Outages Continue to Plague Online Brokerages -- 2nd Update

January 27 2021 - 5:55PM

Dow Jones News

By Geoffrey Rogow and Dawn Lim

Outages and interruptions rattled investors using some of the

largest online brokers on Wednesday.

Charles Schwab Corp., Vanguard Group, Fidelity Investments and

several other online brokerages reported service disruptions,

either to clients directly or on their social-media accounts. The

new technical issues come after brokerage customers already

encountered brief delays executing trades this week or temporarily

lost access to vital account information.

The service disruptions have come during a period of frenetic

trading, with shares of companies such as GameStop Corp. shooting

wildly higher. The volatility has been largely driven by individual

investors and unmoored to the fundamentals of the underlying

companies. The rising prices have prompted bearish investors to buy

back shares they had sold short to cut their losses, pushing the

stock higher still.

None of the brokerages commented on the reason for the issues.

Some surprised customers by imposing new guardrails on trading.

On Wednesday, TD Ameritrade told customers that the firm was

blocking some trades on GameStop, AMC Entertainment Holdings Inc.

and certain securities.

"We made these decisions out of an abundance of caution amid

unprecedented market conditions and other factors," read a

notification to clients when they logged into their accounts.

Schwab, which recently bought TD Ameritrade but runs an

independent brokerage for now, also restricted certain transactions

in GameStop and other securities. "It is not uncommon for Charles

Schwab to place restrictions on some transactions in certain

securities in the interest of helping mitigate risk for our

clients," a Schwab spokeswoman said.

Schwab clients have been barred since Jan. 13 from using

GameStop as collateral for a margin loan.

More broadly, several of the firms have sent notices about the

larger outages to customers.

"Due to a technical issue, some clients are experiencing issues

with online trading. We're working to resolve the issue as quickly

as possible. Please do not place trades again, as duplicate orders

may be created. We apologize for any inconvenience," a notice on

Charles Schwab's Twitter account read Wednesday morning. The firm

told users on social media later in the day that "access has been

restored to our platforms."

A spokeswoman for Fidelity said Wednesday it was "aware that

some clients have experienced issues this morning and we are

working on a resolution. We apologize for the inconvenience."

Later, the spokeswoman said the issue had been resolved, without

elaborating.

A spokeswoman for Vanguard said: "We understand some Vanguard

clients experienced difficulties accessing their accounts this

morning. The issue has been resolved and we thank clients for their

patience."

Individual investors have driven a surge in trading volumes for

many online and retail-focused brokerages in the past year. Devin

Ryan, an analyst with JMP Securities, said individual trading

volume hit a record last year, with many brokers and wealth

managers adding two or even three times as many new accounts as in

2019.

Still, most trading is controlled by institutional

investors.

"These brokers are not systemically important players. They

aren't critical to the functioning of markets. But they do speak to

investor confidence," said Paul Rowady, director of research for

market research and advisory firm Alphacution Research

Conservatory.

David DeKok, 67, a nonfiction author who lives in Harrisburg,

Pa., said that when tried to trade Monday on his Schwab account, he

got a message that he entered the wrong ticker even though he

hadn't. On Wednesday, he tried to sell out of an investment that

was falling -- and gave up after receiving that error message.

"I take it in stride," he said. "If this keeps happening, I'd

consider changing platforms."

A Schwab spokeswoman said the company "will work with all

clients to ensure their situations are made right."

Write to Geoffrey Rogow at geoffrey.rogow@wsj.com and Dawn Lim

at dawn.lim@wsj.com

(END) Dow Jones Newswires

January 27, 2021 17:40 ET (22:40 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

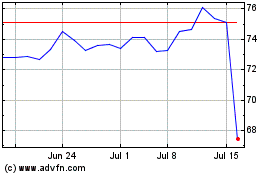

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

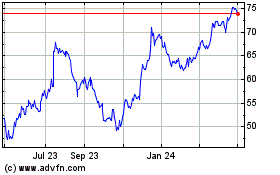

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2023 to Apr 2024