The Charles Schwab Corporation released its Monthly Activity

Report today. Company highlights for the month of November 2020

include:

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20201214005143/en/

- Core net new assets brought to the company by new and existing

clients totaled $32.1 billion. Core net new assets excluding mutual

fund clearing totaled $31.5 billion.

- Total client assets were $6.42 trillion as of month-end

November, up 63% from November 2019 and up 9% compared to October

2020.(1)

- New brokerage accounts were 430 thousand in November, up over

200% from November 2019 and down 97% compared to October

2020.(1)

(1)

Month-over-month and year-over-year

comparisons are affected by the recent close of the TD Ameritrade

acquisition on October 6, 2020.

About Charles Schwab

The Charles Schwab Corporation (NYSE: SCHW) is a leading

provider of financial services, with 29.2 million active brokerage

accounts, 2.0 million corporate retirement plan participants, 1.5

million banking accounts, and $6.4 trillion in client assets as of

November 30, 2020. Through its operating subsidiaries, the company

provides a full range of wealth management, securities brokerage,

banking, asset management, custody, and financial advisory services

to individual investors and independent investment advisors. Its

broker-dealer subsidiaries, Charles Schwab & Co., Inc., TD

Ameritrade, Inc., and TD Ameritrade Clearing, Inc., (members SIPC,

https://www.sipc.org), and their affiliates offer a complete range

of investment services and products including an extensive

selection of mutual funds; financial planning and investment

advice; retirement plan and equity compensation plan services;

referrals to independent, fee-based investment advisors; and

custodial, operational and trading support for independent,

fee-based investment advisors through Schwab Advisor Services. Its

primary banking subsidiary, Charles Schwab Bank, SSB (member FDIC

and an Equal Housing Lender), provides banking and lending services

and products. More information is available at

https://www.aboutschwab.com.

TD Ameritrade, Inc. and TD Ameritrade Clearing, Inc. are

separate but affiliated companies and subsidiaries of TD Ameritrade

Holding Corporation. TD Ameritrade Holding Corporation is a wholly

owned subsidiary of The Charles Schwab Corporation. TD Ameritrade

is a trademark jointly owned by TD Ameritrade IP Company, Inc. and

The Toronto-Dominion Bank.

The Charles Schwab Corporation Monthly Activity Report For

November 2020

2019

2020

Change Nov Dec

Jan Feb Mar

Apr May Jun

Jul Aug Sep

Oct Nov Mo.

Yr. Market Indices (at month

end) Dow Jones Industrial Average

28,051

28,538

28,256

25,409

21,917

24,346

25,383

25,813

26,428

28,430

27,782

26,502

29,639

12

%

6

%

Nasdaq Composite

8,665

8,973

9,151

8,567

7,700

8,890

9,490

10,059

10,745

11,775

11,168

10,912

12,199

12

%

41

%

Standard & Poor’s 500

3,141

3,231

3,226

2,954

2,585

2,912

3,044

3,100

3,271

3,500

3,363

3,270

3,622

11

%

15

%

Client Assets (in billions of dollars) Beginning Client

Assets

3,854.6

3,942.2

4,038.8

4,051.6

3,862.8

3,496.9

3,778.3

4,009.0

4,110.1

4,278.0

4,489.7

4,395.3

5,878.5

Net New Assets (1)

12.0

30.1

20.9

24.4

27.9

15.3

97.5

24.6

11.2

20.0

20.0

1,596.9

32.1

(98

%)

168

%

Net Market Gains (Losses)

75.6

66.5

(8.1

)

(213.2

)

(393.8

)

266.1

133.2

76.5

156.7

191.7

(114.4

)

(113.7

)

510.4

Total Client Assets (at month end)

3,942.2

4,038.8

4,051.6

3,862.8

3,496.9

3,778.3

4,009.0

4,110.1

4,278.0

4,489.7

4,395.3

5,878.5

6,421.0

9

%

63

%

Core Net New Assets (2)

12.0

30.1

20.9

24.4

27.9

15.3

17.6

13.7

2.7

20.0

20.0

25.6

32.1

25

%

168

%

Receiving Ongoing Advisory Services (at month end) Investor

Services

330.8

337.1

336.8

323.2

291.5

309.9

339.8

345.2

355.6

366.8

361.2

378.8

406.7

7

%

23

%

Advisor Services (3)

1,728.2

1,769.7

1,773.2

1,694.0

1,531.3

1,647.9

1,711.7

1,747.5

1,818.5

1,900.5

1,870.1

2,552.0

2,766.1

8

%

60

%

Client Accounts (at month end, in thousands) Active

Brokerage Accounts

12,247

12,333

12,431

12,521

12,736

12,866

14,007

14,107

14,220

14,311

14,393

29,013

29,202

1

%

138

%

Banking Accounts

1,384

1,390

1,403

1,411

1,426

1,439

1,448

1,463

1,480

1,493

1,486

1,496

1,504

1

%

9

%

Corporate Retirement Plan Participants

1,743

1,748

1,732

1,726

1,721

1,696

1,714

1,716

1,712

1,715

1,722

2,072

2,045

(1

%)

17

%

Client Activity New Brokerage Accounts (in thousands) (4)

127

164

167

159

283

201

1,250

201

206

202

184

14,718

430

(97

%)

