Report of Foreign Issuer (6-k)

July 30 2020 - 6:04AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of July, 2020

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS

(Exact name of registrant as specified in its charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

SUMMARY

OF THE DECISIONS

CENTRAIS

ELÉTRICAS BRASILEIRAS S/A CNPJ: 00.001.180/0001-26 | NIRE: 533.0000085-9 PUBLIC COMPANY

Centrais Elétricas Brasileiras

S/A (“Company” or “Eletrobras”) (B3: ELET3, ELET5 & ELET6; NYSE: EBR & EBR.B; LATIBEX: XELT.O

& XELT.B) in compliance with the provisions of item IX of article 21 of CVM Instruction 480/2009, informs the Shareholders

and the market in general the Summary of Resolutions taken at the 60th Shareholders' Annual Meeting held on this date.

The Shareholders attending the 60th Annual

General Meeting decided by majority:

|

|

1.

|

To approve to take the Managements accounts, examine, discuss and

vote on the Management Report and the Company´s Complete Financial Statements, related to the fiscal year ended on December

31, 2019;

|

|

|

2.

|

To approve the deliberation on the proposal of the Company’s

management for destination of the results related to the year ended on December 31, 2019 and the distribution of dividends, to

be paid by December 31, 2020, pursuant to Article 205, paragraph 3, of Federal Law No. 6,404 of December 15, 1976, as amended;

|

|

|

3.

|

To approve the election of Lúcia Maria Martins Casasanta,

for the Board of Directors, by indication of the controlling shareholder, pursuant to article 32, I, of the Bylaws, replacing Mr.

Vicente Falconi Campos, to complete the term of his mandate, to be ended on the 2021 annual general meeting;

|

|

|

4.

|

To approve the election of Hailton Madureira de Almeida (effective)/Ricardo

Takemitsu Simabuku (alternate), appointed by the controlling shareholder, to the Company´s Fiscal Council, in accordance

with its Bylaws, until the 2021 annual general meeting;

|

|

|

5.

|

To approve the election Eduardo Coutinho Guerra (effective)/Marcelo

Senna Valle Pioto (alternate), appointed by the controlling shareholder, to the Company´s Fiscal Council, in accordance

with its Bylaws, until the 2021 annual general meeting;

|

|

|

6.

|

To approve the election of Antônio Emílio Bastos

de Aguiar Freire as alternate member to the Company´s Fiscal Council, by the preferred shareholders, in a separate vote,

for a term until the 2021 annual general meeting;

|

|

|

7.

|

To approve the fixing of the remuneration of the administrators and

members of the Fiscal Council, as oriented by the Secretariat for Coordination and Governance of State-owned Companies, in view

of the provisions of art. 98, item VI, item “i”, of Annex I of Decree No. 9,745, of April 8, 2019, according table

and the following terms:

|

|

|

This document may contain estimates and forecasts that are not statements of fact that occurred in the past but reflect our management beliefs and expectations and may constitute future events' forecasts and estimates under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended. The words "believe", "may", "estimate", "continue", "anticipate", "intend", "expect" and related words are intended to identify estimates that necessarily involve risks and uncertainties, known or unknown . Known risks and uncertainties include, but are not limited to: general economic, regulatory, political and commercial conditions in Brazil and abroad, changes in interest rates, inflation and value of the Real, changes in volumes and the pattern of use of electricity by consumer, competitive conditions, our level of indebtedness, the possibility of receiving payments related to our receivables, changes in rainfall and water levels in the reservoirs used to operate our hydroelectric plants, our financing and capital investment plans, existing and future government regulations , and other risks described in our annual report and other documents filed with CVM and SEC. Estimates and forecasts refer only to the date they were expressed and we assume no obligation to update any of these estimates or forecasts due to the occurrence of new information or future events. Future results of the Company's operations and initiatives may differ from current expectations and the investor should not rely solely on the information contained herein. This material contains calculations that may not reflect accurate results due to rounding.

|

|

|

a.

|

set the global amount to be paid to the managers

of this company at up to R$ 11,510,538.08, in the period between April 2020 and March 2021;

|

|

|

b.

|

set up to R$ 10,883,808.30 the total compensation

to be paid to members of the Executive Board, in the period between April 2020 and March 2021;

|

|

|

c.

|

set the total compensation to be paid to the

Board of Directors at up to R$ 626,729.78, in the period between April 2020 and March 2021;

|

|

|

d.

|

set the total compensation to be paid to the

Fiscal Council at up to R$ 391,706.12, and the total compensation to be paid to the Audit Committee at up to R$ 2,350,236.70, in

the period between April 2020 and March 2021;

|

|

|

e.

|

set the monthly fees of the members of the

Board of Directors and Fiscal Council at one tenth of the average monthly compensation of the members of the Executive Board, excluding

amounts related to additional vacation and benefits;

|

|

|

f.

|

set the monthly fees of the members of the

Audit Committee at 60% of the average monthly compensation of the members of the Executive Board, excluding amounts related to

additional vacation and benefits;

|

|

|

g.

|

recommend the observance of the individual

limits defined by Sest, emphasizing its competence to set these limits for the period of twelve months, by heading and by position,

taking into account the limits defined in points “a” and “b”;

|

|

|

h.

|

expressly prohibit the transfer to the administrators

of any benefits that, eventually, will be granted to the company's employees, upon the formalization of the Collective Labor Agreement

- ACT on their respective base date;

|

|

|

i.

|

prohibit the payment of any remuneration item

not deliberated in this meeting for the administrators, including benefits of any nature and representation fees, under the terms

of Law No. 6,404/76, art. 152;

|

|

|

j.

