Current Report Filing (8-k)

November 20 2019 - 4:07PM

Edgar (US Regulatory)

0001345126COMPASS GROUP DIVERSIFIED HOLDINGS LLCDecember 31false 0001345126 2019-11-20 2019-11-20 0001345126 codi:SharesRepresentingBeneficialInterestsInCompassDiversifiedHoldingsMember 2019-11-20 2019-11-20 0001345126 codi:SeriesAPreferredSharesRepresentingSeriesATrustPreferredInterestInCompassDiversifiedHoldingsMember 2019-11-20 2019-11-20 0001345126 codi:SeriesBPreferredSharesRepresentingSeriesBTrustPreferredInterestInCompassDiversifiedHoldingsMember 2019-11-20 2019-11-20 0001345126 us-gaap:LimitedPartnerMember 2019-11-20 2019-11-20

SECURITIES AND EXCHANGE COMMISSION

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 20, 2019

COMPASS DIVERSIFIED HOLDINGS

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

(State or other jurisdiction

|

|

|

|

|

COMPASS GROUP DIVERSIFIED

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

(State or other jurisdiction

|

|

|

|

|

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (203) 221-1703

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

Shares representing beneficial interests in Compass Diversified Holdings

|

|

|

|

|

Series A Preferred Shares representing Series A Trust Preferred Interest in Compass Diversified Holdings

|

|

|

|

|

Series B Preferred Shares representing Series B Trust Preferred Interest in Compass Diversified Holdings

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

The information set forth below under Item 3.03 of this Current Report on Form

8-K

is hereby incorporated by reference into this Item 1.01.

|

Item 3.03

|

Material Modification to Rights of Security Holders

|

On November 20, 2019, Compass Diversified Holdings (the “Trust”) and Compass Group Diversified Holdings LLC (the “Company” and, together with the Trust, “CODI”) issued 4,000,000 of the Trust’s 7.875% Series C Cumulative Preferred Shares (the “Series C Preferred Shares”) pursuant to a previously announced underwritten public offering. Each Series C Preferred Share corresponds to one underlying 7.875% Series C Cumulative Trust Preferred Interest (the “Series C Trust Preferred Interest”) of the Company that was issued simultaneously to the Trust.

On November 20, 2019, in connection with the issuance of the Series C Preferred Shares and the Series C Trust Preferred Interests, CODI executed a share designation (the “Share Designation”) and a trust interest designation (the “Trust Interest Designation”) to create and fix the rights, preferences and powers of the Series C Preferred Shares and the Series C Trust Preferred Interests, respectively. Each of the Share Designation, which constitutes part of the Second Amended and Restated Trust Agreement of the Trust, and the Trust Interest Designation, which constitutes part of the Fifth Amended and Restated Operating Agreement of the Company, became effective on November 20, 2019.

Holders of Series C Preferred Shares will be entitled to receive cumulative cash distributions on the Series C Preferred Shares at a rate equal to 7.875% per annum of the liquidation preference per share. When, as and if declared by the board of directors of the Company, distributions on the Series C Preferred Shares will be payable quarterly in arrears on January 30, April 30, July 30 and October 30 of each year, beginning January 30, 2020.

Unless full cumulative distributions on the Series C Preferred Shares have been or contemporaneously are declared and paid or declared and set apart for payment on the Series C Preferred Shares for all past distribution periods, no distribution may be declared or paid or set apart for payment on the common shares or on any other shares that the Trust may issue in the future ranking, as to the payment of distributions, junior to the Series C Preferred Shares (together with the common shares, the “Junior Shares”), other than distributions paid in Junior Shares or options, warrants or rights to subscribe for or purchase Junior Shares, and CODI and its subsidiaries may not directly or indirectly repurchase, redeem or otherwise acquire for consideration Junior Shares. These restrictions are not applicable during the initial distribution period, which is the period from the original issue date to but excluding January 30, 2020.

The Company, at its option, may cause the Trust to redeem the Series C Preferred Shares, in whole or in part, at any time on or after January 30, 2025 at a price of $25.00 per Series C Preferred Share, plus accumulated and unpaid distributions thereon (whether or not authorized or declared) to, but excluding, the redemption date. Holders of the Series C Preferred Shares will have no right to require the redemption of the Series C Preferred Shares.

