Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) continued to deliver

strong operational performance and further improved its financial

resilience in the third quarter by remaining committed to

disciplined capital investment, cost leadership and leveraging the

flexibility of its assets and marketing strategy to generate

positive free funds flow. The company took advantage of the higher

commodity prices by ramping up production from its oil sands assets

and selling barrels stored in the preceding quarter. Higher crude

oil prices and increased sales volumes allowed the company to

achieve free funds flow for the third quarter of $266 million,

which contributed to a reduction in net debt to $7.5 billion at the

end of the period.

“The third quarter clearly demonstrated the strength and

reliability of our operations and our ability to effectively manage

production and sales by storing barrels when prices declined and

then capitalizing on a price recovery to optimize returns,” said

Alex Pourbaix, Cenovus President & Chief Executive Officer. “We

continue to find ways to optimize our cost structure, expand our

market access, and strengthen the balance sheet. We believe the

proposed transaction with Husky Energy, announced earlier this

week, will address these priorities, positioning us to come through

this period more resilient, with increased and stable free funds

flow, supporting accelerated deleveraging and returns to

shareholders.”

|

Financial & production summary |

|

(for the period ended September 30) |

2020Q3 |

2019Q3 |

|

|

Financial ($ millions, except per share amounts) |

|

|

% change |

| Cash from (used in) operating

activities |

732 |

834 |

-12 |

|

Adjusted funds flow1, 2 |

414 |

928 |

-55 |

|

Per share diluted |

0.34 |

0.76 |

|

| Free funds flow1, 2 |

266 |

634 |

-58 |

|

Operating earnings (loss)1 |

-452 |

284 |

|

|

Per share diluted |

-0.37 |

0.23 |

|

| Net earnings (loss) |

-194 |

187 |

|

|

Per share diluted |

-0.16 |

0.15 |

|

| Capital

investment |

148 |

294 |

-50 |

| |

|

|

% change |

| Production3 (before

royalties) |

|

|

|

| Oil sands

(bbls/d) |

385,937 |

354,595 |

9 |

| Conventional

liquids3,4 (bbls/d) |

25,851 |

26,104 |

-1 |

| Total

liquids3,4 (bbls/d) |

411,788 |

380,699 |

8 |

| Total natural

gas (MMcf/d) |

360 |

407 |

-12 |

| Total

production4 (BOE/d) |

471,799 |

448,496 |

5 |

|

1 |

Adjusted funds flow, free funds flow and operating earnings/loss

are non-GAAP measures. See Advisory. |

| 2 |

The prior period has been

reclassified to conform with the current period treatment of

non-cash inventory write-downs. |

| 3 |

Includes oil and natural gas

liquids (NGLs). |

| 4 |

Cenovus’s Deep Basin segment

has been renamed the Conventional segment and now includes the

company’s Marten Hills asset. For a description of Cenovus’s

operations, refer to the Reportable Segments section of

Management's Discussion and Analysis. |

Cenovus Husky transactionCenovus’s planned

transaction with Husky Energy Inc. will create a resilient

integrated Canadian energy leader with an advantaged upstream and

downstream portfolio that is expected to provide enhanced free

funds flow generation and superior return opportunities for

investors.

The companies are advancing the arrangement process, with

regulatory filings being prepared and filed. The Joint Management

Information Circular is being prepared for expected distribution by

mid-November and key members of the combined integration teams have

been identified.

“Teams from both Cenovus and Husky are moving the process along

so that we can be in a position to implement the vision of the new

company as soon as possible,” said Pourbaix, who will lead the

combined entity as President & Chief Executive Officer

following a closing anticipated in the first quarter of 2021.

“We’re very excited about the opportunities that the combination of

our two companies creates for all of our stakeholders.”

Business flexibility and financial disciplineIn

the third quarter of 2020, Cenovus increased crude oil production

at its oil sands facilities and overall sales in response to higher

commodity prices while remaining focused on maintaining its low

operating and capital cost structure and deleveraging its balance

sheet. The company was able to use the flexibility of its oil sands

assets and available production curtailment credits to increase

output above the Alberta government’s mandatory limits. Cenovus

achieved average oil sands production of almost 386,000 barrels per

day (bbls/d) in the third quarter, up from 373,000 bbls/d in the

previous quarter and a 9% increase from the same period a year

earlier.

