Chemed Corporation (Chemed) (NYSE:CHE), which operates VITAS

Healthcare Corporation (VITAS), the nation�s largest provider of

end-of-life care, and Roto-Rooter, the nation�s largest commercial

and residential plumbing and drain cleaning services provider,

today reported financial results for its first quarter ended March

31, 2008, versus the comparable prior-year period, as follows:

Consolidated operating results: Revenue increased 5.5% to $285

million Diluted EPS of $.69 Diluted EPS, excluding special items,

of $.73 VITAS segment operating results: Net Patient Revenue of

$199 million, up 7.9% Average Daily Census (ADC) of 11,691, up 3.4%

Admissions of 15,212, an increase of 7.8% Average Length of Stay in

the quarter of 71.5 days Adjusted EBITDA of $23.6 million, a

decline of 9.3% Roto-Rooter segment operating results: Revenue of

$87 million, an increase of 0.3% Job count of 196,249, a decline of

7.0% Adjusted EBITDA of $15.9 million, a decline of 2.7% VITAS Net

revenue for VITAS was $199 million in the first quarter of 2008,

which is an increase of 7.9% over the prior-year period. This

revenue growth was the result of increased ADC of 3.4%, a Medicare

price increase of approximately 3%, and a favorable shift in

revenue mix from routine home care to high acuity care. Average

revenue per patient per day in the quarter was $186.67, which is

3.5% above the prior-year period. Routine home care reimbursement

and high acuity care averaged $145.42 and $633.10, respectively,

per patient per day in the first quarter of 2008. During the

quarter, high acuity days-of-care was 8.5% of total days-of-care.

Quarterly high acuity days-of-care had averaged between 8.0% and

8.4% in 2007. Any shift in revenue mix will have a noticeable

impact on overall revenue given the significant disparity in

reimbursement. However, given the relatively low profitability

margin on high acuity care, this favorable mix shift had minimal

impact on gross profit and net income in the quarter. VITAS did not

have any billing restrictions related to Medicare Cap for its

first-quarter 2008 operating activity. As of March 31, 2008, VITAS

has not accrued any Medicare billing restrictions for the 2008 or

2007 Cap years. Of VITAS� 35 unique Medicare provider numbers, 30

provider numbers, or 86%, have a Cap cushion greater than 20% for

the 2008 Cap year, four provider numbers are between 10% and 20%,

and one provider number has Cap cushion of approximately 4%. Gross

margin in the first quarter of 2008 was 20.0%. This is 257 basis

points below the first quarter of 2007, excluding the 2007 benefit

from Medicare cap. This margin decline is a combination of

increased expenses related to admissions and increased costs for

direct patient care labor. As part of its growth strategy, VITAS

has expanded its investment in the admissions process. At the end

of the first quarter of 2008, VITAS increased staffing of sales

representatives, admissions coordinators and admissions nurses by

18%. This resulted in an additional $2.1 million of admission

expense in the quarter and equates to 106 basis points of the

decline in gross margin in the quarter. The remaining margin

decline is due to an increase in direct patient care labor. This

additional labor is a combination of salary rate increases for

existing employees as well as excess staffing relative to current

patient census and individual plans of care. In the first quarter

of 2008, total field salary increases averaged 4.2% over the

prior-year period which is largely commensurate with local market

salary requirements. This is above the 3.0% inflation per diem

increase VITAS received from CMS in October 2007. Over the past

several years the CMS calculated inflation factor has been below

the actual inflation on direct patient care costs, primarily wages.

Historically, VITAS has been able to offset this inflation

adjustment shortfall through scale in management systems and

infrastructure. VITAS continues to refine the process of scheduling

direct labor to allow for more daily flexibility with the goal of

ensuring proper levels of staffing notwithstanding length of stay

and census fluctuations. This involves more efficient utilization

of field-based labor management tools designed to meet and respond

to hospice team staffing requirements. VITAS anticipates more

efficient labor management during the second quarter of 2008 with

margins returning to more historical levels in the second half of

2008. Selling, general and administrative expense was $16.1 million

in the first quarter of 2008, which is an increase of 1.5% over the

prior year. Adjusted EBITDA totaled $23.6 million, a decline of

9.3% over the prior year and equates to an adjusted EBITDA margin

of 11.9%. Roto-Rooter Roto-Rooter�s plumbing and drain cleaning

business generated sales of $87 million for the first quarter of

2008, 0.3% higher than the $86 million reported in the comparable

prior-year quarter. Net income for the quarter was $9.1 million.

