Bombardier to Sell Assets, Cut 5,000 Jobs in Restructuring--2nd Update

November 08 2018 - 10:50AM

Dow Jones News

By Robert Wall and Colin Kellaher

The shake up of Bombardier Inc., a Canadian plane and train

maker, gained pace Thursday with the company announcing another

5,000 job cuts and a decision to shed its turboprop plane-making

and pilot-training units.

Bombardier has been under financial pressure for several years

after a big bet to battle plane-making giants Boeing Co. and Airbus

SE with a brand-new single-aisle jetliner ran into trouble.

The Montreal-based company said Thursday it would sell its

business aircraft-training activities to CAE Inc. for $645 million.

CAE said it agreed to pay an additional $155 million to Bombardier

to monetize future royalty obligations under an authorized

training-provider agreement.

Bombardier also said it agreed to sell for about $300 million

its turboprop-aircraft programs and the "de Havilland" trademark to

a unit of Longview Aviation Capital Corp., the parent of Canadian

aircraft-maker Viking Air Ltd. The deal includes the Dash 8 Series

100, 200 and 300, along with the Q400 program operations at the

Downsview manufacturing plant in Ontario.

The deals leave Bombardier, which once had ambitions to become a

global aerospace powerhouse, as a maker of private jets, regional

jetliners, plane parts and trains.

Founded in 1937, Bombardier in 2008 embarked on the CSeries to

rival Boeing's best-selling 737 and the equally popular Airbus

A320. Bombardier tried to sway buyers with a brand new, more

fuel-efficient design. But airliner buyers were reluctant to order

the plane, uncertain about its prospects. Technical setbacks caused

development costs to skyrocket.

The company in 2015 gave up almost half its stake in the

program, called the CSeries, in exchange for a $1 billion financial

lifeline from the Quebec government.

But the financial situation failed to improve. Bombardier in

February 2016 announced plans to cut about 7,000 jobs. Little more

than six months later, it was forced to shed a further 7,500

positions.

The CSeries entered service that year. And Delta Air Lines Inc.

agreed to place a landmark 75 plane order for the Bombardier plane.

Boeing challenged the deal, accusing its Canadian rival of price

dumping. Although Bombardier prevailed in legal challenges early

this year, the trade battle during which the U.S. threatened the

CSeries with massive important tariffs created additional

uncertainty over the project.

A year later, Bombardier agreed to hand control of the CSeries

program to Airbus. The plane maker based in Toulouse, France,

formally took charge of the project in July, quickly renaming the

jet family the A220. Bombardier, which holds a 31% stake in the

partnership, agreed to cover losses on the program until around

2021.

Airbus quickly secured deals for the A220 from JetBlue Airways

Corp. and a 60-plane order from a startup carrier being set up by

JetBlue founder David Neeleman.

Bombardier said the latest round of job cuts should take place

during the next 12 to 18 months and result in annualized savings of

about $250 million by 2021. Bombardier says it has around 69,500

employees world-wide. The company said it would post a

restructuring charge of roughly $250 million in 2019.

Bombardier Chief Executive Alain Bellemare said Thursday that

the company now had greater financial flexibility and solid

liquidity.

Write to Robert Wall at robert.wall@wsj.com and Colin Kellaher

at colin.kellaher@wsj.com

(END) Dow Jones Newswires

November 08, 2018 10:35 ET (15:35 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

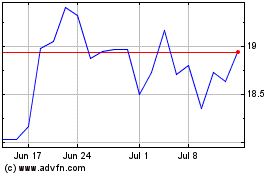

Cae (NYSE:CAE)

Historical Stock Chart

From Mar 2024 to Apr 2024

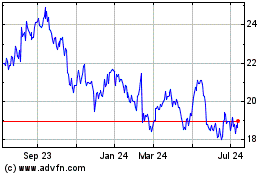

Cae (NYSE:CAE)

Historical Stock Chart

From Apr 2023 to Apr 2024