Starting in the second quarter

of 2022, CSN begins a new format for disclosing its ESG shares and performance. The new model allows stakeholders to have access to key

results, quarterly indicators and can now follow them effectively and even more agilely.

The information included in

this release was selected based on relevance and materiality to the company. Quantitative indicators are presented in comparison with

the period that best represents the metric for monitoring these. Thus, some are compared with the same quarter of the previous year, and

others will be with the average of the previous period, ensuring a comparison based on seasonality and periodicity.

More detailed historical data

on CSN's performance and initiatives can be verified in the Integrated Report 2021, released in June 2022 (esg.csn.com.br/nossa-empresa/relatorio-integrado-gri).

The assurance of ESG indicators occurs annually for the closing of the Integrated Report, so the information contained in the quarterly

releases is subject to adjustments arising from this process.

The Integrated Report 2021

released in June 2022, follows internationally recognized guidelines and frameworks, such as GRI, IIRC, SASB and TCFD and are presented

with due correlation with the SDGs and Principles of the Global Compact.

With the completion of the

survey and integration of CSN's risks and climate opportunities to its internal risk matrix, the Integrated Report for 2021 was the first

in which CSN carried out the structured disclosure based on TCFD reporting format.

Also in this quarter, expanding

the partnership between ITOCHU Corporation and CSN Group in 2021, the two parties signed a Memorandum of Understanding (MOU) with Shell

International Petroleum Company Ltd. to work jointly in the development of solutions for decarbonization of the operations of the CSN

group. The main objective of this collaboration is the advancement in the decarbonization strategy through the application of new technologies

focused mainly on the Steel and Mining segment.

Also, in this period the new

ESG website was launched with the proposal to present in a more agile and transparent way the Actions and ESG indicators of the Company.

Go to esg.csn.com.br.

In the second half of 2022

there was an evolution in the Company's performance in the MSCI and Mood's ESG - V.E. and TPI (Transition Pathway Initiative) global initiative

that assesses the maturity of companies in relation to the transition to a low-carbon economy.

²Considers the emissions of scopes 1 and 2 divided

per ton of iron ore produced at CSN Mineração, according to the methodology of the Brazilian GHG Protocol Program.

³ Considers emissions only from CSN Mining Scope

1 mobile combustion category. They represent 95% of CSN Mineração's Scope 1 emissions, noting that scope 2 emission is zero

due to electricity consumption coming from 100% renewable sources. The data reported in the Company's Integrated Report 2021, considers

the total emissions of the company CSN Mineração, scope 1 and 2. The emission intensity was reported 6.58 kgCO2e/ton of

ore produced.

4 For the year 2022 Alhandra came to be considered

in the data management of CSN Cimentos.

In July 2022, in a ceremony held in Congonhas, 2

electric trucks produced by Sany were symbolic delivery and that will be used in the movement of tailings in the Casa de Pedra mine. These

equipment’s are part of the company's fleet renewal plan. The forecast is initially to electrify the fleet of lighter vehicles within

4 years.

Also in a pioneering way, CSN Cimentos has partnered

with Sany to test a 100% electric truck in its operations. The truck will be used in limestone mining activities, making the company the

first cement company in Brazil to use electric trucks in its fleet.

CSN Cimentos, arcos unit, started waste co-processing

operations in June 2022.

The new process seeks to optimize the fossil fuel

matrix, reducing the consumption of petroleum coke, with partial replacement by solid waste (pieces of wood, tire chip, among others),

contributing to the reduction of CO2 emissions. With the implementation of the co-processing process in oven 2, the intensity of GHG emissions

decreased by 5% compared to May 2022, considering only 15 days of operation. Thus, the expectation is that even more expressive results

will be achieved in the coming months, with a significant reduction in emissions for the year 2022.

| CSN Water Management |

Unit |

2021 |

Accumulated 2022 |

Δ% |

| Intensity by steel production |

M³ /ton of steel |

18.94 |

20.33 |

+7 |

| Intensity per cement production |

M³/ton of cement |

0.07 |

0.06 |

-14 |

| Intensity by ore production |

M³/ton of ore |

0.21 |

0.25 |

+20 |

| Waste Management CSN³ |

Unit |

2Q21 |

2Q22 |

Δ% |

| Waste generation Class 14 |

Tons |

2,805.35 |

4,920.03 |

+75 |

| Class 2 waste generation |

Tons |

642,440.92 |

651,592.65 |

+1 |

| Percentage sent for reuse and reprocessing |

% |

96% |

90% |

-6 |

(3) Considers all steel units and cement plants in Brazil

(4) Due to the demolition and refurbishment

of the coke Battery #3 in the UPV, there was an increase in Class I Residue in the unit.

DAM MANAGEMENT

In the second quarter of 2022, the Vigia Auxiliary

Dam was definitively disregarded and deregistered as a dam of FEAM (State Environmental Foundation) and ANM (National Mining Agency) which

removed the structure of the SIGBM (Integrated Mining Dam Management System) register.

Next quarter, it is expected to be completed the

decharacterization work of the Vigia Dam, belonging to the Casa de Pedra Complex.

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

| | |

| Quarterly Financial Information – June 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

SOCIAL DIMENSION

HEALTH AND SAFETY AT WORK

| Health and safety at work |

2Q21 |

2Q22 |

Δ% |

| Number of accidents with and without leave (own) |

30 |

23 |

-23 |

| Number of accidents with and without leave (third parties) |

20 |

14 |

-30 |

| Fatality (own) |

0 |

1 |

- |

| Fatality (third parties) |

0 |

0 |

- |

| Frequency rate of mandatory reporting accidents (factor of 200,000 HHT) |

0.52 |

0.38 |

-27 |

| Frequency rate of mandatory communication work accidents (factor 1 MM HHT) |

2.60 |

1.91 |

-27 |

| Accident severity rate (factor of 200,000 HHT) |

18 |

72 |

+300 |

| Accident severity rate (1MM HHT factor) |

88 |

360 |

+309 |

PEOPLE MANAGEMENT

| Employment¹ |

Unit |

2Q21 |

2Q22 |

Δ% |

| Women on staff |

% |

16.4 |

19.2 |

+17 |

| Women in leadership positions |

% |

11.1 |

11.8 |

+6 |

| People with disabilities |

% |

1.1 |

1.3 |

+18 |

| Racial Diversity |

|

|

|

|

| • Yellow |

% |

1.3 |

1.4 |

+8 |

| • White |

% |

43.4 |

42.7 |

-2 |

| • Indigenous |

% |

0.3 |

0.3 |

0 |

| • Black |

% |

14.3 |

14.8 |

+3 |

| • Brown |

% |

37.0 |

38.2 |

+3 |

| • Not informed |

% |

3.52 |

2.6 |

-26 |

| Turnover |

% |

1.2 |

1.3 |

+8 |

¹ The data does not consider employees

"Non-CLT" and "Internship Program"

| Training |

Unit |

2Q21 |

2Q22 |

Δ% |

| Training hours |

Hours |

103,560 |

101,917 |

-2 |

| Trained employees |

Number |

8,471 |

7,592 |

-10 |

| Investment in training |

BRL |

557,719 |

697,261 |

+25 |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

| | |

| Quarterly Financial Information – June 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

VALUE CHAIN

| Sustainable Value Chain |

Unit |

2Q21 |

2Q22 |

Δ% |

| Purchases from local suppliers |

% |

33.5 |

30.6 |

-8.7 |

SOCIAL RESPONSABILITY

With the commitment to transform lives and communities

around CSN's operations in the second quarter of 2022, the CSN Foundation participated in the "Walk for Peace", with approximately

4,000 people. Event held in conjunction with UNAS (Union of Nuclei, Associations of Residents of Heliopolis and Region), of which it is

a partner of Garoto Cidadão, a project of the CSN Foundation active in the three CCAS of the Heliopolis region.