N/M

Client Cash as a Percentage of Client Assets (5)

11.3

%

11.3

%

11.3

%

12.0

%

15.1

%

14.3

%

14.0

%

13.6

%

13.0

%

12.5

%

12.8

%

13.4

%

12.4

%

(100) bp 110 bp Derivative Trades as a Percentage of Total Trades

11.7

%

10.7

%

12.0

%

11.5

%

7.0

%

10.2

%

12.2

%

10.6

%

13.1

%

13.8

%

14.5

%

20.5

%

19.4

%

(110) bp 770 bp

Mutual Fund and Exchange-Traded Fund Net

Buys (Sells) (6,7) (in millions of dollars) Large

Capitalization Stock

1,406

991

845

(178

)

984

(693

)

(768

)

(1,254

)

(2,536

)

(1,422

)

(1,360

)

(935

)

4,454

Small / Mid Capitalization Stock

73

201

(314

)

(531

)

(954

)

151

(401

)

(1,063

)

(1,476

)

(441

)

(497

)

(753

)

2,431

International

735

993

1,360

132

(2,116

)

(2,207

)

(1,953

)

(1,580

)

(773

)

230

370

168

2,110

Specialized

484

455

762

397

333

2,059

1,512

1,020

1,505

906

115

215

1,985

Hybrid

(290

)

(96

)

615

(257

)

(4,790

)

(860

)

(518

)

(97

)

(769

)

(124

)

(12

)

(553

)

(402

)

Taxable Bond

2,274

4,710

5,714

3,830

(23,142

)

1,642

5,469

9,215

7,314

7,680

5,734

5,904

4,825

Tax-Free Bond

860

1,255

1,481

1,066

(5,229

)

(242

)

805

1,710

1,297

1,648

1,123

861

1,131

Net Buy (Sell) Activity (in millions of dollars) Mutual

Funds (6)

(761

)

1,097

2,684

(565

)

(34,382

)

(3,863

)

(564

)

1,768

(147

)

2,568

757

(2,260

)

2,832

Exchange-Traded Funds (7)

6,303

7,412

7,779

5,024

(532

)

3,713

4,710

6,183

4,709

5,909

4,716

7,167

13,702

Money Market Funds

4,768

1,515

1,911

1,312

(1,233

)

8,465

4,833

(5,673

)

(9,039

)

(5,614

)

(6,627

)

(4,021

)

(5,908

)

Selected Average Assets (in millions of dollars) Average

Interest-Earning Assets (8,9)

268,254

274,911

279,437

278,966

317,850

353,018

361,814

373,986

379,521

384,690

392,784

442,119

466,677

6

%

74

%

Average Bank Deposit Account Assets (9,10)

-

-

-

-

-

-

-

-

-

-

-

132,030

162,315

23

%

N/M

(1)

October 2020 includes an inflow of $1.6 trillion related to the

acquisition of TD Ameritrade. July 2020 includes an inflow of $8.5

billion related to the acquisition of Wasmer, Schroeder &

Company, LLC. June 2020 includes an inflow of $10.9 billion from a

mutual fund clearing services client. May 2020 includes an inflow

of $79.9 billion related to the acquisition of the assets of USAA’s

Investment Management Company.

(2)

Net new assets before significant one-time inflows or outflows,

such as acquisitions/divestitures or extraordinary flows (generally

greater than $10 billion) relating to a specific client. These

flows may span multiple reporting periods.

(3)

Excludes Retirement Business Services.

(4)

October 2020 includes 14.5 million new brokerage accounts related

to the acquisition of TD Ameritrade. May 2020 includes 1.1 million

new brokerage accounts related to the acquisition of the assets of

USAA’s Investment Management Company.

(5)

Schwab One®, certain cash equivalents, bank deposits, third-party

bank deposit accounts, and money market fund balances as a

percentage of total client assets.

(6)

Represents the principal value of client mutual fund transactions

handled by Schwab, including transactions in proprietary funds.

Includes institutional funds available only to Investment Managers.

Excludes money market fund transactions.

(7)

Represents the principal value of client ETF transactions handled

by Schwab, including transactions in proprietary ETFs.

(8)

Represents average total interest-earning assets on the company's

balance sheet.

(9)

October 2020 averages reflect a full month of Schwab balances and

26 days of TD Ameritrade balances following the acquisition closing

on October 6, 2020. Calculating the consolidated daily average from

the closing date onwards would result in Average Interest Earning

Assets and Average Bank Deposit Account Assets of $450,004 million

and $157,414 million, respectively.

(10)

Represents average TD Ameritrade clients’ uninvested cash sweep

account balances held in deposit accounts at third-party financial

institutions. N/M - Not meaningful

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201214005143/en/

MEDIA: Mayura Hooper Charles Schwab Phone:

415-667-1525

INVESTORS/ANALYSTS: Jeff Edwards Charles Schwab Phone:

415-667-1524

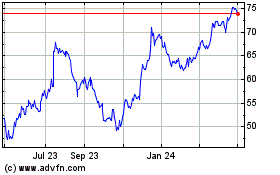

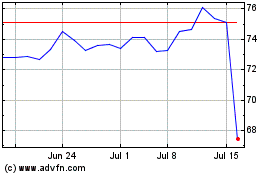

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2023 to Apr 2024