Compass Diversified Holdings (NYSE: CODI) ("CODI" or the

"Company"), an owner of leading middle market businesses, announced

today its consolidated operating results for the three and twelve

months ended December 31, 2019.

Fourth Quarter and Full Year 2019

Highlights

- Reported net sales of $387.0

million for the fourth quarter of 2019 and $1.5 billion for the

full year 2019;

- Reported net income of $5.4 million

for the fourth quarter of 2019 and $307.1 million for the full year

2019;

- Reported non-GAAP Adjusted EBITDA

of $61.7 million for the fourth quarter of 2019 and $226.1 million

for the full year 2019;

- Reported Cash Provided by Operating

Activities of $53.0 million for the fourth quarter of 2019 and

$84.6 million for the full year 2019, and non-GAAP Cash Flow

Available for Distribution and Reinvestment ("CAD") of $30.0

million for the fourth quarter of 2019 and $104.0 million for the

full year 2019;

- Completed an offering of 4,600,000

shares of 7.875% Series C Preferred Shares;

- Paid off the remaining $298.8

million of Term Loans;

- Paid a fourth quarter 2019 cash

distribution of $0.36 per share on CODI's common shares in January

2020, bringing cumulative distributions paid to $18.9552 per common

share since CODI's IPO in May of 2006; and

- Paid a quarterly cash distribution

of $0.453125 per share on the Company's 7.250% Series A Preferred

Shares, $0.4921875 per share on the Company's 7.875% Series B

Preferred Shares, and $0.38281 per share on the Company's 7.875%

Series C Preferred Shares in January 2020.

"Our success in 2019, both in strengthening our

diversified group of leading middle market businesses and unlocking

significant value for shareholders, underscores the benefits of

CODI's permanent capital structure as well as our team's deep

expertise investing across the niche industrial and branded

consumer sectors," said Elias Sabo, CEO of Compass Group

Diversified Holdings LLC. "During the year, we generated strong

cash flow and the highest full year CAD since going public and

achieved fourth quarter revenue and EBITDA growth that exceeded

expectations. Notably, we have begun to realize accelerated value

creation from investments in our subsidiaries, highlighted by

5.11's second consecutive quarter of double-digit revenue growth

and fourth consecutive quarter of double-digit EBITDA growth."

Mr. Sabo continued, "We are pleased to have

opportunistically monetized our investments in Clean Earth and

Manitoba Harvest at attractive valuations in 2019, enabling us to

realize gains in excess of $300 million and increase total gains to

over $1 billion since our IPO. Importantly, we redeployed the

proceeds from these two divestitures to pay down debt, enabling

CODI to have more capital resources available than ever before and

significant flexibility from having leverage below our target level

at only 1.5 times. We expect our strong balance sheet to serve CODI

well as we pursue accretive platform and add-on acquisitions

consistent with our disciplined and proven approach to acquiring,

managing and opportunistically divesting leading middle market

businesses. Looking ahead, we are well-positioned to continue

creating long-term shareholder value as we execute on our strategy

to work closely with our best in class management teams, invest in

our subsidiaries, return substantial capital with our $1.44 per

common share annual distribution and further enhance our commitment

to ESG initiatives across our portfolio."

Operating Results

Net sales for the quarter ended December 31,

2019 were $387.0 million, as compared to $370.9 million for the

quarter ended December 31, 2018. Net sales were $1.5 billion for

the year ended December 31, 2019, as compared to $1.4 billion for

the year ended December 31, 2018. Net sales for the year ended

December 31, 2018 do not include net sales attributable to Ravin

prior to CODI's ownership.

Net income for the quarter ended December 31,

2019 was $5.4 million, as compared to net loss of $6.5 million for

the quarter ended December 31, 2018. For the year ended December

31, 2019, CODI reported net income of $307.1 million, which

included $331.0 million in gains from sales of Clean Earth and

Manitoba Harvest. This compared to a net loss of $1.8 million for

the year ended December 31, 2018.

Adjusted EBITDA (see "Note Regarding Use of

Non-GAAP Financial Measures" below) for the quarter ended December

31, 2019 was $61.7 million, as compared to $56.5 million for the

quarter ended December 31, 2018. Adjusted EBITDA for the year ended

December 31, 2019 was $226.1 million, as compared to $202.1 million

for the year ended December 31, 2018. Adjusted EBITDA for the year

ended December 31, 2018 does not include the results of Ravin prior

to CODI's ownership.

CODI reported CAD (see "Note Regarding Use of

Non-GAAP Financial Measures" below) of $30.0 million for the

quarter ended December 31, 2019, as compared to $22.9 million for

the prior year's comparable quarter. CAD for the year ended

December 31, 2019 was $104.0 million, as compared to $93.7 million

for the year ended December 31, 2018. CODI's CAD is calculated

after taking into account all interest expenses, cash taxes paid,

preferred distributions and maintenance capital expenditures, and

includes the operating results of each of our businesses for the

periods during which CODI owned them. However, CAD excludes the

gains from monetizing interests in CODI's subsidiaries, which have

totaled over $1 billion since going public in 2006. The increase in

CAD over the prior year's quarter is primarily the result of 5.11's

improved operating performance and lower interest expense and

management fees, offset by the loss of cash flow from our two

divestitures in the first half of 2019.

