UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-22328

Columbia Seligman Premium Technology Growth Fund, Inc.

(Exact name of registrant as specified in charter)

225 Franklin Street, Boston, Massachusetts 02110

(Address of principal executive offices) (Zip code)

Christopher O. Petersen

c/o Columbia Management Investment Advisers, LLC

225 Franklin Street

Boston, Massachusetts 02110

Ryan C. Larrenaga, Esq.

c/o Columbia Management Investment Advisers, LLC

225 Franklin Street

Boston, MA 02110

(Name and address of agent for service)

Registrant's telephone number, including area code: (800) 345-6611

Date of fiscal year end: December 31

Date of reporting period: December 31, 2019

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Annual Report

December 31, 2019

Columbia Seligman

Premium Technology Growth Fund

Beginning on January 1, 2021, as

permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semiannual stockholder reports like this one will no longer be sent by mail, unless you

specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (columbiathreadneedleus.com/investor/), and each time a report is posted you will be notified

by mail and provided with a website address to access the report.

If you have already elected to

receive stockholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive stockholder reports and other communications from the Fund electronically

at any time by contacting your financial intermediary (such as a broker-dealer or bank).

You may elect to receive all future

reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue receiving paper copies of your stockholder reports. If you

invest directly with the Fund, you can call 866.666.1532 to let the Fund know you wish to continue receiving paper copies of your stockholder reports. Your election to receive paper reports will apply to all Columbia

Funds held in your account if you invest through a financial intermediary or only to the Fund if you invest directly with the Fund.

FDIC Insured • No bank

guarantee • May lose value

Under Columbia Seligman Premium

Technology Growth Fund’s (the Fund) managed distribution policy and subject to the approval of the Fund’s Board of Directors (the Board), the Fund expects to make quarterly cash distributions (in February,

May, August and November) to holders of common stock (Common Stockholders). The Fund’s most recent distribution under its managed distribution policy (paid on February 25, 2020) amounted to $0.4625 per share,

which is equal to a quarterly rate of 1.9279% (7.71% annualized) of the Fund’s market price of $23.99 per share as of January 31, 2020. You should not draw any conclusions about the Fund’s investment

performance from the amount of the distributions or from the terms of the Fund’s managed distribution policy. Historically, the Fund has at times distributed more than its income and net realized capital gains,

which has resulted in Fund distributions substantially consisting of return of capital or other capital source. A return of capital may occur, for example, when some or all of the money that you invested in the Fund

is paid back to you. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with ‘yield’ or ‘income’. As of the payment

date of the Fund’s 2020 distribution, all Fund distributions paid in 2020 (as estimated by the Fund based on current information), are from the earnings and profits of the Fund and not a return of capital. This

could change during the remainder of the year. The Fund’s Board may determine in the future that the Fund’s managed distribution policy and the amount or timing of the distributions should not be continued

in light of changes in the Fund’s portfolio holdings, market or other conditions or factors, including that the distribution rate under such policy may not be dependent upon the amount of the Fund’s earned

income or realized capital gains. The Board could also consider amending or terminating the current managed distribution policy because of potential adverse tax consequences associated with maintaining the policy. In

certain situations, returns of capital could be taxable for federal income tax purposes, and all or a portion of the Fund’s capital loss carryforwards from prior years, if any, could effectively be forfeited.

The Board may amend or terminate the Fund’s managed distribution policy at any time without prior notice to Fund stockholders; any such change or termination may have an adverse effect on the market price of the

Fund’s shares.

See Notes to Financial Statements

for additional information related to the Fund’s managed distribution policy.

Columbia Seligman Premium Technology Growth Fund

| Annual Report 2019

Letter to the Stockholders

Dear Stockholders,

We are pleased to present the

annual stockholder report for Columbia Seligman Premium Technology Growth Fund, Inc. (the Fund). The report includes the Fund’s investment results, a discussion with the Fund’s Portfolio Managers, the

portfolio of investments and financial statements as of December 31, 2019.

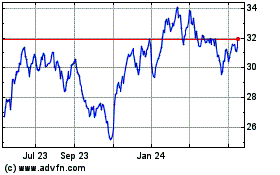

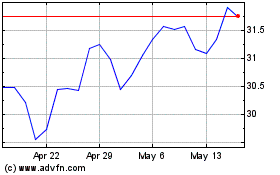

The Fund’s common shares

(Common Stock) returned 51.04%, based on net asset value, and 53.17%, based on market price, for the 12 months ended December 31, 2019. The Fund outperformed its benchmark, the S&P North American Technology Sector

Index, which returned 42.68% for the same time period.

During 2019, the Fund paid four

distributions in accordance with its managed distribution policy that aggregated to $1.85 per share of Common Stock of the Fund. In addition, on January 22, 2019, the Fund paid a special 2018 fourth quarter

distribution, beyond its typical quarterly managed distribution policy, in the amount of $0.6521 per share of Common Stock to stockholders of record on December 17, 2018. The Fund has exemptive relief from the

Securities and Exchange Commission that permits the Fund to make periodic distributions of long-term capital gains more often than once in any one taxable year. Unless you elected otherwise, distributions were paid in

additional shares of the Fund.

On December 12, 2019, the

Fund’s Board of Directors (the Board) unanimously appointed Brian J. Gallagher to the Fund’s Board. His service with the Board commenced on January 1, 2020, for a term expiring at the 2023 annual meeting

of stockholders. Mr. Gallagher currently serves on the board of trustees of certain of the mutual funds and exchange-traded funds (ETFs) within the Columbia Funds Complex and on the board of another closed-end fund

within the Columbia Funds Complex. Effective December 31, 2019, Mr. Edward J. Boudreau, Jr. retired from the Fund’s Board. We thank Mr. Boudreau for his service to the Fund.

Information about the Fund,

including daily pricing, current performance, Fund holdings, stockholder reports, distributions and other information can be found at columbiathreadneedleus.com/investor/ under the Closed-End Funds tab.

On behalf of the Board, I would

like to thank you for your continued support of Columbia Seligman Premium Technology Growth Fund, Inc.

Regards,

Catherine James Paglia

Chair of the BoardFor more information, go online to columbiathreadneedleus.com/investor/; or call American Stock Transfer & Trust Company, LLC, the Fund’s Stockholder Servicing Agent,

at 866.666.1532. Customer Service Representatives are available to answer your questions Monday through Friday from 8 a.m. to 8 p.m. Eastern time.

Columbia Seligman Premium Technology Growth Fund

| Annual Report 2019

|

3

|

|

5

|

|

7

|

|

8

|

|

12

|

|

13

|

|

14

|

|

15

|

|

16

|

|

30

|

|

31

|

|

31

|

Columbia Seligman Premium

Technology Growth Fund (the Fund) mails one stockholder report to each stockholder address. If you would like more than one report, please call shareholder services at 800.937.5449 and additional reports will be sent

to you.