The first-quarter net income includes a $0.4 million aftertax

charge for a settlement of litigation relating to a 2003 fire that,

for unique technical reasons, was not covered by Roto-Rooter�s

secondary insurance carrier. Excluding this settlement, net income

in the first quarter of 2008 declined approximately 0.6% over the

first quarter of 2007. Adjusted EBITDA in the first quarter of 2008

totaled $15.9 million, a decrease of 2.7% over the first quarter of

2007, and equated to an adjusted EBITDA margin of 18.4%. Job count

in the first quarter of 2008 declined 7.0% when compared to the

prior-year period. Total residential jobs declined 6.4% and

consisted of residential plumbing jobs decreasing 4.9% and

residential drain cleaning jobs declining 7.1%, when compared to

the first quarter of 2007. Residential jobs represent approximately

70% of total job count. Total commercial jobs declined 8.4% with

commercial plumbing job count declining 4.9% and commercial drain

cleaning decreasing 9.9%, over the prior-year quarter. The first

quarter of 2008 clearly indicates recessionary pressures impacting

demand for certain plumbing and drain cleaning services. This is

evidenced by an 11% decline in aggregate call volume tracked in

Roto-Rooter�s two centralized call centers. This decline in call

volume has been partially offset by an increase in call conversion

rate to paid jobs. There is also greater disparity in demand within

the United States. The Southeast region has experienced a 14.1%

decline in commercial jobs while the Northeast had a modest 1.8%

decline in commercial volume. Residential demand is also following

a similar pattern in the Southeast, with job count declining 10.1%

while the remaining regions have experienced a job count decline

ranging between 4.3% and 6.7%. Guidance for 2008 VITAS is estimated

to generate full-year revenue growth from continuing operations,

prior to Medicare Cap, of 8% to 10%. Admissions are estimated to

increase 5% to 8% and full-year adjusted EBITDA margin, prior to

Medicare Cap, is estimated to be 13% to 14%. EBITDA margins are

forecasted to improve sequentially throughout 2008, with an

adjusted EBITDA margin averaging 13.5% to 14.0% in the second half

of 2008. This guidance assumes the hospice industry receives a full

Medicare basket price increase of 3.0% in the fourth quarter of

2008. Full calendar year 2008 Medicare contractual billing

limitations are estimated at $3.75 million. Roto-Rooter is

estimated to generate revenue totaling $343 million to $349

million. This guidance assumes revenue of approximately $83 million

to $85 million in the second and third quarters of 2008 and $90

million to $92 million in the fourth quarter of the year. Adjusted

EBITDA margin for 2008 is estimated in the range of 18.5% to 19.5%.

Based upon these factors, an effective tax rate of 39% and an

average diluted share count of 24.2 million shares, our estimate is

that full-year 2008 earnings per diluted share from continuing

operations, excluding noncash expenses for stock options and

charges or credits not indicative of ongoing operations, will be in

the range of $3.05 to $3.20. Conference Call Chemed will host a

conference call and webcast at 10 a.m., ET, on Friday, April 25,

2008, to discuss the company's quarterly results and provide an

update on its business. The dial-in number for the conference call

is (866) 510-0710 for U.S. and Canadian participants and (617)

597-5378 for international participants. The participant passcode

is 12125956. A live webcast of the call can be accessed on Chemed's

website at www.chemed.com by clicking on Investor Relations Home. A

taped replay of the conference call will be available beginning

approximately two hours after the call's conclusion. It can be

accessed by dialing 888-286-8010 for U.S. and Canadian callers and

617-801-6888 for international callers and will be available for

one week following the live call. The replay passcode is 61838951.

An archived webcast will also be available at www.chemed.com and

will remain available for 14 days following the live call. Chemed

Corporation operates in the healthcare field through its VITAS

Healthcare Corporation subsidiary. VITAS provides daily hospice

services to over 11,600 patients with severe, life-limiting

illnesses. This type of care is focused on making the terminally

ill patient's final days as comfortable and pain-free as possible.