In Congonhas, we conducted a training in partnership

with the Municipal Council for the Rights of Children and Adolescents (CMDCA), the Department of Education and the Secretariat of Social

Assistance, to dialogue on children's rights and their understanding of their rights. In addition, the "Know to prevent" questionnaire

was applied, with the intention of diagnosing the understanding of children and adolescents regarding the violation of their rights, in

all we obtained approximately 1,200 responses.

The CSN Foundation materializes the SDDs in its programs

and projects, with the involvement in the dissemination of knowledge about the SDDs and the 2030 Agenda.

In addition to these actions, the Foundation maintained

its projects, obtaining at the end of the second quarter of 2022:

| |

1Q22 |

2Q22 |

| Impacted young people¹ |

3,483 |

3,981 |

| Public cultural initiatives |

3,387 |

69,673 |

|

¹ Young people impacted by the projects

Citizen Boy, Empower, Young Apprentice, Internship, Steel Drums and Football

² Public present in the public presentations,

carried out by the projects: Citizen Boy, Truck, Steel Drums, Cultural Center and Stories that stay. |

The CSN Foundation also acts in support of CSN with

the selection of projects from other entities to expand its social performance through tax incentive laws. Thus, we analyze external projects

for CSN to evaluate and select projects that will be sponsored through tax incentive laws. The initiative must be aligned with the company's

objectives in transforming people's society and lives. BRL1.03 million were invested by the end of the second quarter of 2022.

Capital Markets

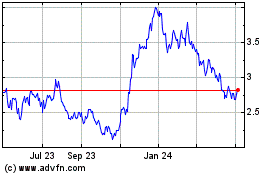

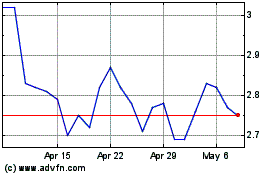

In the second quarter of 2022, CSN shares

devalued 40.6%, while the Ibovespa index fell 18.06%. The average daily value of CSNA3 shares traded at B3 was BRL309.6 million. On the

New York Stock Exchange (NYSE), the Company's American Depositary Receipts (ADRs) devaluation was 45.9%, while Dow Jones fell 11.2%. The

average daily ADRs (SID) trading on the NYSE was USD 25.8 million.

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

| | |

| Quarterly Financial Information – June 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| 2Q22 |

| Number of shares in thousands |

1,326,094.0 |

| Market Value |

|

| Closing Quote (BRL/share) |

15.44 |

| Closing Quote (USD/ADR) |

2.93 |

| Market Value (BRLmillion) |

20,475 |

| Market Value (USD million) |

3,885 |

| Change in period |

|

| CSNA3 (BRL) |

-40.6% |

| SID (USD) |

-45.9% |

| Ibovespa (BRL) |

-18.1% |

| Dow Jones (USD) |

-11.2% |

| Volume |

|

| Daily average (thousand shares) |

11,899 |

| Daily average (BRLthousand) |

309,605 |

| Daily average (thousand ADRs) |

5,101 |

| Daily average (USD thousand) |

25,767 |

|

Source: Bloomberg

|

|

Some of the statements contained herein are future

perspectives that express or imply expected results, performance or events. These perspectives include future results that may be influenced

by historical results and statements made in 'Perspectives'. Current results, performance and events may differ significantly from hypotheses

and perspectives and involve risks such as: general and economic conditions in Brazil and other countries; interest rate and exchange

rate levels, protectionist measures in the U.S., Brazil and other countries, changes in laws and regulations, and general competitive

factors (globally, regionally or nationally). |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

| | |

| Quarterly Financial Information – June 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

INCOME STATEMENT

CONSOLIDATED - Corporate Law - In Thousands of Reais

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

| | |

| Quarterly Financial Information – June 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

BALANCE SHEET

CONSOLIDATED - Corporate Law - In Thousands of Reais

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

| | |

| Quarterly Financial Information – June 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

CASH FLOW STATEMENT

CONSOLIDATED - Corporate Law - In Thousands of Reais

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

| | |

| Quarterly Financial Information – June 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| 1. | DESCRIPTION OF BUSINESS |

Companhia Siderúrgica Nacional “CSN”,

also referred to as “Company”, is a publicly held company incorporated on April 9, 1941, under the laws of the Federative

Republic of Brazil (Companhia Siderúrgica Nacional, its subsidiaries, joint ventures, joint operations and associates are collectively

referred to herein as the "Group”). The Company’s registered office is located in São Paulo, SP, Brazil.

CSN is listed on the São Paulo Stock Exchange

(B3 S.A.- Brasil, Bolsa, Balcão) and on the New York Stock Exchange (NYSE).

The Group's main operating activities are divided

into five (5) segments as follows:

The Company’s main industrial facility is

the Presidente Vargas Steelworks (“UPV”), located in the city of Volta Redonda, State of Rio de Janeiro. This segment consolidates

all operations related to the production, distribution and sale of flat steel, long steel, metallic containers, and galvanized steel.

In addition to the facilities in Brazil, CSN has commercial operations in the United States and operations in Portugal and Germany to

achieve markets and providing excellent services for final consumers. Its steel is used in home appliances, civil construction, package

and automobile industries.

The production of iron ore is developed in the

cities of Congonhas, Ouro Preto and Belo Vale, State of Minas Gerais – by subsidiary CSN Mineração.

Iron ore is sold basically in the

international market, especially in Europe and Asia. The prices charged in these markets are historically cyclical and subject to significant

fluctuations over short periods of time, driven by several factors related to global demand, strategies adopted by the major steel producers,

and the foreign exchange rate. All these factors are beyond the Company’s control. The ore transportation is carried out through

the Terminal de Carvão e Minérios from the Itaguai Port– (“TECAR”), a solid bulk terminal, one of the

four terminals that comprise the Itaguai Port, located in the State of Rio de Janeiro. Imports of coal and coke are also carried out through

this terminal by provision of services by CSN Mineração to CSN. The Company´s mining activities also comprises of

tin exploitation, which is based in the State of Rondônia, to supply the needs of UPV. The excess of raw material is sold to subsidiaries

and third parties.

As a pioneer in the use of technologies that result

in the possibility of stacking the tailings generated in the iron ore production process, the Company has had its iron ore production

since January 2020, 100% independent of tailings dams. After significant investments in recent years to raise the level of reliability,

mischaracterization and dry stacking, the Company has moved on to a scenario in which 100% of its waste goes through a dry filtration

process and is disposed of in geotechnically controlled batteries, areas exclusively destined for stacking.

Because of these measures, the decommissioning

of the dams is the natural way of processing dry waste.

All our mining dams are positively certified and

comply with the environmental legislation in force.

CSN entered the cement production market in 2009,

catapulted by the synergy between this activity and CSN's current business. Beside the UPV facilities, in Volta Redonda / RJ, the Company

installed a business unit, which produces CP-III type cement using the slag produced by the UPV’s own blast furnaces. It also explores

limestone and dolomite at the Arcos / MG unit, to meet the needs of the Steel and the cement plant. Additionally, in Arcos / MG, the clinker

production operation is located.

On January 31, 2021, the Company concluded the

drop down of the cement business and, accordingly, all assets and liabilities related to the cement business were transferred from CSN

to its subsidiary recently incorporated CSN Cimentos S.A. (“CSN Cimentos”)

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

| | |

| Quarterly Financial Information – June 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

On August 31, 2021, the Company completed the acquisition

of control of Elizabeth Cimentos S.A. ("Elizabeth Cimentos") and Elizabeth Mineração S.A. ("Elizabeth Mineração"),

with operations in the Northeast region, especially in Paraíba and Pernambuco, under the terms of the Investment Agreement, Purchase

and Sale of Quotas, Shares and Other Covenants entered into on June 29, 2021. With the closing of this transaction, CSN Cimentos now has

a total capacity of 6 million tons per year.

