SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of July, 2020

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS

(Exact name of registrant as specified in its charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Annual Letter of Public Policies and Corporate Governance for 2019

Summary

|

Message from the Management

|

3

|

|

General identification

|

4

|

|

1. Who we are

|

5

|

|

2. Our Activities

|

6

|

|

3. Our Public Commitment

|

10

|

|

4. Our Risk Management

|

15

|

|

5. Our Internal Controls Structure

|

17

|

|

6. Our Economic and Financial Results

|

20

|

|

7. Our Corporate Governance Model

|

21

|

|

8. Our Major Corporate Governance Improvements

|

26

|

|

|

|

Annual Letter of Public Policies and Corporate Governance for 2019

Message from the Management

Eletrobras´name is intrinsically associated with the robust Brazilian electrical industry. And it’s not for less. We are the largest electric power company in Latin America. In 2019, we overcame the 50 thousand MW of installed capacity milestone and closed the year accounting for 30% of the country’s generation and 45% of transmission lines.

With the activation of the 18th and last turbine in November 2019, we launched Belo Monte - the largest 100% Brazilian hydroelectric power unit, with 11,233 MW. Located in Pará, Belo Monte transforms the strength of the Xingu River into renewable energy for about 60 million Brazilians. The commitment to clean energy, which accounts for 96% of the Eletrobras matrix, also inspired us to implement a landmark of innovation and sustainability: the floating solar plant in the reservoir of the Sobradinho hydroelectric power unit, in the Brazilian State of Bahia.

As important as highlighting operational successes linked to the company’s core business is to emphasize that operational excellence is the result of a management that prioritizes corporate governance, sustainable performance, financial discipline and valuing people, always seeking to find a balance between these themes.

Management and corporate governance practices were also intensely developed and improved in 2019. Throughout the year, in 27 work meetings, the Board of Directors (CA) actively participated in the monitoring of the strategic projects and goals of the Business and Management Master Plan (PDNG), as well as drafted and approved the guidelines of the next strategic planning cycle.

It was also a year of consolidation of Eletrobras’ Statutory Audit and Risk Committee (CAE), which assists the Board in monitoring the PDNG by examining the fundraising and discipline in capital allocation, with analyses of the effectiveness of internal controls, audit and compliance issues.

Market and government recognition certified the Company’s good performance, ensuring the same level of certification as in 2018, in IG-SEST and advancing in the Governance Highlight Program of B3’s State-Owned Companies from 50 to 56 points, only four levels below the maximum score.

In the first days of 2020, after this work, shareholders approved the merger of operations of subsidiaries Eletrosul and CGTEE, thus creating Eletrobras CGT Eletrosul. The new company will deepen the synergy of operations in the Brazilian southern area, allowing greater efficiency, improvement of processes, and optimization of results. The sale of Amazonas GT to Eletronorte was also approved, optimizing the governance of the subsidiaries and the capital structure of the Eletrobras group.

Eletrobras is more integrated, efficient, and sustainable. Nonetheless, there still are many challenges, especially for achieving one of Eletrobras’ primary goals: to recover our investment capacity and expanding the possibility of operating with continued success in a highly competitive environment.

We appreciate the trust, recognition and synergy of our shareholders, employees and other partners in the building of a successful company.

|

Wilson Ferreira Junior

President of Eletrobras

|

José Guimarães Monforte

Chairman of the Board of Directors of Eletrobras

|

Annual Letter of Public Policies and Corporate Governance for 2019

General identification

In accordance with article 8, items I, III and VIII, of Law No. 13,303, of June 30, 2016, with article 13, items I, III and VIII, of Decree No. 8,945, of December 27, 2016 , and with articles 16 and 18 of the Regulations of the B3 (Brasil, Bolsa, Balcão) Highlight Governance Program for State-Owned Companies, the Board of Directors subscribes to this Annual Letter of Public Policies and Corporate Governance of Centrais Elétricas Brasileiras S/A — Eletrobras, for the fiscal year of 2019.

|

CNPJ No. 00.001.180/0002-07, Rio de Janeiro, and No. 00.001.180/0001-28 Brasília. NIRE

53300000859

|

|

Head office in Brasília, Federal District, and central office at Rua da Quitanda 196, 24th floor, Rio de Janeiro, RJ

|

|

Type of State-Owned Company: Government-Controlled Company — Holding

|

|

Controlling Shareholder: Federal Government through National Treasury

|

|

Type of Company: Corporation

|

|

Type of Capital: Subscribed Capital

|

|

Scope of Performance: International

|

|

Field of Activity: Energy

|

|

Finance and Investor Relations Officer: Elvira Baracuhy Cavalcanti Presta — Phone #: (21) 2514-4631, e-mail: df@eletrobras.com

|

|

Current independent auditors of the company: PricewaterhouseCoopers Auditores Independentes

Technician in Charge: Guilherme Naves Valle— Partner

E-mail: Guilherme.valle@pwc.com — Phone #: (21) 32326112

|

|

Board of Directors Subscribers to the Annual Letter

|

BRAZILIAN INDIVIDUAL TAXPAYERS IDENTIFICATION (CPF)

|

|

Wilson Ferreira Junior

|

012.217.298-10

|

|

José Guimarães Monforte (Chief Executive Officer)

|

447.507.658-72

|

|

Mauro Gentile Rodrigues da Cunha

|

004.275.077-66

|

|

Vicente Falconi Campos

|

000.232.216-15

|

|

Ruy Flaks Schneider

|

010.325.267-34

|

|

Bruno Eustáquio Ferreira Castro de Carvalho

|

053.965.606-22

|

|

Ricardo Brandão Silva

|

634.956.941-53

|

|

Marcelo de Siqueira Freitas

|

776.055.601-25

|

|

Luiz Eduardo dos Santos Monteiro

|

083.301.757-82

|

|

Daniel Alves Ferreira

|

205.862.458-04

|

|

Felipe Villela Dias

|

218.680.308-90

|

|

Managers Subscribers to the Annual Letter

|

BRAZILIAN INDIVIDUAL TAXPAYERS IDENTIFICATION (CPF)

|

|

Wilson Ferreira — Chairman

|

012.217.298-10

|

|

Elvira Baracuhy Cavalcanti Presta – Finance and Investor Relations Officer

|

590.604.504-00

|

|

Lucia Maria Martins Casasanta – Governance, Risk and Compliance Officer

|

491.887.206-91

|

|

Pedro Luiz de Oliveira Jatobá – Generation Officer

|

116.073.435-68

|

|

Márcio Szechtman – Transmission Officer

|

155.239.268-68

|

|

Luiz Augusto Pereira de Andrade Figueira – Management and Sustainability Officer

|

844.097.897-91

|

Annual Letter of Public Policies and Corporate Governance for 2019

1. Who we are

Centrais Elétricas Brasileiras S.A - Eletrobras was established by Law No. 3,890-A, of June 11, 1962, as a publicly-held federal government-controlled corporation, controlled by the Federal Government. Its purpose is the promotion of studies, construction and operation projects of generation plants and electrical energy transmission lines, as well as the execution of commercial acts resulting from these activities.

Backed by the collective interest that justified its creation, the purpose of the company is cooperating with the Ministry of Mines and Energy to improve the Country’s energy policy, as described in the following paragraphs. .

In addition, it plays an important role in the energy integration of Latin America, with the government agent responsible for bi-national projects such as Itaipu and border interconnections with Argentina (Conversion Station of Uruguaiana) and Paraguay (Conversora de Rivera station).

Eletrobras also operates in major hydraulic generation projects in the country, such as Belo Monte, Santo Antônio, Jirau and Teles Pires, thus contributing to the construction of the country’s strategic infrastructure in terms of power generation.

The company is responsible for the administration of government programs focused on the development of Brazil through the electricity industry, such as the National Electricity Conservation Program (PROCEL), the National Program for Universal Access to and Use of Electricity (Light for All) and the Alternative Energy Sources Incentive Program (PROINFA).