The company also employed its suite of transportation and

storage assets to capture increased value from the higher prices.

During the quarter, Cenovus sold crude oil inventory built up from

April to June when crude oil prices were significantly lower. The

average benchmark price for Western Canadian Select (WCS) crude oil

almost doubled to $42.41 per barrel (bbl) in the third quarter from

$22.42/bbl in the second quarter of 2020 and significantly higher

than the April benchmark price of $4.92/bbl.

These actions combined with continued capital spending and

operating cost discipline contributed to significantly improved

financial performance during the third quarter compared with the

second quarter of this year. Third quarter capital investment in

the company’s oil sands and conventional segments was flat compared

with the second quarter of 2020 and approximately 50% lower on a

year-over-year basis after the company took decisive action earlier

this year to respond to lower commodity prices and the rapid

weakening of the business environment.

“Our people in the field have done an excellent job of

maintaining strong operating performance even as we reduced capital

spending due to the lower price environment and the challenges

brought on by COVID-19,” said Pourbaix. “Safe and reliable

operations will continue to be a priority, along with a commitment

to finding ways of further reducing our overall costs to help us

maintain our competitive advantage and remain an attractive

long-term investment.”

Third-quarter financial resultsCenovus recorded

cash from operating activities of $732 million in the third quarter

compared with $834 million of cash used in operating activities in

the second quarter of 2020. The company generated third-quarter

adjusted funds flows of $414 million and free funds flow of $266

million driven by the recovery in benchmark commodity prices, the

ramp-up of production in the quarter and increased sales of barrels

that were stored in the second quarter and were withdrawn from

storage and sold as prices recovered.

The company had a third-quarter operating loss of

$452 million and a net loss of $194 million compared with operating

earnings of $284 million and net earnings of $187 million in the

same period in 2019. The operating loss was due to lower cash from

operating activities and adjusted funds flow, and higher

depreciation, depletion, and amortization that included an

impairment charge of $450 million associated with a refinery

Cenovus co-owns with the operator, Phillips 66, at Borger, Texas,

partially offset by non-operating realized foreign exchange gains

of $30 million. The net loss in the third quarter of this year

was due to the operating loss, partially offset by unrealized risk

management gains of $135 million, non-operating unrealized foreign

exchange gains of $152 million compared with losses of $87 million,

and a deferred income tax recovery of $177 million compared with a

deferred income tax expense of $46 million in the third

quarter of 2019. Overall financial results were negatively impacted

compared with the third quarter of 2019 largely due to a one-third

decline in benchmark crude oil prices driven by the COVID-19

pandemic.

The impairment charge taken on the Borger refinery reflects

current market conditions surrounding reduced demand for refined

products, and the expectation of continued lower market crack

spreads in the market.

At the end of the third quarter, Cenovus’s net debt declined to

approximately $7.5 billion from $8.2 billion at the end of the

second quarter of 2020, in part due to directing positive free

funds flow towards debt repayment. In July 2020, Cenovus issued

US$1.0 billion in 5.375% senior unsecured notes due in 2025 with

net proceeds used to repay borrowings on the company’s credit

facilities.Response to COVID-19Earlier this year,

Cenovus responded quickly to the COVID-19 pandemic and in the past

several months has implemented special protocols and measures to

protect the health and safety of its workforce and to ensure the

continuity of its business. With these measures now well

established, the company recently lifted its mandatory work from

home order that had been in place for most staff since mid-March

and is now implementing a gradual return to its Calgary office.

Cenovus continues to closely monitor the COVID-19 situation and

will not compromise on the health and safety of its workers or on

its commitment to safe and reliable operations.

Operating highlightsCenovus’s

upstream and refining assets continued to deliver safe and reliable

operational performance during the third quarter. Planned

maintenance and repair work in the third quarter partially offset

production increases at both of the company’s oil sands operations

and contributed to lower output at its conventional properties. The

work was deferred from earlier in the year due to reduced staffing

at our operations as a result of COVID-19.

