Signs of younger investor engagement offer

hope

The results of the 2020 Ariel-Schwab Black Investor Survey

reveal that Black Americans are not benefitting from stock market

growth at the same rate as white Americans at similar income

levels. The deep-rooted gap in participation between the groups

persists, with 55 percent of Black Americans and 71 percent of

white Americans reporting stock market investments. This disparity,

compounded over time, means that middle-class Black Americans will

have less money saved for retirement and less wealth to pass onto

the next generation than their white peers.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20210225005330/en/

For more than 20 years, the Ariel-Schwab Black Investor Survey

has compared attitudes and behaviors on saving and investing among

Black and white Americans. African American participation in the

stock market stands at its lowest level in the history of the

survey. According to Mellody Hobson, co-CEO and President of Ariel

Investments, and the driving force behind this study, “Black

Americans are already behind the eight ball, and it is

disheartening to see that at current savings and investing rates,

the wealth gap will continue to expand, endangering our futures and

leaving our families exposed.”

In a year like no other, however, there is also evidence of

growing engagement in the stock market by younger Black Americans,

with 63 percent under the age of 40 now participating in the stock

market, equal to their white counterparts. The closing of this gap

among younger investors is being driven by new investors: three

times as many Black investors as white investors (15% vs. 5%)

report having invested in the market for the first time in 2020.

Twenty-nine percent of Black investors under the age of 40 were new

to investing in 2020 compared to 16 percent of whites.

Rick Wurster, Executive Vice President, Schwab Asset Management

Solutions, says, “These findings are encouraging for younger Black

investors, but there is much work to be done to ensure that Black

Americans have access to the resources they need to stay engaged

and successfully investing for the long-term.”

His colleague Carrie Schwab-Pomerantz, President of Charles

Schwab Foundation, agrees, “Many Americans are struggling to make

ends meet and don’t have access to educational resources and tools

that can help them avoid financial pitfalls and get on the right

track. Financial literacy is a great equalizer, and a life skill

that everyone needs. We have a responsibility to help people

develop the knowledge and skills to become financially confident

and remain lifelong savers and investors.”

401(k) Plans and Beyond

Over the last several decades, 401(k) plans have become an

important gateway to investing for many Black Americans, with 63

percent of Black investors having first invested in the stock

market through a retirement plan. Ownership rates of 401(k) plans

are now similar between Black and white Americans (53% vs. 55%).

But savings rates show meaningful differences. Specifically, white

401(k) plan participants invest 26 percent more per month toward

their retirement accounts than Black 401(k) plan participants ($291

vs. $231).

Beyond investing, the survey finds that Black Americans are less

likely than white Americans to own almost every kind of financial

vehicle, with the exception of whole life insurance, which is

favored in the Black community. They are also less likely than

white Americans to have written wills, financial plans, or

retirement plans.

For Black Americans, disparities grow every month; while they

save $393 overall per month, whites are saving 76 percent more, at

$693 per month. Even Black Americans who earn more than $100,000 a

year consistently save or invest considerably less than their white

counterparts at the same income level.

“These differences are not new. Black Americans are

disadvantaged from the outset when it comes to building wealth,”

says Hobson. She notes that while 51 percent of white Americans say

they have inherited wealth, just 23 percent of Black Americans

have.

Schwab-Pomerantz points out that more white Americans (44%) than

Black Americans (33%) are focused on preparing for retirement as

their most important financial goal. “For so many Americans, the

401(k) is the first step to becoming an investor, and while it’s

encouraging to see greater parity among those who have access to

this opportunity through their workplace, it’s incumbent on

employers and all of us in our industry to help 401(k) owners save

more throughout their earning years,” she says.

Trust Remains an Issue

Trust in the financial services industry continues to affect

stock market participation among Black Americans. While similar

proportions of Black and white investors believe that financial

services institutions are not trustworthy (23% vs. 20%), only 35

percent of African American investors feel they are treated with

respect by financial institutions versus 62 percent for white

investors. Additionally, Black Americans are considerably more

likely to cite the importance of racial diversity within the

employee ranks at investment firms (63% vs 27%).