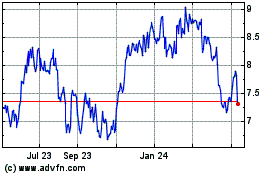

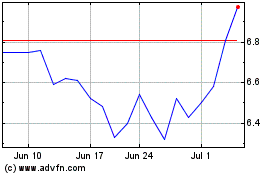

Eletrobras is registered with the Brazilian Securities and Exchange Commission (CVM) and with the US Securities and Exchange Commission (SEC). It trades common shares at Brasil, Bolsa, Balcão [B]³ under ticker “ELET3” and class “B” and class “A” preferred shares under tickers “ELET6” and “ELET5”, respectively. At the New York Stock Exchange (NYSE), the shares are traded through the Level II ADR Program under tickers “EBR” and “EBR-B”. On the Latibex Stock Exchange, the shares are traded through the Latibex Program, under tickers “XELTO” and “XELTB”.

It also acts as holding, with direct equity control in 7 electrical energy generation and/or transmission companies on December 31, 2019, in addition to Eletrobras Participações S.A – Eletropar and interest in Itaipu Binacional – Itaipu (through f joint control under the International Treaty signed by the Governments of Brazil and Paraguay), in Inambari Geração de Energia S.A., and in Rouar S.A. (through joint control with the state-owned Uruguayan company Usina y Transmissiones Eléctricas de Uruguay – UTE). Eletrobras is the main sponsor of the Electrical Energy Research Center - Cepel, which is an advanced infrastructure for applied research in electrical systems and equipment, aiming at the creation and provision of technological solutions with special focus on generation, transmission, distribution and trade of electrical energy in Brazil.

Annual Letter of Public Policies and Corporate Governance for 2019

The Company also operates as energy trading agent for Itaipu Binacional and for participants of the Alternative Energy Sources Incentive Program (PROINFA).

Eletrobras’ share capital totalled BRL 31,305 Billion, accounting for 1,352,634,100 shares, of which 1,087,050,297 are common shares and 265,436,883 are preferred shares. Compared to 2018, there was no material change to the formation of the Company’s share capital.

Our companies:

On December 31, 2019, the Eletrobras System was formed by the Holding and 7 subsidiaries, 6 of which are operational, and 50% of interest in Itaipu Binacional.

We provide below a brief description of Generation and Transmission companies controlled by Eletrobras:

· Amazonas Geração e Transmissão de Energia S/A, which develops generation and transmission activities in the state of Amazonas. It had been a subsidiary of Eletrobras until March 16, 2020, when its shares were transferred to Eletronorte.

· CGT Eletrosul, formed by the consolidation of Eletrosul, which developed generation and transmission activities in the states of Santa Catarina, Rio Grande do Sul, Mato Grosso do Sul and Paraná and CGTEE, that held and operated thermoelectric power plants in the Southern region of Brazil.

· Chesf, which develops generation and transmission activities in the Brazilian Northeastern region.

· Eletronorte, which develops generation, transmission and distribution activities in the North and Midwestern part of Brazil.

· Eletronuclear, which has and operates two nuclear power plants, Angra 1 and Angra 2, and is currently building a third one, Angra 3.

Eletrobras holds a 50% interest in Itaipu Binacional, the world’s second largest hydroelectric power unit. Its control is shared with ANDE, the Paraguayan government entity.

Plus, it controls Eletropar, a company with relevant minority interest in Eletronet S.A. In addition to that, Eletrobras has minority interest in 25 energy companies. The following ones stand out: EDP - Energias do Brasil S.A, Companhia de Transmissão de Energia Elétrica Paulista (CTEEP), Empresa Metropolitana de Águas e Energia S.A. (EMAE), Light S.A, among others.

Eletrobras is the main sponsor of Cepel, the largest center for technological and development research in the electric sector in Latin America.

They also have shareholdings in 136 SPEs (Special Purpose Entities) in Brazil, 108 of which are for generation, 25 for transmission and 3 for services, in addition to 2 SPEs abroad.

2. Our Activities

Through its subsidiaries, Eletrobras performs electric power generation and transmission activities in Brazil. Company revenue comes mainly from:

· Generation of electric energy through its subsidiaries, and sale of such energy to energy distribution companies and free consumers. In 2019, the generation revenue totaled BRL

19,834 million, or 71.5% of the Company’s total net revenue, totaling BRL 23,374 million gross. BRL 18,153 million were from energy supply services and BRL 3,549 million from operation and maintenance services; and

Annual Letter of Public Policies and Corporate Governance for 2019

· Transmission of electrical energy - in 2019, the revenue from transmission activities totaled BRL 8,757 million or 31.6% of the Company’s net revenue.

Until 2018, Eletrobras also operated in electrical energy distribution. The Company held a sale auction and transferred four of its distribution companies in 2018 and two in the first half of 2019, ending its participation in the energy distribution market.

Eletrobras operates in electrical energy generation, transmission and trade in the country and contributes to making the Brazilian energy matrix one of the cleanest, most renewable in the world. In 2019, Brazil reached an installed capacity of 170 GW, of which Eletrobras contributed with 30%, i.e., 51 GW. Of this total, 23.6% correspond to their proportional interest in projects performed through Special Purpose Entities (SPEs) and 15.5% come from shared ventures, including half of Itaipu Binacional’s capacity (7,000 MW).

About 96% of the Company’s installed capacity comes from sources with low greenhouse gas (“GHG”) emissions, such as solar, nuclear, wind and hydraulic. Given their interest in the country’s electricity matrix, in 2019, of the total installed coming from sources with low GHG emissions, 42% belong to Eletrobras.

On December 31, 2019 Eletrobras Companies’ transmission lines reached approximately 71,000 km, out of which 64,1 km are corporate lines of the Eletrobras Systems and 7,000 km correspond to Eletrobras’ participation via SPEs. Considering only the basic network of the Brazilian Interconnected System, i.e., the voltages of ±800, 750, ±600, 525/500, 345 and 230 kV, Eletrobras is responsible for 64,8 km of the transmission lines, which accounts for about 45.25% of Brazil’ total lines relating to said voltages.

Generation Business

Eletrobras’ main activity is the generation of electrical energy, whose net revenue is equivalent to 71.5% of Eletrobras’ total operating revenue in 2019.

On December 31, 2019 Eletrobras had an installed capacity of 51,143, compared to 49,801 in 2018. This includes 7,000MW of the Itaipu plant and 12,048MW from Eletrobras’ participation in SPEs. Additionally, Eletrobras has approximately 1,745MW in Brazilian projects planned until 2026.

Law No. 10,438/2002 ordered Eletrobras to be the Energy Trading Agent for Itaipu. In this condition, in 2019, the company transferred 66,849 GWh of power linked to the contracted power to concessionaires in the Southern, Southeastern and Midwestern Regions, which accounted for a turnover of approximately US$ 3.6 Billion. The contracted power refers to the portion of the monthly power that is up to Eletrobras of the full power of Itaipu available for contracting. The power above that linked to the power contracted, purchased by Eletrobras, was 3,222 GWh.

Transmission Business

The Interconnected Power System in Brazil has a wide transmission system to transport the energy produced by different plants across the country to consumers.

Annual Letter of Public Policies and Corporate Governance for 2019

The system that carries power at high voltages (from 230 kV to 800 kV in AC and DC technology) is known as Basic Network. A small portion of the Brazilian power transmission system, mainly in the Northern region, is still isolated from the Brazilian Interconnected Power System.

Eletrobras had 64,138 km of transmission lines, including 7,015 km from Eletrobras’ participation in SPEs, totaling 71,154 km.

Price Formation

In the current model of the Brazilian electrical energy sector, commercial relationships are established under the Regulated Contracting Environment – ACR and the Free Contracting Environment – ACL. The differences between the amounts generated, contracted and consumed are accounted for and settled in the Short-Term Market. Brazilian Electric Energy Trading Chamber - CCEE is responsible for the operation of these three environments.

The electrical energy auctions held by CCEE, by delegation from the National Electric Energy Agency - ANEEL, is the main form of contracting in the Regulated Contracting Environment - ACR. Purchasers and traders of energy participating in the auctions formalize their commercial relationships via contracts registered under the ACR.