On September 9, 2021, CSN Cimentos signed the Agreement

for the Sale and Purchase of the Shares in LafargeHolcim (Brasil) S.A., whereby it intends to acquire 100% of the shares issued by LafargeHolcim

(Brasil) S.A. ("LafargeHolcim"), such transaction being subject to approval by the Conselho Administrativo de Defesa Econômica

(“CADE”). With the closing of this transaction, CSN Cimentos will have a total capacity of 16.3 million tons per year. The

deal was valued at US$1.025 billion and involves cash payments. On the same date, the Company deposited in an Escrow Account with Banco

Santander the amount of US$50 million as part of the negotiations for the acquisition of LafargeHolcim, see note 9.f.

Railroads:

CSN has interests in three railroad companies:

MRS Logística S.A., which manages the former Southeast Railway System of Rede Ferroviária Federal S.A (“RFFSA”).,

Transnordestina Logística S.A. (“TLSA”) and FTL - Ferrovia Transnordestina Logística S.A. (“FTL”),

which the hold the concession to operate the former Northeast Railway System of RFFSA, in the States of Maranhão, Piauí,

Ceará, Rio Grande do Norte, Paraíba, Pernambuco, Alagoas - stretches from São Luís to Altos, Altos to Fortaleza,

Fortaleza to Sousa, Sousa to Recife/Jorge Lins, Recife/Jorge Lins to Salgueiro, Jorge Lins to Propriá, Paula Cavalcante to Cabedelo,

Itabaiana to Macau (Mesh I) and TLSA is responsible for the stretches from Eliseu Martins-Trindade, Trindade-Salgueiro, Salgueiro-Porto

Suape, Salgueiro - Missão Velha and Missão Velha - Pecém (Mesh II), under construction.

Ports:

The Company operates in the State of Rio de Janeiro,

by means of its subsidiary Sepetiba Tecon S.A., operates the Container Terminal (“TECON”) and by means of its subsidiary CSN

Mineração, the TECAR, both located at the Itaguaí Port. Established in the harbor of Sepetiba, the mentioned port

has a privileged highway, railroad, and maritime access.

TECON is responsible for the shipments of CSN´s

steel products, movement and storage of containers, vehicles, general cargo, among other products; and TECAR performs the operational

activities of loading and unloading of solid bulk ships, storage and distribution (road and rail) of coal, coke, zinc concentrate, sulfur,

iron ore and other bulk, intended for the seaborne market, for our own operation and for third parties.

Since the energy supply is fundamental in CSN´s

production process, the Company owns and operates facilities to generate electric power for guaranteeing its self-sufficiency.

On June 30, 2022, the Company's subsidiaries, CSN

Cimentos and CSN Energia S.A. ("CSN Energia"), completed the acquisition of Santa Ana Energética S.A., as well as Topázio

Energética S.A. ("Topázio") and, indirectly, Brasil Central Energia Ltda. ("BCE"), a subsidiary of Topázio,

under the terms of the Share Purchase Agreement entered into on April 8, 2022 with Brookfield Americas Infrastructure (Brazil Power) Fundo

de Investimento em Participações Multiestratégia, a private equity fund managed by Brookfield Brasil Asset Management

Investimentos Ltda, see note 9.c.

The Management understands that the Company has

adequate resources to continue its operations. Accordingly, the Company's interim financial statements for the period ended June 30, 2022,

have been prepared on a going concern basis.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

| 2.a) | Declaration of conformity |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

| | |

| Quarterly Financial Information – June 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

The consolidated and parent company interim financial

statements have been prepared and are being presented in accordance with accounting practices adopted in Brazil based on the provisions

of the Brazilian Corporate Law, pronouncements, guidelines and interpretations issued (CPC), approved by CVM, besides the own standards

issued by the Brazilian Securities and Exchange Commission (“CVM”) and International Financial Reporting Standards (“IFRS”)

issued by the International Accounting Standard Board (IASB) and highlight all the relevant information at the interim financial statements,

and only this information, which correspond to those used by the Company's management in its activities. The consolidated interim financial

information is identified as "Consolidated" and the parent company's individual interim financial information is identified

as "Parent Company"

| 2.b) | Basis of presentation |

The interim financial statements were prepared based on the historical cost

and were adjusted to reflect: (i) the fair value measurement of certain financial assets and liabilities (including derivative instruments),

as well as pension plan assets; and (ii) impairment losses.

When IFRS and CPCs allows an option between cost or another measurement criterion,

the cost of acquisition criterion was used.

The preparation of these interim financial statements

requires Management to use certain accounting estimates, judgments and assumptions that affect the application of Accounting Polices and

the amounts reported on the balance sheet date of assets, liabilities, income, and expenses may differ from actual future results. The

assumptions used are based on history and other factors considered relevant and are reviewed by the Company’s management.

The interim financial information has been prepared

and is being presented in accordance with CPC 21 (R1) - “Interim Financial Reporting” and IAS 34 - “Interim Financial

Reporting”, consistently with the standards issued by the CVM.

This interim financial

information does not include all requirements of annual or full financial statements and, accordingly, should be read in conjunction with

the Company’s financial statements for the year ended December 31, 2021.The accounting policies, when applicable and relevant,

are included in the respective explanatory notes and are consistent with the previous period presented.

Therefore, in this interim financial information

the following notes are not repeated, either due to redundancy or to the materiality in relation to those already presented in the annual

financial statements:

Note 10 - Basis of consolidation and investments

Note 12 - Intangible assets

Note 18 - Income tax and social contribution

Note 19 - Installment taxes

Note 20 - Tax, social security, labor, civil, environmental

provisions and judicial deposits

Note 30 - Employee benefits

Note 31 - Commitments

The consolidated financial statements were approved

by Board of Directors on August 15, 2022.

| 2.c) | Functional currency and presentation currency |

The accounting records included in the interim

financial statements of each of the Company’s subsidiaries are measured using the currency of the principal of the economic environment

in which each subsidiary operates (“the functional currency”). The consolidated and parent company interim financial statements

are presented in BRL(reais), which is the Company’s functional and reporting currency.

Foreign currency transactions are translated into

the functional currency using the exchange rates prevailing on the transaction or valuation dates, in which the items are remeasured.

The balances of the asset and liability accounts are translated using the exchange rate on the balance sheet date. As of June 30, 2022,

US$1.00 was equivalent to BRL5.2380 (BRL5.5805 on December 31, 2021) and €1.00 was equivalent to BRL5.4842 (BRL6.3210 on December

31, 2021), according to the rates obtained from Central Bank of Brazil website

| 2.d) | Statement of value added |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

| | |

| Quarterly Financial Information – June 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

Pursuant to Law 11,638/07, the presentation

of the statement of value added is required for all publicly held companies. These statements were prepared in accordance with CPC 09

- Statement of Value Added, approved by CVM Resolution 557/08. The IFRS does not require the presentation of this statement and for IFRS

purposes is presented as additional information.

The statement of value added should highlight

the wealth generated by the Company and demonstrate its distribution.

| 3. | CASH AND CASH EQUIVALENTS |

| |

|

|

Consolidated |

|

|

|

Parent Company |

| |

06/30/2022 |

|

12/31/2021 |

|

06/30/2022 |

|

12/31/2021 |

| Cash and banks |

|

|

|

|

|

|

|

| In Brazil |

38,999 |

|

68,638 |

|

16,531 |

|

58,951 |

| Abroad |

7,169,856 |

|

10,007,399 |

|

420,782 |

|

1,438,851 |

| |

7,208,855 |

|

10,076,037 |

|

437,313 |

|

1,497,802 |

| |

|

|

|

|

|

|

|

| Investments |

|

|

|

|

|

|

|

| In Brazil |

7,149,314 |

|

6,493,832 |

|

3,471,467 |

|

2,387,463 |

| Abroad |

565,525 |

|

76,611 |

|

524,393 |

|

|

| |

7,714,839 |

|

6,570,443 |

|

3,995,860 |

|

2,387,463 |

| |

14,923,694 |

|

16,646,480 |

|

4,433,173 |

|

3,885,265 |

Our investments are basically in private and public

securities with yields linked to the variation of Interbank Deposit Certificates (CDI) and repo operations backed by National Treasury

Notes respectively. The Company invests part of the funds through exclusive investment funds which have been consolidated in these financial

statements.