Health and safety Cenovus remains focused on

delivering industry-leading safety performance through its focus on

risk management and asset integrity, delivering very strong results

through the first nine months of the year. The company has achieved

noteworthy year-over-year improvements in focus areas of

Significant Incident Frequency (SIF) and Process Safety Events. The

company recorded a Significant Incident Frequency of zero compared

with 0.12 in the third quarter of 2019 and no Process Safety Events

compared with one in the same period a year earlier. Total

Recordable Injury Frequency has largely remained flat compared with

the same period in 2019 when Cenovus achieved its best ever

performance in this area. These results included significant

safety milestones for Drilling Operations as well as Completions

and Well Services at our Christina Lake oil sands facility, with

both groups achieving one year without a recordable incident during

the third quarter. The company’s Conventional operations also

continued to deliver strong safety performance, marking a one-year

milestone in September since recording a significant process safety

event.

Oil sandsFor the third quarter, Christina Lake

had average production of 220,983 bbls/d, and Foster Creek had

average production of 164,954 bbls/d. The company achieved combined

oil sands production of 385,937 bbls/d in the third quarter,

compared with 354,595 bbls/d in the same period a year earlier.

During the third quarter of 2020, Cenovus was able to produce

additional barrels of oil, despite curtailment, due to the purchase

of low-cost production curtailment credits from other

companies.

Oil sands operating margin in the third quarter increased to

$638 million from $125 million in the second quarter of 2020 due to

higher average realized crude oil sales price and higher sales

volumes, partially offset by increased transportation and blending

costs and higher royalties. Non-fuel per-unit operating costs in

the third quarter declined 5% at Christina Lake and were relatively

flat at Foster Creek compared with the same period a year earlier.

Overall, third-quarter oil sands per-unit operating costs were

$7.53/bbl, up 9% from the same period a year earlier and 2% from

the second quarter of 2020. The year-over-year increase in costs

was primarily due to higher per-barrel fuel costs as a result of

higher natural gas prices, partially offset by increased sales

volumes. Transportation costs were lower due to the suspension of

the company’s crude-by-rail program in response to unfavourable

pricing fundamentals for shipping by rail.

Cenovus’s oil sands facilities continue to operate at

industry-leading steam-to-oil ratios (SOR). At Christina Lake, the

SOR was 2.1 in the third quarter, in line with both the second

quarter of 2020 and the same period a year earlier. The SOR at

Foster Creek was 2.7, level with the preceding quarter of 2020 and

the third quarter a year earlier.

ConventionalConventional production averaged

approximately 85,862 barrels of oil equivalent per day (BOE/d) in

the third quarter, a 9% decrease from the same period in 2019. The

year-over-year decrease was due to natural declines from limited

capital investment and increased downtime due to a planned

turnaround at a non-operated natural gas plant, partially offset by

the addition of Marten Hills heavy oil production starting in

2020.

Capital investment in the company’s Conventional segment is

forecast to range between $75 million and $85 million for full-year

2020. This includes an incremental $30 million of capital

investment in the fourth quarter, relative to Deep Basin guidance,

for a two-rig drilling program targeting low-risk, high-return

development wells near natural gas plants owned and operated by

Cenovus to take advantage of an expected strengthening in commodity

prices during the winter heating season. We continue to take a

disciplined approach to the development of our Conventional

assets.

Total conventional operating costs increased 5% to $81 million

in the third quarter of 2020 compared with the same period in the

previous year and remained flat relative to the second quarter of

2020. Per-barrel operating costs averaged $9.55/BOE compared with

$8.21/BOE in the third quarter of 2019 due to lower sales volumes,

increased costs for planned repairs and maintenance related to

turnaround activities and higher third-party processing fees.

Full-year guidance dated April 1, 2020 is available on our

website at cenovus.com.

Refining and marketingCenovus’s Wood River,

Illinois and Borger refineries, which are co-owned with the

operator, Phillips 66, maintained safe and reliable performance in

the third quarter of 2020. Crude oil runs at both refineries were

reduced in response to the economic slowdown due to COVID-19. Crude

runs averaged 382,000 bbls/d in the third quarter, an increase of

18% from the second quarter of 2020 and 18% lower from the same

period in 2019.