The structuring auctions defined by the National Energy Policy Council - CNPE are held directly by ANEEL.

Contracts in this environment have specific regulation for aspects such as energy price, contract registration submarket and term of supply, which are not subject to bilateral changes by agents. Despite not being contracted at auctions, the energy generated by the Itaipu Binacional plant and the energy associated with the Alternative Energy Sources Incentive Program - Proinfa are included in the ACR, as its contracting is regulated and subject to specific conditions defined by ANEEL.

The price formation process is detailed in item 7.1 of the Reference Form.

Our Strategic Plan

With the mission of acting in the energy markets in an integrated, profitable and sustainable way, Eletrobras wants to be in 2030 among the three largest global clean energy companies and among the ten largest in the world in electric energy, with profitability comparable to the best in the industry, not to mention recognition by all its stakeholders.

|

|

|

|

|

|

|

PURPOSE

|

|

FUTURE VISION

|

|

VALUES

|

|

We put all our energy into the sustainable development of society.

|

|

To be an innovative clean energy company, recognized for its excellence and sustainability.

|

|

Respect for people and life

Ethics and Transparency

Excellence

Innovation

Collaboration and Recognition

|

Annual Letter of Public Policies and Corporate Governance for 2019

The Company is present in the country’s major structuring projects, actively participating in the expansion of the Brazilian electric system with a capital role in the construction of the National Interconnected System, thus accomplishing the goals for what it was created.

In March 2020, Eletrobras’ Board of Directors approved the Business and Management Master Plan for the period from 2020 to 2024 (“2020-2024 PDNG”), which was unfolded from the 2015-2030 Strategic Plan. The main efforts were disclosed to the market through Material Fact dated 03/27/2020. The process saw a significant evolution in the level of monitoring and diligence by the Company’s governance departments.

The figure below shows the results achieved in 2019 out of the main challenges of Strategic Guidelines gathered in Challenge 22 – Sustainable Excellence:

In turn, the targets for 2020 are as follows:

Annual Letter of Public Policies and Corporate Governance for 2019

3. Our Public Commitment

As established in the Law that provided for the creation Eletrobras (Law No. 3,890-A/61) and in its Articles of Incorporation, as a federal government-controlled company, Eletrobras was created in order to explore the economic activities related to the energy industry due to the relevant collective interest that permeates the provision of public utilities.

Pursuant to current legal provisions, Eletrobras shall develop the following activities of public interest:

· operate programs for universal access to electricity;

· manage contracts from programs aimed at increasing the participation of alternative power generation ventures projects;

· execute fostering and consumer guiding programs, projects aimed at a more efficient energy use;

Its Articles of Incorporation also establish that Eletrobras must cooperate with the Ministry of Mines and Energy to improve the Country’s energy policy. In this sense, it is responsible for the management of some specific programs, described below, whose funds come directly from the federal government:

Light for All Program

The Light for All Program (LPT) aims to provide, by 2022, electricity to Brazilian rural populations that still do not have access to this public service.

The Program is coordinated by the Ministry of Mines and Energy (MME) and operated by Eletrobras. In its role, Eletrobras is responsible for the technical and budgetary analysis of Works Programs proposed by the executing agents, for the execution and management of Operationalization Contracts. Plus, it monitors the execution of rural electrification works under the LTP, offering subsidies for release of federal funds and proving how these funds are applied. By not acting as executor in the LPT, Eletrobras Holding does not present universalization goals.

To operate the Light for All Program, Eletrobras implemented internal controls with mapping processes and activities developed in the Company and which, from time to time, subject to internal audit. External audits are also carried out by control bodies, such as the Office of the Federal Controller General, and several requests for information from ANEEL, MME, Prosecution Offices, Federal Police, etc. are satisfied in order to provide transparency to processes managed by Eletrobras.

To cover expenses arising from the operation function, Eletrobras receives funds from the Administrative Costs Reimbursement Rate (TRCA), associated with the Operation Contracts entered into within the scope of the LPT, paid by the Program’s executing agents. According to LPT regulations, in Contracts executed until February 2013, the TRCA is equivalent to 1% (one percent) on the amount of each release of CDE funds and paid at the time of each release.

In Contracts executed as of March 2013, the TRCA is equivalent to 1% (one percent) on the Total Cost of the Works Program contracted by the executing agent and paid, in a single installment, when the execution installment of the respective Operation Contract is released.

Annual Letter of Public Policies and Corporate Governance for 2019

In 2019, the TRCA received by Eletrobras totaled BRL 16,127,646.21, compared to the cost of BRL 10,723,489.99, carried out by the area responsible for managing the LPT at Eletrobras, without considering the costs of other areas involved with the execution of activities related to the Program’s operation, such as the financial, transmission, IT and legal areas.

Program funds come from the Federal Government as a subsidy, through the Energy Development Account (CDE), and as a financing, through the Global Reversion Reserve (RGR) or Caixa Econômica Federal, plus from state governments involved and executing agents. By the end of 2019, these funds totaled BRL 27.62 billion, of which BRL 20.08 billion (73%) were sector funds (CDE and RGR).

Over 3.5 million connections were made in the program since 2004, accounting for 16.8 million beneficiaries in the Brazilian rural areas.

It is important to note that the Light for All Program also covers services provided by contracts not operated by Eletrobras. The MME and the state governments are responsible for monitoring such contracts.

Only considering the commitments with Eletrobras, 9,819 projects were registered in the Light for All Program’s Project Management System in 2019, totaling 551,922 projects since 2004. This total of works resulted in 3,091,690 connections, which corresponds to 95% of the total number of connections contracted between the Executing Agents and Eletrobras.

More Light for the Amazon Program

The National Program for Universal Access to and Use of Electrical Energy in the Legal Amazon - More Light for the Amazon (MLA) aims to provide electricity to the Brazilian population living in remote regions of the Legal Amazon.

The Program, established by Decree No. 10,221/2020, of February 5, 2020, is coordinated by the Ministry of Mines and Energy (MME) and operated by Eletrobras, designated by Ordinance No. 86/2020, of March 9, 2020. The Program is effective until December 31, 2022, with the possibility of an extension until the conclusion of universal access to electricity in remote regions of the states of the Legal Amazon.

Concessionaires, permit holders and public service authorized electrical energy distribution facilities operating in the Legal Amazon are required to join the MLA, whose services will be carried out through renewable sources of electrical energy generation, with a view to integrating energy efficiency to technological options.

The financial funds needed for the Program will come from agents in the electricity sector, from the Energy Development Account (CDE), established as an economic subsidy, and from other sources to be regulated by MME and other government agencies.

Eletrobras, the operational agent, whose attributions in the MLA were defined in the Operation Manual, counts on the expertise of its professionals in the management of rural electrification programs, with procedures already audited and validated by the Federal Accounting Court and by the Office of the Federal Controller General.

In 2020, the Operation Manual for the More Light for the Amazon Program will be published by the Ministry of Mines and Energy. This Manual will define the Program’s execution model and the form of reimbursement to Eletrobras of expenses arising from its operation function, as happens with the Light for All Program.

Annual Letter of Public Policies and Corporate Governance for 2019

According to the Program’s Operation Manual, the Executing Agent will pay Eletrobras a fee as reimbursement of administrative costs equivalent to 1% (one percent) on the total cost of the Works Program contracted by the Executing Agent, under the “MORE LIGHT FOR THE AMAZON” Program. The administrative cost reimbursement fee will be paid through transfer of the amount previously retained by CCEE to the Operation Agent, in a single installment, charged upon the release of the initial subsidy installment associated with the Works Program.

More details on the Program are available at the Ministry of Mines and Energy’s website: www.mme.gov.br.

Alternative Energy Sources Incentive Program - PROINFA

In 2002, the Brazilian government established Proinfa, aiming to create certain incentives for the development of alternative energy sources, such as wind projects, small hydroelectric plants and biomass generation projects. As with other social programs, Eletrobras is involved in the management of Proinfa.

