Firm also announces Schwab Stock Slices™ now

available in Schwab Personal Choice Retirement Account®

According to Charles Schwab’s SDBA Indicators Report, an

industry-leading benchmark on retirement plan participant

investment activity within self-directed brokerage accounts

(SDBAs), the average account balance finished Q1 2020 at $252,675,

down approximately 6% year-over-year and down 14% from Q4 2019.

SDBAs are brokerage accounts within retirement plans, including

401(k)s and other types of retirement plans, that participants can

use to invest retirement savings in stocks, bonds, exchange-traded

funds, mutual funds and other securities that are not part of their

retirement plan's core investment offerings.

The first quarter SDBA Indicators Report also showed trading

volumes increased compared to the previous quarter, at an average

of 13 trades per account up from seven in Q4 2019, which is in line

with broader investor activity seen during the first quarter as

major stock indexes fell and trading activity rose amid market

volatility.

Asset allocations remained similar to last quarter, with the

exception of an increase in cash holdings from 12% in Q4 2019 to

19% in Q1. Mutual funds continue to hold a majority of participant

assets (34%), followed by equities (27%), cash (19%), ETFs (17%),

and fixed income (3%).

Allocation Trends

The data also reveals specific sector holdings within each

investment category:

- Mutual funds: Large-cap funds had

the largest allocation at approximately 30% of all mutual fund

allocations, followed by taxable bond (22%) and international (14%)

funds.

- Equities: Information technology

remained the largest equity sector holdings at 29%, up from 27%

last quarter. Apple (AAPL) continues to be the top overall equity

holding, comprising 11% of the equity allocation of portfolios. The

other equity holdings in the top five include Amazon (AMZN) (6.5%),

Microsoft (MSFT) (3.6%), Berkshire Hathaway (BRKA) (2.5%), and

Tesla (TSLA) (2.1%).

- ETFs: Among ETFs, investors

allocated the most dollars to U.S. equity (48%), followed by U.S.

fixed income (18%), international equity (13%) and sector ETFs

(10%).

Report Highlights

- On average, participants held 10 positions in their SDBAs at

the end of Q1 2020, which has remained steady both year-over-year

and quarter-over-quarter.

- Gen X made up approximately 43% of SDBA participants, followed

by Baby Boomers (37%) and Millennials (14%).

- Baby Boomers had the highest SDBA balances at an average of

$367,425, followed by Gen X at $199,071 and Millennials at

$65,207.

- Gen X had the most advised accounts at 45%, followed by Baby

Boomers (41%) and Millennials (11%).

Schwab Stock Slices™ Now Available

Schwab also announced that its new Schwab Stock Slices™ service

is now available in the Schwab Personal Choice Retirement Account®,

the firm’s SDBA offering. Schwab Stock Slices™ lets investors own

any of America’s leading companies in the S&P 500® for as

little as $5 each, even if their shares cost more. Investors can

use the new service to purchase a single stock slice or up to 10

different Stock Slices™ at once, and they can hold slices of as

many S&P 500 companies in their account as they wish through

multiple purchases. Schwab Stock Slices™ are purchased

commission-free online, just like regular stock trades at

Schwab.

About the SDBA Indicators Report

The SDBA Indicators Report includes data collected from

approximately 145,000 retirement plan participants who currently

have balances between $5,000 and $10 million in their Schwab

Personal Choice Retirement Account®. Data is extracted quarterly on

all accounts that are open as of quarter-end and meet the balance

criteria.

The SDBA Indicators Report tracks a wide variety of investment

activity and profile information on participants with a Schwab

Personal Choice Retirement Account (PCRA), ranging from asset

allocation trends and asset flow in various equity, exchange-traded

fund and mutual fund categories, to age trends and trading

activity. The SDBA Indicators Report provides insight into PCRA

users’ perceptions of the markets and the investment decisions they

make.

Data contained in this quarterly report is from the first

quarter of 2020, and can be found here, along with prior

reports.

