Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

December 09 2020 - 6:03AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Dated December 8, 2020

Registration Statement: No. 333-251156

THE CHARLES SCHWAB CORPORATION

2,500,000 DEPOSITARY SHARES,

EACH REPRESENTING A 1/100th INTEREST IN A SHARE OF 4.000% FIXED-RATE RESET NON-CUMULATIVE PERPETUAL PREFERRED STOCK, SERIES H

(liquidation preference $100,000 per share

(equivalent to $1,000 per depositary share))

SUMMARY OF TERMS

|

|

|

|

|

Issuer:

|

|

The Charles Schwab Corporation

|

|

|

|

|

Security Offered:

|

|

Depositary Shares, Each Representing a 1/100th Interest in a Share of 4.000% Fixed-Rate Reset Non-Cumulative Perpetual Preferred Stock,

Series H (the “Series H Preferred Stock”)

|

|

|

|

|

Expected Ratings*:

|

|

Baa2 (Moody’s) / BBB (S&P) / BBB- (Fitch)

|

|

|

|

|

Size:

|

|

$2,500,000,000 (2,500,000 depositary shares)

|

|

|

|

|

Over-allotment Option:

|

|

None

|

|

|

|

|

Liquidation Preference:

|

|

$100,000 per share of Series H Preferred Stock (equivalent to $1,000 per depositary share)

|

|

|

|

|

First Reset Date:

|

|

December 1, 2030

|

|

|

|

|

Reset Date:

|

|

The First Reset Date and each date falling on the tenth anniversary of the preceding Reset Date

|

|

|

|

|

Reset Period:

|

|

The period from, and including, the First Reset Date to, but excluding, the next following Reset Date and thereafter each period from, and including, each Reset Date to, but excluding, the next following Reset Date

|

|

|

|

|

Dividend Rate (Non-Cumulative):

|

|

From December 11, 2020 to, but excluding, December 1, 2030, 4.000%, and from, and including, December 1, 2030, during each reset period (as defined in the preliminary prospectus supplement dated December 8, 2020 (the

“preliminary prospectus supplement”)), the ten-year treasury rate as of the most recent reset dividend determination date (as defined in the preliminary prospectus supplement) plus 3.079%

|

|

|

|

|

Dividend Payment Dates:

|

|

Quarterly in arrears on the 1st day of March, June, September and December of each year, commencing on March 1, 2021

|

|

|

|

|

|

Day Count:

|

|

30/360

|

|

|

|

|

Term:

|

|

Perpetual

|

|

|

|

|

Optional Redemption:

|

|

In whole or in part, from time to time, on any dividend payment date on or after December 1, 2030, or in whole but not in part, at any time within 90 days following a regulatory capital treatment event (as defined in the preliminary

prospectus supplement), in each case at a redemption price equal to $100,000 per share (equivalent to $1,000 per depositary share), plus any declared and unpaid dividends, without accumulation of any undeclared dividends

|

|

|

|

|

Trade Date:

|

|

December 8, 2020

|

|

|

|

|

Settlement Date:

|

|

December 11, 2020 (T+3)

|

|

|

|

|

Public Offering Price:

|

|

$1,000 per depositary share

|

|

|

|

|

Underwriting Discount:

|

|

$10.00 per depositary share

|

|

|

|

|

Estimated Net Proceeds to Issuer, After Deducting Underwriting Discount:

|

|

$2,475 million

|

|

|

|

|

CUSIP/ISIN for Depositary Shares:

|

|

808513 BJ3 / US808513BJ38

|

|

|

|

|

Joint Book-Running Managers:

|

|

BofA Securities, Inc.

Citigroup Global Markets

Inc.

Credit Suisse Securities (USA) LLC

Goldman

Sachs & Co. LLC

J.P. Morgan Securities LLC

|

|

|

|

|

Senior Co-Managers:

|

|

Morgan Stanley & Co. LLC

Wells Fargo

Securities, LLC

|

|

|

|

|

Co-Managers:

|

|

Barclays Capital Inc.

PNC Capital Markets

LLC

TD Securities (USA) LLC

U.S. Bancorp Investments,

Inc.

|

|

*

|

Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to

revision, suspension or withdrawal at any time.

|

It is expected that delivery

of the depositary shares will be made through the facilities of The Depository Trust Company on or about December 11, 2020, which will be the third business day following the initial sale of the depositary shares (this settlement cycle being

referred to as “T+3”). Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two business days, unless the parties

to a trade expressly agree otherwise. Accordingly, purchasers who wish to trade the depositary shares prior to the second business day before the delivery of the depositary shares will be required, by virtue of the fact that the depositary shares

initially will settle on a delayed basis, to specify alternative settlement arrangements at the time of any such trade to prevent a failed settlement and should consult their own advisor.

2

The Issuer has filed a registration statement (including a preliminary prospectus supplement and

accompanying prospectus) with the U.S. Securities and Exchange Commission (the “SEC”) for the offering to which this communication relates. Before you invest, you should read the preliminary prospectus supplement and accompanying

prospectus and other documents the Issuer has filed with the SEC for more complete information about the Issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov.

Alternatively, the Issuer, any underwriter or any dealer participating in the offering will arrange to send you the preliminary prospectus supplement and accompanying prospectus if you request it by calling BofA Securities, Inc. toll-free at (800) 294-1322, Citigroup Global Markets Inc. toll-free at (800) 831-9146, Credit Suisse Securities (USA) LLC toll-free at (800) 221-1037,

Goldman Sachs & Co. LLC collect at (212) 902-1171, J.P. Morgan Securities LLC collect at (212) 834-4533.

Any disclaimer or other notice that may appear below is not applicable to this communication and should be disregarded. Such disclaimer or notice was

automatically generated as a result of this communication being sent by Bloomberg or another email system.

3

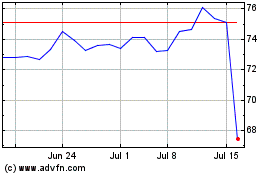

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

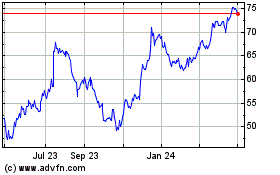

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2023 to Apr 2024