Cenovus had a refining and marketing operating margin shortfall

of $74 million in the third quarter compared with positive

operating margin of $126 million in the same period of 2019,

primarily due to reduced market crack spreads, lower crude oil runs

and crude advantage, partially offset by lower operating costs.

Cenovus’s refining operating margin is calculated on a first-in,

first-out (FIFO) inventory accounting basis. Using the

last-in, first-out (LIFO) accounting method employed by most

U.S. refiners, operating margin from refining and marketing would

have been $39 million lower in the third quarter, compared with $8

million lower in the same period in 2019.

SustainabilityCenovus is committed to

maintaining world-class safety performance and environmental,

social and governance (ESG) leadership, including robust ESG

disclosure. The company will continue earning its position as a

global energy supplier of choice by advancing clean technology and

reducing emissions intensity, including maintaining its ambition of

achieving net zero emissions by 2050. Advancing environmental

stewardship and maintaining strong local community relationships,

with a focus on Indigenous economic reconciliation, will continue

to be a priority for the company following the close of

the Husky transaction. Leading safety practices, strong

governance and advancing diversity and inclusion will remain

central to the company’s ESG commitments. “Striking the right

balance among environmental, economic and social considerations is

core to our strategy of creating long-term value and business

resilience for our company,” said Pourbaix. “We will demonstrate

ongoing leadership through our support of local communities, caring

for the environment and emissions reduction efforts to support the

transition to a low-carbon energy future.”

The targets Cenovus released earlier this year for its key ESG

focus areas involved a robust process to ensure alignment with the

company’s business plan and strategy. The company remains committed

to pursuing meaningful, measurable ESG targets and will undertake a

thorough analysis of the most meaningful targets to pursue for its

expanded portfolio. Once that work is complete in 2021 and approved

by the Board, the new targets and plans to achieve them will be

disclosed.

|

Conference Call Today9 a.m. Mountain Time

(11 a.m. Eastern Time) |

|

Cenovus will host a conference call today, October 29, 2020,

starting at 9 a.m. MT (11 a.m. ET). To participate,

please dial 888-231-8191 (toll-free in North America) or

647-427-7450 approximately 10 minutes prior to the conference call.

A live audio webcast of the conference call will also be available

via cenovus.com. The webcast will be archived for approximately 90

days. |

ADVISORY

Basis of PresentationCenovus reports financial

results in Canadian dollars and presents production volumes on a

net to Cenovus before royalties basis, unless otherwise stated.

Cenovus prepares its financial statements in accordance with

International Financial Reporting Standards (IFRS).

Barrels of Oil

EquivalentNatural gas volumes have been converted

to barrels of oil equivalent (BOE) on the basis of six thousand

cubic feet (Mcf) to one barrel (bbl). BOE may be misleading,

particularly if used in isolation. A conversion ratio of one bbl to

six Mcf is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent value

equivalency at the wellhead. Given that the value ratio based on

the current price of crude oil compared with natural gas is

significantly different from the energy equivalency conversion

ratio of 6:1, utilizing a conversion on a 6:1 basis is not an

accurate reflection of value.

Non-GAAP Measures and Additional

SubtotalThis news release contains references to

adjusted earnings before interest, taxes, depreciation and

amortization (EBITDA), adjusted funds flow, free funds flow,

operating earnings (loss) and net debt, which are non-GAAP

measures, and operating margin, which is an additional subtotal

found in Note 1 of Cenovus's Interim Consolidated Financial

Statements for the period ended September 30, 2020 (available on

SEDAR at sedar.com, on EDGAR at sec.gov and Cenovus's website at

cenovus.com). These measures do not have a standardized meaning as

prescribed by IFRS. Readers should not consider these measures in

isolation or as a substitute for analysis of the company's results

as reported under IFRS. These measures are defined differently by

different companies and therefore are not comparable to similar

measures presented by other issuers. For definitions, as well as

reconciliations to GAAP measures, and more information on these and

other non-GAAP measures and additional subtotals, refer to

“Non-GAAP Measures and Additional Subtotals” on page 1 of Cenovus's

Management's Discussion & Analysis (MD&A) for the period

ended September 30, 2020 (available on SEDAR at sedar.com, on EDGAR

at sec.gov and Cenovus's website at cenovus.com).

