Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

December 13 2021 - 6:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 or

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2021

Commission File Number: 001-14946

CEMEX, S.A.B. de C.V.

(Translation of Registrant’s name into English)

Avenida

Ricardo Margáin Zozaya #325, Colonia Valle del Campestre

San Pedro Garza García, Nuevo León, 66265

México

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F

or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Contents

On December 10, 2021, CEMEX, S.A.B. de C.V. (NYSE:CX) (“CEMEX”) informed the Mexican Stock Exchange (Bolsa Mexicana de Valores)

(“MSE”) that, in relation to the previously reported investigation by the U.S. Department of Justice (“DOJ”) of possible antitrust law violations in connection with sales (and related sales practices) of grey portland cement and

slag by subsidiaries of CEMEX in the United States and its territories, the DOJ has notified CEMEX that it has closed its investigation, and the matter is now closed.

Also, regarding a different matter, CEMEX informed the MSE that, in relation to the previously reported tax audit process covering the tax

years 2010 to 2014 for which an assessment for income taxes, plus late interest, had been notified to CEMEX España on March 26, 2021, the Spanish tax authorities have now notified CEMEX España of a penalty assessment for an

approximate amount of €68 million. This assessment will be appealed before the Administrative Tax Court (Tribunal Económico Administrativo Central) of the Spanish authorities. The payment of the penalty or the provision of

any guarantees is not required until the resolution of the appeal. As of the date of this report, given the current stage of this tax matter in Spain, which could take between 7 to 10 years to be resolved, and considering all possible defenses

available, while we cannot assess with certainty the likelihood of an adverse result in this matter, we believe a final adverse resolution to this matter is not probable. However, if adversely resolved, we believe such adverse resolution could have

a material adverse impact on our results of operations, liquidity and financial condition.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, CEMEX, S.A.B. de C.V. has duly caused this report to be signed on its

behalf by the undersigned, thereunto duly authorized.

|

|

|

CEMEX, S.A.B. de C.V.

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

Date: December 10, 2021

|

|

|

|

By:

|

|

/s/ Rafael Garza

|

|

|

|

|

|

|

|

Name: Rafael Garza

|

|

|

|

|

|

|

|

Title: Chief Comptroller

|

Cemex SaB De Cv (NYSE:CX)

Historical Stock Chart

From Mar 2024 to Apr 2024

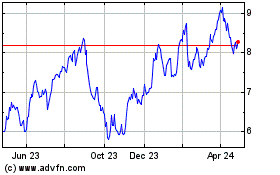

Cemex SaB De Cv (NYSE:CX)

Historical Stock Chart

From Apr 2023 to Apr 2024