By Lisa Beilfuss

When Walt Bettinger's 3 a.m. alarm sounds, among the first

things the Charles Schwab Corp. chief executive does is check how

much net new money his company has pulled in over the past 24

hours. Last year, that was an average of $624 million a day -- more

than its three biggest Wall Street rivals combined.

Schwab was known mostly as a discount broker for amateurs when

he took the helm in 2008 from founder Charles R. "Chuck" Schwab.

Now it resembles something more like a personal-finance

supermarket, offering services for the wealthy and budget-minded

alike, at rock-bottom prices, spanning trading, banking and advice,

both human and robotic.

Once barely noticed by the denizens of Wall Street, Schwab has

amassed a stockpile of client assets that dwarfs those at Bank of

America Corp.'s Merrill Lynch, Morgan Stanley's brokerage arm and

UBS Group AG's Americas unit. Its stock is up 76% since the end of

2007, versus 26% for the Dow Jones U.S. Select Investment Services

Index.

Schwab's blue-chip rivals are being dragged along in its wake.

Forced to respond after years of ignoring the threat, they're

moving down market and cutting fees across the board , eating into

what was once a vital source of income and transforming the

business of personal financial services into something that looks

more like a commodity business.

Morgan Stanley recently published an Instagram post to market

the idea its services aren't just for millionaires. JPMorgan Chase

& Co. is giving away free trades. UBS in April launched an iPad

app for its wealthy clients. Goldman Sachs Group Inc., adviser to

billionaires, is targeting middle-class clients with its Marcus

arm. Companies mentioned in this article were given an opportunity

to comment on Schwab's effect on their business.

"What we have to figure out is how does this business grow more

rapidly than Schwab's," said a wealth-management executive at a

major Wall Street firm that competes with Schwab.

Mr. Bettinger's formula for attracting new money -- $228 billion

in 2018 -- is rooted in Mr. Schwab's blueprint: Keep prices low and

the rest will follow. Self-described "Schwabbies" at the company

are obsessed by it. Jonathan de St. Paer, head of investment

management, said that in his 16 years at Schwab, someone has asked

at every meeting: "Can we do it cheaper?" In March, it introduced

subscription pricing for financial planning that makes advice less

expensive.

Schwab's task is to contend with the response from Wall Street

incumbents as well as challenges from new low-cost entrants. Schwab

has become big enough that, each time it launches a new product or

slashes another fee, it sends ripples out among competitors who

often are forced to respond in kind.

When in February Schwab doubled its lineup of commission-free

funds, Fidelity Investments made a similar move with the hour. "You

can see how other organizations have tried to become more like

Schwab," said Robert Siegel, a lecturer in management at Stanford

University.

Mom and pop

Mr. Schwab, born to a thrifty family in Sacramento, Calif.,

founded an $84-a-year investment newsletter in 1963. When

regulators in 1975 abolished fixed trading commissions, he got

$100,000 from an uncle and launched one of the first discount

brokerages.

Schwab went public in 1987 and attracted clients through the

1990s, as mom-and-pop investors chased stock-market gains. E*Trade

Financial Corp. and TD Ameritrade Holding Corp. followed over the

next decade, but much of Wall Street stuck to its higher fees.

After the tech bubble burst in 2000, Schwab's trading volume

suffered. CEO David Pottruck responded by raising prices. That hurt

volume further, and he left after about a year. Mr. Schwab resumed

control in 2004, slashing fees again. Mr. Pottruck didn't respond

to requests for comment.

Mr. Bettinger recounts how Mr. Schwab continually found new ways

to defy conventional wisdom about fees. In 2005, the company was

about to offer its first checking accounts. Mr. Bettinger, who had

climbed the ranks to president after selling his Ohio

record-keeping company to Schwab in 1995, was armed with an 80-page

presentation laying out pricing scenarios for clients withdrawing

from ATMs.

Mr. Schwab interrupted on slide three, asking what clients would

prefer. The answer: free withdrawals from anyone's ATM. "It was a

pure eureka moment," Mr. Bettinger said. "Who cares what the

competition does? Long term, it's the best decision."

Three years later, when bailouts were sweeping Wall Street and

Mr. Bettinger became CEO, he quickly cut a fifth of Schwab's staff

and slashed expenses. He worked to bolster its banking arm,

launching a fee-free credit card in 2008 that paid clients 2% cash

back -- generous at the time. The idea was to encourage more

clients to open bank accounts and transfer money from traditional

banks.

Wall Street was paying little heed to Schwab's moves. "People

didn't give Schwab a great deal of credibility for many years,"

said Tim Oden, who joined Schwab in 1987 and is now senior managing

director of its business catering to independent advisers. "A lot

of firms looked down their noses."

Schwab's other businesses fed the bank: As its lowered and

eliminated fees attracted new funds, it parked some of the funds in

its bank and earned interest by investing or lending the funds out.

So while it earned less off brokering and products by lowering

costs on trading and fees, those cost reductions helped steer new

money to the bank, where Schwab could earn growing returns on

it.

Schwab's bank made more than half the company's overall revenue

of $10.13 billion in 2018, up from 29% of revenue in 2009.

In 2009, Schwab executives felt the company was late to the

market for exchange-traded funds, or ETFs, mutual funds that trade

like stocks and generated profitable trading commissions for Wall

Street brokerages. To make a splash in ETFs, the Schwab executives

said, the company that year became one of the first in the U.S. to

offer commission-free ETFs, coupled with lower expenses than

rivals. "We thought we could differentiate ourselves," Mr. de St.

Paer said, so "we took a revenue cut."