Forward-looking

InformationThis news release contains certain

forward-looking statements and forward-looking information

(collectively referred to as “forward-looking information”) within

the meaning of applicable securities legislation, including the

United States Private Securities Litigation Reform Act of 1995,

about our current expectations, estimates and projections about the

future, based on certain assumptions made by us in light of our

experience and perception of historical trends. Although Cenovus

believes that the expectations represented by such forward-looking

information are reasonable, there can be no assurance that such

expectations will prove to be correct. Readers are cautioned not to

place undue reliance on forward-looking information as actual

results may differ materially from those expressed or implied.

Forward-looking information in this document is identified by

words such as “achieve”, “advance”, “aim”, “ambition”,

“anticipate”, “believe”, “commitment”, “continue”, “contribute”,

“development”, “drive”, “ensure”, “expect”, “focus”, “forecast”,

“goal”, “guidance”, “maintain”, “opportunity”, “plan”, “position”,

“potential”, “priority”, “protect”, “realize”, “target” and “will”

or similar expressions and includes suggestions of future outcomes,

including, but not limited to, statements about: our expectations

regarding the volatility of commodity prices and our ability to

withstand an extended period of low oil prices; the timing of

distribution of the Joint Management Information Circular and

completion of the plan of arrangement with Husky Energy Inc. (the

“Husky Transaction”); the timing and anticipated receipt of

required regulatory, court and securityholder approvals for the

Husky Transaction and other customary closing conditions;

anticipated benefits of the Husky Transaction; our ability to

generate shareholder returns; the robust performance of our assets;

finding ways to further reduce our overall costs; maintaining our

low operating and capital cost structure and deleveraging our

balance sheet to maintain our competitive advantage and remain an

attractive investment; maintaining our priority of safe and

reliable operations; delivering industry-leading safety performance

through our focus on risk management and asset integrity;

maintaining world-class ESG leadership and disclosure; maintaining

our ambition of achieving net zero emissions by 2050; disclosing

new ESG targets and priorities and plans to achieve them for our

expanded portfolio; monitoring the COVID-19 situation and not

compromising the health and safety of our workers; forecast capital

investment in our Conventional segment; and maintaining a

disciplined approach to development of our Conventional

segment.

Developing forward-looking information involves reliance on a

number of assumptions and consideration of certain risks and

uncertainties, some of which are specific to Cenovus and others

that apply to the industry generally. The factors or assumptions on

which our forward-looking information is based include, but are not

limited to: forecast oil and natural gas, natural gas liquids,

condensate and refined products prices, light-heavy crude oil price

differentials and other assumptions identified in Cenovus’s 2020

guidance (dated April 1, 2020), available at cenovus.com; the

satisfaction of the conditions to closing of the Husky Transaction

in a timely manner and complete the arrangement on the expected

terms; the combined company's ability to successfully integrate the

businesses of Cenovus and Husky; access to sufficient capital to

pursue any development plans associated with full ownership of

Husky; the combined company's ability to issue securities; the

impacts the Husky Transaction may have on the current credit

ratings of Cenovus and Husky and the credit rating of the combined

company following closing; our ability to achieve our ambition of

net zero emissions by 2050; our ability to set new ESG targets for

our expanded portfolio; global demand for refined products will

resume and prices will rise; continued access to short-term capital

such as credit and demand facilities; continued impact of measures

implemented to enhance the company’s resilience; applicable royalty

regimes, including expected royalty rates; future improvements in

availability of product transportation capacity; increase to our

share price and market capitalization over the long term; future or

continued narrowing of crude oil differentials; the ability of our

refining capacity, dynamic storage, existing pipeline commitments

and financial hedge transactions to partially mitigate a portion of

our WCS crude oil volumes against wider differentials; our ability

to adjust production while maintaining reservoir integrity;