Our investments abroad are in private securities in

top-rated banks and are remunerated at pre-fixed rates.

| |

|

|

|

|

|

|

|

Consolidated |

|

|

|

|

|

|

|

Parent Company |

| |

|

Current |

|

Non-current |

|

Current |

|

Non-current |

| |

|

06/30/2022 |

|

12/31/2021 |

|

06/30/2022 |

|

12/31/2021 |

|

06/30/2022 |

|

12/31/2021 |

|

06/30/2022 |

|

12/31/2021 |

| Investments (1) |

|

276,489 |

|

261,673 |

|

15,707 |

|

15,148 |

|

48,801 |

|

43,398 |

|

|

|

|

| Usiminas shares (2) |

|

1,352,357 |

|

2,383,059 |

|

|

|

|

|

1,352,357 |

|

2,383,059 |

|

|

|

|

| Bonds (3) |

|

|

|

|

|

129,121 |

|

132,523 |

|

|

|

|

|

129,121 |

|

132,523 |

| |

|

1,628,846 |

|

2,644,732 |

|

144,828 |

|

147,671 |

|

1,401,158 |

|

2,426,457 |

|

129,121 |

|

132,523 |

| (1) | These are restricted financial investments and linked to a Bank Deposit Certificate (CDB) to guarantee

a letter of guarantee from financial institutions and financial investments in Public Securities (LFT - Letras Financeiras do Tesouro)

managed by their exclusive funds. |

| (2) | Part of the shares guarantees a portion of the Company's debt. |

| (3) | Bonds with Fibra bank due in February 2028 (see note 20.a). |

| |

|

|

Consolidated |

|

|

|

Parent Company |

| |

06/30/2022 |

|

12/31/2021 |

|

06/30/2022 |

|

12/31/2021 |

| Trade receivables |

|

|

|

|

|

|

|

| Third parties |

|

|

|

|

|

|

|

| Domestic market |

1,279,390 |

|

1,218,179 |

|

745,325 |

|

751,616 |

| Foreign market |

1,581,587 |

|

1,472,190 |

|

184,587 |

|

236,882 |

| |

2,860,977 |

|

2,690,369 |

|

929,912 |

|

988,498 |

| Allowance for doubtful debts |

(220,739) |

|

(236,927) |

|

(122,957) |

|

(133,227) |

| |

2,640,238 |

|

2,453,442 |

|

806,955 |

|

855,271 |

| Related parties (Note 20 a) |

104,181 |

|

144,396 |

|

1,047,826 |

|

1,520,241 |

| |

2,744,419 |

|

2,597,838 |

|

1,854,781 |

|

2,375,512 |

The composition of the gross balance of accounts

receivable from third party customers is shown as follows:

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

| | |

| Quarterly Financial Information – June 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| |

|

|

|

Consolidated |

|

|

|

Parent Company |

| |

|

06/30/2022 |

|

12/31/2021 |

|

06/30/2022 |

|

12/31/2021 |

| Current |

|

2,354,979 |

|

2,255,200 |

|

763,359 |

|

803,910 |

| Past-due up to 30 days |

|

262,534 |

|

164,019 |

|

39,577 |

|

44,135 |

| Past-due up to 180 days |

|

57,021 |

|

67,822 |

|

19,903 |

|

16,024 |

| Past-due over 180 days |

|

186,443 |

|

203,328 |

|

107,073 |

|

124,429 |

| |

|

2,860,977 |

|

2,690,369 |

|

929,912 |

|

988,498 |

The changes in estimated credit losses are as follows:

| |

|

|

|

Consolidated |

|

|

|

Parent Company |

| |

|

06/30/2022 |

|

12/31/2021 |

|

06/30/2022 |

|

12/31/2021 |

| Opening balance |

|

(236,927) |

|

(228,348) |

|

(133,227) |

|

(143,735) |

| (Loss)/Reversal estimated |

|

7,237 |

|

1,755 |

|

2,689 |

|

3,277 |

| Recovery and write-offs of receivables |

|

8,951 |

|

6,287 |

|

7,581 |

|

3,683 |

| Drop down of Cements (note 9.c) |

|

|

|

|

|

|

|

3,548 |

| Acquisition of Elizabeth |

|

|

|

(16,621) |

|

|

|

|

| Closing balance |

|

(220,739) |

|

(236,927) |

|

(122,957) |

|

(133,227) |

| |

|

|

Consolidated |

|

|

|

Parent Company |

| |

06/30/2022 |

|

12/31/2021 |

|

06/30/2022 |

|

12/31/2021 |

| Finished goods |

4,118,269 |

|

4,457,842 |

|

2,208,833 |

|

2,570,354 |

| Work in progress |

3,357,472 |

|

2,710,149 |

|

2,188,417 |

|

1,695,075 |

| Raw materials |

3,152,964 |

|

3,638,952 |

|

2,422,544 |

|

2,799,869 |

| Storeroom supplies |

834,159 |

|

770,296 |

|

451,693 |

|

364,872 |

| Advances to suppliers |

16,321 |

|

121,519 |

|

10,984 |

|

92,439 |

| Provision for losses |

(116,093) |

|

(98,730) |

|

(55,155) |

|

(14,426) |

| |

11,363,092 |

|

11,600,028 |

|

7,227,316 |

|

7,508,183 |

| |

|

|

|

|

|

|

|

| Classified: |

|

|

|

|

|

|

|

| Current |

10,564,327 |

|

10,943,835 |

|

7,227,316 |

|

7,508,183 |

| Non-current (1) |

798,765 |

|

656,193 |

|

|

|

|

| |

11,363,092 |

|

11,600,028 |

|

7,227,316 |

|

7,508,183 |

| 1. | Long-term iron ore inventories that will be used after the construction of

the processing plant, which will produce pellet feed. |

The changes in estimated losses on inventories

are as follows:

| |

|

|

|

Consolidated |

|

|

|

Parent Company |

| |

|

06/30/2022 |

|

12/31/2021 |

|

06/30/2022 |

|

12/31/2021 |

| Opening balance |

|

(98,730) |

|

(109,038) |

|

(14,426) |

|

(35,832) |

| (Estimated losses) / Reversal of inventories with low turnover and obsolescence |

|

(17,363) |

|

10,308 |

|

(40,729) |

|

17,101 |

| Drop down of Cements (note 9.c) |

|

|

|

|

|

|

|

4,305 |

| Closing balance |

|

(116,093) |

|

(98,730) |

|

(55,155) |

|

(14,426) |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

| | |

| Quarterly Financial Information – June 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| |

|

|

Consolidated |

|

|

|

Parent Company |

| |

06/30/2022 |

|

12/31/2021 |

|

06/30/2022 |

|

12/31/2021 |

| State Value-Added Tax |

1,049,777 |

|

1,162,900 |

|

783,310 |

|

895,880 |

| Brazilian federal contributions (1) |

1,019,486 |

|

1,352,100 |

|

627,943 |

|

980,316 |

| Other taxes |

151,246 |

|

105,375 |

|

120,951 |

|

70,787 |

| |

2,220,509 |

|

2,620,375 |

|

1,532,204 |

|

1,946,983 |

| |

|

|

|

|

|

|

|

| Classified: |

|

|

|

|

|

|

|

| Current |

1,362,437 |

|

1,655,349 |

|

941,881 |

|

1,255,697 |

| Non-current |

871,175 |

|

965,026 |

|

590,323 |

|

691,286 |

| |

2,233,612 |

|

2,620,375 |

|

1,532,204 |

|

1,946,983 |

The accumulated tax credits arise basically from

ICMS, PIS and COFINS credits on purchases of raw materials and fixed assets used in production. The realization of these credits normally

occurs through offset with debits of these taxes, generated by sales operations and other taxed expenses.

