New pricing model delivers a modern approach to

planning

To simplify its approach to comprehensive professional guidance

and financial planning for the firm’s digital advisory services,

Charles Schwab is moving to a new subscription pricing model for

Schwab Intelligent Advisory™ and renaming the service Schwab

Intelligent Portfolios Premium™. There are no pricing changes to

Schwab Intelligent Portfolios®, the firm’s automated investing

service, which charges no advisory fee.

Schwab Intelligent Portfolios builds, monitors, and

automatically rebalances a diversified portfolio of low-cost

exchange-traded funds (ETFs) based on a client’s goals and provides

24/7 help from Schwab service professionals. This service is

designed as a fully digital end-to-end experience, but clients also

have access to professionals who can help with a range of topics

including client goals, risk tolerance, and portfolio

allocation.

Schwab Intelligent Portfolios Premium builds on Schwab

Intelligent Portfolios to offer:

- Unlimited 1:1 guidance from a CERTIFIED

FINANCIAL PLANNER™ professional who can provide personalized

financial advice based on current goals and provide ongoing advice

as goals and circumstances change

- A comprehensive financial plan that

provides a customized roadmap for reaching financial goals

- Ability to access the financial plan

24/7 via a comprehensive digital planning experience, including the

ability to modify assumptions in real time to see how changing

needs and circumstances could impact a client’s overall financial

picture and help them stay on track

Introducing Subscription-Based Financial Planning

The 0.28% advisory fee clients previously paid for Schwab

Intelligent Advisory, now called Schwab Intelligent Portfolios

Premium, has been replaced with an initial one-time $300 fee for

planning, and a $30 monthly subscription ($90 billed quarterly)

that does not change at higher asset levels.

“Cost and complexity are two of the biggest roadblocks to

accessing financial planning, and our goal is to break down those

barriers,” said Cynthia Loh, Charles Schwab vice president of

digital advice and innovation. “These changes are a result of

client feedback and our commitment to meet consumer expectations

for simplicity, transparency and value.”

“Subscription-based pricing is second nature to many of us who

pay this way for other forms of ongoing access and guidance – from

streaming media services to fitness and personal training

memberships. We think people should have the opportunity to pay for

financial planning the same way,” added Loh. “This new pricing

approach is part of our focus on making the investing and planning

experience easier, more modern, and more approachable. We’re

looking forward to helping people get the financial help they need,

whether they’re investing for the long term or have more immediate

life events that require a plan.”

How Schwab Intelligent Portfolios and

Schwab Intelligent Portfolios Premium Compare

Schwab Intelligent Portfolios

Schwab Intelligent

PortfoliosPremium

Investment minimum $5,000 $25,000 Fees

No advisory fee charged

One-time $300 initialplanning fee and

$30/monthfor unlimited guidance

Diversified portfolio of

low-costexchange-traded funds (ETFs)

Yes Yes

Daily monitoring and automaticrebalancing

as needed

Yes Yes Tax-loss harvesting*

Yes Yes 24/7 support from professionals

Yes Yes

Unlimited 1:1 guidance from aCERTIFIED

FINANCIAL PLANNER™professional

No Yes Comprehensive financial plan

No Yes Interactive online planning

tools No Yes

Just as if they had invested on their own, clients in Schwab

Intelligent Portfolios and Schwab Intelligent Portfolios Premium

pay the operating expenses on the ETFs in the portfolio, which

includes a combination of Schwab ETFs™ and funds from third party

providers. Based on a client’s risk profile, a portion of the

portfolio is placed in an FDIC-insured deposit at Schwab Bank. Some

cash alternatives outside of the program pay a higher yield. See

additional cost information below.

Clients do not pay commissions in Schwab Intelligent Portfolios

and Schwab Intelligent Portfolios Premium. More information about

Schwab’s digital advisory services is available here.

About Charles Schwab

At Charles Schwab, we believe in the power of investing to help

individuals create a better tomorrow. We have a history of

challenging the status quo in our industry, innovating in ways that

benefit investors and the advisors and employers who serve them,

and championing our clients’ goals with passion and integrity.

More information is available at www.aboutschwab.com. Follow us

on Twitter, Facebook, YouTube and LinkedIn.

Disclosures

Please read the Schwab Intelligent Portfolios Solutions™

disclosure brochures for important information, pricing, and

disclosures related to the Schwab Intelligent Portfolios and Schwab

Intelligent Portfolios Premium programs.