About Charles Schwab

At Charles Schwab we believe in the power of investing to help

individuals create a better tomorrow. We have a history of

challenging the status quo in our industry, innovating in ways that

benefit investors and the advisors and employers who serve them,

and championing our clients’ goals with passion and integrity.

More information is available at www.aboutschwab.com. Follow us

on Twitter, Facebook, YouTube and LinkedIn.

Investors in mutual funds and ETFs should consider carefully

information contained in the prospectus, including investment

objectives, risks, charges, and expenses. You can request a

prospectus by visiting Schwab.com or calling 800-435-4000. Please

read the prospectus carefully before investing.

Disclosures:

Brokerage Products: Not FDIC‐Insured • No Bank Guarantee •

May Lose Value

The securities shown are for informational purposes only and are

not a recommendation to transact in any security.

Through its operating subsidiaries, The Charles Schwab

Corporation (NYSE: SCHW) provides a full range of securities

brokerage, banking, money management and financial advisory

services to individual investors and independent investment

advisors. Its broker-dealer subsidiary, Charles Schwab & Co.,

Inc. (member SIPC, www.sipc.org), and affiliates offer a complete

range of investment services and products including an extensive

selection of mutual funds; financial planning and investment

advice; retirement plan and equity compensation plan services;

compliance and trade monitoring solutions; referrals to independent

fee-based investment advisors; and custodial, operational and

trading support for independent, fee-based investment advisors

through Schwab Advisor Services. Its banking subsidiary, Charles

Schwab Bank (member FDIC and an Equal Housing Lender), provides

banking and lending services and products. More information is

available at www.schwab.com and www.aboutschwab.com.

This report is for informational purposes only and is not a

solicitation, or a recommendation that any particular investor

should purchase or sell any particular security.

Schwab Personal Choice Retirement Account® (PCRA) is offered

through Charles Schwab & Co., Inc. (member SIPC), the

registered broker/dealer, which also provides other brokerage and

custody services to its customers.

All corporate names are for illustrative purposes only and are

not a recommendation, offer to sell, or a solicitation of an offer

to buy any security.

Schwab Stock Slices™ is not intended to be investment advice or

a recommendation of any stock. Investing in stocks can be volatile

and involves risk including loss of principal. Consider your

individual circumstances prior to investing.

The standard online $0 commission does not apply to trades

placed through a broker ($25). See the Charles Schwab Pricing Guide

for Retirement Plan Accounts for full fee and commission

schedules.

The “S&P 500® Index” is a product of S&P Dow Jones

Indices LLC or its affiliates (“SPDJI”), and has been licensed for

use by Charles Schwab & Co., Inc. (“CS&Co”). Standard &

Poor’s® and S&P® are registered trademarks of Standard &

Poor’s Financial Services LLC (“S&P”); Dow Jones® is a

registered trademark of Dow Jones Trademark Holdings LLC (“Dow

Jones”). Schwab Stock Slices™ is not sponsored, endorsed, sold or

promoted by SPDJI, Dow Jones, S&P, or their respective

affiliates, and none of such parties make any representation

regarding the advisability of using Schwab Stock Slices™ or

investing in any security available through Schwab Stock Slices™,

nor do they have any liability for any errors, omissions, or

interruptions of the S&P 500 Index.

(0620-0TPV)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200610005153/en/

Mike Peterson Charles Schwab 330-908-4334

mike.peterson@schwab.com Travis Fishstein The Neibart Group

718-801-8205 schwabrps@neibartgroup.com

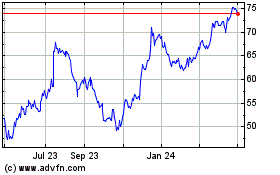

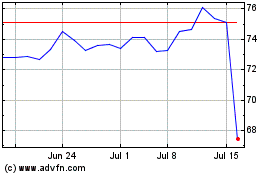

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2023 to Apr 2024