Chemed operates in the residential and commercial plumbing and

drain cleaning industry under the brand name Roto-Rooter.

Roto-Rooter provides plumbing and drain service through

company-owned branches, independent contractors and franchisees in

the United States and Canada. Roto-Rooter also has licensed master

franchisees in Indonesia, Singapore, Japan, and the Philippines.

This press release contains information about Chemed�s EBITDA and

adjusted EBITDA, which are not measures derived in accordance with

generally accepted accounting principles and which exclude

components that are important to understanding Chemed�s financial

performance. Chemed provides EBITDA and adjusted EBITDA to help

investors and others evaluate its operating results, compare its

operating performance with that of similar companies that have

different capital structures and evaluate its ability to meet its

future debt service, capital expenditures and working capital

requirements. Chemed�s EBITDA and adjusted EBITDA should not be

considered in isolation or as a substitute for comparable measures

calculated and presented in accordance with GAAP. A reconciliation

of Chemed�s net income to its adjusted EBITDA is presented in the

tables following the text of this press release. Forward-Looking

Statements Certain statements contained in this press release and

the accompanying tables are "forward-looking statements" within the

meaning of the Private Securities Litigation Reform Act of 1995.

The words "believe," "expect," "hope," "anticipate," "plan" and

similar expressions identify forward-looking statements, which

speak only as of the date the statement was made. Chemed does not

undertake and specifically disclaims any obligation to publicly

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise. These

statements are based on current expectations and assumptions and

involve various risks and uncertainties, which could cause Chemed's

actual results to differ from those expressed in such

forward-looking statements. These risks and uncertainties arise

from, among other things, possible changes in regulations governing

the hospice care or plumbing and drain cleaning industries;

periodic changes in reimbursement levels and procedures under

Medicare and Medicaid programs; difficulties predicting patient

length of stay and estimating potential Medicare reimbursement

obligations; challenges inherent in Chemed's growth strategy; the

current shortage of qualified nurses, other healthcare

professionals and licensed plumbing and drain cleaning technicians;

Chemed�s dependence on patient referral sources; and other factors

detailed under the caption "Description of Business by Segment" or

"Risk Factors" in Chemed�s most recent report on form 10-Q or 10-K

and its other filings with the Securities and Exchange Commission.

You are cautioned not to place undue reliance on such

forward-looking statements and there are no assurances that the

matters contained in such statements will be achieved. CHEMED

CORPORATION AND SUBSIDIARY COMPANIES CONSOLIDATED STATEMENT OF

INCOME (in thousands, except per share data)(unaudited) � � � � � �

� Three Months Ended March 31, 2008 2007 Service revenues and sales

$ 285,268 � $ 270,439 � Cost of services provided and goods sold

(aa) 205,812 188,247 Selling, general and administrative expenses

(aa) 42,727 48,070 Depreciation 5,438 4,715 Amortization 1,450

1,315 Other operating expense/(income) (aa) � - � � (1,138 ) Total

costs and expenses � 255,427 � � 241,209 � Income from operations

29,841 29,230 Interest expense (1,597 ) (3,742 ) Other income--net

� (1,189 ) � 869 � Income before income taxes 27,055 26,357 Income

taxes � (10,235 ) � (10,136 ) Net Income $ 16,820 � $ 16,221 � �

Earnings Per Share (aa) Net income $ 0.70 � $ 0.63 � Average number

of shares outstanding � 23,873 � � 25,716 � � Diluted Earnings Per

Share (aa) Net income $ 0.69 � $ 0.62 � Average number of shares

outstanding � 24,285 � � 26,162 � � � � � � � � � � (aa) Included

in the results of operations are the following credits/(charges)

which may not be indicative of ongoing operations (in thousands,

except per share data): � Three Months Ended March 31, 2008 2007 �

� Cost of services provided and goods sold Unreserved prior year's

insurance claim $ (597 ) $ - Selling, general and administrative

expenses Stock option expense � (1,391 ) � (585 )

Adjustments/(expenses) associated with OIG investigation 15 (66 )