Proxy voting policies and

procedures

The policy of the Board is to vote

the proxies of the companies in which the Fund holds investments consistent with the procedures that can be found by visiting columbiathreadneedleus.com/investor/. Information regarding how the Fund voted proxies

relating to portfolio securities is filed with the SEC by August 31 for the most recent 12-month period ending June 30 of that year, and is available without charge by visiting columbiathreadneedleus.com/investor/; or

searching the website of the SEC at sec.gov.

Quarterly schedule of

investments

The Fund files a complete schedule

of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT, and for reporting periods ended prior to March 31, 2019, on Form N-Q. The Fund’s Form N-Q and Form N-PORT

filings are available on the SEC’s website at sec.gov. The Fund’s complete schedule of portfolio holdings, as filed on Form N-Q or Form N-PORT, can also be obtained without charge, upon request, by calling

800.937.5449.

Additional Fund information

For more information, go online to

columbiathreadneedleus.com/investor/; or call American Stock Transfer & Trust Company, LLC, the Fund’s Stockholder Servicing Agent, at 866.666.1532. Customer Service Representatives are available to answer

your questions Monday through Friday from 8 a.m. to 8 p.m. Eastern time.

Fund investment manager

Columbia Management Investment Advisers, LLC (the

Investment Manager)

225 Franklin Street

Boston, MA 02110

Fund transfer agent

American Stock Transfer & Trust Company,

LLC

6201 15th Avenue

Brooklyn, NY 11219

Columbia Seligman Premium Technology Growth

Fund | Annual Report 2019

Investment objective

Columbia

Seligman Premium Technology Growth Fund (the Fund) seeks growth of capital and current income.

Portfolio management

Paul Wick

Lead Portfolio Manager

Managed Fund since 2009

Braj Agrawal

Co-Portfolio Manager

Managed Fund since 2010

Christopher Boova

Co-Portfolio Manager

Managed Fund since 2016

Jeetil Patel

Technology Team Member

Managed Fund since 2015

Vimal Patel

Technology Team Member

Managed Fund since 2018

Shekhar Pramanick

Technology Team Member

Managed Fund since 2018

Morningstar style boxTM

The Morningstar Style Box is based on a fund’s portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows

investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2020 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or

distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

|

Average annual total returns (%) (for the period ended December 31, 2019)

|

|

|

|

Inception

|

1 Year

|

5 Years

|

10 Years

|

|

Market Price

|

11/24/09

|

53.17

|

16.76

|

13.49

|

|

Net Asset Value

|

11/30/09

|

51.04

|

18.23

|

13.48

|

|

S&P North American Technology Sector Index

|

|

42.68

|

20.34

|

17.55

|

The performance information shown

represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when sold, may be worth more or less than their

original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by visiting

columbiathreadneedleus.com/investor/.

Returns reflect changes in market

price or net asset value, as applicable, and assume reinvestment of distributions. Returns do not reflect the deduction of taxes that investors may pay on distributions or the sale of shares.

The S&P North American

Technology Sector Index is an unmanaged modified capitalization-weighted index based on a universe of technology-related stocks.

Indices are not available for

investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the Fund may not match those in an index.

|

Price Per Share

|

|

|

December 31, 2019

|

September 30, 2019

|

June 30, 2019

|

March 31, 2019

|

|

Market Price ($)

|

23.55

|

21.10

|

20.47

|

20.08

|

|

Net Asset Value ($)

|

23.43

|

20.75

|

20.00

|

20.19

|

|

Distributions Paid Per Common Share

|

|

Payable Date

|

Per Share Amount ($)

|

|

January 22, 2019

|

0.6521(a)

|

|

February 26, 2019

|

0.4625

|

|

May 21, 2019

|

0.4625

|

|

August 20, 2019

|

0.4625

|

|

November 26, 2019

|

0.4625

|

(a) The Fund paid this special

2018 fourth quarter distribution beyond its typical quarterly managed distribution policy to stockholders of record on December 17, 2018.

The net asset value of the

Fund’s shares may not always correspond to the market price of such shares. Common stock of many closed-end funds frequently trade at a discount from their net asset value. The Fund is subject to stock market

risk, which is the risk that stock prices overall will decline over short or long periods, adversely affecting the value of an investment in the Fund.

Columbia Seligman Premium Technology Growth Fund | Annual Report 2019

|

3

|

Fund at a Glance (continued)

|

Portfolio breakdown (%) (at December 31, 2019)

|

|

Common Stocks

|

98.8

|

|

Money Market Funds

|

1.2

|

|

Total

|

100.0

|

Percentages indicated are based

upon total investments excluding investments in derivatives, if any. The Fund’s portfolio composition is subject to change.

|

Equity sector breakdown (%) (at December 31, 2019)

|

|

Communication Services

|

11.4

|

|

Financials

|

0.5

|

|

Industrials

|

0.7

|

|

Information Technology

|

87.4

|

|

Total

|

100.0

|

Percentages indicated are based

upon total equity investments. The Fund’s portfolio composition is subject to change.

|

Equity sub-industry breakdown (%) (at December 31, 2019)

|

|

Information Technology

|

|

|

Application Software

|

9.7

|

|

Communications Equipment

|

3.0

|

|

Data Processing & Outsourced Services

|

9.4

|

|

Internet Services & Infrastructure

|

1.0

|

|

IT Consulting & Other Services

|

0.6

|

|

Semiconductor Equipment

|

16.6

|

|

Semiconductors

|

23.6

|

|

Systems Software

|

11.9

|

|

Technology Hardware, Storage & Peripherals

|

11.6

|

|

Total

|

87.4

|

Percentages indicated are based

upon total equity investments. The Fund’s portfolio composition is subject to change.

|

4

|

Columbia Seligman Premium Technology Growth Fund | Annual Report 2019

|

Manager Discussion of Fund Performance

For the 12-month period that ended

December 31, 2019, shares of the Fund returned 53.17% at market value and 51.04% at net asset value. The Fund solidly outperformed its benchmark, the S&P North American Technology Sector Index, which returned

42.68% for the same time period. A significant overweight in the semiconductor industry accounted for most of the Fund’s performance advantage over its benchmark. Stock selection coupled with an underweight in

internet and direct marketing stocks also aided relative results for the period.

Declining interest rates helped

drive financial markets to new highs

Optimism prevailed early in 2019,

buoyed by solid economic growth and a recovery from meaningful market losses in the fourth quarter of 2018. The labor markets added 184,000 jobs per month, on average. Unemployment fell to 3.5%, annualized. As the

year wore on, U.S. growth slowed from 3.1% in the first quarter to an estimated 2.1%, annualized, for the year overall, as manufacturing activity edged lower. European economies transitioned to a slower pace of

growth, struggling with rising interest rates, trade tensions and uncertainty surrounding the U.K.’s departure from the European Union (Brexit). At the same time, China’s economic conditions weakened and

emerging markets came under pressure, driven by trade and tariff concerns.