(1) In a judgment finalized on September 24, 2021,

the Federal Supreme Court, with general repercussion, decided for the unconstitutionality of the levy of IRPJ and CSLL on amounts of interest

on arrears at the SELIC rate received because of the repetition of undue tax payment. Although the decision is still pending publication,

and the Company's specific lawsuit is still pending judgment, based on its best estimate to date CSN reassessed the judgment on this lawsuit,

as required by ICPC22/IFRIC23 and recorded a credit in the amount of BRL229.000 After the final and unappealable decision of the Company's

legal action, these amounts will be considered in the tax assessments, in accordance with the Federal Tax Authorities of Brazil.

| 8. | OTHER CURRENT AND NON-CURRENT ASSETS |

Other current and non-current assets are as follows:

| |

|

|

|

|

|

|

Consolidated |

|

|

|

|

|

|

|

Parent Company |

| |

Current |

Non-current |

|

Current |

Non-current |

| |

06/30/2022 |

|

12/31/2021 |

|

06/30/2022 |

|

12/31/2021 |

|

06/30/2022 |

|

12/31/2021 |

|

06/30/2022 |

|

12/31/2021 |

| Judicial deposits (note 18) |

|

|

|

|

356,865 |

|

339,805 |

|

|

|

|

|

238,559 |

|

222,481 |

| Prepaid expenses |

287,894 |

|

225,036 |

|

54,994 |

|

74,503 |

|

247,108 |

|

185,968 |

|

46,570 |

|

62,233 |

| Actuarial asset (note 20 a) |

|

|

|

|

59,111 |

|

59,111 |

|

|

|

|

|

47,350 |

|

47,350 |

| Derivative financial instruments (note 20) |

45,161 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Trading securities |

4,890 |

|

12,028 |

|

|

|

|

|

4,793 |

|

11,935 |

|

|

|

|

| Eletrobrás compulsory loan (note 20) |

5,375 |

|

4,511 |

|

1,307,342 |

|

1,143,228 |

|

5,375 |

|

4,511 |

|

1,517,775 |

|

1,290,295 |

| Other receivables from related parties (note 20 a) |

1,828 |

|

1,828 |

|

1,199,316 |

|

927,077 |

|

53,288 |

|

47,296 |

|

1,425,224 |

|

1,151,903 |

| Eletrobrás compulsory loan (1) |

|

|

|

|

892,655 |

|

859,607 |

|

|

|

|

|

891,623 |

|

858,876 |

| Dividends receivables (note 20 a) |

61,924 |

|

76,878 |

|

|

|

|

|

150,989 |

|

486,506 |

|

|

|

|

| Employee debts |

48,707 |

|

43,542 |

|

|

|

|

|

27,748 |

|

25,531 |

|

|

|

|

| Receivables by indemnity (2) |

|

|

|

|

543,753 |

|

534,896 |

|

|

|

|

|

543,753 |

|

534,896 |

| Other (3) |

100,123 |

|

120,297 |

|

456,338 |

|

427,528 |

|

19,373 |

|

28,976 |

|

192,765 |

|

147,077 |

| |

555,902 |

|

484,120 |

|

4,870,374 |

|

4,365,755 |

|

508,674 |

|

790,723 |

|

4,903,619 |

|

4,315,111 |

| 1. | This is a certain and due amount, arising from the res judicata favorable decision to the Company, which

is irreversible and irrevocable, to apply the STJ's consolidated position on the subject, which culminated in the conviction of Eletrobrás

to the payment of the correct interest and monetary adjustment of the Compulsory Loan. The res judicata decision, as well as the

certainty about the amounts involved in the liquidation of the sentence (judicial procedure to request the satisfaction of the right),

allowed the conclusion that the entry of this value is certain. In addition to this amount already recorded, the Company continues to

seek alternatives for the recovery of additional credits and the estimate can reach an amount greater than BRL350 million. |

| 2. | This is a net, certain and enforceable amount, resulting from the final and unappealable decision of the

Court in favor of the Company in 2020, due to losses and damages resulting from the sinking of the voltage in the supply of energy in

the periods from January / 1991 to June / 2002. |

| 3. | Non-current assets refer mainly to the deposit in escrow account made

by CSN Cimentos. with Banco Santander, in the amount of US$50 million, equivalent to BRL262 million updated on June 30, 2022, as part

of the negotiations for the acquisition of LafargeHolcim. |

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

| | |

| Quarterly Financial Information – June 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| 9. | BASIS OF CONSOLIDATION AND INVESTMENTS |

The information related to the activities of jointly

controlled subsidiaries, joint operations, associates and other investments did not change in relation to what was disclosed in the Company's

financial statements as of December 31, 2021. Therefore, Management decided not to repeat them in the accounting information interim of

June 30, 2022.

| |

Number of shares held by CSN in units |

Equity interests (%) |

|

| Companies |

06/30/2022 |

|

12/31/2021 |

|

Core business |

| |

|

|

|

|

|

|

| Direct interest in subsidiaries: full consolidation |

|

|

|

|

|

|

| CSN Islands VII Corp. |

20,001,000 |

100.00 |

|

100.00 |

|

Financial transactions |

| CSN Inova Ventures |

50,000 |

100.00 |

|

100.00 |

|

Equity interests and Financial transactions |

| CSN Islands XII Corp. |

1,540 |

100.00 |

|

100.00 |

|

Financial transactions |

| CSN Steel S.L.U. |

22,042,688 |

100.00 |

|

100.00 |

|

Equity interests and Financial transactions |

| TdBB S.A (*) |

|

100.00 |

|

100.00 |

|

Equity interests |

| Sepetiba Tecon S.A. |

254,015,052 |

99.99 |

|

99.99 |

|

Port services |

| Minérios Nacional S.A. |

141,719,295 |

99.99 |

|

99.99 |

|

Mining and Equity interests |

| Companhia Florestal do Brasil |

71,171,281 |

99.99 |

|

99.99 |

|

Reforestation |

| Estanho de Rondônia S.A. |

195,454,162 |

99.99 |

|

99.99 |

|

Tin Mining |

| Companhia Metalúrgica Prada |

555,142,354 |

99.99 |

|

99.99 |

|

Manufacture of containers and distribution of steel products |

| CSN Mineração S.A. |

4,374,779,493 |

79.75 |

|

78.24 |

|

Mining |

| CSN Energia S.A. |

43,149 |

99.99 |

|

99.99 |

|

Sale of electric power |

| FTL - Ferrovia Transnordestina Logística S.A. |

510,726,198 |

92.71 |

|

92.71 |

|

Railroad logistics |

| Nordeste Logística S.A. |

99,999 |

99.99 |

|

99.99 |

|

Port services |

| CSN Inova Ltd. |

10,000 |

100.00 |

|

100.00 |

|

Advisory and implementation of new development projec |

| CBSI - Companhia Brasileira de Serviços de Infraestrutura |

4,669,986 |

99.99 |

|

99.99 |

|

Equity interests and product sales and iron ore |

| CSN Cimentos S.A. |

385,663,787 |

99.99 |

|

99.99 |

|

Manufacturing and sale of cement |

| Berkeley Participações e Empreendimentos S.A. |

1,000 |

100.00 |

|

100.00 |

|

Electric power generation and equity interests |

| CSN Inova Soluções S.A. |

999 |

99.99 |

|

99.99 |

|

Equity interests |

| CSN Participações I |

999 |

99.99 |

|

99.99 |

|

Equity interests |

| Circula Mais Serviços de Intermediação Comercial S.A.(1) |

1 |

0.01 |

|

99.99 |

|

Commercial intermediation for the purchase and sale of assets and materials in general |