Long-term incentive compensation - (5,447 ) Other - 467 Other

operating expenses/(income) Gain on sale of property � - � � 1,138

� Pretax impact on earnings (1,973 ) (4,493 ) Income tax benefit on

the above 740 1,687 Income tax credit related to prior years � 322

� � - � Aftertax impact on earnings $ (911 ) $ (2,806 ) CHEMED

CORPORATION AND SUBSIDIARY COMPANIES CONSOLIDATED BALANCE SHEET (in

thousands, except per share data)(unaudited) � � � � � � � March

31, 2008 2007 (bb) Assets Current assets Cash and cash equivalents

$ 29,704 $ 30,137 Accounts receivable less allowances 87,004 83,280

Inventories 7,439 6,752 Current deferred income taxes 14,996 21,595

Prepaid expenses and other current assets � 9,035 � � 9,110 � Total

current assets 148,178 150,874 Investments of deferred compensation

plans held in trust 29,524 27,736 Notes receivable - 14,701

Properties and equipment, at cost less accumulated depreciation

72,910 69,295 Identifiable intangible assets less accumulated

amortization 64,168 68,205 Goodwill 438,656 435,040 Other assets �

15,467 � � 16,194 � Total Assets $ 768,903 � $ 782,045 � �

Liabilities Current liabilities Accounts payable $ 46,450 $ 53,341

Current portion of long-term debt 10,166 164 Income taxes 10,100

9,410 Accrued insurance 37,600 39,889 Accrued compensation 31,195

29,110 Other current liabilities � 14,474 � � 26,653 � Total

current liabilities 149,985 158,567 Deferred income taxes 5,465

24,970 Long-term debt 212,070 150,235 Deferred compensation

liabilities 29,653 27,157 Other liabilities � 5,540 � � 5,382 �

Total Liabilities � 402,713 � � 366,311 � Stockholders' Equity

Capital stock 29,379 29,036 Paid-in capital 271,296 260,641

Retained earnings 293,707 234,914 Treasury stock, at cost (230,594

) (111,293 ) Deferred compensation payable in Company stock � 2,402

� � 2,436 � Total Stockholders' Equity � 366,190 � � 415,734 �

Total Liabilities and Stockholders' Equity $ 768,903 � $ 782,045 �

� Book Value Per Share $ 15.43 � $ 16.43 � � � � � � � � � � � � �

� (bb) Reclassified to conform to 2008 presentation. CHEMED

CORPORATION AND SUBSIDIARY COMPANIES CONSOLIDATED STATEMENT OF CASH

FLOWS (in thousands)(unaudited) � � � � � � � � � � Three Months

Ended March 31, 2008 2007 (bb) Cash Flows from Operating Activities

Net income $ 16,820 $ 16,221 Adjustments to reconcile net income to

net cash provided/(used) by operating activities: Depreciation and

amortization 6,888 6,030 Provision for uncollectible accounts

receivable 2,002 2,084 Provision for deferred income taxes (1,126 )

(345 ) Amortization of debt issuance costs 254 455 Noncash

long-term incentive compensation - 4,719 Changes in operating

assets and liabilities, excluding amounts acquired in business

combinations: Decrease in accounts receivable 12,112 5,275 Increase

in inventories (843 ) (174 ) Decrease in prepaid expenses and other

current assets 1,488 858 Decrease in accounts payable and other

current liabilities (5,679 ) (9,091 ) Increase in income taxes

6,677 9,538 Increase in other assets (293 ) (2,102 ) Increase in

other liabilities 532 2,218 Excess tax benefit on share-based

compensation (825 ) (611 ) Other sources/(uses) � 1,524 � � (375 )

Net cash provided by operating activities � 39,531 � � 34,700 �

Cash Flows from Investing Activities Net proceeds/(uses) from the

disposition of discontinued operations 9,556 (3,876 ) Capital

expenditures (3,891 ) (5,764 ) Proceeds from sales of property and

equipment 19 2,975 Other uses � (122 ) � (361 ) Net cash

provided/(used) by investing activities � 5,562 � � (7,026 ) Cash

Flows from Financing Activities Purchases of treasury stock (16,263

) (24,199 ) Repayment of long-term debt (2,595 ) (141 ) Dividends

paid (1,449 ) (1,555 ) Decrease in cash overdrafts payable (963 )