availability of new ways to get our products to new customers;

opportunities to work with industry partners to find innovative

market-based solutions aimed at refining more Canadian oil in

Canada; estimates of quantities of oil, bitumen, natural gas and

liquids from properties and other sources not currently classified

as proved; accounting estimates and judgments; our ability to

obtain necessary regulatory and partner approvals; the successful

and timely implementation of capital projects, development programs

or stages thereof; our ability to generate sufficient liquidity to

meet our current and future obligations; our ability to obtain and

retain qualified staff and equipment in a timely and cost-efficient

manner; our ability to develop, access and implement all technology

and equipment necessary to achieve expected future results, and

that such results are realized.

2020 guidance, dated April 1, 2020, assumes: Brent prices of

US$39.00/bbl, WTI prices of US$34.00/bbl; WCS prices of

US$18.50/bbl; Differential WTI-WCS of US$15.50/bbl; AECO natural

gas prices of $2.00/Mcf; Chicago 3-2-1 crack spread of US$8.30/bbl;

and an exchange rate of $0.70 US$/C$.

The risk factors and uncertainties that could cause our actual

results to differ materially include, but are not limited to:

volatility of and other assumptions regarding commodity prices,

including the extent to which COVID-19 impacts the global economy

and harms commodity prices; the satisfaction of the conditions to

closing of the Husky Transaction in a timely manner and complete

the arrangement on the expected terms; our ability to successfully

integrate the businesses of Cenovus and Husky; access to sufficient

capital to pursue any development plans associated with full

ownership of Husky; our ability to issue securities after the Husky

Transaction closes; the impacts the transaction may have on the

current credit ratings of Cenovus and Husky and the credit rating

of the company following closing; our ability to achieve our

ambition of net zero emissions by 2050; our ability to set new ESG

targets for our expanded portfolio; the extent to which COVID-19

and fluctuations in commodity prices associated with COVID-19

impacts our business, results of operations and financial

condition, all of which will depend on future developments that are

highly uncertain and difficult to predict, including, but not

limited to, the duration and spread of the pandemic, its severity,

the actions taken to contain COVID-19 or treat its impact and how

quickly economic activity normalizes; a resurgence in cases of

COVID-19, which has occurred in certain locations and the

possibility of which in other locations remains high and creates

ongoing uncertainty that could result in restrictions to contain

the virus being re-imposed or imposed on a more strict basis,

including restrictions on movement and businesses; the success of

our COVID-19 protocols and safety measures to protect workers;

maintaining sufficient liquidity to sustain operations through a

prolonged market downturn; the duration of the market downturn;

excessive widening of the WTI-WCS differential; unexpected

consequences related to the Government of Alberta’s mandatory

production curtailment; the effectiveness of our risk management

program; the accuracy of cost estimates regarding commodity prices,

currency and interest rates; product supply and demand; accuracy of

our share price and market capitalization assumptions; market

competition, including from alternative energy sources; risks

inherent in our marketing operations, including credit risks,

exposure to counterparties and partners, including ability and

willingness of such parties to satisfy contractual obligations in a

timely manner; our ability to maintain desirable ratios of net debt

to adjusted EBITDA as well as debt to capitalization; our ability

to access various sources of debt and equity capital, generally,

and on terms acceptable to us; our ability to finance sustaining

capital expenditures; changes in credit ratings applicable to us or

any of our securities; accuracy of our reserves, future production

and future net revenue estimates; accuracy of our accounting

estimates and judgments; our ability to replace and expand oil and

gas reserves; potential requirements under applicable accounting

standards for impairment or reversal of estimated recoverable

amounts of some or all of our assets or goodwill from time to time;

our ability to maintain our relationships with our partners and to

successfully manage and operate our integrated business;

reliability of our assets including in order to meet production

targets; our ability to access or implement some or all of the

technology necessary to efficiently and effectively operate our

assets and achieve expected future results; unexpected cost

increases or potential disruption or unexpected technical

difficulties in developing new products and manufacturing processes

and in constructing or modifying manufacturing or refining

facilities; refining and marketing margins; cost escalations;