Despite these global uncertainties,

the U.S. stock market rose strongly in 2019, as the Fed reduced short-term interest rates three times during the second half of the year, then announced in its December meeting that it would hold the federal funds

target rate at 1.50%-1.75%, judging its current monetary policy appropriate to support economic expansion, a strong labor market and inflation approximating its 2.0% target. Central banks in major foreign economies

followed the Fed’s lead with stimulus efforts. Investors had a strong preference for growth over value stocks, and in some cases a very narrow subset of growth stocks. Nearly one-third of the domestic stock

market’s total return for the year came from the information technology sector, which rose approximately 50% as measured by the S&P 500 Index.

Contributors and detractors

Stock selection in semiconductors

aided relative returns, led by overweight positions in semiconductor capital equipment companies Lam Research Corp. and Teradyne, Inc. Lam is a major player in “etch fabrication” and

“deposition” equipment that creates chips. The company continued to benefit from the rise in labor-intensive chips of all kinds. Given the increased complexity of chips, demand for semiconductor testing,

which is Teradyne’s specialty, has grown. Teradyne has delivered strong earnings on the back of high margins, continued strong demand for collaborative robots and military and cellular testing. Like many other

companies in the sector, Teradyne has availed itself of improved access to offshore cash and repurchased shares over the course of the past year. Synaptics, Inc., a leading developer of human interface solutions, was

another strong contributor to performance for the period. The company recently announced a new, permanent CEO, whose background inspired investor confidence. Synaptics also appears to have locked up touch sensor

design wins in Apple’s 2020 lineup of smartphones, while the company’s current business continued to improve as its pivot to IOT (Internet of Things) devices has shown early signs of progress. Within

software, an overweight position in electronic design automation software maker Synopsis, Inc. aided relative results and produced strong gains for the Fund. The company announced earnings that beat expectations and

reaffirmed forward earnings guidance. Synopsis suggested that design activity and customer demand for electronic design automation tools remain robust, despite general industry weakness. The company also cited strong

results from its nascent Software Integrity business, which has demonstrated strong growth and solid profitability. Speech recognition software company Nuance Communications, Inc. also contributed to returns after

reporting consecutive quarters of better-than-expected results under its new CEO. The company also completed the sale of its Imaging division and appears on track in focusing on its core Healthcare and Enterprise

divisions and returning more cash to shareholders. Within hardware, Xerox Corp. contributed to Fund returns after announcing strong earnings that highlighted solid execution under the company’s new leadership,

which has focused on cost containment and increasing its share repurchase program.

Security selection in software

detracted from relative performance, notably an underweight in Microsoft Corp., as the company’s Azure cloud computing division continued to demonstrate rapid growth as corporations shift to the cloud. At year

end the company won a landmark Department of Defense contract in a head-to-head competition with Amazon. Microsoft also produced good results across its Server, Office and Window divisions. A position in LogMeIn,

Inc., a provider of remote access and collaborative software solutions, detracted from returns on investor concerns of increased competition, a dated product set and the increased expenses needed to reignite growth in

the Unified Communication as a Service (UCaaS)

Columbia Seligman Premium Technology Growth Fund | Annual Report 2019

|

5

|

Manager Discussion of Fund Performance (continued)

space. By the end of the year, the company had

entered into an agreement to be acquired by a pair of private equity funds. Within IT Services, DXC Technology Co. struggled with balancing a fast-growing digital IT/ app-based services practice with legacy businesses

in outsourced data center management and business process optimization that are in decline. DXC shares dropped in 2019, making them among the portfolio’s worst performing investments. While the company trades at

a low valuation, it does have a meaningful amount of debt at a time when leverage has gone out of favor. The Fund enjoyed solid gains from Apple, Inc. and from exposure to Apple suppliers, including Synaptics, Qorvo,

Inc. and Broadcom, Inc., but it was underweight in Apple, which detracted from relative results as the smartphone market outperformed expectations, paced by a positive reception for Apple’s new iPhone 11

series.

Call options detracted from

results

Given the strong results for

technology stocks and relatively low volatility for both technology and technology-related stocks, the Fund’s call option writing strategy detracted from returns.

At period’s end

Equity markets had a banner year

in 2019, particularly technology stocks which recovered strongly from a sell-off at the end of 2018. As always, we continue to adhere to our disciplined investment process, which relies on deep fundamental analysis to

identify those companies that we believe have superior growth prospects, trade at attractive valuations and that have the potential to deliver solid investment returns over time.

The market prices of

technology-related stocks tend to exhibit a greater degree of market risk and price volatility than other types of investments. These stocks may fall in and out of favor with investors rapidly, which may cause sudden

selling and dramatically lower market prices. These stocks may also be affected adversely by changes in technology, consumer and business purchasing patterns, government regulation and/or obsolete products or

services. Technology-related companies are often smaller and less experienced and may be subject to greater risks than larger companies, such as limited product lines, markets and financial and managerial resources.

These risks may be heightened for technology companies in foreign markets. The Fund’s use of derivatives introduces risks possibly greater than the risks associated with investing directly in the investments

underlying the derivatives. A relatively small price movement in an underlying investment may result in a substantial gain or loss.

The views expressed in this report

reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and

results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update

such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf

of any particular Columbia fund. References to specific securities should not be construed as a recommendation or investment advice.

|

6

|

Columbia Seligman Premium Technology Growth Fund | Annual Report 2019

|

Fund Objectives and Rules-Based Option

Strategy

(Unaudited)

The Fund’s investment

objectives are to seek growth of capital and current income. Under normal market conditions, the Fund’s investment program will consist primarily of (i) investing in a portfolio of equity securities of

technology and technology-related companies that seeks to exceed the total return, before fees and expenses, of the S&P North American Technology Sector Index and (ii) writing call options on the NASDAQ 100

Index®, an unmanaged index that includes the largest and most active non-financial domestic and international companies listed on the Nasdaq Stock Market, or its exchange-traded fund equivalent (the NASDAQ 100)

on a month-to-month basis, with an aggregate notional amount typically ranging from 0%-90% of the underlying value of the Fund’s holdings of Common Stock (the Rules-based Option Strategy). The Fund expects to

generate current income from premiums received from writing call options on the NASDAQ 100. The Fund may also buy or write other call and put options on securities, indices, ETFs and market baskets of securities to

generate additional income or return or to provide the portfolio with downside protection.

The Fund’s Rules-based Option

Strategy with respect to writing call options is as follows:

|

When the VXN Index (a) is:

|

Aggregate Notional Amount of

Written Call Options as a

Percentage of the Fund’s

Holdings in Common Stocks

|

|

17 or less

|

25%

|

|

Greater than 17, but less than 18

|

Increase up to 50%

|

|

At least 18, but less than 33

|

50%

|

|

At least 33, but less than 34

|

Increase up to 90%

|

|

At least 34, but less than 55

|

90%

|

|

At 55 or greater

|

0% to 90%

|

|

(a)

|

The VXN Index is a leading barometer of investor sentiment and market volatility relating to the NASDAQ 100 Index.

|

In addition to the Rules-based

Option Strategy, the Fund may write additional calls with aggregate notional amounts of up to 25% of the value of the Fund’s holdings in Common Stock (to a maximum of 90% when aggregated with the call options

written pursuant to the Rules-based Option Strategy) when Columbia Management Investment Advisers, LLC (the Investment Manager) believes call premiums are attractive relative to the risk of the price of the NASDAQ

100. The Fund may also close (or buy back) a written call option if the Investment Manager believes that a substantial amount of the premium (typically, 70% or more) to be received by the Fund has been captured before

exercise, potentially reducing the call position to 0% of total equity until additional calls are written.