|

if there is any Director in the situation of

ceded (public servant or employee of another state-owned company), the provisions of Decree No. 9.144/2017 must be observed, and

the reimbursement to the cedant should be limited to the individual amount approved for that member at the General Meeting;

|

|

|

This document may contain estimates and forecasts that are not statements of fact that occurred in the past but reflect our management beliefs and expectations and may constitute future events' forecasts and estimates under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended. The words "believe", "may", "estimate", "continue", "anticipate", "intend", "expect" and related words are intended to identify estimates that necessarily involve risks and uncertainties, known or unknown . Known risks and uncertainties include, but are not limited to: general economic, regulatory, political and commercial conditions in Brazil and abroad, changes in interest rates, inflation and value of the Real, changes in volumes and the pattern of use of electricity by consumer, competitive conditions, our level of indebtedness, the possibility of receiving payments related to our receivables, changes in rainfall and water levels in the reservoirs used to operate our hydroelectric plants, our financing and capital investment plans, existing and future government regulations , and other risks described in our annual report and other documents filed with CVM and SEC. Estimates and forecasts refer only to the date they were expressed and we assume no obligation to update any of these estimates or forecasts due to the occurrence of new information or future events. Future results of the Company's operations and initiatives may differ from current expectations and the investor should not rely solely on the information contained herein. This material contains calculations that may not reflect accurate results due to rounding.

|

|

|

k.

|

if any Director is an employee of the company,

his employment contract must be suspended, under the terms of Precedent No. 269 of the TST

|

|

|

l.

|

to condition the payment of the “quarantine”

to the approval of the Public Ethics Committee of the Presidency of the Republic - CEP/PR, under the terms of the current legislation;

|

|

|

m.

|

to clarify that it is the responsibility of

the Board of Directors, with the support of Internal Audit and the Audit Committee, to ensure compliance with the global and individual

compensation limits for statutory members defined in this General Meeting;

|

|

|

n.

|

to condition the payment of the Annual Variable

Remuneration - RVA of the directors to strict compliance with the terms and conditions contained in the RVA Programs previously

approved by Sest;

|

|

|

o.

|

to apply, if applicable, reversal of deferred

installments not yet paid for RVA Programs from previous years in which, considering the net profit for the year 2019, there is

a drop of more than 20% when compared to the base years of the Programs, under the terms current legislation; and

|

|

|

p.

|

to condition the payment of the "supplementary

pension" to the provisions of article No. 202, §3 of CF/88 and article No. 16 of Complementary Law No. 109/2001.

|

|

|

8.

|

To approve the alteration of the newspapers in which the Company

carries out its legal publications, starting to make its publications, for all purposes recommended in article 289, of Law 6.404/1976,

in the Official Gazette of the Union - DOU and in the Jornal de Brasília.

|

The Shareholders attending the 178th

Shareholders’ Extraordinary General Meeting decided by majority:

|

|

1.

|

To approve the reform of the following articles

of the Company's Bylaws: 32, item II, 36, item XXII and 50, I, for adaptation and compliance with Law No. 13,844 of June 18, 2019,

which now have the following wording:

|

Article 32, item II: “an

advisor appointed by the Minister of State for the Economy, in accordance with the legislation in force.”

Article 36, item XXII: “to

resolve on the appointment and dismissal of the holder of the position of holder of the Internal Audit, after approval by the Office

of the Comptroller General, the Ombudsman and the Secretariat of Governance.”

Article 50, item I: “01 (one)

member and respective alternate nominated by the Ministry of Economy, as representative of the National Treasury, who must be a

civil servant with a permanent bond with the federal public administration.”

Rio de Janeiro, July 29, 2020

Elvira Cavalcanti Presta

CFO and Investor Relations Officer

|

|

This document may contain estimates and forecasts that are not statements of fact that occurred in the past but reflect our management beliefs and expectations and may constitute future events' forecasts and estimates under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended. The words "believe", "may", "estimate", "continue", "anticipate", "intend", "expect" and related words are intended to identify estimates that necessarily involve risks and uncertainties, known or unknown . Known risks and uncertainties include, but are not limited to: general economic, regulatory, political and commercial conditions in Brazil and abroad, changes in interest rates, inflation and value of the Real, changes in volumes and the pattern of use of electricity by consumer, competitive conditions, our level of indebtedness, the possibility of receiving payments related to our receivables, changes in rainfall and water levels in the reservoirs used to operate our hydroelectric plants, our financing and capital investment plans, existing and future government regulations , and other risks described in our annual report and other documents filed with CVM and SEC. Estimates and forecasts refer only to the date they were expressed and we assume no obligation to update any of these estimates or forecasts due to the occurrence of new information or future events. Future results of the Company's operations and initiatives may differ from current expectations and the investor should not rely solely on the information contained herein. This material contains calculations that may not reflect accurate results due to rounding.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS

|

|

|

|

|

|

By:

|

/S/ Elvira Baracuhy Cavalcanti Presta

|

|

|

|

Elvira Baracuhy Cavalcanti Presta

CFO and Investor Relations Officer

|

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

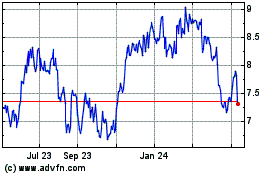

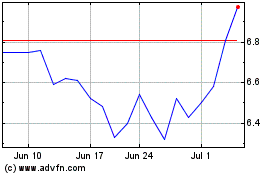

Centrais Eletricas Brasi... (NYSE:EBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Centrais Eletricas Brasi... (NYSE:EBR)

Historical Stock Chart

From Apr 2023 to Apr 2024