Liquidity and Capital

Resources

For the quarter ended December 31, 2019, CODI

reported Cash Provided by Operating Activities of $53.0 million, as

compared to Cash Provided by Operating Activities of $55.7 million

for the quarter ended December 31, 2018. CODI's weighted average

number of shares outstanding for the quarters ended December 31,

2019 and December 31, 2018 were 59.9 million.

For the year ended December 31, 2019, CODI

generated Cash Provided by Operating Activities of $84.6 million,

as compared to Cash Provided by Operating Activities of $114.5

million for the year ended December 31, 2018. CODI's weighted

average number of shares outstanding for the twelve month periods

ended December 31, 2019 and December 31, 2018 were 59.9

million.

As of December 31, 2019, CODI had approximately

$100.3 million in cash and cash equivalents, $400.0 million

outstanding in 8.00% Senior Notes due 2026 and no outstanding

borrowings under its revolving credit facility. The Company repaid

$193.8 million of its 2018 Term Loan in July 2019, and repaid the

remaining $298.8 million due under the 2018 Term Loan in November

2019.

The Company has no significant debt maturities

until 2026 and had net borrowing availability of $596.4 million at

December 31, 2019 under its revolving credit facility.

In November 2019, the Company completed an

offering of 4,000,000 shares of 7.875% Series C Cumulative

Preferred Shares (the "Series C Preferred Shares") with a

liquidation preference of $25.00 per share. The underwriters

exercised in full their option to purchase an additional 600,000

Series C Preferred Shares, which resulted in total proceeds to the

Company of $111.0 million, after deducting the underwriting

discount and estimated offering expenses payable by the Company.

The Company used the net proceeds from the offering, together with

its own cash, to repay in full the outstanding balance of its 2018

Term Loan, and for general corporate purposes.

Concurrent with the June 2019 sale of Clean

Earth, Compass Group Management volunteered to waive the management

fee on cash balances held at CODI, commencing with the management

fee due for the quarter ended June 30, 2019 and continuing until

the quarter during which the Company next borrows under its

revolving credit facility.

Fourth Quarter 2019

Distributions

On January 6, 2020, CODI's Board of Directors

(the "Board") declared a fourth quarter distribution of $0.36 per

share on the Company's common shares. The cash distribution was

paid on January 23, 2020 to all holders of record of common shares

as of January 16, 2020. Since its IPO in 2006, CODI has paid a

cumulative distribution of $18.9552 per common share.

The Board also declared a quarterly cash

distribution of $0.453125 per share on the Company's 7.250% Series

A Preferred Shares (the "Series A Preferred Shares"). The

distribution on the Series A Preferred Shares covers the period

from, and including, October 30, 2019, up to, but excluding,

January 30, 2020. The distribution for such period was paid on

January 30, 2020 to all holders of record of Series A Preferred

Shares as of January 15, 2020.

The Board also declared a quarterly cash

distribution of $0.4921875 per share on the Company's 7.875% Series

B Preferred Shares (the "Series B Preferred Shares"). The

distribution on the Series B Preferred Shares covers the period

from, and including, October 30, 2019, up to, but excluding,

January 30, 2020. The distribution for such period was paid on

January 30, 2020 to all holders of record of Series B Preferred

Shares as of January 15, 2020.

The Board also declared a quarterly cash

distribution of $0.38281 per share on the Company's 7.875% Series C

Preferred Shares. The distribution on the Series C Preferred Shares

covers the period from, and including, November 20, 2019, the

original issue date of the Series C Preferred Shares, up to, but

excluding, January 30, 2020. The distribution for such period was

paid on January 30, 2020 to all holders of record of Series C

Preferred Shares as of January 15, 2020.

2020 Guidance

The Company expects its current subsidiaries to

produce consolidated Adjusted EBITDA in 2020 of between $238

million and $258 million. This estimate is based on the

summation of our expectations for our current subsidiaries in 2020,

absent additional acquisitions or divestitures, and excludes

corporate expense such as interest expense, management fees and

corporate overhead. In addition, our Payout Ratio, defined as

our prior year's annual distribution to common shareholders divided

by our 2020 estimate for CAD, is anticipated to be between 80% and

90%. These estimates assume an economic growth rate in 2020

that is similar to the growth rate experienced in 2019, and does

not take into account potential disruption from the

coronavirus. As discussed below, it is not possible to

reconcile, without unreasonable efforts, our consolidated Adjusted

EBITDA for 2020 or our 2020 Payout Ratio due to an inability to

identify the timing or occurrence of events and transactions that

could significantly impact future GAAP Net Income (Loss) and Cash

Flow from Operating Activities if they were to occur.

Conference Call

Management will host a conference call on

Wednesday, February 26, 2020 at 5:00 p.m. ET to discuss the latest

corporate developments and financial results. The dial-in number

for callers in the U.S. is (855) 212-2368 and the dial-in number

for international callers is (315) 625-6886. The access code for

all callers is 4209368. A live webcast will also be available on

the Company's website at https://www.compassequity.com.

A replay of the call will be available through

March 5, 2020. To access the replay, please dial (855) 859-2056 in

the U.S. and (404) 537-3406 outside the U.S., and then enter the

access code 4209368.