Schwab Intelligent Portfolios® and Schwab Intelligent Portfolios

Premium™ are made available through Charles Schwab & Co. Inc.

(“Schwab”), a dually registered investment advisor and broker

dealer. Portfolio management services are provided by Charles

Schwab Investment Advisory, Inc. ("CSIA"). Schwab and CSIA are

subsidiaries of The Charles Schwab Corporation.

Additional Cost Information

There is no advisory fee or commissions charged for Schwab

Intelligent Portfolios. For Schwab Intelligent Portfolios Premium,

there is an initial planning fee of $300 upon enrollment and a $30

per month advisory fee charged on a quarterly basis as detailed in

the Schwab Intelligent Portfolios Solutions™ disclosure brochures.

Investors in Schwab Intelligent Portfolios and Schwab Intelligent

Portfolios Premium (collectively, “Schwab Intelligent Portfolios

Solutions”) do pay direct and indirect costs. These include ETF

operating expenses which are the management and other fees the

underlying ETFs charge all shareholders. The portfolios include a

cash allocation to a deposit account at Schwab Bank. Our affiliated

bank earns income on the deposits, and earns more the larger the

cash allocation is. The lower the interest rate Schwab Bank pays on

the cash, the lower the yield. Some cash alternatives outside of

Schwab Intelligent Portfolios Solutions pay a higher yield.

Deposits held at Schwab Bank are protected by FDIC insurance up to

allowable limits per depositor, per account ownership category.

Schwab Intelligent Portfolios Solutions invests in Schwab ETFs. A

Schwab affiliate, Charles Schwab Investment Management, receives

management fees on those ETFs. Schwab Intelligent Portfolios

Solutions also invests in third party ETFs. Schwab receives

compensation from some of those ETFs for providing shareholder

services, and also from market centers where ETF trade orders are

routed for execution. Fees and expenses will lower performance, and

investors should consider all program requirements and costs before

investing. Expenses and their impact on performance, conflicts of

interest, and compensation that Schwab and its affiliates receive

are detailed in the Schwab Intelligent Portfolios Solutions

disclosure brochures.

The cash allocation in Schwab Intelligent Portfolios Solutions™

will be accomplished through enrollment in the Schwab Intelligent

Portfolios Sweep Program (Sweep Program), a program sponsored by

Charles Schwab & Co., Inc. By enrolling in Schwab Intelligent

Portfolios Solutions, clients consent to having the free credit

balances in their Schwab Intelligent Portfolios Solutions brokerage

accounts swept to deposit accounts at Charles Schwab Bank through

the Sweep Program. Charles Schwab Bank is a FDIC‐insured depository

institution affiliated with Charles Schwab & Co., Inc. and

Charles Schwab Investment Advisory, Inc.

*Tax‐loss harvesting is available for clients with invested

assets of $50,000 or more in their account. Clients must choose to

activate this feature.

Through its operating subsidiaries, The Charles Schwab

Corporation (NYSE: SCHW) provides a full range of securities

brokerage, banking, money management and financial advisory

services to individual investors and independent investment

advisors. Its broker-dealer subsidiary, Charles Schwab & Co.,

Inc. (member SIPC, www.sipc.org), and affiliates offer a complete

range of investment services and products including an extensive

selection of mutual funds; financial planning and investment

advice; retirement plan and equity compensation plan services;

compliance and trade monitoring solutions; referrals to independent

fee-based investment advisors; and custodial, operational and

trading support for independent, fee-based investment advisors

through Schwab Advisor Services. Its banking subsidiary, Charles

Schwab Bank (member FDIC and an Equal Housing Lender), provides

banking and lending services and products. Edelman Intelligence is

not affiliated with the Charles Schwab Corporation or its

affiliates. More information is available at www.schwab.com and

www.aboutschwab.com.

Investment Products: Not FDIC Insured • No Bank Guarantee •

May Lose Value.

© 2019 Charles Schwab & Co., Inc., All rights reserved.

Member SIPC. (0319-9T04)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190328005640/en/

Marianne AhlmannCharles

Schwab415-667-1115Marianne.ahlmann@schwab.com

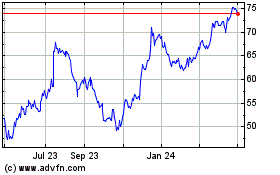

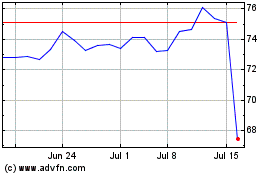

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2023 to Apr 2024