401(k) participants aged 39-54 are saving a bit

more for the future than other generations, but they’re bogged down

by competing financial obligations in the present.

According to research from Schwab Retirement Plan Services, many

401(k) participants in Generation X are struggling with credit card

and other kinds of debt as they try to save for a comfortable

retirement. While a small majority of this group, aged 39 to 54,

say they are more focused on saving for retirement (58%), a full

42% say they are more focused on paying off debt right now.

The nationwide survey of 1,000 401(k) plan participants,

including 368 Gen Xers, 315 Millennials and 317 Baby Boomers, shows

that 70% of Gen Xers feel on top of their 401(k) investments but

they still face obstacles and experience financial stress while

trying to meet their long-term goals.

When asked about what is preventing them from saving more for

retirement, Gen Xers named:

- Unexpected expenses like home repairs (38%),

- Credit card debt (31%), and

- Needing money for monthly bills (29%) as their top

barriers.

- Moreover, 22% are paying for children’s education/tuition, and

11% are still paying off their own student loans.

Saving for retirement is Gen Xers’ top source of money-related

stress (40%), followed by credit card debt (27%) and keeping up

with monthly expenses (23%).

“Gen Xers are at a time in their lives when they have financial

pressures on all sides. While many are caring for children and

financing those children’s education, many are also providing care

and financial assistance to older relatives. Given all of these

competing priorities, it’s not too surprising that they’re relying

on credit to cover expenses,” said Catherine Golladay, president,

Schwab Retirement Plan Services. “Most in this group are in

critical earning years and at an age when it makes sense to really

focus on retirement preparations. With additional guidance and a

solid financial plan, Gen Xers could feel more confident and better

manage the many responsibilities they face.”

Gen X and their 401(k)s: Help Wanted

The majority of Gen Xers are relying on their 401(k) plans to

fund their golden years. Most (58%) say their 401(k) is their

largest or only source of retirement savings, compared to 68% of

Millennials and 48% of Boomers.

On average, Gen Xers think they will need $1.81 million for a

comfortable retirement, more than either of the other groups

(Millennials say $1.78 million and Boomers, $1.51 million). Yet

they may not be saving enough to meet that goal.

While Gen Xers saved slightly more in their 401(k)s last year

than the other two surveyed generations – $9,499 on average, with

Boomers right behind at $9,433 and Millennials at $7,257 – this

only equates to about half of the 2018 IRS contribution limit of

$18,500 for those under age 50.

In addition, many Gen Xers may not be thinking about their

401(k)s as a long-term savings vehicle. Almost a third (31%) have

taken a loan from their 401(k), and more than half of those

borrowers (61%) have done so more than once – higher than either of

the other generations in both cases.

The survey shows that this group could benefit from help and

education to make more of their 401(k) plans:

- 41% of Gen Xers say they don’t know which investments to choose

for their 401(k) to have enough for retirement.

- Just one in three (28%) say they are “very confident” in making

401(k) investment decisions on their own.

Gen Xers say they want help with fundamentals like:

- Calculating how much money they need to save for retirement

(41%),

- Determining at what age they can afford to retire (38%),

and

- Deciding where to invest their 401(k) (37%).

“A sizeable majority of Gen Xers, 69%, expressed a desire for

personalized help with their 401(k). Fortunately, most plans today

offer some kind of managed account or advice service,” added

Golladay. “We encourage people at any stage of their career to take

full advantage of the resources available to them. Professional

advice can boost your investing confidence as you formulate a

tailored plan you can stick to, all with the goal of ultimately

helping you achieve better outcomes.”

Beyond 401(k) advice, many workplace plans offer broader

financial wellness resources to help employees address a range of

financial challenges, including debt management, college planning

and more. Schwab has also developed the Savings Fundamentals to

help people manage and prioritize their competing financial

obligations using a step-by-step approach.

About the Survey

This online survey of U.S. 401(k) participants was conducted by

Logica Research for Schwab Retirement Plan Services, Inc. Logica

Research is neither affiliated with, nor employed by, Schwab

Retirement Plan Services, Inc. The survey is based on 1,000

interviews and has a 3% margin of error at the 95% confidence

level. Survey respondents worked for companies with at least 25

employees, were current contributors to their 401(k) plans and were

25-70 years old. Survey respondents were not asked to indicate

whether they had 401(k) accounts with Schwab Retirement Plan

Services, Inc. All data is self-reported by study participants and

is not verified or validated. Respondents participated in the study

between March 19 and March 29, 2019. Additional survey information

can be found here.

About Charles Schwab

At Charles Schwab we believe in the power of investing to help

individuals create a better tomorrow. We have a history of

challenging the status quo in our industry, innovating in ways that

benefit investors and the advisors and employers who serve them,

and championing our clients’ goals with passion and integrity.

More information is available at www.aboutschwab.com. Follow us

on Twitter, Facebook, YouTube and LinkedIn.

Financial tools and resources are available at

www.schwabmoneywise.com.

Disclosures

Through its operating subsidiaries, The Charles Schwab

Corporation (NYSE: SCHW) provides a full range of securities

brokerage, banking, money management and financial advisory

services to individual investors and independent investment

advisors. Its broker-dealer subsidiary, Charles Schwab & Co.,

Inc. (member SIPC, www.sipc.org), and affiliates offer a complete

range of investment services and products including an extensive

selection of mutual funds; financial planning and investment

advice; retirement plan and equity compensation plan services;

compliance and trade monitoring solutions; referrals to independent

fee-based investment advisors; and custodial, operational and

trading support for independent, fee-based investment advisors

through Schwab Advisor Services. Its banking subsidiary, Charles

Schwab Bank (member FDIC and an Equal Housing Lender), provides

banking and lending services and products. More information is

available at www.schwab.com and www.aboutschwab.com.

The Charles Schwab Corporation provides services to retirement

and other benefit plans and participants through its separate but

affiliated companies and subsidiaries: Charles Schwab Bank; Charles

Schwab Trust Bank; Charles Schwab & Co., Inc.; and Schwab

Retirement Plan Services, Inc. Trust, custody, and deposit products

and services are available through Charles Schwab Bank and Charles

Schwab Trust Bank, Members of FDIC. Schwab Retirement Plan

Services, Inc. is not a fiduciary to retirement plans or

participants and only provides recordkeeping and related

services.

Schwab MoneyWise® is provided by Charles Schwab & Co.,

Inc.

©2019 Schwab Retirement Plan Services, Inc. All rights reserved.

(0919-9331)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190910005170/en/

Mike Peterson Charles Schwab 330-908-4334

mike.peterson@schwab.com

Jade Faugno Intermarket Communications 212-754-5425

jfaugno@intermarket.com

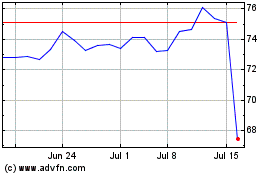

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

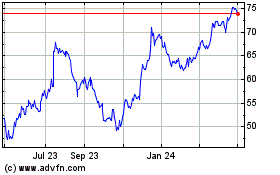

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2023 to Apr 2024