Note Regarding Use of Non-GAAP Financial

Measures

Adjusted EBITDA is a non-GAAP measure used by

the Company to assess its performance. We have reconciled

Adjusted EBITDA to Net Income (Loss) on the attached schedules. We

consider Net Income (Loss) to be the most directly comparable GAAP

financial measure to Adjusted EBITDA. We believe that Adjusted

EBITDA provides useful information to investors and reflects

important financial measures as it excludes the effects of items

which reflect the impact of long-term investment decisions, rather

than the performance of near term operations. When compared to Net

Income (Loss), Adjusted EBITDA is limited in that it does not

reflect the periodic costs of certain capital assets used in

generating revenues of our businesses or the non-cash charges

associated with impairments, as well as certain cash charges. This

presentation also allows investors to view the performance of our

businesses in a manner similar to the methods used by us and the

management of our businesses, provides additional insight into our

operating results and provides a measure for evaluating targeted

businesses for acquisition. We believe Adjusted EBITDA is also

useful in measuring our ability to service debt and other payment

obligations.

CAD is a non-GAAP measure used by the Company to

assess its performance, as well as its ability to sustain quarterly

distributions. We have reconciled CAD to Net Income (Loss)

and Cash Flow from Operating Activities on the attached schedules.

We consider Net Income (Loss) and Cash Flow from Operating

Activities to be the most directly comparable GAAP financial

measures to CAD.

CAD is calculated after taking into account all

interest expense, cash taxes paid and maintenance capital

expenditures, and includes the operating results of each of our

businesses for the periods during which CODI owned them. We

believe that CAD provides investors additional information to

enable them to evaluate our performance and ability to make

anticipated quarterly distributions.

Payout Ratio is a non-GAAP measure defined as

our prior year's annual distribution to common shareholders divided

by our CAD. We believe the Payout Ratio provides investors

additional information to enable them to evaluate our performance

and our ability to sustain quarterly distributions. We have

reconciled CAD to Net Income (Loss) and Cash Flow from Operating

Activities on the attached schedules. We consider Net Income (Loss)

and Cash Flow from Operating Activities to be the most directly

comparable GAAP financial measures to CAD. However, we do not

provide a reconciliation of the Payout Ratio since it is a

calculation investors can perform by dividing our distribution by

our CAD.

In reliance on the unreasonable efforts

exception provided under Item 10(e)(1)(i)(B) of Regulation S-K, we

have not reconciled Adjusted EBITDA or the Payout Ratio to their

comparable GAAP measures because we do not provide guidance on the

applicable reconciling items as a result of the uncertainty

regarding, and the potential variability of, these items. The

actual amount of such reconciling items will have a significant

impact on our Adjusted EBITDA and the Payout Ratio and,

accordingly, a reconciliation is not available without unreasonable

effort.

None of Adjusted EBITDA, CAD nor Payout Ratio is

meant to be a substitute for GAAP measures and may be different

from or otherwise inconsistent with non-GAAP financial measures

used by other companies.

About Compass Diversified Holdings

("CODI")

CODI owns and manages a diverse family of

established North American middle market businesses. Each of its

current subsidiaries is a leader in its niche market.

CODI maintains controlling ownership interests

in each of its subsidiaries in order to maximize its ability to

impact long term cash flow generation and value. The Company

provides both debt and equity capital for its subsidiaries,

contributing to their financial and operating flexibility. CODI

utilizes the cash flows generated by its subsidiaries to invest in

the long-term growth of the Company and to make cash distributions

to its shareholders.

Our eight majority-owned subsidiaries are

engaged in the following lines of business:

- The design and marketing of

purpose-built technical apparel and gear serving a wide range of

global customers (5.11);

- The manufacture of quick-turn,

small-run and production rigid printed circuit boards

(Advanced Circuits);

- The manufacture of engineered

magnetic solutions for a wide range of specialty applications and

end-markets (Arnold Magnetic

Technologies);

- The design and marketing of

wearable baby carriers, strollers and related products

(Ergobaby);

- The design and manufacture of

custom molded protective foam solutions and OE components

(Foam Fabricators);

- The design and manufacture of

premium home and gun safes (Liberty

Safe);

- The manufacture and marketing of

portable food warming fuels for the hospitality and consumer

markets, flameless candles and house and garden lighting for the

home decor market, and wickless candle products used for home decor

and fragrance systems (Sterno); and

- The design, manufacture and

marketing of airguns, archery products, optics and related

accessories (Velocity Outdoor).

This press release may contain certain

forward-looking statements, including statements with regard to the

future performance of CODI. Words such as "believes," "expects,"

“anticipates,” “estimate,” "projects," and "future" or similar

expressions, are intended to identify forward-looking statements.

These forward-looking statements are subject to the inherent

uncertainties in predicting future results and conditions. Certain

factors could cause actual results to differ materially from those

projected in these forward-looking statements, and some of these

factors are enumerated in the risk factor discussion in the Form

10-K filed by CODI with the SEC for the year

ended December 31, 2019, and other filings with the SEC.