(1,608 ) Excess tax benefit on share-based compensation 825 611

Other sources � 68 � � 81 � Net cash used by financing activities �

(20,377 ) � (26,811 ) Increase in Cash and Cash Equivalents 24,716

863 Cash and cash equivalents at beginning of year � 4,988 � �

29,274 � Cash and cash equivalents at end of period � 29,704 � $

30,137 � � � � � � � � � � � � � (bb) Reclassified to conform to

2008 presentation. CHEMED CORPORATION AND SUBSIDIARY COMPANIES

CONSOLIDATING STATEMENT OF INCOME FOR THE THREE MONTHS ENDED MARCH

31, 2008 AND 2007 (in thousands)(unaudited) � � � � � � � � �

Chemed VITAS Roto-Rooter Corporate Consolidated 2008 � Service

revenues and sales $ 198,585 � $ 86,683 � $ - � $ 285,268 � Cost of

services provided and goods sold 158,803 47,009 - 205,812 Selling,

general and administrative expenses (a) 16,147 23,771 2,809 42,727

Depreciation 3,280 2,082 76 5,438 Amortization � 996 � � 13 � � 441

� � 1,450 � Total costs and expenses � 179,226 � � 72,875 � � 3,326

� � 255,427 � Income/(loss) from operations 19,359 13,808 (3,326 )

29,841 Interest expense (51 ) (83 ) (1,463 ) (1,597 ) Intercompany

interest income/(expense) 1,365 1,042 (2,407 ) - Other income�net �

23 � � 28 � � (1,240 ) � (1,189 ) Income/(loss) before income taxes

20,696 14,795 (8,436 ) 27,055 Income taxes (a) � (7,398 ) � (5,700

) � 2,863 � � (10,235 ) Net income/(loss) $ 13,298 � � 9,095 � �

(5,573 ) � 16,820 � � � 2007 (f) Service revenues and sales $

184,049 � $ 86,390 � $ - � $ 270,439 � Cost of services provided

and goods sold 142,095 46,152 - 188,247 Selling, general and

administrative expenses (b) 15,904 23,542 8,624 48,070 Depreciation

2,538 2,101 76 4,715 Amortization 996 15 304 1,315 Other operating

expense/(income) (b) � - � � - � � (1,138 ) � (1,138 ) Total costs

and expenses � 161,533 � � 71,810 � � 7,866 � � 241,209 �

Income/(loss) from operations 22,516 14,580 (7,866 ) 29,230

Interest expense (36 ) (83 ) (3,623 ) (3,742 ) Intercompany

interest income/(expense) 1,712 1,156 (2,868 ) - Other income�net �

(88 ) � 50 � � 907 � � 869 � Income/(loss) before income taxes

24,104 15,703 (13,450 ) 26,357 Income taxes (b) � (9,117 ) � (6,197

) � 5,178 � � (10,136 ) Net income/(loss) $ 14,987 � $ 9,506 � $

(8,272 ) $ 16,221 � � The "Footnotes to Financial Statements" are

integral parts of this financial information. CHEMED CORPORATION

AND SUBSIDIARY COMPANIES CONSOLIDATING SUMMARY OF EBITDA FOR THE

THREE MONTHS ENDED MARCH 31, 2008 AND 2007 (in

thousands)(unaudited) � � � � � � � � � � � � Chemed VITAS

Roto-Rooter Corporate Consolidated 2008 Net income/(loss) $ 13,298

$ 9,095 $ (5,573 ) $ 16,820 Add/(deduct): Interest expense 51 83

1,463 1,597 Income taxes 7,398 5,700 (2,863 ) 10,235 Depreciation

3,280 2,082 76 5,438 Amortization � 996 � � 13 � � 441 � � 1,450 �

EBITDA 25,023 16,973 (6,456 ) 35,540 Add/(deduct): Unreserved

insurance claim - 597 - 597 Legal expenses of OIG investigation (15

) - - (15 ) Stock option expense - - 1,391 1,391 Advertising cost

adjustment (c) - (570 ) - (570 ) Interest income (38 ) (18 ) (281 )

(337 ) Intercompany interest income/(expense) � (1,365 ) � (1,042 )