Columbia Seligman Premium Technology Growth Fund | Annual Report 2019

|

7

|

Portfolio of Investments

December 31, 2019

(Percentages represent value of

investments compared to net assets)

Investments in securities

|

Common Stocks 98.1%

|

|

Issuer

|

Shares

|

Value ($)

|

|

Communication Services 11.1%

|

|

Broadcasting 1.7%

|

|

Discovery, Inc., Class A(a)

|

192,200

|

6,292,628

|

|

Total Broadcasting

|

6,292,628

|

|

Cable & Satellite 0.3%

|

|

Comcast Corp., Class A

|

27,400

|

1,232,178

|

|

Total Cable & Satellite

|

1,232,178

|

|

Integrated Telecommunication Services 0.2%

|

|

Ooma, Inc.(a)

|

49,984

|

661,288

|

|

Total Integrated Telecommunication Services

|

661,288

|

|

Interactive Home Entertainment 2.0%

|

|

Activision Blizzard, Inc.

|

111,708

|

6,637,689

|

|

Sciplay Corp., Class A(a)

|

62,656

|

770,042

|

|

Total Interactive Home Entertainment

|

7,407,731

|

|

Interactive Media & Services 6.9%

|

|

Alphabet, Inc., Class A(a),(b)

|

10,375

|

13,896,171

|

|

Alphabet, Inc., Class C(a),(b)

|

8,474

|

11,329,908

|

|

Tencent Holdings Ltd., ADR

|

13,000

|

624,195

|

|

Total Interactive Media & Services

|

25,850,274

|

|

Total Communication Services

|

41,444,099

|

|

Financials 0.5%

|

|

Investment Banking & Brokerage 0.5%

|

|

XP, Inc., Class A(a)

|

50,000

|

1,926,000

|

|

Total Investment Banking & Brokerage

|

1,926,000

|

|

Total Financials

|

1,926,000

|

|

Industrials 0.7%

|

|

Heavy Electrical Equipment 0.5%

|

|

Bloom Energy Corp., Class A(a)

|

241,700

|

1,805,499

|

|

Total Heavy Electrical Equipment

|

1,805,499

|

|

Research & Consulting Services 0.2%

|

|

Nielsen Holdings PLC

|

32,000

|

649,600

|

|

Total Research & Consulting Services

|

649,600

|

|

Total Industrials

|

2,455,099

|

|

Information Technology 85.8%

|

|

Common Stocks (continued)

|

|

Issuer

|

Shares

|

Value ($)

|

|

Application Software 9.5%

|

|

Cerence, Inc.(a)

|

116,338

|

2,632,729

|

|

Cerence, Inc.(a)

|

24,664

|

558,146

|

|

Cornerstone OnDemand, Inc.(a)

|

31,221

|

1,827,990

|

|

Dropbox, Inc., Class A(a)

|

70,300

|

1,259,073

|

|

Nuance Communications, Inc.(a)

|

215,204

|

3,837,087

|

|

Salesforce.com, Inc.(a)

|

33,000

|

5,367,120

|

|

Splunk, Inc.(a)

|

11,558

|

1,731,042

|

|

Synopsys, Inc.(a),(b)

|

100,489

|

13,988,069

|

|

TeamViewer AG(a)

|

51,617

|

1,845,813

|

|

Verint Systems, Inc.(a)

|

44,200

|

2,446,912

|

|

Total Application Software

|

35,493,981

|

|

Communications Equipment 2.9%

|

|

Arista Networks, Inc.(a)

|

11,179

|

2,273,808

|

|

CommScope Holding Co., Inc.(a)

|

61,100

|

867,009

|

|

F5 Networks, Inc.(a)

|

16,000

|

2,234,400

|

|

Juniper Networks, Inc.

|

67,400

|

1,660,062

|

|

Plantronics, Inc.

|

93,100

|

2,545,354

|

|

Telefonaktiebolaget LM Ericsson, ADR

|

153,500

|

1,347,730

|

|

Total Communications Equipment

|

10,928,363

|

|

Data Processing & Outsourced Services 9.2%

|

|

Euronet Worldwide, Inc.(a)

|

9,525

|

1,500,759

|

|

Fidelity National Information Services, Inc.

|

44,200

|

6,147,778

|

|

Fiserv, Inc.(a)

|

38,400

|

4,440,192

|

|

Genpact Ltd.

|

72,500

|

3,057,325

|

|

Global Payments, Inc.

|

20,657

|

3,771,142

|

|

Pagseguro Digital Ltd., Class A(a)

|

87,358

|

2,984,149

|

|

Visa, Inc., Class A(b)

|

66,100

|

12,420,190

|

|

Total Data Processing & Outsourced Services

|

34,321,535

|

|

Internet Services & Infrastructure 1.0%

|

|

GoDaddy, Inc., Class A(a)

|

52,215

|

3,546,443

|

|

Total Internet Services & Infrastructure

|

3,546,443

|

|

IT Consulting & Other Services 0.6%

|

|

DXC Technology Co.

|

59,100

|

2,221,569

|

|

Total IT Consulting & Other Services

|

2,221,569

|

The accompanying Notes to Financial

Statements are an integral part of this statement.

|

8

|

Columbia Seligman Premium Technology Growth Fund | Annual Report 2019

|

Portfolio of Investments (continued)

December 31, 2019

|

Common Stocks (continued)

|

|

Issuer

|

Shares

|

Value ($)

|

|

Semiconductor Equipment 16.3%

|

|

Advanced Energy Industries, Inc.(a)

|

62,400

|

4,442,880

|

|

Applied Materials, Inc.(b)

|

202,900

|

12,385,016

|

|

Lam Research Corp.(b)

|

96,205

|

28,130,342

|

|

Teradyne, Inc.(b)

|

197,506

|

13,467,934

|

|

Xperi Corp.

|

117,083

|

2,166,036

|

|

Total Semiconductor Equipment

|

60,592,208

|

|

Semiconductors 23.2%

|

|

Broadcom, Inc.(b)

|

63,900

|

20,193,678

|

|

Infineon Technologies AG

|

233,300

|

5,271,264

|

|

Inphi Corp.(a)

|

46,405

|

3,434,898

|

|

Intel Corp.