| CSN Participações III |

999 |

99.99 |

|

99.99 |

|

Equity interests |

| CSN Participações IV |

999 |

99.99 |

|

99.99 |

|

Equity interests |

| CSN Participações V |

999 |

99.99 |

|

99.99 |

|

Equity interests |

| |

|

|

|

|

|

|

| Indirect interest in subsidiaries: full consolidation |

|

|

|

|

|

|

| Lusosider Projectos Siderúrgicos S.A. |

|

100.00 |

|

100.00 |

|

Equity interests and product sales |

| Lusosider Aços Planos, S. A. |

|

99.99 |

|

99.99 |

|

Steel and Equity interests |

| CSN Resources S.A. |

|

100.00 |

|

100.00 |

|

Financial transactions and Equity interests |

| Companhia Brasileira de Latas |

|

99.99 |

|

99.99 |

|

Sale of cans and containers in general and Equity interests |

| Companhia de Embalagens Metálicas MMSA |

|

99.99 |

|

99.99 |

|

Production and sale of cans and related activities |

| Companhia de Embalagens Metálicas - MTM |

|

99.99 |

|

99.99 |

|

Production and sale of cans and related activities |

| CSN Steel Holdings 1, S.L.U. |

|

100.00 |

|

100.00 |

|

Financial transactions, product sales and Equity interests |

| CSN Productos Siderúrgicos S.L. |

|

100.00 |

|

100.00 |

|

Financial transactions, product sales and Equity interests |

| Stalhwerk Thüringen GmbH |

|

100.00 |

|

100.00 |

|

Production and sale of long steel and related activities |

| CSN Steel Sections Polska Sp.Z.o.o |

|

100.00 |

|

100.00 |

|

Financial transactions, product sales and Equity interests |

| CSN Mining Holding, S.L |

|

78.24 |

|

78.24 |

|

Financial transactions, product sales and Equity interests |

| CSN Mining GmbH |

|

78.24 |

|

78.24 |

|

Financial transactions, product sales and Equity interests |

| CSN Mining Asia Limited |

|

78.24 |

|

78.24 |

|

Commercial representation |

| Lusosider Ibérica S.A. |

|

100.00 |

|

100.00 |

|

Steel, commercial and industrial activities and equity interests |

| CSN Mining Portugal, Unipessoal Lda. |

|

78.24 |

|

78.24 |

|

Commercial and representation of products |

| Companhia Siderúrgica Nacional, LLC |

|

100.00 |

|

100.00 |

|

Import and distribution/resale of products |

| Elizabeth Cimentos S.A. |

|

99.98 |

|

99.98 |

|

Manufacturing and sale of cement |

| Elizabeth Mineração Ltda (2) |

|

|

|

99.96 |

|

Mining |

| Santa Ana Energética S.A.(3) |

|

100.00 |

|

|

|

Electric power generation |

| Topázio Energética S.A. (3) |

|

100.00 |

|

|

|

Electric power generation |

| Brasil Central Energia Ltda. (3) |

|

100.00 |

|

|

|

Electric power generation |

| Direct interest in joint operations: proportionate consolidation |

|

|

|

|

|

|

| Itá Energética S.A. |

253,606,846 |

48.75 |

|

48.75 |

|

Electric power generation |

| Consórcio da Usina Hidrelétrica de Igarapava |

|

17.92 |

|

17.92 |

|

Electric power consortium |

| |

|

|

|

|

|

|

| Direct interest in joint ventures: equity method |

|

|

|

|

|

|

| MRS Logística S.A. (4) |

63,377,198 |

18.64 |

|

18.64 |

|

Railroad transportation |

| Aceros Del Orinoco S.A. (*) |

|

31.82 |

|

31.82 |

|

Dormant company |

| Transnordestina Logística S.A. (5) |

24,670,093 |

47.26 |

|

47.26 |

|

Railroad logistics |

| Equimac S.A |

2,123 |

50.00 |

|

50.00 |

|

Rental of commercial and industrial machinery and equipment |

| |

|

|

|

|

|

|

| Indirect interest in joint ventures: equity method |

|

|

|

|

|

|

| MRS Logística S.A. (4) |

|

14.58 |

|

14.58 |

|

Railroad transportation |

| |

|

|

|

|

|

|

| Direct interest in associates: equity method |

|

|

|

|

|

|

| Arvedi Metalfer do Brasil S.A. |

57,224,882 |

20.00 |

|

20.00 |

|

Metallurgy and Equity interests |

| |

|

|

|

|

|

|

| Exclusive funds: full consolidation |

|

|

|

|

|

|

| Diplic II - Private credit balanced mutual fund |

|

100.00 |

|

100.00 |

|

Investment fund |

| Caixa Vértice - Private credit balanced mutual fund |

|

100.00 |

|

100.00 |

|

Investment fund |

| VR1 - Private credit balanced mutual fund |

|

100.00 |

|

100.00 |

|

Investment fund |

(*) Dormant companies.

(1) On March 10, 2022, the change in the company's

name from "CSN Participações II S.A." to "Circula Mais Serviços de Intermediação Comercial

S.A."; the change in the corporate purpose from "equity investments" to "commercial intermediation for the purchase

and sale of assets and materials in general" was approved at the Meeting. On the same date, as a result of share transfers, 99.99%

of the shares became held by CSN Inova Soluções S.A. and 0.01% of the shares became held by the Company;

(2) On April 30, 2022, Elizabeth Mineração

was merged into CSN Cimentos, so that, with the merger of the company and its respective extinction, CSN Cimentos became the legal successor

by incorporation of the company, universally and for all legal purposes, with all its rights and obligations;

(3) On June 30, 2022, the Company's subsidiaries

CSN Cimentos and CSN Energia acquired 100% of the shares of Santa Ana Energética S.A. and Topázio Energética S.A.,

which, in turn, holds 100% of the shares of Brasil Central Energia Ltda;

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

| | |

| Quarterly Financial Information – June 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

(4) On June 30, 2022, and December 31, 2021, the

Company directly held 63,377,198 shares, of which 26,611,282 were common shares and 36,765,916 preferred shares, and its direct subsidiary

CSN Mineração S.A. held 63,338,872 shares, of which 25,802,872 were common shares and 37,536,000 preferred shares, in MRS

Logística S.A.

(5) On June 30, 2022, and December 31, 2021, the

Company held 24,670,093, being 24,168,304 common shares and 501,789 Class B preferred shares, of the company Transnordestina Logística

S.A.

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

| | |

| Quarterly Financial Information – June 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| 9.a) | Investments in joint ventures, joint operations, associates and other investments |

The number of shares, the balances of assets and

liabilities, shareholders’ equity and the profit / (loss) amounts for the period in those investees are as follows:

| |

|

|

|

|

|

|

|

06/30/2022 |

|

|

|

|

|

|

|

06/30/2021 |

| Companies |

|

Participation in |

|

|

|

|

Participation in |

|

|

| |

Assets |

|

Liabilities |

|

Shareholders’ equity |

|

Profit /(Loss) for the period |

|

Assets |

|

Liabilities |

|

Shareholders’ equity |

|

Profit /(Loss) for the period |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Investments under the equity method |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subsidiaries |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CSN Islands VII Corp. |