� 2,407 � � - � Adjusted EBITDA $ 23,605 � $ 15,940 � $ (2,939 ) $

36,606 � � 2007 (f) Net income/(loss) $ 14,987 $ 9,506 $ (8,272 ) $

16,221 Add/(deduct): Interest expense 36 83 3,623 3,742 Income

taxes 9,117 6,197 (5,178 ) 10,136 Depreciation 2,538 2,101 76 4,715

Amortization � 996 � � 15 � � 304 � � 1,315 � EBITDA 27,674 17,902

(9,447 ) 36,129 Add/(deduct): Long-term incentive compensation - -

5,447 5,447 Gain on sale of property - - (1,138 ) (1,138 ) Legal

expenses of OIG investigation 66 - - 66 Stock option expense - -

585 585 Advertising cost adjustment (c) - (297 ) - (297 ) Interest

income (13 ) (59 ) (695 ) (767 ) Intercompany interest

income/(expense) (1,712 ) (1,156 ) 2,868 - Other � - � � - � � (467

) � (467 ) Adjusted EBITDA $ 26,015 � $ 16,390 � $ (2,847 ) $

39,558 � � The "Footnotes to Financial Statements" are integral

parts of this financial information. CHEMED CORPORATION AND

SUBSIDIARY COMPANIES RECONCILIATION OF ADJUSTED NET INCOME FOR THE

THREE MONTHS ENDED MARCH 31, 2008 AND 2007 (in thousands, except

per share data)(unaudited) � � � � � � � � � 2008 2007 Net income

as reported $ 16,820 $ 16,221 � Add/(deduct): Aftertax cost of

long-term incentive compensation - 3,414 Aftertax cost of legal

expenses/(adjustments) of OIG investigation (9 ) 41 Aftertax stock

option expense 884 371 Aftertax gain on sale of property - (724 )