|

33,400

|

1,998,990

|

|

Marvell Technology Group Ltd.(b)

|

458,192

|

12,169,580

|

|

Micron Technology, Inc.(a),(b)

|

247,504

|

13,310,765

|

|

NXP Semiconductors NV(b)

|

54,600

|

6,948,396

|

|

ON Semiconductor Corp.(a),(b)

|

434,818

|

10,600,863

|

|

Qorvo, Inc.(a)

|

24,142

|

2,806,025

|

|

Rambus, Inc.(a)

|

40,600

|

559,265

|

|

SMART Global Holdings, Inc.(a)

|

25,399

|

963,638

|

|

Synaptics, Inc.(a),(b)

|

122,681

|

8,068,729

|

|

Total Semiconductors

|

86,326,091

|

|

Systems Software 11.7%

|

|

ForeScout Technologies, Inc.(a)

|

34,000

|

1,115,200

|

|

Fortinet, Inc.(a),(b)

|

79,524

|

8,489,982

|

|

Microsoft Corp.

|

74,900

|

11,811,730

|

|

Oracle Corp.

|

104,100

|

5,515,218

|

|

Common Stocks (continued)

|

|

Issuer

|

Shares

|

Value ($)

|

|

Palo Alto Networks, Inc.(a),(b)

|

29,400

|

6,798,750

|

|

SailPoint Technologies Holding, Inc.(a)

|

66,019

|

1,558,049

|

|

Symantec Corp.

|

202,375

|

5,164,610

|

|

TiVo Corp.

|

356,900

|

3,026,512

|

|

Total Systems Software

|

43,480,051

|

|

Technology Hardware, Storage & Peripherals 11.4%

|

|

Apple, Inc.(b)

|

68,300

|

20,056,295

|

|

Dell Technologies, Inc.(a)

|

49,800

|

2,559,222

|

|

NetApp, Inc.(b)

|

148,700

|

9,256,575

|

|

Western Digital Corp.(b)

|

163,400

|

10,370,998

|

|

Total Technology Hardware, Storage & Peripherals

|

42,243,090

|

|

Total Information Technology

|

319,153,331

|

Total Common Stocks

(Cost: $216,812,401)

|

364,978,529

|

|

|

|

Money Market Funds 1.2%

|

|

|

Shares

|

Value ($)

|

|

Columbia Short-Term Cash Fund, 1.699%(c),(d)

|

4,613,600

|

4,613,138

|

Total Money Market Funds

(Cost: $4,613,138)

|

4,613,138

|

Total Investments in Securities

(Cost $221,425,539)

|

369,591,667

|

|

Other Assets & Liabilities, Net

|

|

2,471,126

|

|

Net Assets

|

$372,062,793

|

At December 31, 2019,

securities and/or cash totaling $200,207,547 were pledged as collateral.

Investments in

derivatives

|

Call option contracts written

|

|

Description

|

Counterparty

|

Trading

currency

|

Notional

amount

|

Number of

contracts

|

Exercise

price/Rate

|

Expiration

date

|

Premium

received ($)

|

Value ($)

|

|

Marvell Technology Group Ltd.

|

Deutsche Bank

|

USD

|

(132,800)

|

(50)

|

32.00

|

1/17/2020

|

(3,987)

|

(100)

|

|

Marvell Technology Group Ltd.

|

Deutsche Bank

|

USD

|

(162,016)

|

(61)

|

31.00

|

1/17/2020

|

(5,900)

|

(122)

|

|

Marvell Technology Group Ltd.

|

Deutsche Bank

|

USD

|

(1,245,664)

|

(469)

|

35.00

|

1/15/2021

|

(47,819)

|

(63,081)

|

|

NASDAQ-100 Index

|

Deutsche Bank

|

USD

|

(179,901,304)

|

(206)

|

8,900.00

|

1/17/2020

|

(618,901)

|

(647,870)

|

|

Western Digital Corp.

|

Deutsche Bank

|

USD

|

(2,545,147)

|

(401)

|

90.00

|

1/15/2021

|

(148,912)

|

(96,841)

|

|

Total

|

|

|

|

|

|

|

(825,519)

|

(808,014)

|

The accompanying Notes to Financial

Statements are an integral part of this statement.

Columbia Seligman Premium Technology Growth Fund | Annual Report 2019

|

9

|

Portfolio of Investments (continued)

December 31, 2019

|

Put option contracts written

|

|

Description

|

Counterparty

|

Trading

currency

|

Notional

amount

|

Number of

contracts

|

Exercise

price/Rate

|

Expiration

date

|

Premium

received ($)

|

Value ($)

|

|

Marvell Technology Group Ltd.

|

Deutsche Bank

|

USD

|

(1,256,288)

|

(473)

|

15.00

|

01/17/2020

|

(50,669)

|

(710)

|

|

Marvell Technology Group Ltd.

|

Deutsche Bank

|

USD

|

(2,563,040)

|

(965)

|

17.00

|

01/15/2021

|

(132,165)

|

(69,962)

|

|

Western Digital Corp.

|

Deutsche Bank

|

USD

|

(2,551,494)

|

(402)

|

40.00

|

01/15/2021

|

(127,416)

|

(82,209)

|

|

Total

|

|

|

|

|

|

|

(310,250)

|

(152,881)

|

Notes to Portfolio of

Investments

|

(a)

|

Non-income producing investment.

|

|

(b)

|

This security or a portion of this security has been pledged as collateral in connection with derivative contracts.

|

|

(c)

|

The rate shown is the seven-day current annualized yield at December 31, 2019.

|

|

(d)

|

As defined in the Investment Company Act of 1940, an affiliated company is one in which the Fund owns 5% or more of the company’s outstanding voting securities, or a company

which is under common ownership or control with the Fund. Holdings and transactions in these affiliated companies during the year ended December 31, 2019 are as follows:

|

|

Issuer

|

Beginning

shares

|

Shares

purchased

|

Shares

sold

|

Ending

shares

|

Realized gain

(loss) —

affiliated

issuers ($)

|

Net change in

unrealized

appreciation

(depreciation) —

affiliated

issuers ($)

|

Dividends —

affiliated

issuers ($)

|

Value —

affiliated

issuers

at end of

period ($)

|

|

Columbia Short-Term Cash Fund, 1.699%

|

|

|

9,299,869

|

102,338,361

|

(107,024,630)

|

4,613,600

|

534

|

—

|

141,208

|

4,613,138

|

Abbreviation Legend

|

ADR

|

American Depositary Receipt

|

Currency Legend

Fair value measurements

The Fund categorizes its fair

value measurements according to a three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing that the most observable input be used when available.

Observable inputs are those that market participants would use in pricing an investment based on market data obtained from sources independent of the reporting entity. Unobservable inputs are those that reflect the

Fund’s assumptions about the information market participants would use in pricing an investment. An investment’s level within the fair value hierarchy is based on the lowest level of any input that is

deemed significant to the asset’s or liability’s fair value measurement. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example,

certain U.S. government securities are generally high quality and liquid, however, they are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

Fair value inputs are summarized in

the three broad levels listed below:

|

■

|

Level 1 — Valuations based on quoted prices for investments in active markets that the Fund has the ability to access at the measurement date. Valuation adjustments are not applied to Level 1 investments.

|

|

■

|

Level 2 — Valuations based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.).

|

|

■

|

Level 3 — Valuations based on significant unobservable inputs (including the Fund’s own assumptions and judgment in determining the fair value of investments).

|

Inputs that are used in determining

fair value of an investment may include price information, credit data, volatility statistics, and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary

between investments, and is affected by various factors such as the type of investment, and the volume and level of activity for that investment or similar investments in the marketplace. The inputs will be considered

by the Investment Manager, along with any other relevant factors in the calculation of an investment’s fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include

periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels

within the hierarchy.