Except as required by law, CODI undertakes no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise.

|

Investor Relations: |

Media Contact: |

|

The IGB Group |

Joele Frank, Wilkinson Brimmer Katcher |

|

Leon Berman |

Jon Keehner / Julie Oakes / Kate Thompson |

|

212-477-8438 |

212-355-4449 |

|

lberman@igbir.com |

|

|

|

|

|

Compass Diversified Holdings |

|

Condensed Consolidated Statements of

Operations |

|

(unaudited) |

| |

|

|

|

|

|

|

|

| |

Three months ended |

|

Twelve months ended |

| |

December 31, |

|

December 31, |

| (in thousands, except per

share data) |

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Net sales |

$ |

386,999 |

|

|

$ |

370,918 |

|

|

$ |

1,450,253 |

|

|

$ |

1,357,320 |

|

| Cost of sales |

246,209 |

|

|

247,439 |

|

|

930,810 |

|

|

887,478 |

|

| Gross

profit |

140,790 |

|

|

123,479 |

|

|

519,443 |

|

|

469,842 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Selling, general and administrative expense |

91,445 |

|

|

78,832 |

|

|

335,181 |

|

|

320,085 |

|

|

Management fees |

8,678 |

|

|

11,239 |

|

|

37,030 |

|

|

43,443 |

|

|

Amortization expense |

13,523 |

|

|

14,153 |

|

|

54,155 |

|

|

49,686 |

|

|

Impairment expense (reversal) |

(500 |

) |

|

— |

|

|

32,881 |

|

|

— |

|

| Operating

income |

27,644 |

|

|

19,255 |

|

|

60,196 |

|

|

56,628 |

|

| Other income (expense): |

|

|

|

|

|

|

|

|

Interest expense, net |

(9,792 |

) |

|

(20,018 |

) |

|

(58,216 |

) |

|

(55,245 |

) |

|

Amortization of debt issuance costs |

(689 |

) |

|

(927 |

) |

|

(3,314 |

) |

|

(3,905 |

) |

|

Loss on paydown of debt |

(7,281 |

) |

|

— |

|

|

(12,319 |

) |

|

(744 |

) |

|

Loss on sale of Tilray securities |

— |

|

|

— |

|

|

(10,193 |

) |

|

— |

|

|

Other expense, net |

(972 |

) |

|

(2,860 |

) |

|

(2,185 |

) |

|

(5,145 |

) |

| Income (loss) from

continuing operations before income taxes |

8,910 |

|

|

(4,550 |

) |

|

(26,031 |

) |

|

(8,411 |

) |

|

Provision for income taxes |

4,367 |

|

|

2,909 |

|

|

14,742 |

|

|

10,466 |

|

| Income (loss) from

continuing operations |

4,543 |

|

|

(7,459 |

) |

|

(40,773 |

) |

|

(18,877 |

) |

|

Income from discontinued operations, net of income tax |

— |

|

|

898 |

|

|

16,901 |

|

|

15,829 |

|

|

Gain on sale of discontinued operations |

810 |

|

|

93 |

|

|

331,013 |

|

|

1,258 |

|

| Net income

(loss) |

5,353 |

|

|

(6,468 |

) |

|

307,141 |

|

|

(1,790 |

) |

|

Less: Income from continuing operations attributable to

noncontrolling interest |

1,545 |

|

|

2,742 |

|

|

5,542 |

|

|

5,217 |

|

|

Less: Loss from discontinued operations attributable to

noncontrolling interest |

— |

|

|

(2,031 |

) |

|

(266 |

) |

|

(1,305 |

) |

| Net income (loss)

