and Exhibits

|

|

Financial Statements and Exhibits

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consent of Richards, Layton & Finger, P.A. (contained in Exhibits 5.1 and 5.2 hereto).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPASS DIVERSIFIED HOLDINGS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPASS GROUP DIVERSIFIED HOLDINGS LLC

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

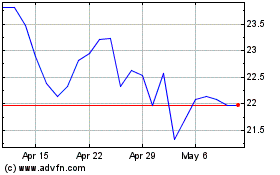

Compass Diversified (NYSE:CODI)

Historical Stock Chart

From Mar 2024 to Apr 2024

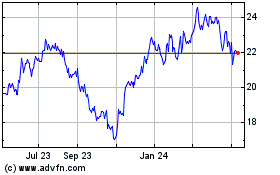

Compass Diversified (NYSE:CODI)

Historical Stock Chart

From Apr 2023 to Apr 2024