Foreign equity securities actively

traded in markets where there is a significant delay in the local close relative to the New York Stock Exchange are classified as Level 2. The values of these securities may include an adjustment to reflect the impact

of significant market movements following the close of local trading, as described in Note 2 to the financial statements – Security valuation.

Investments falling into the Level 3

category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency

and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models may rely on one or more significant

unobservable inputs and/or significant assumptions by the Investment Manager. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and

estimated cash flows, and comparable company data.

The accompanying Notes to Financial Statements are

an integral part of this statement.

|

10

|

Columbia Seligman Premium Technology Growth Fund | Annual Report 2019

|

Portfolio of Investments (continued)

December 31, 2019

Fair value measurements (continued)

Under the direction of the Fund’s Board of Directors (the Board), the Investment Manager’s Valuation Committee (the Committee) is responsible for overseeing the valuation procedures approved by the Board.

The Committee consists of voting and non-voting members from various groups within the Investment Manager’s organization, including operations and accounting, trading and investments, compliance, risk management

and legal.

The Committee meets at least monthly

to review and approve valuation matters, which may include a description of specific valuation determinations, data regarding pricing information received from approved pricing vendors and brokers and the results of

Board-approved valuation control policies and procedures (the Policies). The Policies address, among other things, instances when market quotations are or are not readily available, including recommendations of third

party pricing vendors and a determination of appropriate pricing methodologies; events that require specific valuation determinations and assessment of fair value techniques; securities with a potential for stale

pricing, including those that are illiquid, restricted, or in default; and the effectiveness of third party pricing vendors, including periodic reviews of vendors. The Committee meets more frequently, as needed, to

discuss additional valuation matters, which may include the need to review back-testing results, review time-sensitive information or approve related valuation actions. The Committee reports to the Board, with members

of the Committee meeting with the Board at each of its regularly scheduled meetings to discuss valuation matters and actions during the period, similar to those described earlier.

The following table is a summary of

the inputs used to value the Fund’s investments at December 31, 2019:

|

|

Level 1 ($)

|

Level 2 ($)

|

Level 3 ($)

|

Total ($)

|

|

Investments in Securities

|

|

|

|

|

|

Common Stocks

|

|

|

|

|

|

Communication Services

|

40,819,904

|

624,195

|

—

|

41,444,099

|

|

Financials

|

1,926,000

|

—

|

—

|

1,926,000

|

|

Industrials

|

2,455,099

|

—

|

—

|

2,455,099

|

|

Information Technology

|

312,036,254

|

7,117,077

|

—

|

319,153,331

|

|

Total Common Stocks

|

357,237,257

|

7,741,272

|

—

|

364,978,529

|

|

Money Market Funds

|

4,613,138

|

—

|

—

|

4,613,138

|

|

Total Investments in Securities

|

361,850,395

|

7,741,272

|

—

|

369,591,667

|

|

Investments in Derivatives

|

|

|

|

|

|

Liability

|

|

|

|

|

|

Options Contracts Written

|

(960,895)

|

—

|

—

|

(960,895)

|

|

Total

|

360,889,500

|

7,741,272

|

—

|

368,630,772

|

See the Portfolio of Investments for

all investment classifications not indicated in the table.

The Fund’s assets assigned to

the Level 2 input category are generally valued using the market approach, in which a security’s value is determined through reference to prices and information from market transactions for similar or identical

assets. These assets include certain foreign securities for which a third party statistical pricing service may be employed for purposes of fair market valuation. The model utilized by such third party statistical

pricing service takes into account a security’s correlation to available market data including, but not limited to, intraday index, ADR, and exchange-traded fund movements.

The accompanying Notes to Financial Statements are

an integral part of this statement.

Columbia Seligman Premium Technology Growth Fund | Annual Report 2019

|

11

|

Statement of Assets and Liabilities

December 31, 2019

|

Assets

|

|

|

Investments in securities, at value

|

|

|

Unaffiliated issuers (cost $216,812,401)

|

$364,978,529

|

|

Affiliated issuers (cost $4,613,138)

|

4,613,138

|

|

Cash collateral held at broker for:

|

|

|

Options contracts written

|

4,168,400

|

|

Receivable for:

|

|

|

Investments sold

|

9,615

|

|

Dividends

|

166,742

|

|

Prepaid expenses

|

33,240

|

|

Total assets

|

373,969,664

|

|

Liabilities

|

|

|

Option contracts written, at value (premiums received $1,135,769)

|

960,895

|

|

Payable for:

|

|

|

Investments purchased

|

788,435

|

|

Management services fees

|

10,765

|

|

Stockholder servicing and transfer agent fees

|

2,502

|

|

Compensation of board members

|

107,636

|

|

Compensation of chief compliance officer

|

71

|

|

Other expenses

|

36,567

|

|

Total liabilities

|

1,906,871

|

|

Net assets applicable to outstanding Common Stock

|

$372,062,793

|

|

Represented by

|

|

|

Paid in capital

|

217,509,554

|

|

Total distributable earnings (loss)

|

154,553,239

|

|

Total - representing net assets applicable to outstanding Common Stock

|

$372,062,793

|

|

Shares outstanding applicable to Common Stock

|

15,879,011

|

|

Net asset value per share of outstanding Common Stock

|

$23.43

|

|

Market price per share of Common Stock

|

$23.55

|

The accompanying Notes to Financial Statements are

an integral part of this statement.

|

12

|

Columbia Seligman Premium Technology Growth Fund | Annual Report 2019

|

Statement of Operations

Year Ended December 31, 2019

|

Net investment income

|

|

|

Income:

|

|

|

Dividends — unaffiliated issuers

|

$3,362,904

|

|

Dividends — affiliated issuers

|

141,208

|

|

Foreign taxes withheld

|

(10,648)

|

|

Total income

|

3,493,464

|

|

Expenses:

|

|

|

Management services fees

|

3,445,638

|

|

Stockholder servicing and transfer agent fees

|

18,059

|

|

Compensation of board members

|

57,918

|

|

Custodian fees

|

12,349

|

|

Printing and postage fees

|

35,687

|

|

Stockholders’ meeting fees

|

32,705

|

|

Audit fees

|

39,221

|

|

Legal fees

|

9,821

|

|

Compensation of chief compliance officer

|

67

|

|

Other

|

100,436

|

|

Total expenses

|

3,751,901

|

|

Net investment loss

|

(258,437)

|

|

Realized and unrealized gain (loss) — net

|

|

|

Net realized gain (loss) on:

|

|

|

Investments — unaffiliated issuers

|

36,482,806

|

|

Investments — affiliated issuers

|

534

|

|

Foreign currency translations

|

(3,299)

|

|

Options purchased

|

(63,250)

|

|

Options contracts written

|

(8,323,973)

|

|

Net realized gain

|

28,092,818

|

|

Net change in unrealized appreciation (depreciation) on:

|

|

|

Investments — unaffiliated issuers

|

102,152,843

|

|

Foreign currency translations

|

(6)

|

|

Options contracts written

|

1,907,951

|

|

Net change in unrealized appreciation (depreciation)

|

104,060,788

|

|

Net realized and unrealized gain

|

132,153,606

|

|

Net increase in net assets resulting from operations

|

$131,895,169

|

The accompanying Notes to

Financial Statements are an integral part of this statement.