Under the program, Eletrobras purchases the energy generated by these alternative sources for a period of up to 20 years and transfers that energy to free consumers and certain energy distribution companies (which are responsible for including the costs of the program in the tariffs charged from all final consumers in their respective concession areas, except for low-income consumers). In its initial phase, Proinfa is limited to a contracted capacity of 3,300MW (1,100MW from each alternative energy source).

In 2019, PROINFA generated 8.9 million MWh with a cost of BRL 4.05 billion. Eletrobras received BRL 16,152,394.56 in 2018, from the Federal Government to reimburse administrative costs, as presented in the PROINFA Annual Plan – PAP, approved by ANEEL. The figures for 2019 are being ascertained by the competent bodies.

Global Reversion Reserve - RGR

Eletrobras was responsible for managing financing contracts awarded with funds from the Global Reversion Reserve - RGR until May 1, 2017, when management was transferred to CCEE. However, in accordance with article 28 of Decree No. 9,022/2017, financing contracts executed until November 17, 2016 remained under the responsibility of Eletrobras, which must carry out the collection of the installments and repay the RGR with funds received as amortization, contractual interest and credit facility fees.

Eletrobras is entitled to a contract management fee for exercising such financing contract management activity.

Furthermore, in the event of contract breach by the debtor against Eletrobras, the reimbursement of such amount should only occur once the debtor makes such payment to Eletrobras, inclusive of interest and any applicable penalties due until the date of such payment is settled. Therefore, Eletrobras is not subject to risk of default or late payment by the debtor due to its management of such contracts.

Annual Letter of Public Policies and Corporate Governance for 2019

National Electrical Energy Conservation Program - PROCEL

Aimed at promoting the efficient use of electricity in the country by combating waste and reducing sectorial costs, the National Electrical Energy Conservation Program (“Procel”) is a program created by the Federal Government to implement sectorial actions in the areas of education and dissemination of information, construction, environmental sanitation, municipal energy management, public lighting and industry across the country. Information on Procel’s subprograms is available at www.procelinfo.com.br.

Procel funds come comes from Law 13,280/16. It has an extra-budgetary nature (i.e., its funds do not come from the Federal Government) and its funds come from 0.1% of the Net Operating Revenue (NOR) of electricity distribution companies.

The transfer of funds provided for by Law No. 13280/2016 to Procel and their further use are conditioned upon the presentation and approval of the Annual Fund Investment Plan (RAP) and accountability of the previous year. The benefits produced by the program may be accounted for both by the energy savings and by the investments postponed in the expansion of the sector, which revert to benefits for society.

The funds provided for by the Law are deposited in a specific account, called Procel Account, separate from the Eletrobras account. The collection of funds does not follow the calendar year, as it depends on prior approval of an investment plan by a Committee coordinated by the MME and subsequent order by ANEEL. This entire process may depend on the agenda defined by the MME and other members of the Committee, considering the terms defined in Law No. 13,280.

In its second cycle of the Fund Investment Plan (PAR), which was carried out throughout much of 2019, Procel invested BRL 136.8 million.

The second payment of funds provided for by the Law deposited in the Procel Account, plus the income from financial investments totaled BRL 146,657,205.07 in December 2019.

Based on market estimates and application of specific result assessment methodologies, Procel is estimated to have promoted approximately 21.6 billion kWh in energy savings in 2019. This energy saved helped the country to prevent 1.620 million tCO2 equivalents from being released into the atmosphere, corresponding to the emissions of 557,000 vehicles in one year.

This result is also equivalent to the energy supplied by a hydroelectric power unit with 5,182 MW capacity in a year. In addition, according to estimates, the actions promoted by Procel contributed to reducing end-user demand by 8,129 MW.

It is important to emphasize that the overall energy results achieved by the program are mainly due to the Procel Label for Energy Savings, or, simply, the Procel Label, which shows the emphasis placed on the final consumer, through orientation and encouragement to purchase more efficient equipment.

We highlight some of the Procel’s actions in 2019 below:

· Industry: Continuity of the “More Productive Brazil Program Expansion” project, aiming at energy efficiency actions to reduce energy consumption in 300 small and medium industrial companies; execution of the “Alliance for Energy Efficiency Project”, which provides for the development of energy efficiency actions in processes of large industrial consumers;

· Public Lighting: 2nd Public Call that selected projects to improve lighting with LED systems in 75 municipalities in all regions of the country, with investments in the order of BRL 30 million;

Annual Letter of Public Policies and Corporate Governance for 2019

· Education: Through Procel at the School, it develops and makes available the “Energy that Transforms” and “Landscape Nature” methodologies to encourage and facilitate the approach, by basic education teachers, of the themes such as energy efficiency and sustainable development. For undergraduate and graduate students and professionals in the energy area, Procel has invested in the construction of a network of labs and research centers to design and disseminate advanced educational tools in energy efficiency and to develop and monitor energy optimization studies;

· Information: Over 1.7 million accesses and over 54 thousand users registered on the Procel Info Portal;

· Procel Label: Disclosure of the results of an unprecedented work that sought to assess the adequacy of the products that have the Procel Label for Energy Savings through an in-depth analysis of their minimum energy efficiency specifications. For this purpose, 1,362 samples of 295 models were acquired in the national retail market (physical and online stores).

Marketing: Campaign to advertise Procel’s actions and results via social media, TV and Radio, reaching over 90 million views, according to a recall survey.

The benefits produced by the program may be accounted for both by the energy savings and by the investments postponed in the expansion of the sector, which revert to benefits for society.

In 2019, the area responsible for Procel at Eletrobras had personnel costs amounting to BRL 9,514,765.86. BRL 8,131,219.31 of such amount is covered by the funds from Law No. 13,280/2016, plus BRL 1,354,564.23 received as management fee.

Therefore, the amount contributed by Eletrobras in relation to personnel costs in the area responsible for Procel was BRL 28,982.32.

It should be noted that Procel’s other expenses are also covered by funds from Law No. 13,280/2016.

Federal Government Assets under Eletrobras’ Management - BUSA

Federal Government Assets under Eletrobras’ Management (BUSA) are assets and facilities expropriated by the Federal Union with funds from the Global Reversion Reserve (RGR). These assets are integrated into the same account as Federal Government assets under special use regime in the public service, under the management of Eletrobras, as provided for by Decree-Law No. 1,383/1974, in its article 2. Eletrobras, as asset manager, is responsible for the registration, conservation and operation of the BUSA asset collection. The same decree authorized Eletrobras to enter into agreements with state-owned electrical energy concessionaires with the intervention of the National Department of Water and Electrical Energy (DNAEE), currently ANEEL.

There are currently 1,994 assets of the Federal Government registered with the Federal Government Asset Management Computer System (SIGBUSA) under Eletrobras’ Management. 1,897 are operational and connected to concession of companies in the industry and 25 usable assets are deactivated. On April 25, 2019, Aneel performed an inquiry, which is still pending an expert’s opinion, for the sale of 67 assets considered useless or unusable for provision of electricity. 23 other assets were sold. Between 2015 and 2019, Eletrobras spent BRL 12.7 Million to manage Federal Government’s assets (BUSA). The Federal Government sent to

National Congress Bill (PL) No. 5,877/2019, which provides for the privatization of Eletrobras and, among other measures, amends Decree Law No. 1,383/1974, of December 26t, 1974, and proposes new possibilities for BUSA assets. The Bill provides for the creation of a semi-public company or public company that, among other purposes, is responsible for managing the Assets of the Federal Administration under Eletrobras’ Management. Said bill has not yet been voted on by the Brazilian National Congress.

Annual Letter of Public Policies and Corporate Governance for 2019

With the publication of Law No. 13,360/2016, the management and operation of Sectorial Funds was transferred in full, since May 1, 2017, to the Brazilian Electric Energy Trading Chamber (CCEE), without having defined legal mechanisms for reimbursement to Eletrobras for the costs incurred by the management of BUSA. The Company had BRL 1,2 million in administrative costs with the management of these assets in 2019.

