Schwab Expands Its Fixed Income Offering With the Launch of Five Wasmer Schroeder™ Strategies

November 18 2021 - 8:35AM

Business Wire

New additions include two positive impact

strategies, bringing new choices for clients who want to align

their investments with their values

Schwab Asset Management, the asset management arm of The Charles

Schwab Corporation, today announced the expansion of its suite of

fixed income separately managed account strategies available to

Charles Schwab & Co., Inc. (Schwab) clients with five Wasmer

Schroeder Strategies, including two positive impact strategies.

The positive impact strategies include the Wasmer Schroeder

Positive Impact Bond strategy (PIBX), a taxable, limited duration

strategy, and the Wasmer Schroeder Positive Impact Tax Exempt

strategy (PIFI), an intermediate duration, high credit quality

municipal strategy. Known for its rigorous approach to fixed income

management, the Wasmer Schroeder team employs a distinctive

use-of-proceeds methodology to identify bonds that finance projects

and initiatives with positive social or environmental impacts,

distinguishing Wasmer Schroeder strategies from offerings that rely

solely on third-party ESG ratings or scoring lists.

“Generating income in the current environment is challenging,

and investors need solutions that address a wide variety of

objectives as well as unique preferences,” said John Sturiale, Head

of Product Management and Strategy, Schwab Asset Management. “We

are pleased to expand the universe of fixed income choices for

Schwab clients and deliver more options for those who wish to make

an impact with their portfolio.”

Schwab is also adding three strategies that focus on higher

yielding sectors than Wasmer Schroeder’s core intermediate

products, providing new options for clients seeking to generate

additional income. These additions include the Intermediate

Strategic Tax Exempt strategy (ISTEFI) along with the Intermediate

IG Credit (ITTX+) and Multi-Sector Income (MITX) strategies, both

of which are taxable strategies.

Schwab acquired Wasmer Schroeder’s comprehensive lineup of tax

exempt and taxable strategies and brought on its deeply experienced

investment team in July 2020. The launch of additional strategies

delivers on Schwab’s objective of providing clients with more fixed

income choices and compelling value through the Wasmer Schroeder

acquisition.

The Wasmer Schroeder Strategies now available to Schwab clients

include a total of 25 strategies, including nine actively managed

strategies, two positive impact strategies, two ultra-short

strategies, and a series of 12 bond ladders. For more information,

visit www.schwab.com/wasmer-schroeder.

About Schwab Asset Management

Schwab Asset Management offers a focused lineup of competitively

priced ETFs, mutual funds and separately managed account strategies

designed to serve the central needs of most investors. As part of

the Charles Schwab organization, we champion the needs of investors

and seek to enhance the financial lives of our clients in all we

do. Operating our business through clients’ eyes and putting them

at the center of our decisions, we aim to deliver exceptional

experiences to investors and the financial professionals who serve

them. Established in 1989, Schwab Asset Management manages more

than $640.5 billion in assets and draws on the knowledge and

expertise of more than 119 investment professionals (figures as of

9/30/2021). More information is available at

www.schwabassetmanagement.com.

About Charles Schwab

At Charles Schwab we believe in the power of investing to help

individuals create a better tomorrow. We have a history of

challenging the status quo in our industry, innovating in ways that

benefit investors and the advisors and employers who serve them,

and championing our clients’ goals with passion and integrity.

More information is available at www.aboutschwab.com. Follow us

on Twitter, Facebook, YouTube and LinkedIn.

Disclosures:

Schwab Asset Management is the dba name for Charles Schwab

Investment Management, Inc. (CSIM). Schwab Asset Management is a

part of the broader Schwab Asset Management Solutions organization

(SAMS), a collection of business units of The Charles Schwab

Corporation aligned by a common function—asset management-related

services—under common leadership. CSIM and Charles Schwab &

Co., Inc. (Schwab) Member SIPC are separate but affiliated

companies and subsidiaries of The Charles Schwab Corporation.

Please refer to the Charles Schwab Investment Management,

Inc. Wasmer Schroeder Strategies Disclosure Brochure for additional

information. Wasmer Schroeder Strategies are available through

Schwab's Managed Account Connection® program ("Connection"). Please

read Schwab's disclosure brochure for important information and

disclosures relating to Connection and Schwab Managed Account

Services™.

Investments in managed accounts should be considered in view of

a larger, more diversified investment portfolio. There are risks

associated with any investment approach, and the Wasmer Schroeder

Strategies have their own set of risks. The Wasmer Schroeder

Strategies invests primarily in fixed income instruments and as

such the strategies are subject to various risks including but not

limited to interest rate risk, reinvestment risk, credit risk,

default risk and event risk. Fixed income securities are subject to

increased loss of principal during periods of rising interest

rates. Fixed income investments are subject to various other risks

including changes in credit quality, market valuations, liquidity,

prepayments, early redemption, corporate events, tax ramifications

and other factors.

Tax exempt bonds are not necessarily a suitable investment for

all persons. Information related to a security's tax-exempt status

(federal and in-state) is obtained from third-parties and CSIM does

not guarantee its accuracy. Tax-exempt income may be subject to the

Alternative Minimum Tax (AMT). Capital appreciation from bond funds

and discounted bonds may be subject to state or local taxes.

Capital gains are not exempt from federal income tax.

Because environmental, social and governance (ESG) strategies

exclude some securities, ESG-focused products may not be able to

take advantage of the same opportunities or market trends as

products that do not use such strategies. Additionally, the

criteria used to select companies for investment may result in

investing in securities, industries or sectors that underperform

the market as a whole.

(1121-1GTV)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211118005206/en/

Christine Hudacko Charles Schwab 415-961-3790

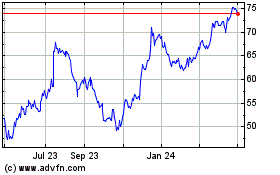

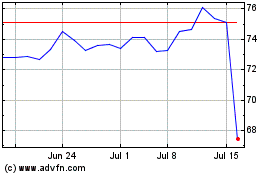

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2023 to Apr 2024