Columbia Seligman Premium Technology Growth Fund | Annual Report 2019

|

13

|

Statement of Changes in Net Assets

|

|

Year Ended

December 31, 2019

|

Year Ended

December 31, 2018

|

|

Operations

|

|

|

|

Net investment loss

|

$(258,437)

|

$(179,055)

|

|

Net realized gain

|

28,092,818

|

37,137,729

|

|

Net change in unrealized appreciation (depreciation)

|

104,060,788

|

(58,397,231)

|

|

Net increase (decrease) in net assets resulting from operations

|

131,895,169

|

(21,438,557)

|

|

Distributions to stockholders

|

|

|

|

Net investment income and net realized gains

|

(29,351,348)

|

(39,107,876)

|

|

Total distributions to stockholders

|

(29,351,348)

|

(39,107,876)

|

|

Increase in net assets from capital stock activity

|

4,204,361

|

5,389,156

|

|

Total increase (decrease) in net assets

|

106,748,182

|

(55,157,277)

|

|

Net assets at beginning of year

|

265,314,611

|

320,471,888

|

|

Net assets at end of year

|

$372,062,793

|

$265,314,611

|

|

|

Year Ended

|

Year Ended

|

|

|

December 31, 2019

|

December 31, 2018

|

|

|

Shares

|

Dollars ($)

|

Shares

|

Dollars ($)

|

|

Capital stock activity

|

|

Common Stock issued at market price in distributions

|

257,740

|

4,618,719

|

253,576

|

5,389,156

|

|

Common Stock purchased in the open market

|

(20,562)

|

(414,358)

|

—

|

—

|

|

Total net increase

|

237,178

|

4,204,361

|

253,576

|

5,389,156

|

The accompanying Notes to Financial Statements are

an integral part of this statement.

|

14

|

Columbia Seligman Premium Technology Growth Fund | Annual Report 2019

|

The Fund’s financial

highlights are presented below. Per share operating performance data is designed to allow investors to trace the operating performance, on a per Common Stock share basis, from the beginning net asset value to the

ending net asset value, so that investors can understand what effect the individual items have on their investment, assuming it was held throughout the period. Generally, the per share amounts are derived by

converting the actual dollar amounts incurred for each item, as disclosed in the financial statements, to their equivalent per Common Stock share amounts, using average Common Stock shares outstanding during the

period.

Total return measures the

Fund’s performance assuming that investors purchased Fund shares at market price or net asset value as of the beginning of the period, reinvested all their distributions, and then sold their shares at the

closing market price or net asset value on the last day of the period. The computations do not reflect taxes or any sales commissions investors may incur on distributions or on the sale of Fund shares. Total returns

and portfolio turnover are not annualized for periods of less than one year. The portfolio turnover rate is calculated without regard to purchase and sales transactions of short-term instruments and certain

derivatives, if any. If such transactions were included, a Fund’s portfolio turnover rate may be higher.

|

|

Year ended December 31,

|

|

2019

|

2018

|

2017

|

2016

|

2015

|

|

Per share data

|

|

|

|

|

|

|

Net asset value, beginning of period

|

$16.96

|

$20.83

|

$17.78

|

$17.29

|

$17.69

|

|

Income from investment operations:

|

|

|

|

|

|

|

Net investment loss

|

(0.02)

|

(0.01)

|

(0.06)

|

(0.05)

|

(0.04)

|

|

Net realized and unrealized gain (loss)

|

8.34

|

(1.36)

|

5.74

|

2.39

|

1.49

|

|

Total from investment operations

|

8.32

|

(1.37)

|

5.68

|

2.34

|

1.45

|

|

Less distributions to Stockholders from:

|

|

|

|

|

|

|

Net realized gains

|

(1.85)

|

(2.50)

|

(2.63)

|

(1.85)

|

(1.85)

|

|

Total distributions to Stockholders

|

(1.85)

|

(2.50)

|

(2.63)

|

(1.85)

|

(1.85)

|

|

Net asset value, end of period

|

$23.43

|

$16.96

|

$20.83

|

$17.78

|

$17.29

|

|

Market price, end of period

|

$23.55

|

$16.81

|

$22.25

|

$18.74

|

$17.93

|

|

Total return

|

|

|

|

|

|

|

Based upon net asset value

|

51.04%

|

(7.77%)

|

32.72%

|

15.29%

|

8.40%

|

|

Based upon market price

|

53.17%

|

(14.42%)

|

34.51%

|

17.18%

|

5.05%

|

|

Ratios to average net assets

|

|

|

|

|

|

|

Total gross expenses(a)

|

1.15%

|

1.15%

|

1.16%

|

1.17%

|

1.17%

|

|

Net investment loss

|

(0.08%)

|

(0.05%)

|

(0.28%)

|

(0.33%)

|

(0.24%)

|

|

Supplemental data

|

|

|

|

|

|

|

Net assets, end of period (in thousands)

|

$372,063

|

$265,315

|

$320,472

|

$273,226

|

$265,426

|

|

Portfolio turnover

|

43%

|

34%

|

47%

|

61%

|

61%

|

|

Notes to Financial Highlights

|

|

(a)

|

In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such

indirect expenses are not included in the Fund’s reported expense ratios.

|

The accompanying Notes to Financial Statements are

an integral part of this statement.

Columbia Seligman Premium Technology Growth Fund | Annual Report 2019

|

15

|

Notes to Financial Statements

December 31, 2019

Note 1. Organization

Columbia Seligman Premium

Technology Growth Fund (the Fund) is a non-diversified fund. The Fund is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as a closed-end management investment company.

The Fund was incorporated under the

laws of the State of Maryland on September 3, 2009, and commenced investment operations on November 30, 2009. The Fund had no investment operations prior to November 30, 2009 other than those relating to

organizational matters and the sale to Columbia Management Investment Advisers, LLC (the Investment Manager), a wholly-owned subsidiary of Ameriprise Financial, Inc. (Ameriprise Financial), of 5,250 shares of Common

Stock at a cost of $100,275 on October 14, 2009. As of December 31, 2009, the Fund issued 14,300,000 shares of Common Stock, including 13,100,000 shares of Common Stock in its initial public offering and 1,200,000

shares of Common Stock purchased by the Fund’s underwriters pursuant to an over-allotment option granted to the underwriters in connection with the initial public offering. On January 13, 2010, the Fund’s

underwriters purchased an additional 545,000 shares of Common Stock pursuant to the over-allotment option, resulting in a total of 14,845,000 shares of Common Stock issued by the Fund in its initial public offering,

including shares purchased by the underwriters pursuant to the over-allotment option. With the closing of this additional purchase of Common Stock, the Fund’s total raise-up in its initial public offering was an

aggregate of $296.9 million. The Fund has one billion authorized shares of Common Stock. The issued and outstanding Common Stock trades on the New York Stock Exchange under the symbol “STK”.