|

502,021 |

|

3,130,245 |

|

(2,628,224) |

|

128,251 |

|

533,108 |

|

3,289,583 |

|

(2,756,475) |

|

61,098 |

| CSN Inova Ventures |

|

9,074,740 |

|

10,585,194 |

|

(1,510,454) |

|

(185,868) |

|

9,121,133 |

|

10,445,718 |

|

(1,324,585) |

|

(229,121) |

| CSN Islands XII Corp. |

|

2,307,739 |

|

5,554,445 |

|

(3,246,706) |

|

72,106 |

|

2,569,183 |

|

5,887,995 |

|

(3,318,812) |

|

(78,526) |

| CSN Steel S.L.U. |

|

5,017,085 |

|

38,938 |

|

4,978,147 |

|

413,672 |

|

5,517,653 |

|

367,372 |

|

5,150,281 |

|

14,392 |

| Sepetiba Tecon S.A. |

|

803,624 |

|

490,719 |

|

312,905 |

|

(90) |

|

812,701 |

|

499,706 |

|

312,995 |

|

3,450 |

| Minérios Nacional S.A. |

|

524,101 |

|

221,024 |

|

303,077 |

|

6,993 |

|

501,969 |

|

205,885 |

|

296,084 |

|

133,488 |

| Valor Justo - Minérios Nacional |

|

|

|

|

|

2,123,507 |

|

|

|

|

|

|

|

2,123,507 |

|

|

| Estanho de Rondônia S.A. |

|

148,325 |

|

205,377 |

|

(57,052) |

|

(5,533) |

|

125,066 |

|

176,554 |

|

(51,488) |

|

(9,700) |

| Companhia Metalúrgica Prada |

|

899,038 |

|

651,559 |

|

247,479 |

|

(18,332) |

|

893,439 |

|

627,628 |

|

265,811 |

|

92,770 |

| CSN Mineração S.A. |

|

24,135,448 |

|

13,970,431 |

|

10,165,017 |

|

1,233,236 |

|

26,989,379 |

|

16,036,647 |

|

10,952,732 |

|

3,852,844 |

| CSN Energia S.A. |

|

109,756 |

|

35,176 |

|

74,580 |

|

(17,184) |

|

133,967 |

|

42,204 |

|

91,763 |

|

1,608 |

| FTL - Ferrovia Transnordestina Logística S.A. |

|

508,392 |

|

335,673 |

|

172,720 |

|

(24,752) |

|

489,628 |

|

292,156 |

|

197,472 |

|

(14,026) |

| Companhia Florestal do Brasil |

|

51,052 |

|

3,106 |

|

47,946 |

|

(1,298) |

|

51,308 |

|

2,063 |

|

49,245 |

|

(1,716) |

| Nordeste Logística |

|

62 |

|

63 |

|

(1) |

|

1 |

|

64 |

|

65 |

|

(1) |

|

(4) |

| CBSI - Companhia Brasileira de Serviços de Infraestrutura |

140,318 |

|

121,067 |

|

19,251 |

|

(5,877) |

|

135,544 |

|

110,416 |

|

25,128 |

|

6,703 |

| Goodwill - CBSI - Companhia Brasileira de Serviços de Infraestrutura |

|

|

|

|

|

15,225 |

|

|

|

|

|

|

|

15,225 |

|

|

| CSN Cimentos |

|

7,250,618 |

|

3,145,348 |

|

4,105,270 |

|

46,578 |

|

4,676,213 |

|

617,457 |

|

4,058,756 |

|

92,088 |

| |

|

51,472,319 |

|

38,488,365 |

|

15,122,687 |

|

1,641,903 |

|

52,550,355 |

|

38,601,449 |

|

16,087,638 |

|

3,925,348 |

| Joint-venture and Joint-operation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Itá Energética S.A. |

|

214,478 |

|

24,272 |

|

190,206 |

|

3,655 |

|

214,524 |

|

27,578 |

|

186,946 |

|

14,394 |

| MRS Logística S.A. |

|

2,449,769 |

|

1,488,914 |

|

960,855 |

|

57,285 |

|

2,524,062 |

|

1,620,565 |

|

903,497 |

|

51,793 |

| Transnordestina Logística S.A. |

|

5,112,794 |

|

4,014,432 |

|

1,098,362 |

|

(15,872) |

|

4,885,994 |

|

3,771,760 |

|

1,114,234 |

|

(19,222) |

| Fair Value (*) - Transnordestina |

|

|

|

|

|

271,116 |

|

|

|

|

|

|

|

271,116 |

|

|

| Equimac S.A |

|

27,526 |

|

11,469 |

|

16,057 |

|

1,369 |

|

20,155 |

|

11,727 |

|

8,428 |

|

135 |

| |

|

7,804,567 |

|

5,539,087 |

|

2,536,596 |

|

46,437 |

|

7,644,735 |

|

5,431,630 |

|

2,484,221 |

|

47,100 |

| Associates |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Arvedi Metalfer do Brasil |

|

44,831 |

|

21,236 |

|

23,595 |

|

2,514 |

|

46,739 |

|

25,198 |

|

21,541 |

|

1,438 |

| |

|

44,831 |

|

21,236 |

|

23,595 |

|

2,514 |

|

46,739 |

|

25,198 |

|

21,541 |

|

1,438 |

| Classified at fair value through profit or loss (note 13 l) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Panatlântica |

|

|

|

|

|

187,967 |

|

|

|

|

|

|

|

190,321 |

|

|

| |

|

|

|

|

|

187,967 |

|

|

|

|

|

|

|

190,321 |

|

|

| Other investments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profits on subsidiaries' inventories |

|

|

|

|

|

(170,802) |

|

129,494 |

|

|

|

|

|

(300,295) |

|

(19,705) |

| Investment Property |

|

|

|

|

|

141,374 |

|

|

|

|

|

|

|

142,578 |

|

|

| Others |

|

|

|

|

|

63,545 |

|

459 |

|

|

|

|

|

63,545 |

|

7,574 |

| |

|

|

|

|

|

34,117 |

|

129,953 |

|

|

|

|

|

(94,172) |

|

(12,131) |

| Total investments |

|

|

|

|

|

17,904,962 |

|

1,820,807 |

|

|

|

|

|

18,689,549 |

|

3,961,755 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Classification of investments in the balance sheet |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investments in assets |

|

|

|

|

|

25,206,024 |

|

|

|

|

|

|

|

25,998,331 |

|

|

| Investments with negative equity |

|

|

|

|

|

(7,442,436) |

|

|

|

|

|

|

|

(7,451,360) |

|

|

| Investment Property |

|

|

|

|

|

141,374 |

|

|

|

|

|

|

|

142,578 |

|

|

| |

|

|

|

|

|

17,904,962 |

|

|

|

|

|

|

|

18,689,549 |

|

|

(*) As of June 30, 2022, and December 31, 2021,

the net balance of BRL271,116 refers to the Fair Value generated by the loss of control of Transnordestina Logística SA in the

amount of BRL659,105 and impairment of BRL387,989.

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

| | |

| Quarterly Financial Information – June 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| 9.b) | Changes in investments in subsidiaries, jointly controlled companies, joint operations, associates, and

other investments |

| |

|

|

Consolidated |

|

|

|

Parent Company |

| |

06/30/2022 |

|

12/31/2021 |

|

06/30/2022 |

|

12/31/2021 |

| |

|

|

|

| Opening balance of investments (assets) |

3,849,647 |

|

3,535,906 |

|

25,998,331 |

|

19,401,494 |

| Opening balance of loss provisions (liabilities) |

|

|

|

|

(7,451,360) |

|

(5,942,863) |

| Total |

3,849,647 |

|

3,535,906 |

|

18,546,971 |

|

13,458,631 |

| Capital increase and (Decrease)/acquisition of shares (1) |

366,739 |

|

58,178 |

|

5,079 |

|

3,894,624 |

| Dividends (2) |

(26) |

|

(61,898) |

|

(2,010,348) |

|

(3,162,117) |

| Comprehensive income (3) |

345 |

|

453 |

|

(634,228) |

|

(519,638) |

| Update of shares measured at fair value through profit or loss (Note 13 II) |

(2,354) |

|

109,254 |

|

(2,354) |

|

109,254 |

| Sales of equity interest (note 9.c) (4) |

|

|

|

|

|

|

(692,115) |

| Net gain due to increased capital and issued new shares in n investments (note 9.c) (5) |

|

|

|

|

|

|

822,093 |

| Equity in results of affiliated companies (6) |

101,957 |

|

219,508 |

|

1,820,807 |

|

4,629,144 |

| Amortization of fair value - investment MRS |

(5,873) |

|

(11,747) |

|

|

|

|

| Others |

891 |

|

(7) |

|

37,661 |

|

7,095 |

| Closing balance of investments (assets) |

4,311,326 |

|

3,849,647 |

|

25,206,024 |

|

25,998,331 |

| Balance of provision for investments with negative equity (liabilities) |

|

|

|

|

(7,442,436) |

|

(7,451,360) |

| Total |

4,311,326 |

|

3,849,647 |

|

17,763,588 |

|

18,546,971 |

(1) Consolidated: Acquisition of shares

in June 2022 of the companies Topázio Energética S.A., Santa Ana Energética S.A. and indirect acquisition of Brasil

Central Energia Ltda. In 2021, through CSN Inova Ventures, strategic investments were made in startups, as follows: 2D Materials, H2Pro

Ltda., 1S1 Energy, Traive INC., OICO Holdings and Clarke Software, with a total amount invested of US$ 4,950, corresponding to BRL27,040.