4. Our Risk Management

The Corporate Risk Management at Eletrobras companies aims to avoid the materialization of events that may negatively impact its strategic objectives, in favor of the generation and preservation of value and the provision of transparent information to the market and to its shareholders.

The corporate risk process of Eletrobras’ companies is governed by a single Risk Management Policy approved and reviewed by its Board of Directors in its latest version, from September 2019, available at the company’s website. This process is coordinated by the Holding, which guarantees systemic vision of results and standardization among all companies of the group. It is led by the corporate risk and internal control areas and by the risk committees of each company. The general orientation is given by the holding’s Risk Committee and process results are submitted to the Executive Board and to the Board of Directors via the Statutory Audit and Risk Committee - CAE. Eletrobras’ Board of Directors periodically deliberates on strategic issues concerning the corporate risk process, including the role of the Executive Board in risk management and the policy that should guide the entire process.

The international ISO 31000 standard - Risk Management was used as methodological base to implement the corporate risk process at Eletrobras Companies: Principles and Guidelines and COSO ERM - Enterprise Risk Management Framework and COSO 2013 - Internal Control Integrated Framework. Furthermore, the legal bases of the process are Laws No. 13.303/2016 and 12.846/2013, along with Decree No. 8.945/2016. Thus, the risk management model adopted is based on the identification and consolidation, in a matrix, of the strategic, operational, financial and compliance risks to which companies are exposed, for further analysis, processing and monitoring through specific activities developed by their respective owners. The company reports the results of its evaluations internally through quarterly reports and, externally, through the Reference Form (CVM) and Form 20-F (SEC), both available on its website, in the Investor Relations section.

In order to support the corporate risk process, Eletrobras’ Internal Control Department supports the managers in designing controls and preparing and monitoring remediation plans for eventual deficiencies. Additionally, the Integrity Department acts in this process in order to

ensure the dissemination of the culture of compliance with laws and regulations that govern the activities of the group’s companies. Through assessment and treatment of issues related to unethical conduct, fraud and corruption, and through the implementation and coordination of a robust integrity program, the area aims to provide the necessary support to mitigate compliance risks to which the group’s companies may be exposed.

Annual Letter of Public Policies and Corporate Governance for 2019

It is important to note that Eletrobras, in its corporate risk process, permanently monitors its business environment, seeking to reflect its concerns and those of its investors and the market in general. Therefore, the risks recognized as most relevant within the scope of Eletrobras companies are prioritized and addressed through the implementation of responses to risks prepared based on technical recommendations from the areas of Corporate Risks and Internal Controls, in partnership with risk owners, always considering the exposure level validated by Management.

In 2019, the risks: Regulatory Framework; Energy Trading; New Businesses; Human Rights; Cash Flow; Accounting and Financial Statements; SPE Business Management; Dam Safety; Transmission Operation and Maintenance; Generation Operation and Maintenance; Storage of Irradiated Combustible Elements; Social and Environmental Management of Projects; Training and Management of the Legal Department; and Fraud and Corruption were prioritized by the Board of Directors and analyzed, reported on a quarterly basis and, where necessary, responses to risks were defined, even when they outside the level of exposure intended by the Management, and continue to be constantly monitored by the managers in charge of them.

More detailed information on these risks and the corporate risk process can be obtained in the forms filed with the CVM and SEC, made available by the company on its website: http://eletrobras.com/pt/Paginas/Gestao-de-Riscos.aspx.

Transactions with Related Parties:

The Eletrobras Companies’ Related Party Transaction Policy aims to establish the principles that guide the execution of Related Party Transactions, in order to safeguard the interests of Eletrobras and its shareholders and regulate the transfer of information necessary to comply with the legislation of applicable capital market, in Brazil and abroad.

The basic principles of the Policy are the identification of measures and procedures to be followed to address conflicts of interest in a satisfactory manner, the guarantee that the strictly commutative nature of the agreed conditions or the appropriate compensatory payment are respected, that the market is informed about its terms, conditions and the parties involved in each TPR. The best corporate governance practices are also observed when hiring TPR, the zeal for the interest of the company in which the TPR operates, preserving equity among all shareholders, in addition to observing the duties of loyalty and diligence.

TPRs must be disclosed as follows:

1) Accounting disclosure - The financial statements of the Eletrobras company that carried out a TPR must contain the necessary disclosures to highlight to its public of interest the possibility that the entity’s balance sheet and income statement are affected by the existence of business with related parties.

Annual Letter of Public Policies and Corporate Governance for 2019

2) Disclosure to the Capital Market - In accordance with item XXXIII of article 30 of CVM Instruction No. 480, of December 7, 2014, with the new wording given by CVM Instruction No. 552, of October 9, 2014, Eletrobras must communicate to the market, by filing with the Brazilian Securities and Exchange Commission, the US Securities Exchange Commission (SEC), the Brazilian and foreign stock exchanges where it has listed securities and the Eletrobras holding investor relations website, the TPRs defined in CVM Instruction No. 552/2014, mentioning all the data provided for in its annex C.

More detailed information on Eletrobras Companies’ Related Party Transaction Policy available at: https://eletrobras.com/pt/GestaoeGorvernancaCorporativa/Estatutos_politicas_manuais/Politica-de-Transacoes-com-Partes-Relacionadas-das-Empresas-Eletrobras.pdf

5. Our Internal Controls Structure

In line with the Risk Management Policy, the following bodies of the Company are directly involved in the identification, assessment, treatment and monitoring of risks:

· Eletrobras’ Board of Directors - responsible for deliberating on strategic issues concerning the risk management process, such as the risk matrix and risk prioritization, companies’ degree of risk appetite, the role of executive boards in risk management and the policy that should guide the entire process.

· Audit and Risk Committee - responsible for monitoring, at least quarterly, the risk management process, bringing the most relevant findings to the attention of the Board. Previously analyze and issue an opinion on all materials submitted to the Board regarding the company’s risk management.

· Executive Boards of Eletrobras companies - responsible for assessing the assertiveness of the risk management system and promoting the necessary improvements; sponsoring the implementation of risk management in companies; allocating necessary resources to the process and defining the appropriate infrastructure for risk management activities; approving specific standards; defining risk owners and taking a stand against the risks considering the analyses reported by the Risk Managements and the appetite limits approved by the Board of Directors.

· Risk committees - responsible for monitoring the risk management process, validating risk analyses and mitigation actions to be reported to the Executive Board, and promoting strategic and operational issues in the risk management process.

· Eletrobras risk management - responsible for coordinating and defining the standards to be followed with respect to risk management processes, its support systems and the forms and frequency of its reports, supporting identification and assessment of corporate risks of other Eletrobras companies and consolidating the status of risks prioritized by the Board of Directors, based on information collected in each company.

Annual Letter of Public Policies and Corporate Governance for 2019

· Management of Eletrobras internal controls - responsible for consolidating the internal control environment of Eletrobras companies based on information received from equivalent areas in each company;

· Risk owners - areas responsible for acting as the first line of defense, managing the risks inherent in their activities, identifying, evaluating and treating them and for providing the Risk Management with solid and reliable information.

In addition to these instances, Eletrobras companies have their own structures to identify the risks inherent in their activities, in line with the Company’s Risk Management Policy.

For more information on the composition of Eletrobras’ Board of Directors and Audit & Risk Committee, see section 12 of the Reference Form.

The internal control structure of Eletrobras companies also covers:

• Process mapping: habitual and constant activity aimed at identifying risks and internal controls designed correctly and which operate according to the activity performed by the management area;

• Management Tests: periodic activity aimed at evaluating the structure of internal controls through the execution of tests to verify design efficiency and effectiveness of the operation of internal controls. The tests conducted are documented. This cycle also involves the audit, conducted by the Independent Auditor, of internal controls over the financial statements.