If a Tax Redemption Event (as defined in the Trust Interest Designation) occurs prior to January 30, 2025, the Company, at its option, may cause the Trust to redeem the Series C Preferred Shares, in whole but not in part, upon at least 30 days’ notice, within 60 days of the

occurrence of such Tax Redemption Event, out of funds received by the Trust on the corresponding Series C Trust Preferred Interests and legally available therefor, at a price of $25.25 per Series C Preferred Share, plus any accumulated and unpaid distributions thereon (whether or not authorized or declared) to, but excluding, the redemption date.

If a Fundamental Change (as defined in the Share Designation) occurs, unless, prior to or concurrently with the time the board of directors of the Company is required to cause the Trust to make an offer to repurchase the Series C Preferred Shares, the board of directors of the Company has caused the Company to provide a redemption notice with respect to all of the outstanding Series C Preferred Shares, the board of directors of the Company will cause the Trust to make an offer to repurchase the Series C Preferred Shares, out of funds received by the Trust on the corresponding Series C Trust Preferred Interests, at a purchase price of $25.25 per Series C Preferred Share, plus any accumulated and unpaid distributions thereon (whether or not authorized or declared) to, but excluding, the date of purchase. If (i) a Fundamental Change occurs and (ii) CODI does not give notice prior to the 31st day following the Fundamental Change to repurchase or redeem all the outstanding Series C Preferred Shares, the distribution rate per annum on the Series C Preferred Shares will increase by 5.00%, beginning on the 31st day following such Fundamental Change. Following any such increase in the distribution rate per annum, CODI will be under no further obligation to offer to repurchase or redeem any Series C Preferred Shares.

The terms of the Series C Trust Preferred Interests are designed to mirror those of the Series C Preferred Shares.

The description of the terms of the Series C Preferred Shares and corresponding Series C Trust Preferred Interests in this Item 3.03 is qualified in its entirety by reference to the Share Designation, the form of 7.875% Series C Cumulative Preferred Share certificate and the Trust Interest Designation, which are included as Exhibits 3.1, 4.1 and 3.2, respectively, to this Current Report on Form

8-K

and are incorporated by reference herein.

|

Item 5.03

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

|

The information set forth above under Item 3.03 of this Current Report on Form

8-K

is hereby incorporated by reference into this Item 5.03.

On November 20, 2019, CODI closed the sale of 4,000,000 of the Trust’s Series C Preferred Shares. The Series C Preferred Shares offered by CODI were registered under the Securities Act of 1933, as amended, pursuant to a Registration Statement on Form

S-3

(Registration No.

333-234665)

(the “Registration Statement”). The offer and sale of the Series C Preferred Shares are described in CODI’s prospectus dated November 13, 2019, constituting a part of the Registration Statement, as supplemented by a prospectus supplement dated November 13, 2019. The following documents are being filed with this Current Report on Form

8-K

and shall be incorporated by reference into the Registration Statement: (i) validity opinion with respect to the Series C Preferred Shares and their underlying Series C Trust Preferred Interests of the Company; and (ii) tax opinion with respect to the Series C Preferred Shares.

|

Item 9.01

|

Financial Statements and Exhibits

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consent of Richards, Layton & Finger, P.A. (contained in Exhibits 5.1 and 5.2 hereto)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPASS DIVERSIFIED HOLDINGS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPASS GROUP DIVERSIFIED

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

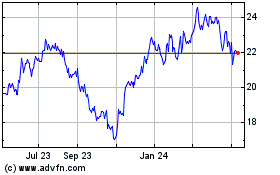

Compass Diversified (NYSE:CODI)

Historical Stock Chart

From Mar 2024 to Apr 2024

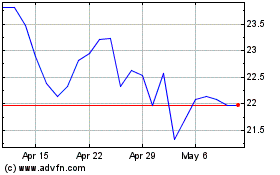

Compass Diversified (NYSE:CODI)

Historical Stock Chart

From Apr 2023 to Apr 2024