attributable to Holdings |

$ |

3,808 |

|

|

$ |

(7,179 |

) |

|

$ |

301,865 |

|

|

$ |

(5,702 |

) |

| |

|

|

|

|

|

|

|

| Basic income

(loss) per common share attributable to Holdings |

|

|

|

|

|

|

|

Continuing operations |

$ |

(0.24 |

) |

|

$ |

(0.30 |

) |

|

$ |

(2.17 |

) |

|

$ |

(0.73 |

) |

|

Discontinued operations |

0.01 |

|

|

(0.05 |

) |

|

5.81 |

|

|

0.31 |

|

| |

$ |

(0.23 |

) |

|

$ |

(0.35 |

) |

|

$ |

3.64 |

|

|

$ |

(0.42 |

) |

| |

|

|

|

|

|

|

|

| Basic weighted average number

of common shares outstanding |

59,900 |

|

|

59,900 |

|

|

59,900 |

|

|

59,900 |

|

| |

|

|

|

|

|

|

|

| Cash distributions declared

per Trust common share |

$ |

0.36 |

|

|

$ |

0.36 |

|

|

$ |

1.44 |

|

|

$ |

1.44 |

|

| |

|

|

|

|

|

|

|

|

Compass Diversified Holdings |

|

Net Sales to Pro Forma Net Sales

Reconciliation |

|

(unaudited) |

| |

|

|

|

|

|

|

|

| |

Three months ended |

|

Twelve months ended |

| |

December 31, |

|

December 31, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

| |

|

|

|

|

|

|

|

|

Net Sales |

$ |

386,999 |

|

|

$ |

370,918 |

|

|

$ |

1,450,253 |

|

|

$ |

1,357,320 |

|

|

Acquisitions (1) |

— |

|

|

— |

|

|

— |

|

|

39,828 |

|

| Pro Forma Net Sales |

$ |

386,999 |

|

|

$ |

370,918 |

|

|

$ |

1,450,253 |

|

|

$ |

1,397,148 |

|

| |

|

|

|

|

|

|

|

|

|

(1) |

|

Net sales of Foam Fabricators and Rimports (Sterno Group add-on) as

if those businesses were acquired January 1, 2018. |

|

|

|

|

|

|

Compass Diversified Holdings |

|

Subsidiary Pro Forma Net Sales |

|

(unaudited) |

| |

|

|

|

|

|

| |

Three months ended |

|

Twelve months ended |

| |

December 31, |

|

December 31, |

| (in thousands) |

2019 |

|

2018 |

|

2019 |

|

2018 |

| |

|

|

|

|

|

|

|

| Branded

Consumer |

|

|

|

|

|

|

|

|

5.11 Tactical |

$ |

109,667 |

|

|

$ |

95,900 |

|

|

$ |

388,645 |

|

|

$ |

347,922 |

|

| Ergobaby |

21,253 |

|

|

20,190 |

|

|

89,995 |

|

|

90,566 |

|

| Liberty |

28,598 |

|

|

20,917 |

|

|

96,164 |

|

|

82,658 |

|

| Velocity Outdoor

(2) |

40,447 |

|

|

37,031 |

|

|

147,842 |

|

|

131,296 |

|

|

Total Branded Consumer |

$ |

199,965 |

|

|

$ |

174,038 |

|

|

$ |

722,646 |

|

|

$ |

652,442 |

|

| |

|

|

|

|

|

|

|

| Niche

Industrial |

|

|

|

|

|

|

|

| Advanced Circuits |

$ |

23,386 |

|

|

$ |

24,057 |

|

|

$ |

90,791 |

|

|

$ |

92,511 |

|

| Arnold Magnetics |

29,544 |

|

|

27,374 |

|

|

119,948 |

|

|

117,860 |

|

| Foam Fabricators

(1) |

27,790 |

|

|

31,443 |

|

|

121,424 |

|

|

128,465 |

|

| Sterno Group

(1) |

106,312 |

|

|

114,006 |

|

|

395,444 |

|

|

405,870 |

|

|

Total Niche Industrial |

$ |

187,032 |

|

|

$ |

196,880 |

|

|

$ |

727,607 |

|

|

$ |

744,706 |

|

| |

|

|

|

|

|

|

|

| |

$ |

386,997 |

|

|

$ |

370,918 |

|

|

$ |

1,450,253 |

|

|

$ |

1,397,148 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

|

Foam Fabricators and Rimports (Sterno Group add-on) are pro forma

as if those businesses were acquired January 1, 2018. |

| |

|

|

|

|

(2) |

|

The above 2018 results exclude management's estimate of net sales

of $33.5 million for the year ended December 31, 2018 at Ravin

before our ownership. Ravin was acquired by Velocity Outdoor

in September 2018. |

|

|

|

|

|

|

Compass Diversified Holdings |

|

Net Income to Adjusted EBITDA and Cash Flow Available for

Distribution and Reinvestment |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

