Current Report Filing (8-k)

May 15 2020 - 4:42PM

Edgar (US Regulatory)

SCHWAB CHARLES CORP false 0000316709 0000316709 2020-05-14 2020-05-14 0000316709 us-gaap:CommonStockMember 2020-05-14 2020-05-14 0000316709 us-gaap:SeriesCPreferredStockMember 2020-05-14 2020-05-14 0000316709 us-gaap:SeriesDPreferredStockMember 2020-05-14 2020-05-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 14, 2020

The Charles Schwab Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

Commission File Number: 1-9700

|

|

94-3025021

|

|

(State or other jurisdiction

of incorporation)

|

|

|

|

(IRS Employer

Identification No.)

|

211 Main Street, San Francisco, CA 94105

(Address of principal executive offices, including zip code)

(415) 667-7000

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☒

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock - $.01 par value per share

|

|

SCHW

|

|

New York Stock Exchange

|

|

Depositary Shares, each representing a 1/40th ownership interest in a share of 6.00% Non-Cumulative Preferred Stock, Series C

|

|

SCHW PrC

|

|

New York Stock Exchange

|

|

Depositary Shares, each representing a 1/40th ownership interest in a share of 5.95% Non-Cumulative Preferred Stock, Series D

|

|

SCHW PrD

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§232.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

Amendment to Agreement and Plan of Merger

As previously disclosed, on November 24, 2019, The Charles Schwab Corporation, a Delaware corporation (“Schwab”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with TD Ameritrade Holding Corporation, a Delaware corporation (“TD Ameritrade”), and Americano Acquisition Corp., a Delaware corporation and direct wholly owned subsidiary of Schwab (“Merger Sub”). In accordance with the terms of the Merger Agreement, immediately prior to the effective time of the merger contemplated by the Merger Agreement, Schwab’s certificate of incorporation will be amended as set forth on Exhibit B to the Merger Agreement (the “Charter Amendment”).

On May 14, 2020, Schwab, TD Ameritrade and Merger Sub entered into Amendment No. 1 to the Merger Agreement (the “Merger Agreement Amendment”). The Merger Agreement Amendment revises the Charter Amendment to reflect certain technical changes to the transfer restrictions applicable to the Parent Nonvoting Common Stock (as defined in the Merger Agreement) and to remove the option, exercisable under certain limited circumstances, of a holder of the Parent Nonvoting Common Stock to convert the Parent Nonvoting Common Stock to Parent Common Stock (as defined in the Merger Agreement).

Other than as expressly modified pursuant to the Merger Agreement Amendment, the Merger Agreement remains in full force and effect as originally executed on November 24, 2019. The foregoing descriptions of the Merger Agreement and the Merger Agreement Amendment do not purport to be complete and are qualified in their entirety by reference to the full text of the Merger Agreement and the Merger Agreement Amendment, respectively, copies of which are attached hereto as Exhibits 2.1 and 2.2, respectively, and each of which is incorporated herein by reference.

Schwab has prepared a Supplement to the Joint Proxy Statement/Prospectus for the Special Meeting of Stockholders to be held June 4, 2020 describing the Merger Agreement Amendment and the revised Charter Amendment, a copy of which is attached hereto as Exhibit 99.1 and which is incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

The following exhibits are attached hereto:

|

|

|

|

|

|

|

Exhibit

No.

|

|

|

Description of Exhibit

|

|

|

|

|

|

|

|

|

2.1*+

|

|

|

Agreement and Plan of Merger, dated as of November 24, 2019, by and among The Charles Schwab Corporation, TD Ameritrade Holding Corporation and Americano Acquisition Corp. (incorporated by reference to Exhibit 2.1 to Schwab’s Current Report on Form 8-K filed with the SEC on November 27, 2019).

|

|

|

|

|

|

|

|

|

2.2

|

|

|

Amendment No. 1 to Agreement and Plan of Merger, dated as of May 14, 2020, by and among The Charles Schwab Corporation, TD Ameritrade Holding Corporation and Americano Acquisition Corp.

|

|

|

|

|

|

|

|

|

99.1

|

|

|

Supplement to the Joint Proxy Statement/Prospectus for the Special Meeting of Stockholders to be held June 4, 2020, dated May 15, 2020.

|

|

*

|

Incorporated by reference and not filed herewith.