Black Americans are less likely to work with financial advisors

(21% vs. 45% of whites), but Rick Wurster points out that the

majority of Black investors who do work with a financial advisor

say they feel like they are treated with respect by financial

institutions, and he believes that encouraging these relationships

will lead to positive change. “I believe this is a clear call to

action for our industry that these partnerships should be

nourished, because they can be truly impactful,” he says.

Belts Tightened but Optimism Prevails

The pandemic, not surprisingly, affected Black and white

Americans in different ways financially. While both groups report a

sharply increased focus on saving for emergencies compared to prior

years, the pandemic’s impact on the economy caused Black Americans

to take action in greater numbers than white Americans.

Black Americans were more likely to cut spending on both extras

(50% vs. 41%) and basics (19% vs. 13%). Student loan delay or

deferral was reported as being three times more common among Black

Americans (16%) than whites (5%).

Despite this, a sizable minority of Black Americans – and

significantly more than white Americans – were forced to tap their

savings to make ends meet. More than twice as many Black 401(k)

plan participants (12% vs. 5%) borrowed money from their retirement

accounts. Almost twice as many Black Americans (18% vs. 10%) dipped

into an emergency fund. And nine percent of Black Americans (vs. 4%

of white Americans) say they asked their family or friends for

financial support in 2020, while 18 percent of Black Americans and

13 percent of white Americans acknowledged giving financial support

to family and friends last year.

Hobson emphasizes, “The pandemic has further exposed fault lines

between the fortunes of middle-class Black and white Americans.”

She notes although real problems persist, Black Americans remain

eternally optimistic: when asked to forecast their personal

financial situation in 2021 compared to 2020, 60 percent of Black

Americans say they feel their situations will improve, compared to

only 40 percent of white Americans who felt the same way.

This optimism, coupled perhaps with the unique circumstances of

the 2020 market, created an opportunity for historically

underinvested Black Americans to help one another learn more about

investing. “Not only are Black Americans beginning to walk the

walk, we are also beginning to talk the talk,” adds Hobson, noting

that Black Americans are now much more likely to discuss the stock

market with their families than in years past.

Black Americans

White Americans

Discussed Stock Market Growing

Up

10%

23%

Discuss Stock Market Now

37%

36%

These dinner conversations appear to be paying off: more than

twice as many Black investors under the age of 40 (18% vs. 7% of

older Black investors) say they discussed the stock market growing

up. Overall, about half of all Black investors (49%) say they are

the first in their families to ever invest, compared to 39 percent

of white investors.

Committed to Diversity and Inclusion

As the first minority-owned investment firm established in the

United States, Ariel Investments is a leader in the financial

services industry as it relates to diversity, equity and inclusion

issues. Today, the firm is 89 percent owned by women and

minorities, with women comprising over half of the

organization—including 14 holding executive or senior level

positions. Ariel’s efforts extend into the boardrooms of the

companies it owns, cementing their legacy as change agents in the

asset management industry, and by having helped place over 50

diverse individuals on portfolio company boards. Eighteen years

ago, Ariel partnered with Russell Reynolds Associates to create the

Black Corporate Directors Conference, bringing together leading

Fortune 500 Black and Latinx directors to advance the civil rights

agenda in the boardroom and across all business sectors.

Since its founding, Ariel has encouraged a firmwide policy of

community involvement and civic responsibility. It has created

unique educational opportunities for economically disadvantaged

youth through the Ariel Education Initiative, which provides

financial educational opportunities and resources for low-income,

inner-city youth, which may have been otherwise unavailable.

Additionally, the Ariel Community Academy (ACA) was created as a

small Chicago Public School based on a

student-family-school-community partnership. Lastly, in 2017,

Founder John W. Rogers, Jr., partnered with the University of

Chicago on a financial internship program that connects interns

from underrepresented backgrounds with endowment, foundation and

non-profit investment offices across the country.

