Charles Schwab Ranks Highest Among DIY Investors in the J.D. Power 2019 U.S. Self-Directed Investor Satisfaction Study

April 04 2019 - 8:30AM

Business Wire

Schwab achieves highest scores in Interaction,

Account Information, Commissions and Fees, Product Offerings, and

Information Resources

Charles Schwab has received the highest ranking among DIY

investors in overall satisfaction nationwide in the J.D. Power 2019

U.S. Self-Directed Investor Satisfaction Study. With an index score

of 805 on a 1,000-point scale, Schwab scored 37 points above the

overall satisfaction industry average, and received the highest

scores in the areas of interaction, account information,

commissions and fees, product offerings, and information

resources.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20190404005173/en/

Charles Schwab Exterior and Logo (Image

provided by Schwab)

Charles Schwab executive vice president and head of Schwab

Investor Services Terri Kallsen said, “In announcing this ranking,

J.D. Power emphasizes that Schwab’s commitment to expanding access

to investing, providing our clients with more choices, and lowering

costs to help them achieve better outcomes is earning and building

their trust and loyalty. We’re gratified that clients are

responding well to our enhanced product offerings and value

proposition, and are equally focused on serving them where, when

and how they choose.”

Earlier this year Schwab doubled its lineup on the Schwab ETF

OneSource™ platform to more than 500 ETFs with $0 online

commissions, no enrollment requirements and no early redemption

fees or activity assessment fees. Last year, the firm eliminated

minimums for individual U.S. brokerage and retirement accounts, and

lowered the operating expense ratios on five Schwab market cap

index mutual funds, removed investment minimums, and consolidated

share classes across a variety of Schwab mutual funds.

In recent years, Schwab has also expanded its suite of products

and services aimed at full-service investors, particularly in the

area of wealth management. Assets enrolled in Schwab’s advisory

solutions stood at $272.4 billion at the end of 2018, a year during

which the firm attracted a record 1.6 million new brokerage

accounts, up 9% from the previous year; total brokerage accounts

stood at 11.6 million.

The company now serves more than $3.5 trillion in client assets

through multiple channels 24/7, including 350 branches.

The official J.D. Power press release can be viewed here.

About Charles Schwab

At Charles Schwab, we believe in the power of investing to help

individuals create a better tomorrow. We have a history of

challenging the status quo in our industry, innovating in ways that

benefit investors and the advisors and employers who serve them,

and championing our clients’ goals with passion and integrity.

More information is available at www.aboutschwab.com. Follow us

on Twitter, Facebook, YouTube and LinkedIn.

Disclosures

Charles Schwab received the highest numerical score in the DIY

segment of the J.D. Power 2019 Self-Directed Investor Satisfaction

Study of investors’ satisfaction who use self-directed investment

firms. Visit jdpower.com/awards.

Through its operating subsidiaries, The Charles Schwab

Corporation (NYSE: SCHW) provides a full range of securities

brokerage, banking, money management and financial advisory

services to individual investors and independent investment

advisors. Its broker-dealer subsidiary, Charles Schwab & Co.,

Inc. (member SIPC, www.sipc.org), and affiliates offer a complete

range of investment services and products including an extensive

selection of mutual funds; financial planning and investment

advice; retirement plan and equity compensation plan services;

compliance and trade monitoring solutions; referrals to independent

fee-based investment advisors; and custodial, operational and

trading support for independent, fee-based investment advisors

through Schwab Advisor Services. Its banking subsidiary, Charles

Schwab Bank (member FDIC and an Equal Housing Lender), provides

banking and lending services and products. More information is

available at www.schwab.com and www.aboutschwab.com.

Charles Schwab Investment Management, Inc. (CSIM) is the

investment advisor for Schwab Funds which are distributed by

Charles Schwab & Co., Inc. (Schwab), Member SIPC. CSIM and

Schwab are separate but affiliated companies and subsidiaries of

The Charles Schwab Corporation.

Investment Products: Not FDIC Insured • No Bank Guarantee •

May Lose Value.

Some links provided in this press release take you to websites

not owned by Charles Schwab or its affiliates. Charles Schwab is

not responsible for the content on those websites and does not

provide, edit, or endorse any of the content. Those non-affiliated

companies are wholly responsible for the content and features found

on their sites.

© 2019 Charles Schwab & Co., Inc., All rights reserved.

Member SIPC.

(0419-9KGW)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190404005173/en/

Hibah ShariffCharles Schwab415-667-0507hibah.shariff@schwab.com

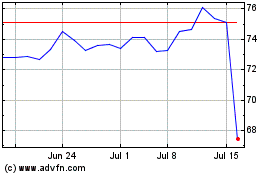

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

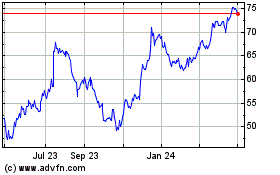

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2023 to Apr 2024