|

|

+

|

The schedules and exhibits have been omitted pursuant to Item 601(b)(2) of Regulation S-K. Schwab agrees to furnish supplementally a copy of such schedules and exhibits, or any section thereof, to the SEC upon request.

|

Important Information About the Transaction and Where to Find it

In connection with the proposed transaction between Schwab and TD Ameritrade, Schwab and TD Ameritrade have filed and will file relevant materials with the Securities and Exchange Commission (the “SEC”). Schwab has filed a registration statement on Form S-4 that includes a joint proxy statement of Schwab and TD Ameritrade that also constitutes a prospectus of Schwab. The registration statement on Form S-4, as amended, was declared effective by the SEC on May 6, 2020 and Schwab and TD Ameritrade mailed the definitive joint proxy statement/prospectus to their respective stockholders on or about May 6, 2020. INVESTORS AND SECURITY HOLDERS OF SCHWAB AND TD AMERITRADE ARE URGED TO READ THE REGISTRATION STATEMENT, THE DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the registration statement and the definitive joint proxy statement/prospectus and other documents filed with the SEC by Schwab or TD Ameritrade through the website maintained by the SEC at http://www.sec.gov or by contacting the investor relations department of Schwab or TD Ameritrade at the following:

|

|

|

|

|

|

|

|

|

The Charles Schwab Corporation

|

|

TD Ameritrade Holding Corporation

|

|

|

|

211 Main Street

|

|

200 South 108th Avenue

|

|

|

|

San Francisco, CA 94105

|

|

Omaha, Nebraska 68154

|

|

|

|

Attention: Investor Relations

|

|

Attention: Investor Relations

|

|

|

|

(415) 667-7000

|

|

(800) 669-3900

|

|

|

|

investor.relations@schwab.com

|

|

|

Schwab, TD Ameritrade, their respective directors and certain of their respective executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding the directors and executive officers of Schwab, and their direct or indirect interests in the transaction, by security holdings or otherwise, is contained in Schwab’s Form 10-K for the year ended December 31, 2019, its proxy statement filed on March 31, 2020 and its Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Information regarding the directors and executive officers of TD Ameritrade, and their direct or indirect interests in the transaction, by security holdings or otherwise, is contained in TD Ameritrade’s Form 10-K for the year ended September 30, 2019, as amended, and its Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Additional information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the definitive joint proxy statement/prospectus and other relevant materials filed with the SEC.

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: May 15, 2020

|

|

|

|

THE CHARLES SCHWAB CORPORATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Peter Crawford

|

|

|

|

|

|

|

|

Peter Crawford

|

|

|

|

|

|

|

|

Executive Vice President and Chief Financial Officer

|

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit

No.

|

|

|

Description of Exhibit

|

|

|

|

|

|

|

|

|

2.1*+

|

|

|

Agreement and Plan of Merger, dated as of November 24, 2019, by and among The Charles Schwab Corporation, TD Ameritrade Holding Corporation and Americano Acquisition Corp. (incorporated by reference to Exhibit 2.1 to Schwab’s Current Report on Form 8-K filed with the SEC on November 27, 2019).

|

|

|

|

|

|

|

|

|

2.2

|

|

|

Amendment No. 1 to Agreement and Plan of Merger, dated as of May 14, 2020, by and among The Charles Schwab Corporation, TD Ameritrade Holding Corporation and Americano Acquisition Corp.

|

|

|

|

|

|

|

|

|

99.1

|

|

|

Supplement to the Joint Proxy Statement/Prospectus for the Special Meeting of Stockholders to be held June 4, 2020, dated May 15, 2020.

|

|

*

|

Incorporated by reference and not filed herewith.

|

|

+

|

The schedules and exhibits have been omitted pursuant to Item 601(b)(2) of Regulation S-K. Schwab agrees to furnish supplementally a copy of such schedules and exhibits, or any section thereof, to the SEC upon request.

|

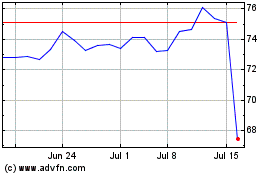

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

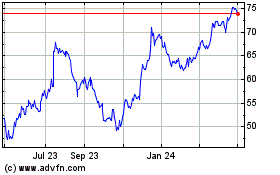

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2023 to Apr 2024