• Deficiency Remediation Program: habitual and constant activity, with the support of Eletrobras Management, which aims to develop and implement action plans capable of remedying deficiencies identified by the Management Tests or by the Independent Audit assessment. Within the scope of the Remediation Program, action plans are reviewed or prepared to remedy the deficiencies identified, deadlines are monitored and interim actions are developed to implement the action plan. Also within the scope of the program, managers

responsible for deficient control and the implementation of the action plan are monitored and oriented. The purpose of the Program is to ensure the timely and correct execution of actions, including after the implementation of the plan through the execution of tests that will attest to the effectiveness and efficiency of the actions implemented to remedy the identified deficiencies.

Annual Letter of Public Policies and Corporate Governance for 2019

In 2016, in order to give greater visibility and support to the process, Eletrobras’ Board of Directors approved the creation of the Board of Compliance, currently called the Governance, Risk and Compliance Board. All activities related to risk management, internal controls and compliance are concentrated in this Board.

Training on Eletrobras’ Ethical Conduct and Integrity Code

In 2019, the online course “Integrity and Ethical Culture of Eletrobras Companies” was offered to all employees. The objective was disseminating and internalizing the ethics and integrity commitments expressed in the policies and procedures of the Integrity Program and the Code of Ethical Conduct and Integrity. 80% of Eletrobras employees participated.

Complaint Reporting Channel

The total valid reports registered in the external Reporting Channel, since its creation on August 21, 2017 until the end of December 2019, was 1,252 cases. 851 of them, i.e., 68% were completed in 2019. Among completed complaints, 14% were closed as valid (118) and 8% as partially valid (65). Of the total number of complaints received, 5% came from external reports, 50% from internal, and 45% did not identify themselves. It is important to emphasize that the registration of complaints does not require identification of the reporting parties, who may or may not identify themselves. Confidentiality of data is ensured in any circumstances.

Updates on and detailing of accountability and report remediation procedures, and the development of performance indicators for the activity and contracting of support systems for the investigation of complaints are expected for 2020.

Plus, in April 2019, the Corporate Complaint Management and Treatment Regulation was approved for all Eletrobras Companies, replacing the rules that addressed the matter in an isolated manner. This Regulation was approved by Eletrobras holding (in April 2019) and by Eletrobras companies during the second half of the same year. It is important to note that the adoption of the Regulation implied, among other issues, the formatting of areas for assessment or focal points in all companies that will operate in networks, under the coordination of the holding company.

408 valid complaints were received in 2019. In the same period, 91 of them were finalized and 317 were still being investigated as of December 31, 2019. If all complaints from the database are taken into account, 282 protocols were finalized in 2019. Of the valid complaints received, the main topics were: Violation of Internal Rules (83); Favoring (75); Misuse of Assets and Resources (59) and Irregularities in Bids (52).

Between 2019 and 2018 the number of complaints received decreased by 19%. This variation was mainly due to the privatization of the distribution companies of the Eletrobras system. In

2018, if all distribution companies are excluded, 398 valid complaints were received. Therefore, there is a positive variation of 3% in the total number of complaints received in 2019.

Annual Letter of Public Policies and Corporate Governance for 2019

6. Our Economic and Financial Results

In the fiscal year ended December 31, 2019, Eletrobras’ continued operations revenues increased by 9% compared the fiscal year ended December 31,2018, mainly as a result of the increase of the generation segment gross revenue by 16.1%.

In the accounting year ended December 31, 2018, Eletrobras gross revenues from continued operations decreased 10 % in relation to the accounting year ended December 31, 2017, mainly due to the decrease in transmission revenues.

The table below shows the company’s gross revenue per operating segment (Continued and Discontinued) in the periods informed:

|

Gross Revenue per Industry (Continued Operations)

(in millions of BRL)

|

|

|

12/31/2019

|

12/31/2018

|

12/31/2017

|

|

Generation

|

23,374

|

20,139

|

22,370

|

|

Transmission

|

9,544

|

9,868

|

10,300

|

|

Other

|

769

|

869

|

1,041

|

|

|

33,687

|

30,876

|

33,711

|

|

Gross Revenue per Industry (Discontinued Operations)

|

|

(in millions of BRL)

|

|

|

|

|

|

12/31/2019

|

12/31/2018

|

12/31/2017

|

|

Distribution*

|

2,116

|

14,815

|

12,416

|

|

Other

|

40

|

1,009

|

1,026

|

|

|

2,157

|

15,823

|

13,442

|

|

• The distribution operation was classified as Discontinued Operation.

Further details in Item 10.3 of this document.

|

In the past three financial years, the financial situation and the results of Eletrobras’ operations were impacted, among other reasons, by factors such as the Brazilian macroeconomic development, changes of exchange rates, impairments and onerous contracts, startup of generation projects, fixed income from transmission, accounting records of financial income connected to electric energy transmission assets existing on May 31, 2000, the so-called facilities of the Basic Network of the Existing System – RBSE, with an impact on transmission revenue, in addition to operating provisions and legal contingencies, which are detailed below. The transfer of control of the Distribution Companies Ceron, Cepisa, Eletroacre, Amazonas D, Ceal, and Boa Vista, in 2018 and 2019, as well as the sale and transfer of several Special Purpose Entities (SPEs), also had great impact on the Company’s financial situation and results. Emphasis is also placed on the applications of IFRS 9, 15 and 16, detailed in Item

10.4 of the reference form. More information on our Financial Statements available at: https://eletrobras.com/pt/ri/Paginas/Demonstracoes-Financeiras.aspx

Annual Letter of Public Policies and Corporate Governance for 2019

7. Our Corporate Governance Model

Overview

Ethics, transparency, fairness, accountability and corporate responsibility are the guiding principles of our corporate governance practices.

The requirements and functions of governance bodies are established in the Company’s Articles of Incorporation and in the respective Bylaws of each collegiate body, as are provisions regarding compliance with legal, regulatory and voluntary environments.

Eletrobras’ corporate governance model includes the General Shareholders’ Meeting, the Board of Directors (CA”), Board Advisory Committees: Statutory Audit and Risk Committee (CAE), Management, People and Eligibility Committee (CGPE), Strategy, Governance and Sustainability Committee (CEGS), Audit Committee (CF) and Executive Board (DE).

The following organizational units are directly subordinate to the Board of Directors: Governance Office (CAAS), Ombudsman’s Office (CAO) and Internal Audit (CAI)

The Board of Directors (CA) acted with all of its members in 2019, in accordance with the powers provided for in the Company’s Articles of Incorporation and Bylaws. To improve its governance, in 2019 the Board of Directors also relied on three advisory committees for

analysis, follow-up and recommendations on specific issues in each area: Strategy, Governance and Sustainability Committee; Management, People and Eligibility Committee and Audit and Risk Committee. The last two are provided for in the Articles of Incorporation. In 2019, all committees were 100% formed by members of the board of directors.

Annual Letter of Public Policies and Corporate Governance for 2019

Since its establishment in May 2018, the Statutory Audit and Risk Committee (CAE), which is permanent, assumed all duties of the Audit Committee that until then were shared between the former Audit Committee (COAUD) and by Eletrobras’ Audit Committee, the latter with regard to US legislation, including the provisions of the Sarbanes-Oxley Act and the rules issued by the Securities and Exchange Commission (SEC) and New York Stock Exchange (NYSE).

In 2019, the CAE held 63 ordinary meetings. Among these, 1 (one) was carried out with the managers and representatives of the internal control areas of Eletrobras Companies (09/20), 3 (three) with the Holding Company’s Audit Committee (03/22, 8/7 and 10/24) ) and 2 (two) with the subsidiaries Furnas (06/14 and 12/02), Eletropar (05/03 and 07/11), Eletronuclear (07/23 and 11/12), Chesf (05/08 and 11/25), Eletronorte (05/23 and 11/01), Eletrosul and CGTEE (06/19 and 11/19) and Amazonas GT (06/06 and 12/12) with the participation of the Board of Director, Audit Committee, executive boards and technical units of these companies.

The Board of Directors (CA) was composed of eleven (11) members and met twenty-seven (27) times in 2019, in accordance with the powers provided for in the Company’s Articles of Incorporation and Bylaws. The board members meet the requirements of Law No. 6.404/1976, Law No. 13.303/2016, Decree No. 8.945/2016, the Company’s Articles of Incorporation and the Eletrobras Companies’ Referral Policy and all legal criteria applicable by the regulatory agencies. The main issues discussed in the CA were:

· Capital increase for capitalization of Advances for Future Capital Increase (AFAC) in the Holding company.