The Fund currently has outstanding

Common Stock. Each outstanding share of Common Stock entitles the holder thereof to one vote on all matters submitted to a vote of the Common Stockholders, including the election of directors. Because the Fund has no

other classes or series of stock outstanding, Common Stock possesses exclusive voting power. All of the Fund’s shares of Common Stock have equal dividend, liquidation, voting and other rights. The Fund’s

Common Stockholders have no preference, conversion, redemption, exchange, sinking fund, or appraisal rights and have no preemptive rights to subscribe for any of the Fund’s securities.

Although the Fund has no current

intention to do so, the Fund is authorized and reserves the flexibility to use leverage to increase its investments or for other management activities through the issuance of Preferred Stock and/or borrowings. The

costs of issuing Preferred Stock and/or a borrowing program would be borne by Common Stockholders and consequently would result in a reduction of net asset value of Common Stock.

Note 2. Summary of

significant accounting policies

Basis of preparation

The Fund is an investment company

that applies the accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services - Investment Companies (ASC 946). The financial statements are prepared in accordance with U.S. generally accepted accounting principles (GAAP), which requires

management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the

reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

The following is a summary of

significant accounting policies followed by the Fund in the preparation of its financial statements.

Security valuation

All equity securities are valued at

the close of business of the New York Stock Exchange. Equity securities are valued at the official closing price on the principal exchange or market on which they trade. Unlisted securities or listed securities for

which there were no sales during the day are valued at the mean of the latest quoted bid and ask prices on such exchanges or markets.

Foreign equity securities are

valued based on the closing price on the foreign exchange in which such securities are primarily traded. If any foreign equity security closing prices are not readily available, the securities are valued at the mean

of the latest quoted bid and ask prices on such exchanges or markets. Foreign currency exchange rates are determined at the scheduled closing time of the New York Stock Exchange. Many securities markets and exchanges

outside the U.S. close prior to the

|

16

|

Columbia Seligman Premium Technology Growth Fund | Annual Report 2019

|

Notes to Financial Statements (continued)

December 31, 2019

close of the New York Stock Exchange; therefore,

the closing prices for securities in such markets or on such exchanges may not fully reflect events that occur after such close but before the close of the New York Stock Exchange. In those situations, foreign

securities will be fair valued pursuant to a policy adopted by the Board of Directors. Under the policy, the Fund may utilize a third-party pricing service to determine these fair values. The third-party pricing

service takes into account multiple factors, including, but not limited to, movements in the U.S. securities markets, certain depositary receipts, futures contracts and foreign exchange rates that have occurred

subsequent to the close of the foreign exchange or market, to determine a good faith estimate that reasonably reflects the current market conditions as of the close of the New York Stock Exchange. The fair value of a

security is likely to be different from the quoted or published price, if available.

Investments in open-end investment

companies, including money market funds, are valued at their latest net asset value.

Option contracts are valued at the

mean of the latest quoted bid and ask prices on their primary exchanges. Option contracts, including over-the-counter option contracts, with no readily available market quotations are valued using mid-market

evaluations from independent third-party vendors.

Investments for which market

quotations are not readily available, or that have quotations which management believes are not reflective of market value or reliable, are valued at fair value as determined in good faith under procedures approved by

and under the general supervision of the Board of Directors. If a security or class of securities (such as foreign securities) is valued at fair value, such value is likely to be different from the quoted or published

price for the security, if available.

The determination of fair value

often requires significant judgment. To determine fair value, management may use assumptions including but not limited to future cash flows and estimated risk premiums. Multiple inputs from various sources may be used

to determine fair value.

GAAP requires disclosure regarding

the inputs and valuation techniques used to measure fair value and any changes in valuation inputs or techniques. In addition, investments shall be disclosed by major category. This information is disclosed following

the Fund’s Portfolio of Investments.

Foreign currency transactions and

translations

The values of all assets and

liabilities denominated in foreign currencies are generally translated into U.S. dollars at exchange rates determined at the close of regular trading on the New York Stock Exchange. Net realized and unrealized gains

(losses) on foreign currency transactions and translations include gains (losses) arising from the fluctuation in exchange rates between trade and settlement dates on securities transactions, gains (losses) arising

from the disposition of foreign currency and currency gains (losses) between the accrual and payment dates on dividends, interest income and foreign withholding taxes.

For financial statement purposes,

the Fund does not distinguish that portion of gains (losses) on investments which is due to changes in foreign exchange rates from that which is due to changes in market prices of the investments. Such fluctuations

are included with the net realized and unrealized gains (losses) on investments in the Statement of Operations.

Derivative instruments

The Fund may invest in certain

derivative instruments, which are transactions whose values depend on or are derived from (in whole or in part) the value of one or more other assets, such as securities, currencies, commodities or indices. The Fund

uses a rules-based call option writing strategy on the NASDAQ 100 Index®, an unmanaged index that includes the largest and most active nonfinancial domestic and international companies listed on the Nasdaq Stock

Market, or its exchange-traded fund equivalent (NASDAQ 100) on a month-to-month basis.

The Fund may also seek to provide

downside protection by purchasing puts on the NASDAQ 100 when premiums on these options are considered by the Investment Manager to be low and, therefore, attractive relative to the downside protection provided.

The Fund may also buy or write

other call and put options on securities, indices, ETFs and market baskets of securities to generate additional income or return or to provide the portfolio with downside protection. In this regard, options may

include writing “in-” or “out-of-the-money” put options or buying or selling options in connection with closing out positions prior to

Columbia Seligman Premium Technology Growth Fund | Annual Report 2019

|

17

|

Notes to Financial Statements (continued)

December 31, 2019

expiration of any options. However, the Fund does

not intend to write “naked” call options on individual stocks (i.e., selling a call option on an individual security not owned by the Fund) other than in connection with implementing the options strategies

with respect to the NASDAQ 100. The put and call options purchased, sold or written by the Fund may be exchange-listed or over-the-counter.

The notional amounts of derivative

instruments, if applicable, are not recorded in the financial statements. A derivative instrument may suffer a mark to market loss if the value of the contract decreases due to an unfavorable change in the market

rates or values of the underlying instrument. Losses can also occur if the counterparty does not perform under the contract. Options written by the Fund do not typically give rise to counterparty credit risk, as

options written generally obligate the Fund and not the counterparty to perform. With exchange-traded purchased options, there is minimal counterparty credit risk to the Fund since the exchange’s clearinghouse,