Stimulus Payments Slow Down Online Banking

April 15 2020 - 7:00PM

Dow Jones News

By Orla McCaffrey

Customers at some banks across the country were temporarily

unable to access their accounts online or through mobile apps on

Wednesday, shortly after the first round of government stimulus

checks started landing in bank accounts.

Customers reported trouble accessing account information at

JPMorgan Chase & Co., Citigroup Inc., U.S. Bancorp, PNC

Financial Services Group and Truist Financial Corp., among

others.

The banks acknowledged that some customers had problems logging

in throughout the afternoon and said they were working to resolve

the issues. PNC, Citigroup and JPMorgan said in the late afternoon

that they had fixed the problem. Truist said most of its online and

mobile services had been restored.

A PNC spokeswoman said an "unprecedented volume" of customers

logging on to check for stimulus payments prompted the network

issues.

The payments are part of the economic-relief package passed by

Congress last month to try to keep the economy afloat during the

coronavirus crisis. It relies heavily on banks as the conduit.

The Treasury Department began transferring payments to banks on

Friday. Banks had until Wednesday to start transferring the money

to customers.

The glitches weren't limited to large financial

institutions.

Fiserv Inc., which provides the underlying technology for many

banks, particularly smaller ones, said "exceptionally high

systemwide volume" led to intermittent accessibility Wednesday.

Fiserv said midafternoon that its services had returned to

normal.

An alert on the website of Summit Credit Union in Madison, Wis.,

warned that "online and mobile banking systems are experiencing

slowness" because of a wave of customers hoping to find their

stimulus deposits.

Wells Fargo said it didn't experience connectivity issues

Wednesday. But its daily volume of direct deposits hit a record

high and was roughly three times the average, according to Ed

Kadletz, the bank's head of deposit products.

Wells Fargo had been preparing to handle the flow by, for

example, ironing out how to handle direct deposits that arrive in

accounts that have been closed. It also temporarily halted

collection on negative balances to avoid eating up customers'

stimulus funds.

Ben Eisen contributed to this article.

Write to Orla McCaffrey at orla.mccaffrey@wsj.com

(END) Dow Jones Newswires

April 15, 2020 18:45 ET (22:45 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

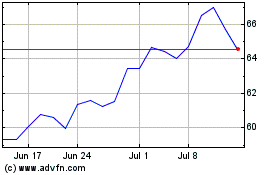

Citigroup (NYSE:C)

Historical Stock Chart

From Mar 2024 to Apr 2024

Citigroup (NYSE:C)

Historical Stock Chart

From Apr 2023 to Apr 2024