Charles Schwab has been committed to creating greater access in

financial services since day one. Schwab is a leader in delivering

financial education through its partnerships with Boys and Girls

Clubs of America, DonorsChoose.org, and SIFMA Foundation, as well

as its free personal finance resources available at

SchwabMoneyWise.com. In addition to its work with Ariel

Investments, Schwab is advancing its diversity and inclusion

efforts by:

- Mobilizing a special corps of employee volunteers who will be

trained to deliver financial education programs, with a special

focus on underrepresented teens from low-income backgrounds

- Funding a $3.5 million endowed scholarship program – funded

through Charles Schwab Foundation – to provide financial assistance

and career opportunities to college students from underrepresented

communities

- Providing mentorship opportunities to support career growth

opportunities for employees of color

About the Survey

The online survey was conducted in December 2020 by Helical

Research among 2,104 Americans age 18 and older with $50,000 or

more household income in 2019. The margin of error for the total

survey sample is two percentage points. Detailed survey results can

be found here. Historical survey data can be found here.

About Ariel Investments

Ariel Investments, LLC is a global value-based asset management

firm founded in 1983. The firm is headquartered in Chicago, with

offices in New York City, Washington, D.C., and Sydney. As of

January 31, 2021, Ariel’s firm-wide assets under management totaled

approximately $15 billion. The firm serves individual and

institutional investors through five no-load mutual funds and 11

separate account strategies. For more information, please visit

Ariel’s website at arielinvestments.com.

About Charles Schwab

At Charles Schwab we believe in the power of investing to help

individuals create a better tomorrow. We have a history of

challenging the status quo in our industry, innovating in ways that

benefit investors and the advisors and employers who serve them,

and championing our clients’ goals with passion and integrity.

More information is available at www.aboutschwab.com. Follow us

on Twitter, Facebook, YouTube and LinkedIn.

About The Charles Schwab Corporation

The Charles Schwab Corporation (NYSE: SCHW) is a leading

provider of financial services, with 30.5 million active brokerage

accounts, 2.1 million corporate retirement plan participants, 1.5

million banking accounts, and $6.8 trillion in client assets as of

January 31, 2021. Through its operating subsidiaries, the company

provides a full range of wealth management, securities brokerage,

banking, asset management, custody, and financial advisory services

to individual investors and independent investment advisors. Its

broker-dealer subsidiaries, Charles Schwab & Co., Inc., TD

Ameritrade, Inc., and TD Ameritrade Clearing, Inc., (members SIPC,

https://www.sipc.org), and their affiliates offer a complete range

of investment services and products including an extensive

selection of mutual funds; financial planning and investment

advice; retirement plan and equity compensation plan services;

referrals to independent, fee-based investment advisors; and

custodial, operational and trading support for independent,

fee-based investment advisors through Schwab Advisor Services. Its

primary banking subsidiary, Charles Schwab Bank, SSB (member FDIC

and an Equal Housing Lender), provides banking and lending services

and products. More information is available at

https://www.aboutschwab.com.

TD Ameritrade, Inc. and TD Ameritrade Clearing, Inc. are

separate but affiliated companies and subsidiaries of TD Ameritrade

Holding Corporation. TD Ameritrade Holding Corporation is a wholly

owned subsidiary of The Charles Schwab Corporation. TD Ameritrade

is a trademark jointly owned by TD Ameritrade IP Company, Inc. and

The Toronto-Dominion Bank.

About Charles Schwab Foundation

Charles Schwab Foundation is an independent nonprofit public

benefit corporation, funded by The Charles Schwab Corporation and

classified by the IRS as a charity under section 501(c)(3) of the

Internal Revenue Code. The Foundation is neither a part of Charles

Schwab & Co., Inc. (member SIPC) nor its parent company, The

Charles Schwab Corporation. Its mission is to educate, volunteer

and advocate on behalf of those in need so that everyone has the

opportunity to achieve financial well-being. More information is

available at https://www.aboutschwab.com/citizenship.

0221-1NK4

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210225005330/en/

Christina Sciarrino Ariel Investments 321-277-2854

csciarrino@arielinvestments.com Stephanie Corns Charles Schwab

415-629-0700 stephanie.corns@schwab.com

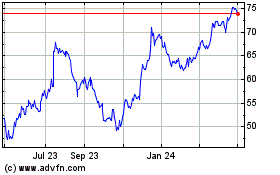

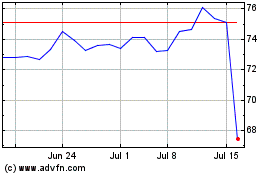

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2023 to Apr 2024