| |

Three months

ended |

|

Twelve

months ended |

| |

December

31, |

|

December

31, |

| (in thousands) |

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Net income (loss) |

$ |

5,353 |

|

|

$ |

(6,468 |

) |

|

$ |

307,141 |

|

|

$ |

(1,790 |

) |

|

Income from discontinued operations, net of income tax |

— |

|

|

898 |

|

|

16,901 |

|

|

15,829 |

|

|

Gain on sale of discontinued operations |

810 |

|

|

93 |

|

|

331,013 |

|

|

1,258 |

|

| Income (loss) from

continuing operations |

$ |

4,543 |

|

|

$ |

(7,459 |

) |

|

$ |

(40,773 |

) |

|

$ |

(18,877 |

) |

|

Provision for income taxes |

4,367 |

|

|

2,909 |

|

|

14,742 |

|

|

10,466 |

|

| Income (loss) from

continuing operations before income taxes |

$ |

8,910 |

|

|

$ |

(4,550 |

) |

|

$ |

(26,031 |

) |

|

$ |

(8,411 |

) |

|

Other expense, net |

(8,253 |

) |

|

(2,860 |

) |

|

(14,504 |

) |

|

(5,145 |

) |

|

Amortization of debt issuance costs |

(689 |

) |

|

(927 |

) |

|

(3,314 |

) |

|

(3,905 |

) |

|

Loss on sale of Tilray securities |

— |

|

|

— |

|

|

(10,193 |

) |

|

(744 |

) |

|

Interest expense, net |

(9,792 |

) |

|

(20,018 |

) |

|

(58,216 |

) |

|

(55,245 |

) |

| Operating income

(loss) |

$ |

27,644 |

|

|

$ |

19,255 |

|

|

$ |

60,196 |

|

|

$ |

56,628 |

|

| Adjusted

For: |

|

|

|

|

|

|

|

|

Depreciation |

8,526 |

|

|

8,270 |

|

|

33,153 |

|

|

31,195 |

|

|

Amortization |

13,523 |

|

|

16,745 |

|

|

54,155 |

|

|

59,506 |

|

|

Non-controlling shareholder compensation |

1,789 |

|

|

739 |

|

|

6,054 |

|

|

6,711 |

|

|

Acquisition expenses |

— |

|

|

110 |

|

|

— |

|

|

3,661 |

|

|

Integration services fees |

— |

|

|

562 |

|

|

281 |

|

|

2,719 |

|

|

Management fees |

8,678 |

|

|

11,239 |

|

|

37,030 |

|

|

43,442 |

|

|

Impairment expense (reversal) |

(500 |

) |

|

— |

|

|

32,881 |

|

|

— |

|

|

Earnout provision adjustment |

2,022 |

|

|

(4,800 |

) |

|

2,022 |

|

|

(4,800 |

) |

|

Other |

— |

|

|

4,364 |

|

|

324 |

|

|

3,046 |

|

| Adjusted

EBITDA |

$ |

61,682 |

|

|

$ |

56,484 |

|

|

$ |

226,096 |

|

|

$ |

202,108 |

|

|

Interest at Corporate, net of unused fee (1) |

(9,281 |

) |

|

(15,441 |

) |

|

(52,417 |

) |

|

(53,615 |

) |

|

Swap payment |

— |

|

|

(339 |

) |

|

(675 |

) |

|

(1,783 |

) |

|

Management fees |

(8,678 |

) |

|

(11,237 |

) |

|

(37,030 |

) |

|

(43,442 |

) |

|

Capital expenditures (maintenance) |

(7,244 |

) |

|

(3,400 |

) |

|

(18,510 |

) |

|

(18,881 |

) |

|

Current tax expense (cash taxes) (2) |

(2,706 |

) |

|

(5,237 |

) |

|

(15,288 |

) |

|

(12,817 |

) |

|

Preferred share distributions |

(3,781 |

) |

|

(3,781 |

) |

|

(15,125 |

) |

|

(12,179 |

) |

|

Discontinued operations |

— |

|

|

7,187 |

|

|

16,987 |

|

|

34,602 |

|

|

Miscellaneous items |

— |

|

|

(1,326 |

) |

|

— |

|

|

(343 |

) |

| Cash Flow Available

for Distribution and Reinvestment ('CAD') |

$ |

29,992 |

|

|

$ |

22,910 |

|

|

$ |

104,038 |

|

|

$ |

93,650 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

|

Interest expense at Corporate reflects consolidated interest

expense less non-cash components such as, unrealized gains and

losses on our swap and original issue discount amortization.