· Issuance of bonds by the Holding company.

· Operation of issuance of debentures by subsidiaries.

· Divestment process in shareholdings of SPEs.

· Approval of operation of debentures of the Holding company.

· Operation of merger of Eletrosul by CGTEE.

· Monitoring of private pension plans and health care plans, with support from the Statutory Audit and Risk Commission (CAE).

· Call notice for an Special Shareholders’ Meeting (AGE) and support for approval of the sale of distributor Amazonas D.

· Approval of the sharing contract for the Shared Services Center (CSC).

· Filing of Form 20-F with the Securities and Exchange Commission.

· Approval of an improvement program for directors and officers of Eletrobras companies.

· Revision/approval of Eletrobras’ governance documents.

· Revision of the CAE’s Bylaws and election of an independent member.

The active participation of the board members in the committees provided greater security and reliability in decision-making. This is because, at each ordinary board meeting there is a session dedicated to reporting the activities of each committee by their respective representatives. At that moment, the coordinators not only report the works performed in the month by the respective committee, but also indicate positions and opinions regarding related matters of board deliberation.

The Audit Committee (CF) held 14 meetings in 2019, including ordinary meetings, on a monthly basis, and extraordinary meetings, adhering to the Articles of Incorporation and to the rules for its operation, defined in the Bylaws amended in December 2019.

Annual Letter of Public Policies and Corporate Governance for 2019

The Executive Board (DEE) held 57 meetings in 2019. Officers have a unified term of office of two (02) years, allowing for a maximum of three (03) consecutive reinstatements, as provided for in the Law of State-owned Companies (Law No. 13.303/2016).

According to CVM Resolution No. 301, those who hold or have held, in the last 5 years, relevant public positions, jobs or functions, in Brazil or in other countries, territories and foreign dependencies, as well as their representatives, family members and other closely related individuals.

The following Managers and Members of the Audit Committee are considered Publicly Exposed Persons:

· Board of Directors: José Guimarães Monforte, Wilson Ferreira Júnior, Mauro Gentile Rodrigues Cunha, Vicente Falconi Campos, Bruno Eustáquio Ferreira Castro de Carvalho, Ricardo Brandão Silva and Marcelo de Siqueira Freitas.

· Audit Committee: Thaís Marcia Fernandes Matano Lacerda and Patricia Valente Stierli.

· Management Board: Elvira Baracuhy Cavalcanti Presta, Márcio Szechtman, Lucia Maria Martins Casasanta and Luiz Augusto Pereira de Andrade Figueira.

The following Managers and Members of the Audit Committee are not considered Publicly Exposed Persons:

· Board of Directors: Ruy Flaks Schneider, Daniel Alves Ferreira, Felipe Villela Dias and Luiz Eduardo dos Santos Monteiro.

· Audit Committee: Eduardo Coutinho Guerra, Márcio Leão Coelho, Dario Spegiorin Silveira, Gaspar Carreira Júnior and Giuliano Barbato Wolf.

· Management Board: Pedro Luiz de Oliveira Jatobá.

· Statutory Audit and Risk Committee: Luís Henrique Bassi Almeida.

Eletrobras periodically develops and updates instruments aimed at strengthening corporate governance, through regulations that establish guidelines for performance, selection, appointment, evaluation and training of members of governance bodies. The following should be highlighted in the last year: revision of the Referral Policy approved in February 2020. Document available in the Corporate Governance area on the company’s website:

http://eletrobras.com/pt/Paginas/Governanca-Corporativa.aspx

Additional efforts were made to systematize the policies and standards of the company. In this regard, a significant step was taken with the subsequent event in February/2019, with the approval of the Matrix Policy of the Eletrobras System’ Policies and Regulations by the Board of Directors.

Managers, members of the audit committee and members of other committees follow the requirements and prohibitions enforced by Law No. 13.303/2016, by Decree No. 8.945/2016, and by the Referral Policy at the Holding Company and Subsidiaries, Affiliates, Foundations and Associations of the Eletrobras Companies, without prejudice to the provisions in this regard contained in current legislation and to the Company’s Articles of Incorporation. The Manual of Board Members Representing the Eletrobras Companies reports, among other things, the directors’ duties and responsibilities, always abiding by the duties assigned to them by law, the Articles of Incorporation, the Internal Regulations of the Board of Directors, if any, and other internal rules of the company.

For the vacancies of Independent Directors, we sought professionals certified by the Brazilian Institute of Corporate Governance (IBGC) in the market or professionals with remarkable experience in boards of other Brazilian companies.

Annual Letter of Public Policies and Corporate Governance for 2019

On December 31, 2019, 55% of the members of the Board of Directors of Eletrobras were independent, according to the criteria of Decree 8.945/2016, namely: José Guimarães Monforte, Daniel Alves Ferreira, Felipe Villela Dias, Mauro Gentile Rodrigues da Cunha, Ruy Flaks Schneyder and Vicente Falconi Campos.

Eletrobras’ Articles of Incorporation provides for situations of conflict of interest, according to which the manager is prohibited from deliberating on matters that conflict with his interests or relative to third parties under his influence, under the terms of art. 156 of Law No. 6,404/1976. In this case, such person should record the divergence and refrain from discussing the topic.

In order to avoid possible conflicts and use of confidential and strategic information, upon consultation with the Holding Company’s Governance, Risks and Compliance Board and if previously and specifically approved by the Board of Directors, the Chief Executive Officer and the Officers may occupy positions on the Board of Directors or Audit Committees in state-owned, controlled companies, subsidiaries or affiliates, special purpose companies, and private companies not connected to the electricity sector, subject to the provisions of current legislation regarding remuneration and prohibitions. In these cases, they may occupy positions on the Board of Directors and Audit Committees subject, however, to the remuneration provisions of Law No. 9,292/1996.

Officers are required to submit to the Public Ethics Commission a Confidential Information Statement (DCI) which lists the assets of officers and the Chief Executive Officer. Such statement must also include situations or shareholdings that may constitute a conflict of interest and describe the measures taken by the Officers and the Chief Executive Officer to mitigate them.

Assessment of performance and training

The assessment of individual and collective performance of the Board of Directors (CA), Executive Board (DEE) and Audit Committee (CF) has been performed since 2013. As of 2018, this research started being performed by independent consultants in all Eletrobras companies and in Committees of the Holding Company’s Board of Directors. It also involves the Officers and Directors of Cepel and of the SPEs in which Eletrobras or their subsidiaries have majority interest.

Assessment procedures were improved in 2019 to include a structured interview, self-assessment and tailored assessments for Chairmen of the Boards of Directors and Chief Executive Officers. The assessment criteria include three pillars: competences, results and duties of the agency. The assessments of the 2019/2020 cycle are underway. They are expected to be completed by late March 2020.

Law No. 13,303, of June 30, 2016 (State-Owned Company Law) and its regulatory decree, Decree No. 8,945, of December 27, 2016, brought a new profile for candidates to the positions of manager and member of the audit committee. Among other issues, it was established that the managers and tax advisers of state-owned enterprises should participate in specific training on relevant topics connected to their activities.

Based on this need, in 2017, Eletrobras launched the “Improvement Program for Eletrobras Directors Officers”, which includes several educational actions for stakeholders of the Holding Company, subsidiaries, affiliates and SPEs aimed at the consistent and continued development of directors, members of the audit committee and officers.

Annual Letter of Public Policies and Corporate Governance for 2019

As regards to educational actions for managers, a lecture on “Risks, Internal Controls and Integrity” was given to the Holding company’s CA and transmitted to the subsidiaries and four face-to-face workshops at the Brasília, Rio de Janeiro, Recife and Florianópolis bases with topics such as “Roles and Responsibilities of Directors and Managers”, “Human Rights”, “Corporate Governance” and “SPE Management”, with a 53% attendance rate.

