Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

July 28 2020 - 5:14PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration No. 333-233702

July 28, 2020

TERM SHEET

Cenovus Energy Inc.

US$1,000,000,000 5.375% Notes due 2025 (the “Notes”)

|

Issuer

|

Cenovus Energy Inc.

|

|

|

|

|

Principal Amount

|

US$1,000,000,000

|

|

|

|

|

Expected Ratings*

|

Ba2/BBB-/BB+/BBB(low) (Moody’s/S&P/Fitch/DBRS)

|

|

|

|

|

Public Offering Price

|

100%

|

|

|

|

|

Coupon

|

5.375%

|

|

|

|

|

Yield to Maturity

|

5.375%

|

|

|

|

|

Trade Date

|

July 28, 2020

|

|

|

|

|

Settlement Date

|

July 30, 2020

|

|

|

|

|

Maturity Date

|

July 15, 2025

|

|

|

|

|

Interest Payment Dates

|

Semi-annually on January 15 and July 15, beginning January 15, 2021

|

|

|

|

|

Record Dates

|

January 1 and July 1

|

|

|

|

|

Make-Whole Call

|

Prior to April 15, 2025 (the date that is three months prior to the Maturity Date of the Notes), at the applicable “make-whole” (Adjusted Treasury Rate plus 50 basis

points).

|

|

|

|

|

Par Call

|

On or after April 15, 2025 (the date three months prior to the Maturity Date of the Notes).

|

|

|

|

|

Change of Control Triggering Event

|

If the Issuer experiences a Change of Control Triggering Event, it will be required to offer to repurchase the Notes from holders at 101% of the principal amount

thereof plus accrued and unpaid interest to, but excluding, the repurchase date.

|

|

|

|

|

CUSIP

|

15135U AS8

|

|

|

|

|

ISIN

|

US15135UAS87

|

|

|

|

|

Active Joint Book-Running Managers

|

BofA Securities, Inc.

BMO Capital Markets Corp.

Scotia Capital (USA) Inc.

|

|

Joint Book-Running Managers

|

RBC Capital Markets, LLC

TD Securities (USA) LLC

|

|

|

|

|

Senior Co-Managers

|

ATB Capital Markets Inc.

CIBC World Markets Corp.

|

|

|

|

|

Co-Managers

|

Barclays Capital Inc.

Credit Suisse Securities (USA) LLC

Desjardins Securities Inc.

J.P. Morgan Securities LLC

Mizuho Securities USA LLC

MUFG Securities Americas Inc.

National Bank of Canada Financial Inc.

SMBC Nikko Securities America, Inc.

Wells Fargo Securities, LLC

|

*Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision, suspension or withdrawal at any time.

The Issuer has filed a registration statement (including a base shelf prospectus) and a preliminary prospectus

supplement with the U.S. Securities and Exchange Commission (the “SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement, the preliminary prospectus supplement and

other documents the Issuer has filed with the SEC for more complete information about the Issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, Cenovus, any underwriter or

any dealer participating in the offering will arrange to send you the prospectus if you request it by contacting BofA Securities, Inc. toll-free at 1-800-294-1322 or at dg.prospectus_requests@bofa.com, BMO Capital Markets Corp. toll-free at

1-866-864-7760 or Scotia Capital (USA) Inc. toll-free at 1-800-372-3930.

Certain of the Underwriters may not be U.S. registered broker-dealers and accordingly will not effect any sales

within the United States except in compliance with applicable U.S. laws and regulations, including the rules of the Financial Industry Regulatory Authority.

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND

SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

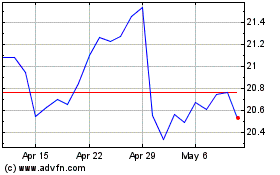

Cenovus Energy (NYSE:CVE)

Historical Stock Chart

From Mar 2024 to Apr 2024

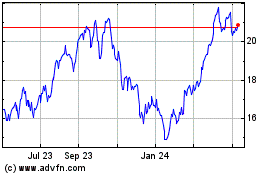

Cenovus Energy (NYSE:CVE)

Historical Stock Chart

From Apr 2023 to Apr 2024