We include the cash component of our swap payment above in our

reconciliation to CAD. |

| |

|

|

|

|

(2) |

|

Current tax expense is calculated by deducting the change in

deferred tax from the statement of cash flows from the income tax

provision on the statement of operations. |

|

|

|

|

|

|

Compass Diversified Holdings |

|

Adjusted EBITDA (1) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

| |

Three months ended |

|

Twelve months ended |

| |

December 31, |

|

December 31, |

| (in thousands) |

2019 |

|

2018 |

|

2019 |

|

2018 |

| |

|

|

|

|

|

|

|

| Branded

Consumer |

|

|

|

|

|

|

|

|

5.11 Tactical |

$ |

15,290 |

|

|

$ |

10,989 |

|

|

$ |

46,900 |

|

|

$ |

32,303 |

|

| Ergobaby |

3,574 |

|

|

3,724 |

|

|

20,263 |

|

|

21,138 |

|

| Liberty |

3,243 |

|

|

1,558 |

|

|

10,867 |

|

|

8,060 |

|

| Velocity Outdoor

(2) |

5,607 |

|

|

5,764 |

|

|

21,571 |

|

|

20,543 |

|

|

Total Branded Consumer |

$ |

27,714 |

|

|

$ |

22,035 |

|

|

$ |

99,601 |

|

|

$ |

82,044 |

|

| |

|

|

|

|

|

|

|

| Niche

Industrial |

|

|

|

|

|

|

|

| Advanced Circuits |

$ |

7,521 |

|

|

$ |

8,025 |

|

|

$ |

28,926 |

|

|

$ |

29,954 |

|

| Arnold Magnetics |

3,766 |

|

|

1,871 |

|

|

15,376 |

|

|

13,976 |

|

| Foam Fabricators

(2) |

5,856 |

|

|

7,433 |

|

|

28,531 |

|

|

26,556 |

|

| Sterno Group

(2) |

22,010 |

|

|

20,821 |

|

|

68,529 |

|

|

63,845 |

|

|

Total Niche Industrial |

$ |

39,153 |

|

|

$ |

38,150 |

|

|

$ |

141,362 |

|

|

$ |

134,331 |

|

|

|

|

|

|

|

|

|

|

| Corporate expense

(3) |

(5,186 |

) |

|

(3,702 |

) |

|

(14,867 |

) |

|

(14,267 |

) |

|

Total Adjusted EBITDA |

$ |

61,681 |

|

|

$ |

56,483 |

|

|

$ |

226,096 |

|

|

$ |

202,108 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

|

Please refer to our recently filed Form 10-K for detail on

subsidiary pro forma Adjusted EBITDA, and reconciliation to net

income. |

| |

|

|

|

|

(2) |

|

The above 2018 results exclude management's estimate of Adjusted

EBITDA, before our ownership, of $5.5 million at Rimports, $2.8

million at Foam Fabricators and $10.8 million at Ravin for the year

ended December 31st. |

| |

|

|

|

|

(3) |

|

Please refer to the recently filed Form 10-K for a

reconciliation of our Corporate expense to Net Income. |

|

|

|

|

|

| Compass

Diversified Holdings |

| Summarized

Statement of Cash Flows |

|

(unaudited) |

| |

|

|

|

| |

Year ended December 31, |

| (in thousands) |

2019 |

|

2018 |

|

Net cash provided by operating activities |

$ |

84,562 |

|

|

$ |

114,452 |

|

|

Net cash provided by (used in) investing activities |

743,126 |

|

|

(604,080 |

) |

|

Net cash (used in) provided by financing activities |

(779,522 |

) |

|

500,111 |

|

| Effect of foreign currency on cash |

(1,178 |

) |

|

2,958 |

|

| Net increase in cash and cash

equivalents |

46,988 |

|

|

13,441 |

|

| Cash and cash equivalents —

beginning of period (1) |

53,326 |

|

|

39,885 |

|

| Cash and cash equivalents —

end of period |

$ |

100,314 |

|

|

$ |

53,326 |

|

| |

|

|

|

|

|

(1) |

|

Includes cash from discontinued operations of $4.6 million at

January 1, 2019 and $4.2 million at January 1, 2018. |

| |

|

|

|

| Compass

Diversified Holdings |

| Condensed

Consolidated Table of Cash Flow Available for Distribution and

Reinvestment |

|

(unaudited) |

| |

|

|

|

|

|

|

|

| |

Three months

ended |

|

Twelve

months ended |

| |

December

31, |

|

December

31, |

| (in thousands) |

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Net income |

$ |

5,353 |

|

|

$ |

(6,468 |

) |

|

$ |

307,141 |

|

|

$ |

(1,790 |

) |

| Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

22,049 |

|

|

32,697 |

|

|

100,462 |

|

|

120,575 |

|

|

Gain on sale of business |

(810 |

) |

|

(93 |

) |

|

(331,013 |

) |

|

(1,258 |

) |

|

Impairment expense (reversal) |

(500 |

) |

|

— |

|

|

32,881 |

|

|

— |

|

|

Amortization of debt issuance costs and original issue

discount |

751 |

|

|

1,080 |

|

|

3,773 |

|

|

4,483 |

|

|

Loss (gain) on interest rate derivative |

14 |

|

|

2,398 |

|

|

3,500 |

|

|

(2,251 |

) |

|

Noncontrolling stockholder charges |

1,789 |

|

|

1,281 |

|

|

7,993 |

|

|

8,975 |

|

|

Provision for loss on receivables |

770 |

|

|

(26 |

) |

|

3,556 |

|

|

433 |

|

|

Other |

8,478 |

|

|

961 |

|

|

14,438 |

|

|

1,007 |

|

|

Deferred taxes |

1,662 |

|

|

(2,850 |

) |

|

(12,876 |

) |

|

(9,472 |

) |

|

Changes in operating assets and liabilities |

13,423 |

|

|

26,700 |

|

|

(45,293 |

) |

|

(6,250 |

) |

| Net cash provided by operating activities |

52,979 |

|

|

55,680 |

|

|

84,562 |

|

|

114,452 |

|

| Plus: |

|

|

|

|

|

|

|

|

Unused fee on revolving credit facility |

458 |

|

|

348 |

|

|

1,851 |

|

|

1,630 |

|

|

Successful acquisition costs |

— |

|

|

348 |

|

|

596 |

|

|

5,343 |

|

|

Integration services fee (1) |

— |

|

|

563 |

|

|

281 |

|

|

2,719 |

|

|

Realized loss from foreign currency effect (2) |

— |

|

|

2,719 |

|

|

363 |

|

|

4,083 |

|

|

Changes in operating assets and liabilities |

— |

|

|

— |

|

|

45,293 |

|

|

6,250 |

|

|

Loss on sale of Tilray securities |

— |

|

|

— |

|

|

10,193 |

|

|

— |

|

|

Earnout provision adjustment |

2,022 |

|

|

— |

|

|

2,022 |

|

|

— |

|

|

Other (3) |

— |

|

|

4,296 |

|

|

— |

|

|

5,181 |

|

| Less: |

|

|

|

|

|

|

|

|

Maintenance capital expenditures (4) |

7,245 |

|

|

5,425 |

|

|

22,005 |

|

|

27,246 |

|

|

Payment of interest rate swap |

— |

|

|

339 |

|

|