Aftertax other - (296 ) Income tax credit related to prior years

(322 ) - Aftertax unreserved insurance cost � 358 � � - � �

Adjusted Net Income $ 17,731 � $ 19,027 � � � Earnings Per Share As

Reported Net Income $ 0.70 � $ 0.63 � Average number of shares

outstanding � 23,873 � � 25,716 � Diluted Earnings Per Share As

Reported Net Income $ 0.69 � $ 0.62 � Average number of shares

outstanding � 24,285 � � 26,162 � � � Adjusted Earnings Per Share

Net Income $ 0.74 � $ 0.74 � Average number of shares outstanding �

23,873 � � 25,716 � Adjusted Diluted Earnings Per Share Net Income

$ 0.73 � $ 0.73 � Average number of shares outstanding � 24,285 � �

26,162 � � The "Footnotes to Financial Statements" are integral

parts of this financial information. CHEMED CORPORATION AND

SUBSIDIARY COMPANIES OPERATING STATISTICS FOR VITAS SEGMENT FOR THE

THREE MONTHS ENDED MARCH 31, 2008 AND 2007 (unaudited) � � � � � �

2008 2007 OPERATING STATISTICS Net revenue ($000) (d) Homecare $

141,617 $ 131,548 Inpatient 25,971 23,462 Continuous care � 30,997

� 28,567 Total before Medicare cap allowance 198,585 $ 183,577

Medicare cap allowance � - � 472 Total $ 198,585 $ 184,049 Net

revenue as a percent of total before Medicare cap allowance

Homecare 71.3 % 71.6 % Inpatient 13.1 12.8 Continuous care � 15.6 �

15.6 Total before Medicare cap allowance 100.0 100.0 Medicare cap

allowance � - � 0.3 Total � 100.0 % � 100.3 % Average daily census

("ADC") (days) Homecare 7,154 6,786 Nursing home � 3,548 � 3,574

Routine homecare 10,702 10,360 Inpatient 453 426 Continuous care �

536 � 523 Total � 11,691 � 11,309 � Total Admissions 15,212 14,110

Total Discharges 14,992 14,051 Average length of stay (days) 71.5

76.9 Median length of stay (days) 13.0 13.0 ADC by major diagnosis

Neurological 32.5 % 33.3 % Cancer 20.0 19.7 Cardio 13.0 14.6

Respiratory 6.9 7.0 Other � 27.6 � 25.4 Total � 100.0 % � 100.0 %

Admissions by major diagnosis Neurological 19.0 % 18.9 % Cancer

33.4 33.6 Cardio 11.9 13.3 Respiratory 8.5 7.8 Other � 27.2 � 26.4

Total � 100.0 % � 100.0 % Direct patient care margins (e) Routine

homecare 49.5 % 50.8 % Inpatient 19.3 20.1 Continuous care 16.5

20.0 Homecare margin drivers (dollars per patient day) Labor costs

$ 52.26 $ 49.12 Drug costs 7.49 8.18 Home medical equipment 6.17

5.75 Medical supplies 2.57 2.17 Inpatient margin drivers (dollars

per patient day) Labor costs $ 266.18 $ 252.42 Continuous care

margin drivers (dollars per patient day) Labor costs $ 509.62 $

464.54 Bad debt expense as a percent of revenues 0.9 % 0.9 %

Accounts receivable -- days of revenue outstanding 45.5 38.1 � The

"Footnotes to Financial Statements" are integral parts of this

financial information. CHEMED CORPORATION AND SUBSIDIARY COMPANIES

FOOTNOTES TO FINANCIAL STATEMENTS FOR THE THREE MONTHS ENDED MARCH

31, 2008 AND 2007 (unaudited) � � � � � � � � � � � (a) Included in

the results of operations for the three months ended March 31, 2008

are the following significant credits/(charges) which may not be

indicative of ongoing operations (in thousands): � VITAS

Roto-Rooter Corporate Consolidated � Cost of services provided and

goods sold Unreserved prior year's insurance claim $ - $ (597) $ -

$ (597) Selling, general and administrative expenses Stock option

expense � - � - � (1,391) � (1,391) Adjustments/ (expenses)

associated with OIG investigation � 15 � - � - � 15 Pretax impact

on earnings 15 (597) (1,391) (1,973) Income tax benefit/(charge) on

the above (6) 239 507 740 Income tax credit related to prior years

� 322 � - � - � 322 Aftertax impact on earnings $ 331 $ (358) $

(884) $ (911) � (b) Included in the results of operations for the

three months ended March 31, 2007 are the following significant

credits/(charges) which may not be indicative of ongoing operations

(in thousands): � VITAS Corporate Consolidated Selling, general and

administrative expenses Long-term incentive compensation $ - $

(5,447) $ (5,447) Costs associated with OIG investigation (66) -

(66) Stock option expense - (585) (585) Other - 467 467 Other

operating expenses/(income) Gain on sale of property � - � 1,138 �

1,138 Pretax impact on earnings (66) (4,427) (4,493) Income tax

benefit/(charge) on the above � 25 � 1,662 � 1,687 Aftertax impact

on earnings $ (41) $ (2,765) $ (2,806) � (c) Under Generally

Accepted Accounting Principles ("GAAP"), the Roto-Rooter segment

expenses all advertising, including the cost of telephone

directories, immediately upon the initial release of the

advertising. Telephone directories are generally in circulation 12

months. If a directory is in circulation for a time period greater

or less than 12 months, the publisher adjusts the directory billing

for the change in billing period. The timing of when a telephone

directory is published can and does fluctuate significantly on a

quarterly basis. This "direct expensing" results in significant

fluctuations in quarterly advertising expense. In the first

quarters of 2008 and 2007, GAAP advertising expense for Roto-Rooter

totaled $5,456,000 and $5,193,000, respectively. If the expense of

the telephone directories were spread over the periods they are in

circulation, advertising expense for the first quarters of 2008 and

2007 would total $6,026,000 and $5,490,000, respectively. � (d)

VITAS has 5 large (greater than 450 ADC), 17 medium (greater than

200 but less than 450 ADC) and 21 small (less than 200 ADC) hospice

programs. There is one program continuing at March 31, 2008 with

Medicare cap cushion of less than 10% for the 2008 measurement

period. � (e) Amounts exclude indirect patient care and

administrative costs, as well as Medicare Cap billing limitation. �

(f) Reclassified to conform to 2008 presentation.

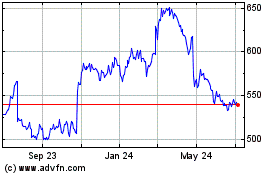

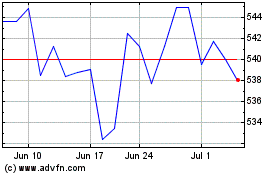

Chemed (NYSE:CHE)

Historical Stock Chart

From Aug 2024 to Sep 2024

Chemed (NYSE:CHE)

Historical Stock Chart

From Sep 2023 to Sep 2024