potential failure of products to achieve or maintain acceptance in

the market; risks associated with fossil fuel industry reputation

and litigation related thereto; unexpected difficulties in

producing, transporting or refining of bitumen and/or crude oil

into petroleum and chemical products; risks associated with

technology and equipment and its application to our business,

including potential cyberattacks; risks associated with climate

change and our assumptions relating thereto; our ability to secure

adequate and cost effective product transportation including

sufficient pipeline, crude-by-rail, marine or alternate

transportation, including to address any gaps caused by constraints

in the pipeline system or storage capacity; possible failure to

obtain and retain qualified staff and equipment in a timely and

cost efficient manner; changes in the regulatory framework in any

of the locations in which we operate, including changes to the

regulatory approval process and land-use designations, royalty,

tax, environmental, greenhouse gas, carbon, climate change and

other laws or regulations, or changes to the interpretation of such

laws and regulations, as adopted or proposed, the impact thereof

and the costs associated with compliance; changes in general

economic, market and business conditions; the impact of production

agreements among OPEC and non-OPEC members; the political and

economic conditions in the countries in which we operate or which

we supply; the occurrence of unexpected events, such as pandemics,

fires, severe weather conditions, explosions, blow-outs, equipment

failures, transportation incidents and other accidents or similar

events, and the instability resulting therefrom; and risks

associated with existing and potential future lawsuits, shareholder

proposals and regulatory actions against us.

Statements relating to “reserves” are deemed to be

forward-looking information, as they involve the implied

assessment, based on certain estimates and assumptions, that the

reserves described exist in the quantities predicted or estimated

and can be profitably produced in the future.

Readers are cautioned that the foregoing lists are not

exhaustive and are made as at the date hereof. Events or

circumstances could cause our actual results to differ materially

from those estimated or projected and expressed in, or implied by,

the forward-looking information. For a full discussion of Cenovus’s

material risk factors, refer to “Risk Management and Risk Factors”

in the Corporation’s annual 2019 MD&A and the MD&A for the

period ended September 30, 2020, and to the risk factors described

in other documents Cenovus files from time to time with securities

regulatory authorities in Canada, available on SEDAR at sedar.com,

and with the U.S. Securities and Exchange Commission on EDGAR at

sec.gov, and on the Corporation’s website at cenovus.com.

Cenovus Energy Inc.Cenovus Energy Inc. is a Canadian

integrated oil and natural gas company. It is committed to

maximizing value by sustainably developing its assets in a safe,

innovative and cost-efficient manner, integrating environmental,

social and governance considerations into its business plans.

Operations include oil sands projects in northern Alberta, which

use specialized methods to drill and pump the oil to the surface,

and established natural gas and oil production in Alberta and

British Columbia. The company also has 50% ownership in two U.S.

refineries. Cenovus shares trade under the symbol CVE and are

listed on the Toronto and New York stock exchanges. For more

information, visit cenovus.com.

Find Cenovus on Facebook, Twitter, LinkedIn, YouTube and

Instagram.

|

CENOVUS CONTACTS: Investor

RelationsInvestor Relations general

line403-766-7711 |

Media RelationsMedia Relations general

line403-766-7751 |

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/af760d60-a024-4d6b-a7d3-72036801339e

https://www.globenewswire.com/NewsRoom/AttachmentNg/5546848d-09ca-4f95-a185-597d8eb5396a

https://www.globenewswire.com/NewsRoom/AttachmentNg/beca83e2-dcc0-4fd4-938c-b78b5e7f1273

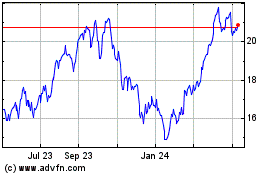

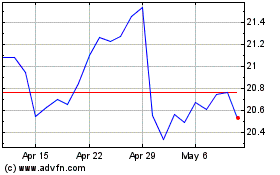

Cenovus Energy (NYSE:CVE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cenovus Energy (NYSE:CVE)

Historical Stock Chart

From Apr 2023 to Apr 2024