675 |

|

|

1,783 |

|

|

Changes in operating assets and liabilities |

13,423 |

|

|

26,700 |

|

|

— |

|

|

— |

|

|

Preferred share distributions |

3,781 |

|

|

3,781 |

|

|

15,125 |

|

|

12,179 |

|

|

Earnout provision adjustment |

— |

|

|

4,800 |

|

|

— |

|

|

4,800 |

|

|

Other (5) |

1,018 |

|

|

— |

|

|

3,318 |

|

|

— |

|

| CAD |

$ |

29,992 |

|

|

$ |

22,909 |

|

|

$ |

104,038 |

|

|

$ |

93,650 |

|

| |

|

|

|

|

|

|

|

| Distribution paid in April

2019/ 2018 |

$ |

— |

|

|

$ |

— |

|

|

$ |

21,564 |

|

|

$ |

21,564 |

|

| Distribution paid in July

2019/ 2018 |

— |

|

|

— |

|

|

21,564 |

|

|

21,564 |

|

| Distribution paid in October

2019/ 2018 |

— |

|

|

— |

|

|

21,564 |

|

|

21,564 |

|

| Distribution paid in January

2020/ 2019 |

21,564 |

|

|

21,564 |

|

|

21,564 |

|

|

21,564 |

|

| |

$ |

21,564 |

|

|

$ |

21,564 |

|

|

$ |

86,256 |

|

|

$ |

86,256 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(1) |

|

Represents fees paid by newly acquired companies to the Manager for

integration services performed during the first year of ownership,

payable quarterly. |

| |

|

|

|

| |

(2) |

|

Reflects the foreign currency transaction gain/ loss resulting from

the Canadian dollar intercompany loans issued to Manitoba

Harvest. |

| |

|

|

|

| |

(3) |

|

Includes $4.2 million in additional reserves established during the

fourth quarter of 2018 for slow moving inventory acquired prior to

our ownership of 5.11 |

| |

|

|

|

| |

(4) |

|

Excludes growth capital expenditures of approximately $5.7 million

and $3.3 million for the three months ended December 31, 2019 and

2018, respectively, and $16.4 million and $24.3 million for the

twelve months ended December 31, 2019 and 2018, respectively. |

| |

|

|

|

| |

(5) |

|

Represents the effect on earnings of reserves for inventory and

accounts receivable. |

| |

|

|

|

|

Compass Diversified Holdings |

|

Maintenance Capital Expenditures |

|

(unaudited) |

| |

|

|

|

|

|

| |

Three months

ended |

|

Twelve

months ended |

| |

December

31, |

|

December

31, |

| (in thousands) |

2019 |

|

2018 |

|

2019 |

|

2018 |

| Branded

Consumer |

|

|

|

|

|

|

|

|

5.11 Tactical |

$ |

696 |

|

|

$ |

(307 |

) |

|

$ |

2,243 |

|

|

$ |

2,322 |

|

| Ergobaby |

22 |

|

|

91 |

|

|

605 |

|

|

737 |

|

| Liberty |

(186 |

) |

|

91 |

|

|

534 |

|

|

1,130 |

|

| Velocity Outdoor |

803 |

|

|

705 |

|

|

2,899 |

|

|

3,768 |

|

|

Total Branded Consumer |

$ |

1,335 |

|

|

$ |

580 |

|

|

$ |

6,281 |

|

|

$ |

7,957 |

|

| |

|

|

|

|

|

|

|

| Niche

Industrial |

|

|

|

|

|

|

|

| Advanced Circuits |

$ |

3,663 |

|

|

$ |

419 |

|

|

$ |

4,790 |

|

|

$ |

1,588 |

|

| Arnold Magnetics |

988 |

|

|

1,548 |

|

|

3,862 |

|

|

4,708 |

|

| Foam Fabricators |

359 |

|

|

340 |

|

|

1,746 |

|

|

1,795 |

|

| Sterno Group |

899 |

|

|

374 |

|

|

1,831 |

|

|

2,694 |

|

|

Total Niche Industrial |

$ |

5,909 |

|

|

$ |

2,681 |

|

|

$ |

12,229 |

|

|

$ |

10,785 |

|

| |

|

|

|

|

|

|

|

| Total maintenance capital

expenditures |

$ |

7,244 |

|

|

$ |

3,261 |

|

|

$ |

18,510 |

|

|

$ |

18,742 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Compass

Diversified Holdings |

| Condensed

Consolidated Balance Sheets |

| |

|

|

|

| |

December 31, 2019 |

|

December 31, 2018 |

| (in thousands) |

|

|

|

| Assets |

|

|

|

| Current assets |

|

|

|

|

Cash and cash equivalents |

$ |

100,314 |

|

|

$ |

48,771 |

|

|

Accounts receivable, net |

191,405 |

|

|

205,545 |

|

|

Inventories |

317,306 |

|

|

307,437 |

|

|

Prepaid expenses and other current assets |

35,247 |

|

|

29,670 |

|

|

Current assets of discontinued operations |

— |

|

|

89,762 |

|

|

Total current assets |

644,272 |

|

|

681,185 |

|

| Property, plant and equipment,

net |

146,428 |

|

|

146,601 |

|

| Goodwill and intangible

assets, net |

1,000,465 |

|

|

1,086,707 |

|

| Other non-current assets |

100,727 |

|

|

8,378 |

|

| Non-current assets of

discontinued operations |

— |

|

|

449,464 |

|

| Total

assets |

$ |

1,891,892 |

|

|

$ |

2,372,335 |

|

| |

|

|

|

| Liabilities and

stockholders’ equity |

|

|

|

| Current liabilities |

|

|

|

|

Accounts payable and accrued expenses |

$ |

178,857 |

|

|

$ |

183,781 |

|

|

Due to related party |

8,049 |

|

|

11,093 |

|

|

Current portion, long-term debt |

— |

|

|

5,000 |

|

|

Other current liabilities |

22,573 |

|

|

6,912 |

|

|

Current liabilities of discontinued operations |

— |

|

|

52,494 |

|

|

Total current liabilities |

209,479 |

|

|

259,280 |

|

| Deferred income taxes |

33,039 |

|

|

33,984 |

|

| Long-term debt |

394,445 |

|

|

1,098,871 |

|

| Other non-current

liabilities |

89,054 |

|

|

12,615 |

|

| Non-current liabilities of

discontinued operations |

— |

|

|

48,243 |

|

|

Total liabilities |

726,017 |

|

|

1,452,993 |

|

| Stockholders'

equity |

|

|

|

| Total stockholders' equity

attributable to Holdings |

1,115,327 |

|

|

859,372 |

|

| Noncontrolling interest |

50,548 |

|

|

39,922 |

|

|

Noncontrolling interest of discontinued operations |

— |

|

|

20,048 |

|

|

Total stockholders' equity |

1,165,875 |

|

|

919,342 |

|

| Total liabilities and

stockholders’ equity |

$ |

1,891,892 |

|

|

$ |

2,372,335 |

|

| |

|

|

|

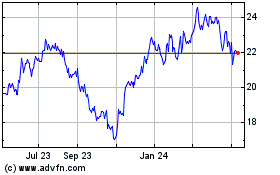

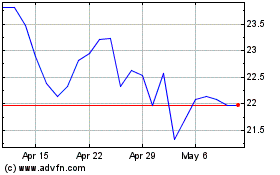

Compass Diversified (NYSE:CODI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Compass Diversified (NYSE:CODI)

Historical Stock Chart

From Apr 2023 to Apr 2024