Parent Company: In 2022, the amount

refers to the capital increase carried out in the company Equimac S.A.. In 2021, refers mainly to the capital increase in the subsidiary

CSN Cimentos, in the amount of BRL2,956,094, resulting from the payment by CSN of net assets composed of certain assets and liabilities

(as described below note 9.c).

(2) Parent Company: refers mainly to

dividends distributed by CSN Mineração, totaling BRL2,009,940 in 2021 and BRL2,984,155 in 2022.

(3) Refers to the conversion into presentation

currency of investments abroad whose functional currency is not the Real, actuarial gain/(loss) and reflection and hedge of investments

reflecting investments accounted for under the equity method.

(4) In 2021, refers to the disposal

of part of the equity interest of the company CSN Mineração at the cost of disposal of shares (see note 9.c).

(5) In 2021, refers to gain on the

change in the percentage of ownership interest in the subsidiary CSN Mineração, after the issue of shares.

(6) The reconciliation of equity in

earnings of companies with shared control classified as joint ventures and associates and the amount presented in the income statement

is presented below and results from the elimination of the results of CSN's transactions with these companies:

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

| | |

| Quarterly Financial Information – June 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| |

|

|

Consolidated |

| |

06/30/2022 |

|

06/30/2021 |

| |

|

| Equity in results of affiliated companies |

|

|

|

| MRS Logística S.A. |

114,541 |

|

103,560 |

| Transnordestina Logística S.A. |

(15,872) |

|

(19,222) |

| Arvedi Metalfer do Brasil S.A. |

2,514 |

|

1,438 |

| Equimac S.A. |

1,369 |

|

135 |

| Others |

(595) |

|

2,089 |

| |

101,957 |

|

88,000 |

| Eliminations |

|

|

|

| To cost of sales |

(33,968) |

|

(28,852) |

| To taxes |

11,549 |

|

9,810 |

| Others |

|

|

|

| Amortizated at fair value - Investment in MRS |

(5,873) |

|

(5,873) |

| Others |

|

|

5,481 |

| Equity in results |

73,665 |

|

68,566 |

| 9.c) | Main events occurred in the subsidiaries in 2021 e 2022 |

·

CSN MINERAÇÃO

·

IPO of CSN MINERAÇÃO

Headquartered in Congonhas, in the State of Minas

Gerais, CSN Mineração SA has as its main objective the production, purchase and sale of iron ore, and has the commercialization

of products in the foreign market as its focal point. As of November 30, 2015, CSN Mineração SA started to centralize CSN’s

mining operations, including the establishments of the Casa de Pedra mine, the TECAR port and an 18.63% stake in MRS. CSN Mineração

publicly held corporation and its shares are listed on the São Paulo Stock Exchange, B3 - Brasil, Bolsa, Balcão.

The interest held by CSN in this subsidiary is

79.75% on June 30, 2022 and 78.24% on December 31, 2021.

Below as the main transactions occurred in the

subsidiary is 2021:

| a) | Initial Public Offering (IPO) |

On February 17, 2021, the subsidiary CSN Mineração

concluded its initial public offering at B3 – Brasil, Bolsa, Balcão. The final prospectus of the public offering consisted

of: (i) primary distribution of 161,189,078 shares (“Primary Offering”); and (ii) secondary distribution of 422,961,066 shares,

being initially 372,749,743 shares (“Secondary Offering”), increased by 50,211,323 supplementary shares held by CSN (“Supplementary

Shares”).

The price per share was fixed at BRL8.50 after

the collection of intention of investments collected from institutional buyers in Brasil and abroad.

Upon conclusion of the offering, the Company’s

interest in the subsidiary CSN Mineração changed from 87.52% to 78.24%.

| i. | Primary Distribution of Shares |

Upon the primary distribution, CSN Mineração

issued 161,189,078 shares (“Primary Offering”) and capitalized the total amount of BRL1,370,107 (BRL1,347,862 net of transaction

costs).

The issuance of 161,189,078 shares diluted the

Company’s interest in the capital of CSN Mineração and, accordingly, the Company recognized in other comprehensive

income a gain from the change of ownership percentage.

The impact of the transaction is presented below:

(CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) | |

| | |

| Quarterly Financial Information – June 30, 2022 – CIA SIDERURGICA NACIONAL | Version: 1 |

| Gain on participation in the capital increase |

1,060,530 |

| Loss due to dilution of participation with issue of new shares |

(231,044) |

| Equity adjustment by dilution of share percentage |

(7,393) |

| Net gain from the transaction |

822,093 |

| ii. | Secondary Distribution of Shares |

Upon the secondary distribution of shares, the

Companhia Siderúrgica Nacional sold 327,593,584 common shares and, additionally, in March 2021 sold supplementary 50,211,323 common

shares, totaling 377,804,907 or 9.3% of shares previously held, in the total amount of BRL3,211,342 (BRL3,164,612 net of transaction costs).

The gain for the sale was recognized as Other Operating Income.

The main impacts of the transaction are presented

as follows:

| Equity in the transaction |

|

9,947,525 |

| Number of share before initial public offering |

|

5,430,057,060 |

| Cost per share |

|

R$ 1.83 |

| |

|

|

| Number of shares sold by CSN |

|

377,804,907 |

| Price per share |

|

R$ 8.50 |

| |

|

|

| (+) Net cash generated in the transaction |

|

3,211,342 |

| (-) Transaction cost |

|

(46,730) |

| (=) net cash reveivable (a) |

|

3,164,612 |

| (-) Cost of shares (b) |

|

(692,115) |

| (=) Net gain from the transaction (a)+(b) |

|

2,472,497 |

| b) | Share repurchase programs of subsidiary CSN Mineração |

On March 24, 2021, November 3, 2021, and May 18,2022,

the Board of Directors of CSN Mineração approved the Share Repurchase Plans, to remain in treasury and subsequent disposal

or cancellation, pursuant to CVM Instruction 567/2015, described below.

On May 18, 2022, the cancellation of 105,907,300 nominative

common shares without a nominal value, repurchased and held in treasury, was approved at a Board of Directors' Meeting. On June 30, 2022,

the subsidiary CSN Mineração had no treasury shares.

| Program |

|

Board’s Authorization |

|

Authorized quantity |

|

Program period |

|

Average buyback price |

|

Minimum and maximum buyback price |

|

Number bought back |

|

Share cancelation |

|

Treasury balance |

| 1º |

|

03/24/2021 |

|

58,415,015 |

|

from 3/25/2021 to 9/24/2021 |

|

R$6.1451 |

|

R$5.5825 and R$6.7176 |

|

52,940,500 |

|

|

|

52,940,500 |

| 2º |

|

11/03/2021 |

|

53,000,000 |

|

from 11/04/2021 to 9/24/2022 |

|

R$6.1644 |

|

R$5.0392 and R$6.1208 |

|

52,466,800 |

|

|

|

105,907,300 |

| |

|

05/18/2022 |

|

|

|

|

|

Not applicable |

|

Not applicable |

|

|

|

105,907,300 |

|

|

| 3º |

|

05/18/2022 |

|

106,000,000 |

|

from 05/19/2022 to 5/18/2023 |

|

|

|

|

|

|

|

|