The Board of Directors of the Holding company also attended lectures on 1) Risks, Internal Controls and Integrity; 2) Regulatory law in the Electric Industry; 3) Energy trade; 4) Fiduciary duties of loyalty and diligence in addressing material corporate information; 5) Responsibility of managers, with emphasis on the Disclosure Policy; and 6) Use of Relevant Information and Securities Trading by Eletrobras Companies, with the latter having the attendance of the Members of the Audit Committees and Officers of the Holding company, in addition to Members of the Board of Directors and Inspectors of subsidiaries. In November 2019, the members of the Board of Directors visited Angra II Plant and Cepel.

Eletrobras also approved the Improvement Program for Directors and Officers of Eletrobras Companies, with an estimate of holding periodic lectures during ordinary meetings. The topics of such lectures are a response to the feedback given by the directors in annual surveys and when they take office.

Compensation

The main purpose of the remuneration practice adopted by Eletrobras is to align the interests of managers with the interests of Company’s shareholders. The remuneration of Eletrobras’ managers is in line with remuneration practices adopted by the market for companies similar in size to Eletrobras, with the rules defined by the State-Owned Companies Coordination and Governance Secretariat (SEST) for state-owned companies, and with responsibilities inherent to each position.

Pursuant to Law No. 9,292/96, the remuneration of members of the Board of Directors and of the Audit Committee is set at one tenth of the average monthly remuneration of the members of the Executive Board (CEO and Officers) minus amounts connected to direct and indirect benefits granted to said members.

Eletrobras’ Statutory Board members are entitled to a monthly fixed remuneration corresponding to the fees attributed to the exercise of the function plus the following benefits: vacation bonus, supplementary private pension, transfer allowance, group life insurance, funeral insurance, medical expenses, meal voucher, housing assistance and special allowance.

The special allowance refers to the Christmas bonus paid to all members of the Executive Board. The entire Board of Eletrobras is statutory.

Members of the Executive Board are entitled to annual variable remuneration based on fulfillment of certain annual goals agreed by and between Eletrobras and its subsidiaries (derived from the Business and Management Plans), with approval by the Ministry of Mines and Energy (MME) and with the Ministry of Economy’s State-Owned Companies Coordination and Governance Secretariat (SEST).

Pursuant to Federal Law No. 12,813 of May 16, 2013 and pursuant to Article 4 of Decree No. 4,187, of April 8, 2002, members of the Statutory Board are entitled to benefits once they cease to exercise such office.

The purpose of such benefit, called “Quarantine”, is to ensure that former Company managers do not take other and/or new offices in companies considered competitors of the Company

within the six (6) months following their resignation. The members of the Statutory Board are not entitled to stock-based compensation.

Annual Letter of Public Policies and Corporate Governance for 2019

The overall compensation of officers, members of the Board of Directors and members of the Audit Committee of Eletrobras is determined by an already established process. Once a year, Eletrobras’ Management submits to SEST and to MME the remuneration proposal for managers (Executive Board and Board of Directors) and members of the Audit Committee for the following term of office (from April of the current year to March of the following year).

The calculation methodology adopted for the preparation of the proposal of the Annual Fixed Remuneration follows the guidelines established by SEST for each heading that composes it.

Ordinarily, SEST adopts the National Extended Consumer Price Index (IPCA) accumulated in the last 12 months, except for Housing Assistance, which abides by the threshold established by the applicable laws (Article 5 of Decree No. 3.255/1999):

(i) The amount connected to manager remuneration is previously established by the Ministry of Economy’s SEST, which defines the individual compensation of each Eletrobras management body;

(ii) SEST submits the remuneration defined for Eletrobras’ managers for approval by the National Treasury Office.

(iii) Once the amount defined by SEST is approved, the National Treasury Office submits it in the form of voting instructions for approval by Eletrobras’ Annual Shareholders’ Meeting.

Once a year, at the Annual Shareholders’ Meeting, the remuneration of Eletrobras’ managers may be adjusted and are approved in accordance with the limits established by SEST.

In 2019, the annual remuneration (fees) of the Chief Executive Officer of Eletrobras was BRL 688,530.83 (including the amount earned as member of the Board of Directors). The other officers earned BRL 598,350.84.

In this same year, the total average annual fixed remuneration for Eletrobras employees was BRL 142,273.62.

Therefore, the ratio between the annual remuneration of the Chief Executive Officer and the average remuneration of employees was 4.84.

More information available in item 13 of Eletrobras’s Reference Form at http://eletrobras.com/pt/ri/Paginas/Demonstracoes-Financeiras.aspx.

8. Our Major Corporate Governance Improvements

Changes in the structure and in Governance practices

As a publicly traded company, Eletrobras follows international corporate governance standards compatible with the rules of the markets in which it operates. Furthermore, the company has been implementing actions to improve its corporate governance for better alignment with its Strategic Plan and its 2020-2024 Business and Management Master Plan, as well as with the B3 Outstanding Governance Program for State-Owned Companies, with Law No. 13,303/16, Decree No. 8,945/16 and other laws currently in force.

Annual Letter of Public Policies and Corporate Governance for 2019

In the wake of the adoption of Law No. 13,303/16 and Decree No. 8,945/16, which regulated it, Eletrobras adapted the internal statutes and regulations to the new legislation. In addition, it published internal policies and regulations on the basis of this legislation.

Within the scope of the 2020-2024 PDNG, in the Governance and Compliance pillar, the achievement of governance labels and certifications was continued. In this sense, 2 new IG-SEST assessment cycles were developed in 2018, in May and November/2018. In November, Eletrobras achieved the Governance Index Certification - IG-SEST, Level 1 (excellence level), with a score of 8.08. The 2nd cycle of index evaluation was completed on 05/11/2018 with a score of 10.0, maintaining Level 1, obtained in November 2017. In the 3rd evaluation cycle, the company maintained Level 1, showing its commitment to continuous adaptation to good governance practices.

Additionally, in March 2018, Eletrobras concluded its adherence to the B3 Highlight Governance Program for State-Owned Companies.

Ø B3 Highlight Program

6 mandatory measures, provided for in articles 16, II; 25; 27; 30 and 32, were complied with. 50 points out of 60 were obtained.

The following points were scored in 2019:

ü Article 28 (Disclosure of the CAE summary report together with the DFs, 4 points);

Demand already met, document disclosed and available at: http://eletrobras.com/pt/ri/Paginas/Demonstracoes-Financeiras.aspx

ü Article 34 (Assessment of Senior Management’s Performance, 2 points);

Demand already met, since the company responsible for evaluating the managers was selected and the results were submitted to Eletrobras’ Board of Directors.

With this, Eletrobras’ compliance with the following requirement is still pending:

ü Article 42 (Code of Conduct for Senior Management, which provides for rules in accordance with the Program, 4 points). Requirement that depends on management with controlling shareholder.

Summary of Main Practices

Main corporate governance practices adopted by Eletrobras:

· Board of Directors formed by 55% of independent members;

· Permanent Audit Committee, with competences and functioning defined in Internal Regulations and adhering to SEC requirements regarding performance of the Audit Committee;

· Members of the Holding company’s Executive Board who participated in the Board of Directors of all subsidiaries;

· Existence of a Policy for Trading Securities Issued by Eletrobras;

· Existence of a Policy for Use and Disclosure of Relevant Information;

· Existence of a single Code of Ethics and Conduct adopted by all Eletrobras Companies;

Annual Letter of Public Policies and Corporate Governance for 2019

· Policy for Appointment of Representatives in Subsidiaries, Affiliates, Foundations and Associations of Eletrobras Companies;

· Publication of the Policy for Use and Disclosure of Relevant Information and of the Policy for Trading Securities Issued by Eletrobras;

· Publication of the Anticorruption Policy of Eletrobras companies;

· Publication of the Spokesperson Policy of Eletrobras companies;

· Listing of B3’s Level 1 Corporate Governance;

· Different communication channels for complaints and/or reports;

· Certification of internal controls by the managers (CEO and CFO) and by independent auditors, with transparent approach to possible deficiencies and their remediation plans;