Within a year, Fidelity and Vanguard said they, too, would offer

some commission-free ETFs. Much of Wall Street ignored Schwab,

sticking to charging lucrative commissions on ETF trades.

Mr. Bettinger also sought to expand Schwab's business in

providing personal financial advice, aiming to undercut Wall Street

firms. When Schwab waded into advice soon after opening its bank in

2003, it had taken prodding to convince Mr. Schwab, who hated the

idea of cultivating a high-pressure sales culture, Schwab

executives say.

Robo advice

As CEO, Mr. Bettinger pushed Schwab further into advice-giving.

In 2011, he began opening independent branch franchises to help

attract financial advisers, some from Wall Street firms, and gather

more assets with the pitch: "Drive down costs for your clients."

Schwab formed partnerships to help build the business -- unusual at

a time when it typically went it alone. "There wasn't a playbook,

or a firm we could follow," said Mr. Oden of adviser services. "We

had to innovate."

At the same time, Schwab was working to attract more independent

financial advisers who would keep their client assets at the firm.

Nearly half of Schwab's total customer assets are now managed by

roughly 7,500 independent advisory firms that use Schwab as

custodian.

Among them is Phil Fiore, who left UBS and opened his own

advisory firm in 2017. He needed a place to put clients' assets.

Now, clients at his Shelton, Conn., firm together have about $700

million at Schwab, which offered technology and research making it

easier to leave a traditional firm, he said.

"It's a magnet for some of the larger teams across the country,"

he said, speaking of groups of brokers who tend to stick together

when they leave Wall Street.

Wells Fargo & Co. is responding by trying to recruit

independent advisers to a new platform. E*Trade in 2017 bought a

custodial firm to get in on the business. Morgan Stanley and UBS

that year made it harder for brokers to leave with their clients,

slowing the pace of defectors Schwab attracted in 2018, Mr. Oden

said.

In 2014, Schwab announced its "robo advice" service, a system

that uses algorithms to provide portfolio-management services.

Assets in Schwab's digital-advice offerings now total $38 billion.

With it, Schwab has driven down fees for advice, for some clients

to nothing.

Schwab's pitch lured Ryan Post, 34, an Indianapolis project

engineer who last year moved his money from Northwestern Mutual.

Schwab's robo service built him an ETF portfolio to fit his goals.

"I said, 'look, the S&P made 22%, you earned me 8% and I had to

pay you 1.2%,' " he said. "It was kind of silly to be paying all

that money."

Northwestern Mutual said its number of wealth-management clients

is up from a year ago.

Schwab turns clients like Mr. Post into more-profitable

customers in part by putting them in funds run by its $400 billion

investment-management arm. Some have small annual fees that add up

to billions a year. And Schwab says in regulatory disclosures it

may require robo clients to keep up to 30% of the account in cash.

Doing so, Schwab earns money from interest and lending the funds to

others.

Jon Stein, founder and CEO of robo-advising pioneer Betterment

LLC, said these moves undermine Schwab's sales proposition. "Free

advice is a sham, " he said. When the relatively high cash

allocation and sweep of funds into low-yielding bank accounts are

taken into account, "they are charging way more than we are."

Betterment charges 0.25% annually on assets. Betterment is also

going after independent advisers and counts about 450 firms using

its digital service.

"Cash plays an important role in a diversified portfolio," said

Schwab spokeswoman Alison Wertheim. The service was designed to

help investors get advice, she said, and "many investors understand

and are comfortable with this approach."

Schwab's in-house advice is causing some tension as it overlaps

with the services offered by independent financial advisers

affiliated with Schwab. The tension was a popular topic during a

forum with Mr. Bettinger at an October conference, where the CEO

called any threat from its robo platform "pretty low."

Mr. Bettinger has also been driving Schwab further into wealth

management for well-to-do clients who were once the turf of elite

Wall Street firms. In 2015, he promoted Terri Kallsen, previously

head of Schwab's branch network, to head of retail. She has

overseen a 63% increase in the number of new retail clients opening

managed investment accounts. New accounts receiving advice now

average about $600,000.

There were clear signs Wall Street was finally waking up to the

Schwab threat in 2016, when Morgan Stanley lured a Schwab executive

to run its digital efforts. Morgan Stanley and other firms,

including UBS and Wells Fargo, began launching robo-adviser

services widely seen as a response to Schwab. JPMorgan Chief James

Dimon in 2017 told analysts the firm's new self-directed trading

platform, offering free trades, was a response to Schwab, said a

person who was there.

Last October, Morgan Stanley lowered the maximum rate brokers

can charge clients for advice. Executives and brokers at other

traditional brokerages say they are discounting more to keep

customers. Wealthfront Inc., a robo-adviser firm whose founding CEO

once said he modeled the company on the early days of Schwab,

recently made automated financial planning free to clients who

download the company's app.

Robinhood Markets Inc., a Silicon Valley brokerage startup, has

lured millions of new investors with commission-free trading. TD

Ameritrade is expanding its independent adviser channel. Fidelity

in August started offering index funds with no management fees

after Vanguard let clients trade rivals' funds free.

Mr. Bettinger, who said he frequently consults with Mr. Schwab,

still chairman, said he is unfazed. "The rest of the industry ends

up having to copy us anyway."

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

April 28, 2019 14:10 ET (18:10 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

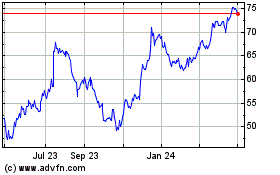

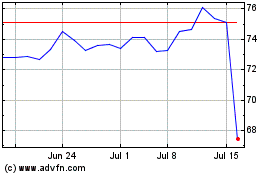

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2023 to Apr 2024